【Industry In-Depth Research】Why Does Meituan Pay Tribute to Ele.me, Recognizing It as the Best Competitor?

![]() 11/25 2025

11/25 2025

![]() 428

428

Author | Yuan Fang Learn more financial information | BT Finance Data Pass The main text is 3,497 words, with an estimated reading time of 9 minutes.

The Chinese local life services sector witnessed a highly dramatic 'farewell ceremony.'

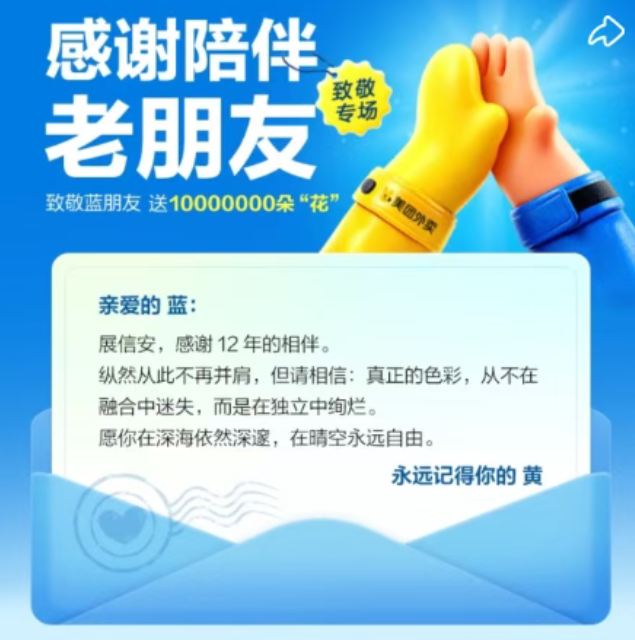

In early November 2025, Ele.me officially announced its rebranding as 'Taobao Flash Delivery,' fully integrating into Alibaba's 'Grand Consumption Platform' strategic ecosystem. Surprisingly, its long-standing rival Meituan swiftly launched a 'Tribute' button at the bottom of its app, accompanied by an image of yellow and blue gloves clapping, along with an open letter titled 'A Tribute to Our Blue Friends': 'Thank you for 12 years of companionship. Even though we no longer walk side by side, true colors never fade in integration. May you remain profound in the depths.'

Beneath the surface warmth lies a hidden edge. Dubbed by netizens as the 'pinnacle of ambivalent literature,' this letter, paired with a marketing campaign offering '10 million flowers' (actually sharpshooter coupons), quickly ignited the trending topic #MeituanPaysTributeToEleme. This seemingly emotional interaction reflects a deeper truth: throughout Meituan's two-decade journey, Ele.me stands as the only competitor capable of long-term rivalry, sparking strategic vigilance and even respect.

This series of moves, though seemingly dramatic commercial banter, conceals Meituan's complex emotions toward Ele.me and strategic considerations amid fierce market competition.

1

The Evolutionary Logic of Ele.me

As the pioneer in establishing an online food delivery platform, Ele.me holds a pivotal position in the development of the food delivery industry. It initiated a new era for the sector. Prior to Ele.me's emergence, people's food delivery options were extremely limited, mainly relying on traditional phone orders, with a restricted number of merchants and service scopes. Ele.me broke this mold by leveraging internet technology to build a convenient bridge connecting merchants and consumers, making food delivery services more efficient, transparent, and diverse.

Founded in 2008, Ele.me is one of China's earliest online food delivery platforms. Long before Meituan entered the food delivery market in 2013, Ele.me had already established a solid user base and delivery network within Shanghai's university circles. Initially focusing on 'campus food delivery,' it rapidly gained a foothold in East China by deeply binding with local merchants and relentlessly pursuing delivery efficiency.

However, the true test began in 2015 when Meituan fully launched its food delivery business. Facing Meituan's vast merchant resources, capital advantages, and highly efficient ground promotion teams built on its group-buying foundation, Ele.me did not opt for blind expansion or endless subsidy wars. Instead, it adopted a highly rational differentiated and focused strategy.

Over the past decade, Ele.me has proactively narrowed its battlefield, concentrating limited resources on core cities like Beijing, Shanghai, Guangzhou, and Shenzhen, as well as high-value user segments. By deeply cultivating regional markets and reinforcing service commitments such as 'On-Time Delivery' and 'Worry-Free After-Sales,' Ele.me has built a solid reputation moat among premium white-collar workers and business professionals. This 'less but better' approach has enabled it to maintain strong brand loyalty and user stickiness, even with a smaller overall market share.

More importantly, Ele.me has never ceased investing in 'fulfillment capability,' the core barrier of local life services. Its self-built 'Fengniao Instant Delivery' system not only serves its own platform but also gradually opens up to external merchants, becoming a vital instant logistics infrastructure within Alibaba's ecosystem. This relentless focus on foundational capabilities has laid a solid groundwork for its deep integration with Taobao Flash Delivery.

2

Will Ele.me Disappear?

Ele.me's rebranding as 'Taobao Flash Delivery' in 2025 does not signify a 'brand disappearance' or 'strategic retreat,' as misinterpreted by some. Instead, it represents a proactive strategic upgrade. This move marks Ele.me's transition from a standalone food delivery platform to a key fulfillment engine within Alibaba's 'Grand Consumption Platform' strategy.

Alibaba has been vigorously driving the evolution of retail e-commerce from 'shelf-based transactions' to 'scenario-based instant consumption.' The launch of Taobao Flash Delivery serves as the core vehicle for this strategic shift. Ele.me's value lies precisely in its mature instant delivery network, millions of active riders, and deep operational experience with local merchants—capabilities that traditional e-commerce lacks in the 'last mile.'

The integration of the two is far from a simple superposition (superposition). Taobao provides vast commodity supply, user traffic, and a seamless payment ecosystem; Ele.me offers 30-minute fulfillment capability and local service touchpoints. Together, they are reshaping consumer shopping behavior: from 'receiving goods tomorrow' to 'wanting it now.' This 'e-commerce + local life services' fusion model not only enhances user experience but also opens up a trillion-dollar instant retail market.

For the industry, this represents a profound paradigm shift. Ele.me stands as an active participant and driver of this transformation. Rather than clinging to food delivery alone, it embraces group strategy, redefining its value at a higher dimension. This strategic clarity and evolutionary capability are precisely what Meituan fears most.

3

Why Does Ele.me Deserve Meituan's 'Tribute'?

Over its two-decade history, Meituan has consistently studied rivals and adopted a 'wait-and-see' approach, earning industry recognition for its steady progress. Throughout this journey, Ele.me has remained its most formidable competitor. From market share battles to user resource competition, from merchant partnership expansion to delivery service optimization, both sides have engaged in fierce competition across all fronts. This balanced competitive dynamic has kept Meituan vigilant, maintaining high market sensitivity and competitiveness.

In Meituan's two-decade history, it has faced numerous rivals: from Lashou and Wowo in the group-buying wars to Baidu Nuomi and Koubei in the food delivery arena, and more recently, cross-border entries by Douyin and JD.com. Yet, why does it exhibit such complex emotions toward Ele.me? The answer lies in Ele.me being the only competitor truly 'on par' with Meituan, engaging in sustained strategic clashes for over a decade.

In the battle for food delivery market share, Ele.me leveraged its first-mover advantage and differentiated strategy to secure a significant footprint in core cities. To compete, Meituan continuously increased market investments, optimized delivery algorithms, and enhanced service quality, gradually narrowing the gap with Ele.me and even surpassing it in some regions. This fierce competition drove both sides to continually elevate their capabilities, accelerating the industry's rapid development.

Ele.me's differentiated focus strategy and its integration with Taobao Flash Delivery have endowed it with unique strategic value and far-reaching industry influence. By deeply cultivating core markets and reinforcing service commitments, Ele.me has forged a competitive brand image and user reputation, setting industry benchmarks. Its integration with Taobao Flash Delivery further leads industry trends, driving retail e-commerce transformation and upgrading.

Meituan fully recognizes the profound impact of Ele.me's strategic moves on the industry landscape. Ele.me's successful experiences and development models offer Meituan valuable insights and inspiration. Meanwhile, Ele.me's innovation and adaptability during industry transformations have made Meituan acknowledge it as a worthy competitor. Meituan understands that only by confronting Ele.me's competition and continuously learning and innovating can it remain competitive in the fierce market.

The competition between Meituan and Ele.me spans the entire growth cycle of China's food delivery industry. Both sides have engaged in all-around competition in subsidy strategies, rider management, algorithm optimization, and merchant services, jointly driving the improvement of industry infrastructure. Arguably, today's user-familiar service standards like '30-minute delivery,' 'online customer service,' and 'complaint compensation' were gradually established during this decade-long tug-of-war.

Unlike other competitors' aggressiveness or short-sightedness, Ele.me has demonstrated remarkable strategic resilience over most periods. Even after being wholly acquired by Alibaba, it refrained from blind expansion or sacrificing user experience for scale. This 'restrained aggressiveness' has prevented Meituan from ever fully defeating it, forcing continuous resource allocation to counter. As military strategy states, 'A skilled warrior achieves greatness without ostentation.' Ele.me's formidability lies in its unassuming yet methodical advancement.

More admirably, Ele.me has not confined competition to market share battles. Through deep integration with Taobao Flash Delivery, it explores a new path of 'ecosystem synergy' rather than 'point-to-point confrontation.' This attempt offers the entire industry a possibility beyond zero-sum games—where competition can coexist, platforms can complement each other, and user value can be shared.

Hence, Meituan's 'tribute' to Ele.me during its 'transition' reflects complex emotions. The phrase 'true colors never fade in integration' ostensibly questions its independence but reveals concerns about its ability to maintain innovation within Alibaba's ecosystem. Meanwhile, 'may you remain profound in the depths' implies awe for its future influence.

4

Beyond Zero-Sum: Inspiration and Enlightenment

Ele.me's active participation and contribution to industry transformation inspire all players, including Meituan, to explore possibilities beyond zero-sum games. In traditional market competition, firms often view rivals as enemies, pursuing maximum self-interest while neglecting overall industry development and win-win cooperation. However, Ele.me's integration with Taobao Flash Delivery demonstrates that through deep collaboration and resource integration, firms can achieve complementary strengths and jointly drive industry progress.

As a key industry player, Meituan also recognizes opportunities beyond zero-sum games from Ele.me's development. It realizes that competition with Ele.me and others need not be a life-or-death struggle but can involve collaboration and innovation to jointly explore new market spaces and create greater value. This shift in thinking will help Meituan formulate more scientific and rational development strategies for sustainable growth.

The event of Meituan 'paying tribute' to Ele.me highlights how Ele.me, as a pioneer and strategic adherent in the food delivery industry, has not only secured enduring vitality and industry respect through differentiated focus and deep integration with Taobao Flash Delivery but also driven retail e-commerce transformation and upgrading.

Meituan regards Ele.me as its top competitor precisely because of Ele.me's strength, strategic value, and industry influence demonstrated in market competition. In future market competition, it is hoped that Meituan and Ele.me will continue to learn from and inspire each other, jointly driving the industry toward healthier, innovative, and win-win development, bringing consumers more high-quality products and services and creating better consumption experiences.

This article is an original piece by BT Finance. Unauthorized use, reproduction, dissemination, or adaptation of this article is prohibited. Legal action will be pursued for infringement.