Can iPhone 16 help Apple regain the top spot in the Chinese market?

![]() 09/11 2024

09/11 2024

![]() 613

613

By Leon

Edited by cc Sun Congying

On September 10, Beijing time, Apple unveiled its new generation of smartphones, the iPhone 16 series, which will be available for pre-order on September 13 and officially go on sale on September 20. Like previous years, the specifications and new features of the iPhone 16 were almost fully leaked before its announcement, leaving little room for surprises.

At the event, Apple Intelligence (hereinafter referred to as Apple AI) took up the largest portion of the presentation, indicating that there were no significant hardware changes in the iPhone 16 series.

However, Apple AI will not be available with the phone's initial release on September 20. The English version will only be available with the next system update, while the Chinese, Japanese, French, and Spanish versions are expected to be released sometime next year.

The market response to the iPhone 16 series announcement was lukewarm. As of press time, Apple's stock price in the U.S. had risen slightly by 0.04%, trading at $220.91 per share.

In 2023, Apple surpassed Samsung for the first time to become the global leader in smartphone sales, shipping 234.6 million units worldwide. In the Chinese market, Apple also topped domestic manufacturers such as Huawei, Xiaomi, Oppo, and Vivo. However, in the first half of this year, Apple's market share in China plummeted, dropping out of the top five for the first time in four years. Given the current situation, market expectations for the iPhone 16 series remain pessimistic.

Hardware upgrades continue to be incremental

Typically, Apple introduces significant hardware updates to the iPhone every 3-4 years, referred to as a "super cycle." For example, the iPhone X abandoned the Touch ID fingerprint design used since the iPhone 6 and introduced a full-screen display and Face ID. This year's iPhone 16 series comprises four models with relatively minor upgrades. Let's take a look at the key features.

Key features of the iPhone 16 and 16 Plus:

● Available in five colors: Cerulean Blue, Deep Blue, Pink, White, and Black

● Equipped with the A18 chip, offering up to 30% CPU performance improvement over previous generations and featuring a Neural Engine

● Features 6.1-inch and 6.7-inch screens with a 60Hz refresh rate

● Rear dual cameras arranged vertically, featuring a 48MP + 12MP configuration with a camera control button

● Prices range from 5999/6999/8999 yuan for the iPhone 16 and 6999/7999/9999 yuan for the 16 Plus

Key features of the iPhone 16 Pro and 16 Pro Max:

● Available in four colors: Black Titanium, White Titanium, Silver Titanium, and Desert Sand Titanium

● Features ultra-narrow bezels, with the Pro screen upgraded to 6.3 inches and the Max to 6.9 inches, both with a 120Hz adaptive refresh rate

● Equipped with the A18 Pro chip, offering a 15% performance improvement over last year's A17 Pro and featuring a 16-core AI Neural Engine

● Retains the triple-camera setup, with the wide-angle camera upgraded to 48MP and both telephoto lenses offering 5x optical zoom, along with a camera control button

● Prices range from 7999/8999/10999/12999 yuan for the iPhone 16 Pro and 9999/11999/13999 yuan for the 16 Pro Max

For easy comparison, here's a detailed parameter comparison chart for the four iPhone 16 series models:

Essentially, the most notable new design element on the iPhone 16 series is the capacitive camera control button, which allows for quick camera access, zoom control, and shutter functionality, eliminating the need to touch the screen while taking photos. Additionally, the Pro and Max models feature narrower bezels and larger screens for an enhanced visual experience. Processor and battery upgrades are standard annual improvements.

While the pricing of the iPhone 16 series remains unchanged, starting at 128GB, it hardly offers exceptional value for money. Furthermore, the base models' 60Hz screens, which have remained unchanged for years, are now standard even in some budget Android phones, a point of criticism among many netizens.

If incremental hardware upgrades have become the norm for Apple, the company has turned to new features and functionalities to generate buzz, particularly with Apple AI.

AI features as a "future promise"; Chinese version launch date remains uncertain

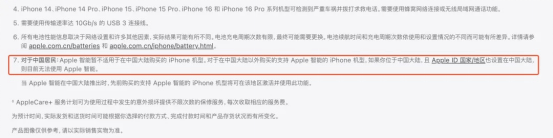

For Chinese users, the good news about Apple AI is that the Chinese version is finally confirmed for next year. The bad news is that the specific launch date is still unclear.

Apple's official China website states, "Apple AI is currently not available for iPhone models purchased in mainland China." The launch date of Apple AI depends on regulatory approvals.

Setting aside the uncertainty around the Chinese version, even the English version of Apple AI does not inspire much excitement. Currently available in the iOS 18.1 Developer Beta, The Washington Post reported that it frequently makes errors, such as misinterpreting email content or text meanings when generating summaries. Whether these issues will be resolved upon official release remains to be seen.

Moreover, the upcoming Apple AI update in October will not be a complete version. Apple has stated that "more related features will be introduced soon."

During the WWDC developer conference, Apple demonstrated Apple AI's capabilities, including AI summaries and transcriptions, AI emojis, priority notifications, smart replies, photo search and editing, and a smarter Siri. However, these features do not represent a significant disruption. Domestic users will not have access to the directly integrated ChatGPT functionality.

Apple falls out of China's top five; iPhone 16 outlook is pessimistic

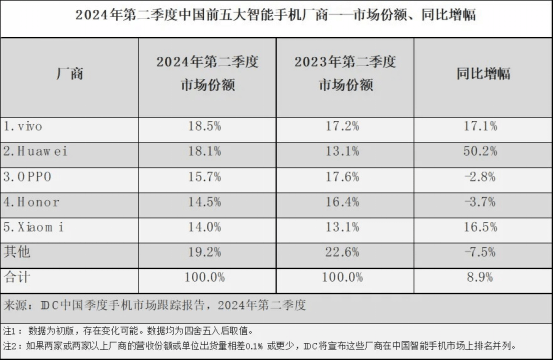

Data shows that smartphone sales in China grew by 4% year-on-year in the first half of this year, indicating a modest recovery. However, Apple's market share has been declining steadily.

According to IDC, in the first quarter of this year, Apple fell from the top to fifth place in mainland China in terms of shipments (with a 15% market share). In the second quarter, Apple dropped out of the top five entirely, with shipments accounting for approximately 13.6% of the market, a decrease of approximately 9.33% quarter-on-quarter.

So, is the Chinese market crucial for Apple? The answer is yes. According to Apple's fiscal second-quarter 2024 earnings report, revenue in Greater China amounted to $16.372 billion, a year-on-year decrease of 8%, accounting for approximately 18.04% of total revenue. Undoubtedly, mainland China is the primary consumer market in Greater China.

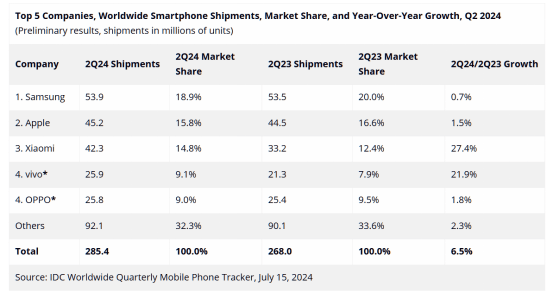

Globally, Apple shipped 45.2 million smartphones in the second quarter, representing a mere 1.5% year-on-year increase. In comparison, Xiaomi, ranked third, experienced a surge of 27.4%.

Global smartphone shipments by brand in the second quarter of 2024

Combining these two sets of data, it becomes evident that the iPhone user base is largely stable, making it challenging to attract a significant number of new users. The average replacement cycle for existing users is 2-3 years (according to CIRP data), which is insufficient to sustain Apple's growth.

From a product perspective, the primary reasons for declining iPhone sales are rooted in a lack of innovation. First, the design remains largely unchanged, with a single mold often lasting 4-5 years (the 16 Pro largely retains the design of the 12 Pro). Second, Apple lags behind in innovation, particularly in areas such as foldable devices, where competitors like Samsung, Huawei, Xiaomi, and OV have already introduced multiple products. Third, Apple focuses solely on the high-end market, but its relatively high prices have reduced its competitiveness amid the global economic downturn.

Apple's conservative product strategy is driven by the need to maintain high profits. According to Counterpoint, Apple captured 50% of global smartphone sales and over 90% of industry profits in 2023.

While Steve Jobs revolutionized the smartphone era with capacitive touchscreens and multi-touch, the smartphone market is now highly mature, with products tending towards homogenization. Without significant innovation, the iPhone's competitive edge dwindles.

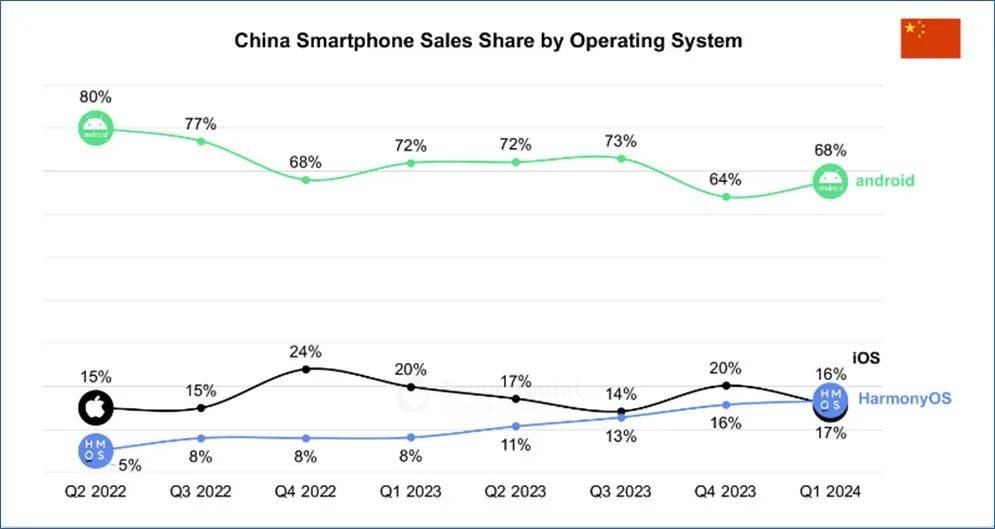

In the Chinese market, Apple faces challenges from all sides. Prior to the announcement, Counterpoint released detailed operating system data for China's first quarter of 2024, revealing that Huawei's HarmonyOS surpassed iOS by a narrow margin to become the second-largest mobile operating system in China.

HarmonyOS surpasses iOS in China's market share

Furthermore, the third quarter of each year marks the flagship smartphone launch cycle. In addition to Huawei's Mate XT Masterpiece, which has already received 3 million pre-orders (without a deposit) and starts at 19,999 yuan, high-end market competition is fierce, with the Huawei Mate 80 series and Xiaomi 15 series directly competing with the iPhone 16.

TF International Securities analyst Ming-Chi Kuo, who has long tracked Apple products, predicts that shipments of the iPhone 16 series will reach 88-89 million units this year, with the majority of growth coming from the standard models. Shipments in the third quarter are expected to increase by 10% year-on-year, but the fourth quarter is projected to decline by 5-7%, resulting in overall shipments slightly higher than the same period last year. However, due to significant declines in Chinese sales in the first and second quarters, Apple's iPhone sales for 2024 are unlikely to match those of 2023.