"Taking the path of entry-level SUVs, has BYD left no room for joint venture brands?"

![]() 09/13 2024

09/13 2024

![]() 583

583

The fifth-generation DM technology, which enables vehicles to achieve a comprehensive driving range of over 2,000 km, has allowed BYD to dominate the mainstream family car market.

BYD's Qin L and Dolphin 06 DM-i, the first models to incorporate this technology into mass production, now boast a stable monthly sales volume of over 30,000 units. The subsequent launch of the Song PLUS DM-i and Song L DM-i has further elevated the market influence of the Song series.

Undoubtedly, BYD's next major move will be to rapidly apply the fifth-generation DM technology to other models in the Dynasty and Ocean series. Many are already speculating about the technical prowess that the Qin PLUS DM-i, equipped with this technology, will ultimately showcase.

However, those eagerly awaiting the new Qin PLUS DM-i with its updated technology will have to wait a little longer. Recently, BYD unveiled teasers for the second-generation Song Pro DM-i and Sea Lion 05 DM-i, signaling the company's commitment to consolidating its position in the entry-level family SUV market.

Essentially sister models, these two new vehicles share similar hardware specifications despite their differing design philosophies. It is therefore reasonable to assume that the positioning and pricing of the Sea Lion 05 DM-i will not deviate significantly from those of the second-generation Song Pro DM-i. With its impressive monthly sales figures, the Song Pro DM-i's market influence is undeniable, and customers are keenly anticipating the improvements that the second-generation model will bring.

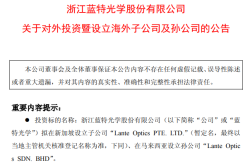

Although BYD has only released a teaser image of the front view of the second-generation Song Pro DM-i, close observation of other exposed details reveals several notable product highlights. Let's delve into these aspects in greater detail.

This subtle change has significantly enhanced the appeal

At first glance, the official teaser image of the second-generation Song Pro DM-i simply showcases the Dragon Face design language adopted by BYD's Dynasty series, featuring a silver chrome strip and an exaggerated lower bumper design.

However, true surprises often lie beyond what meets the eye.

According to filings with the Ministry of Industry and Information Technology, the second-generation Song Pro DM-i has already completed its application process. Compared to the current Song Pro DM-i, the new model forgoes some of the more aggressive exterior elements, opting instead for a more traditional silver chrome and smoked finish for the front lip, side skirts, and rear bumper. Additionally, the tail logo has been simplified from "BUILD YOUR DREAMS" to the more concise "BYD" branding.

Examining the relevant data from the application filings, we find that the new model is powered by the BYD472QC engine, which boasts a maximum power output of 74kW, identical to that found in the Qin L. This confirms that the second-generation Song Pro DM-i will indeed employ the fifth-generation DM technology, promising improvements in fuel economy and performance. However, considering the vehicle's design, its fuel consumption in low-battery mode is expected to be slightly higher than the Qin L's 2.9L/100km.

In terms of dimensions, the second-generation Song Pro DM-i measures 4735/1860/1700 (or 1710) mm in length, width, and height, respectively, with a wheelbase of 2712 mm. This represents a 3mm increase in length compared to the current model, while all other dimensions remain unchanged.

Current Song Pro DM-i

It is reasonable to assume that the minimal changes in vehicle dimensions will have negligible impact on interior space, which may seem contrary to expectations for a new-generation model. However, we believe that this lack of significant spatial enhancement will not significantly affect the appeal of the second-generation Song Pro DM-i. After all, customers seeking ample passenger and storage space may opt for the Song PLUS DM-i, which starts at just RMB 129,800. As long as the second-generation Song Pro DM-i maintains its position in the "Pro" segment, it will continue to thrive.

As the sister model of the second-generation Song Pro DM-i, the Sea Lion 05 DM-i has already unveiled its overall design philosophy. Frankly, the exterior does not offer much in terms of surprises, as it shares design elements common to other Ocean series models. Inside, the steering wheel bears a striking resemblance to that of the Tengshi Z9 GT, while the gearshift area mimics the design of the Dolphin EV.

Official interior rendering of the Sea Lion 05 DM-i

While official interior renderings of the second-generation Song Pro DM-i have yet to be released, spy shots suggest a design that is markedly different from both the Sea Lion 05 DM-i and the current Song Pro DM-i.

Spy shot of the interior of the second-generation Song Pro DM-i

The central control screen remains a rotatable floating display, while the digital instrument cluster has transitioned from a floating design to an embedded one. The steering wheel adopts a four-spoke design, and the gearshift area features a more angular layout. A wireless charging pad and air vents are positioned in front, while a spacious cup holder and hollowed-out storage area are provided behind, ideal for storing infrequently used items.

Interior of the current Song Pro DM-i

We believe that these design adjustments are tailored to better meet customer preferences, making them undoubtedly the right choices. In contrast to the current Song Pro DM-i, which connects the armrest console directly to the center console for a more dynamic visual effect but compromises on storage space, the new design prioritizes practicality over aesthetics. Given the high demand for spaciousness among SUV buyers, the interior improvements of the second-generation Song Pro DM-i appear to have heeded feedback from existing customers.

Moreover, BYD's latest DiLink 100 infotainment system is expected to be integrated into the vehicle. In other words, the second-generation Song Pro DM-i will incorporate BYD's latest technologies in terms of design, powertrain, and features. While some may argue that the lack of significant size changes could be a point of contention, we maintain that the model nonetheless embodies the necessary innovations expected of a new-generation vehicle.

The twin-car strategy may lead to internal competition, but the ultimate goal remains the same

In the past, the "twin-car strategy" was primarily adopted by foreign brands. For instance, Honda operates two sales channels in China—Guangqi Honda and Dongfeng Honda—and introduced two distinct models, the Vezel (known as the Honda HR-V overseas) as the Vezel and XR-V, respectively. Despite their differing names and designs, both models are essentially based on the same platform.

Ultimately, the essence of the twin-car strategy lies in leveraging a brand's dual sales channels in China to maximize sales. While BYD does not have joint ventures with foreign brands in the domestic market, it has established two sales channels by expanding its product lines.

When the Ocean series was first introduced, some industry insiders were skeptical about its prospects, given the already established popularity of the Dynasty series in China. However, the success of the Ocean series has proven that as long as a product possesses exceptional qualities, it stands a good chance of becoming a rising star. Today, the Ocean series has become an indispensable contributor to BYD's sales figures.

However, some argue that in the case of BYD, which employs the twin-car strategy as a single brand, there is a risk of internal competition between the two models. We acknowledge that this phenomenon could indeed occur, given that both the Dynasty and Ocean series belong to BYD, and customers' preferences are primarily driven by aesthetics rather than brand loyalty.

Sales figures reveal that the current Song Pro DM-i dominates its segment, with 19,288 units sold in August alone. In comparison, the Toyota Corolla Cross sold 16,169 units, the Toyota Corolla Fenglanda sold 15,994 units, and the Nissan Qashqai sold 9,353 units.

The Song Pro DM-i's advantages lie in its fuel efficiency, spaciousness, and comprehensive features, not to mention its affordable starting price of under RMB 110,000. This has posed a significant challenge to joint venture brands, which have resorted to offering limited-time discounts to attract family car buyers. Despite these efforts, joint venture entry-level SUVs have struggled to compete effectively against the Song Pro DM-i.

It is foreseeable that the introduction of the Sea Lion 05 DM-i could potentially cannibalize some market share from the second-generation Song Pro DM-i. Nevertheless, the primary objective remains to further compress the survival space of joint venture brands in the entry-level SUV segment. Moreover, in this competitive market landscape, the twin-car strategy employed by joint venture brands is gradually losing its effectiveness, particularly for entry-level SUVs from Honda, Toyota, and Volkswagen, whose sales may experience a gradual decline.

As the Chinese market continues to intensify its competition, joint venture brands are struggling to keep pace with the rapid product iteration of domestic brands. The compact SUV segment is a crucial battleground for mainstream automakers, and we can expect more brands to enter this space in the future, such as Chery's Fengyun series and JETOUR's Shanhai series, both of which will pose challenges to the Song Pro DM-i.

Rumors suggest that the second-generation Song Pro DM-i is scheduled for launch on September 23. We will continue to closely monitor developments and provide a more comprehensive analysis of the new model upon its release.

Source: Leitech