NIO's second-quarter financial report refutes bankruptcy rumors, and Ledao becomes the key to "changing destiny"

![]() 09/10 2024

09/10 2024

![]() 561

561

Since its inception, NIO has been plagued by rumors of "bankruptcy," but most of them have been brushed aside with a smile. However, despite not being in the first tier of new-energy vehicle sales, NIO has maintained stable sales, with both production scale and output value growing steadily. The recent rumors of "bankruptcy" thus come as somewhat of a surprise.

This time, NIO is no longer willing to tolerate such rumors and has launched a strong counterattack. On the one hand, NIO has received a police reply stating that the suspects involved in spreading the rumors have been arrested. On the other hand, NIO has released its second-quarter financial report, directly addressing its operating conditions.

Judging from the second-quarter financial report, NIO's development has indeed been on an upward trajectory, with key data indicators nearly doubling. During the reporting period, NIO generated revenue of RMB 17.45 billion, a year-on-year increase of 98.9%. Among this, automotive sales revenue reached RMB 15.7 billion, up 118.2% year-on-year.

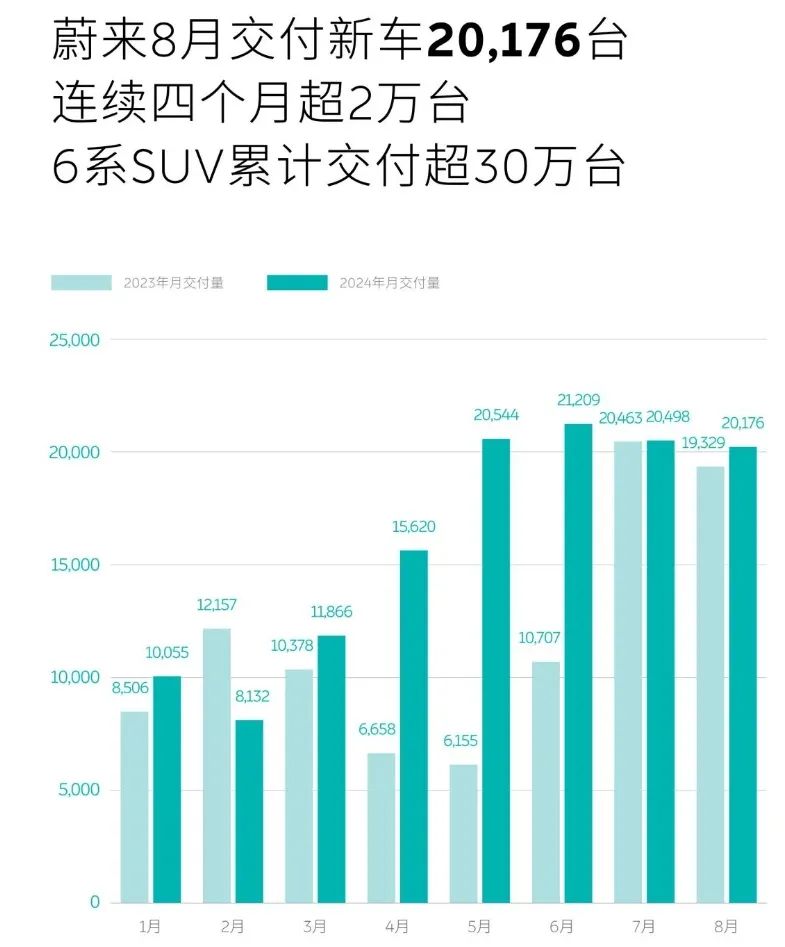

In terms of sales, NIO delivered a total of 57,400 vehicles in the second quarter, representing a year-on-year increase of 143.9% and a quarter-on-quarter increase of 90.9%.

Losses are narrowing, but still a persistent problem

Although NIO has yet to overcome the persistent problem of not turning a profit, its losses have narrowed. In the second quarter, NIO's net loss was RMB 5.05 billion, a decrease of RMB 1 billion from the same period last year. For the first half of this year, NIO's net loss reached RMB 10 billion, a decrease of RMB 600 million from the same period last year.

Currently, NIO does not appear to be strapped for cash. As of June 30, 2024, NIO's cash and cash equivalents, restricted cash, short-term investments, and long-term time deposits totaled RMB 41.6 billion. However, until the issue of losses is resolved, rumors of bankruptcy will likely persist.

Compared to its peers XPeng and Lixiang, NIO's losses are particularly notable. Many attribute this to factors such as NIO's large-scale construction of battery swap stations and high user operation costs.

According to the financial report, NIO's selling, general, and administrative expenses increased by more than 30% in the second quarter. This can be attributed to two main factors: first, the increase in sales led to an increase in labor costs, including the number of employees and bonuses; second, NIO's full refresh of its 2024 models in March and April led to a significant increase in marketing expenses compared to the previous quarter. Additionally, NIO will continue to invest heavily in research and development, maintaining quarterly investments exceeding RMB 3 billion.

Ledao becomes the key to "changing destiny"

For NIO to "change its destiny," two factors are crucial: increasing sales and improving vehicle profitability. For these two aspects to improve in the short term, the market performance of Ledao L60, the first model from NIO's upcoming new brand, will be pivotal.

During the earnings call, Ledao naturally became a focal point of attention. As Ledao L60's direct competitor, Tesla's Model Y sold over 45,000 units in China in August. Currently, the pre-sale price of Ledao L60 is RMB 30,000 lower than that of Model Y, and it is expected to decrease further upon official launch. Coupled with the Bass plan, Ledao L60 offers a significant price advantage over Model Y and demonstrates various "latecomer" advantages in other aspects.

Therefore, NIO expects Ledao L60's monthly sales to exceed 20,000 units. This figure is not only evident from the answers given by NIO's founder and chairman, Li Bin, during the earnings call but is also confirmed by communications with Ledao's newly established sales network product specialists.

Ledao's sales team is diverse, comprising not only former NIO sales personnel but also sales representatives from Tesla, BYD, and luxury brands. The allure of Ledao lies in its higher incentive policies and promising market prospects.

Currently, NIO's monthly sales have stabilized at over 20,000 units. If Ledao's monthly sales exceed 20,000 units, this would double NIO's overall sales, propelling it into the first tier of new-energy vehicle sales.

Meanwhile, as Ledao leverages NIO's research and development system, its development costs will be significantly reduced. In terms of user operations, Ledao will also differentiate itself from NIO, further reducing its costs. Although NIO's vehicle profitability increased to 12.2% in the second quarter, this is still relatively low for a luxury brand. Ledao's profitability is expected to reach around 15%, significantly enhancing NIO's overall vehicle profitability.