When will SAIC "catch its breath"?

![]() 09/11 2024

09/11 2024

![]() 425

425

SAIC Motor, the "elder brother" in the automotive industry, has been firmly seated at the top of the "largest automotive group in China" for 18 years, but now faces the risk of losing its throne. With the surge of new energy vehicles, the landscape of the automotive industry has continued to change, and new energy upstarts such as BYD have risen like dark horses, posing a fierce challenge to SAIC Motor's traditional position.

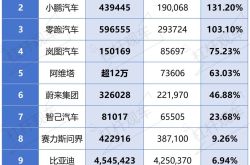

According to the latest production and sales report, SAIC Motor's vehicle production and sales in August 2024 both declined by nearly 40% compared to the same period last year. Although the production of new energy vehicles increased slightly, sales declined; exports and overseas markets also suffered setbacks, with both production and sales falling by more than 20%. In contrast, BYD has surged ahead, surpassing SAIC Motor in sales for two consecutive months.

This "battle between the old and the new" has attracted widespread attention both within and outside the industry. "How long can SAIC Motor retain its position as the 'largest' automaker?" has become a hot topic of discussion.

Looking back at SAIC Motor's glorious history, it relied on the "three pillars" of joint ventures - SAIC Volkswagen, SAIC GM, and SAIC-GM-Wuling - to dominate the gasoline-powered vehicle era, establishing a vast empire. However, as the market for new energy vehicles has developed, the traditional gasoline-powered vehicle market has gradually declined, and the once-invincible "iron triangle" has also suffered. With declining sales and market share being eroded, SAIC Motor is under unprecedented pressure.

Of course, facing these challenges, SAIC Motor has also made positive changes.

The launch of new energy brands such as IM Motors and R Auto is the best proof of SAIC Motor's determination to transform. Although the transformation path has not been smooth, the innovative attempts of IM Motors' "solid-state battery" technology and R Auto's "battery swap technology" are worthy of recognition for their foresight and innovation. These technological breakthroughs are expected to open up a new path for SAIC in the new energy field.

SAIC-GM-Wuling's performance in the new energy market is also eye-catching. Thanks to the popularity of models like the Hongguang MINI EV, Wuling has successfully carved out a niche in the new energy market by opening up new battlegrounds, demonstrating its unique insights into the market and product innovation. Even in the face of challenges such as rising raw material prices and declining subsidies for new energy vehicles, Wuling has maintained sales growth, which is no easy feat.

Wuling has proven with practical actions that even in an apparently saturated market, new growth points can be found through precise positioning and differentiation strategies. This approach is also worth learning from by other traditional automakers undergoing transformation.

In addition, SAIC Motor's overseas expansion strategy is also commendable. In particular, its MG brand has made a striking impression in the European market. However, with the European Union raising tariffs on Chinese electric vehicles, SAIC's sales in the European market have been affected. Moving forward, how to meet the challenges of the international market has become an issue that SAIC must face.

In terms of independent brand building, SAIC Motor's passenger vehicle brands have also achieved certain results, with notable progress made by brands such as Roewe and MG. However, as market competition intensifies and consumer expectations rise, more effort must be made in product differentiation and quality improvement to take these independent brands to the next level. Only by capturing consumers' hearts and minds can one remain invincible in the fierce market competition.

Postscript

Although it is difficult for a large ship to change course, it is not difficult to see SAIC's profound foundation and determination to transform. Whether it is the incubation of new energy brands, the development of new technologies, or precise positioning and differentiation strategies, SAIC deserves praise. However, the challenges are also formidable. The declining traditional gasoline-powered vehicle market, lower-than-expected new energy sales, tariff pressures in overseas markets, and the ongoing need for independent brands to continuously improve differentiation and quality are all hurdles that SAIC must overcome. But as long as SAIC continues to innovate and adapt, it will naturally remain invincible. The road ahead may be long and difficult, but it is full of hope. We look forward to SAIC catching its breath soon and revitalizing its former glory.