Has the 'Revolutionary' Satellite Communication Faded? Phone Makers Cut Promotions, but It's Actually a Sign of Widespread Adoption

![]() 12/02 2025

12/02 2025

![]() 539

539

From a 'Unique Selling Proposition' to a 'Basic Expectation'.

Have you noticed that mobile satellite communication, once a heavily touted feature by phone manufacturers, has gradually faded from the limelight?

In 2022, the Huawei Mate 50 series and iPhone 14 Pro series made headlines by publicly supporting mobile satellite communication at their launch events. Initially limited to short message services, this innovation was hailed as a new frontier for high-end smartphones. Over the following year, brands like Samsung, Honor, Xiaomi, OPPO, and Vivo also joined the 'satellite communication league' (a Chinese term meaning 'group' or 'camp').

(Image source: Honor)

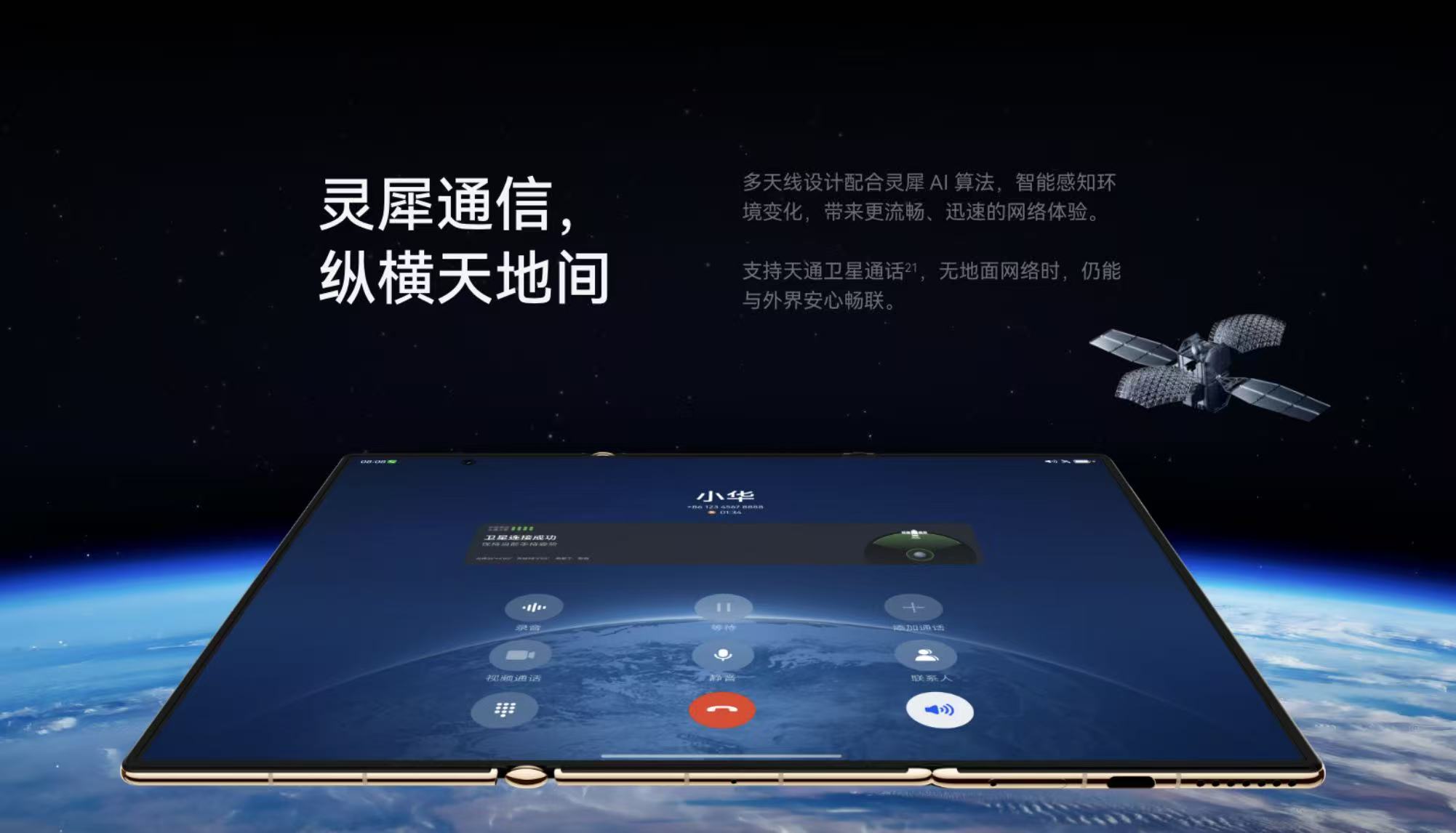

In just three years, mobile satellite communication technology has advanced rapidly, evolving from basic short messages and custom text messages to satellite calls and even multimedia messaging. It's fair to say that the satellite communication capabilities of modern smartphones now surpass those of some mid-to-low-end satellite phones.

Yet, despite being a 'premium feature,' by 2025, few manufacturers still emphasize it as a key selling point. The time devoted to it during launch events has dwindled, and some new models may even slip under the radar, offering this functionality without much fanfare. Why has mobile satellite communication suddenly lost its appeal?

Satellite Communication Can 'Break Through the Sky,' but User Interest Remains Low.

While mobile satellite communication technology has made significant strides, the barriers to entry remain high, including service fees and terminal costs. This has resulted in weak user adoption and limited attention, leading manufacturers to deprioritize it in their marketing efforts—creating a vicious cycle.

As we know, mobile satellite communication is closely tied to operator services. China Telecom and China Mobile obtained satellite mobile communication business licenses in 2023 and 2024, respectively. China Telecom provides satellite voice and messaging services via the Tiantong-1 system, while China Mobile partners with Beidou for messaging. China Unicom was slower, securing its license only in September 2025.

Different operators offer varying satellite services with distinct pricing structures. For example, mobile users can only access Beidou satellite messaging, not voice services.

On the hardware side, satellite communication is currently limited to flagship models. Some manufacturers even reserve it exclusively for their top-tier configurations, such as the OPPO Find X9 Pro, where only the 16+1TB variant includes satellite communication at a $40 premium over the standard version. By 2025, seven manufacturers had launched over thirty satellite-enabled models, with cumulative sales exceeding 20 million units. However, this market share remains relatively small compared to the overall smartphone market.

(Image source: OPPO)

In reality, it's not that manufacturers are unwilling to promote satellite communication or deliberately make it a flagship exclusive—cost is the primary obstacle. Satellite antennas, power amplifiers, and isolation designs require space, while satellite basebands and alignment algorithms add to expenses. Meanwhile, consumers prioritize features with immediate perceived value, such as imaging, cooling, and battery life.

Most consumers view satellite communication as an unnecessary expense for something they rarely use. This is a common sentiment in the early adoption phase of any new technology, as seen with 5G and NFC, which initially debuted as flagship exclusives before becoming mainstream.

The Decline in Enthusiasm for Mobile Satellite Communication Technology Stems from Its Limited Use Cases.

(Image source: Apple)

Satellite communication requires open, unobstructed environments and often necessitates holding the phone aloft to establish a connection. This contrasts sharply with modern users' expectations for instant, seamless connectivity. As previously mentioned, many consumers believe they rarely encounter situations with no signal, especially in China, which boasts some of the world's best mobile coverage. Even in emergencies, satellite rescue may not be necessary.

This vicious cycle has led to declining discussions around the technology, prompting manufacturers to deprioritize its promotion.

No Longer a Selling Point, Is Mobile Satellite Communication About to Become Mainstream?

Judging by consumer discussions and manufacturer emphasis during launch events, the hype around mobile satellite communication has indeed faded. However, this could signal an impending breakthrough.

Earlier, we noted that its lack of widespread adoption stems from its presence in high-end flagship models, which limits its reach to adventurous early adopters. This year, however, that trend has begun to shift.

Honor equipped both models in its Magic8 series with satellite communication, including the standard 1TB version supporting Beidou messaging. This reduced the entry price from over $900 to $600–$750. Recently, Huawei launched the Enjoy 70X Premium Edition at just $240 with Beidou support, further lowering the barrier.

(Image source: Huawei)

Clearly, compared to its early days, the cost of mobile satellite communication has declined. Combined with advancements in chip manufacturing and internal space optimization, its integration into budget models is now feasible.

On the operator side, progress has been swifter than anticipated. China Telecom has maintained encrypted coverage via its Tiantong system while advancing low-to-medium Earth orbit integration, enabling easier satellite connections in more regions. Two years ago, Leitech tested smartphone satellite communication, which required significant technical skill. By last year, connection speeds had improved notably.

Additionally, China Mobile's NTN technology, trialed successfully between 2024 and 2025, enables 5G smartphones to connect to satellites without dedicated hardware. This suggests future satellite communication may rely on software upgrades rather than specialized chips, becoming a fundamental network capability.

(Image source: Huawei)

This explains why manufacturers are downplaying current satellite communication technologies—if future iterations can be deployed universally via software, today's specialized solutions will lose their promotional appeal.

Overall, the 'cooling down' of mobile satellite communication reflects its transition from a sudden breakthrough to a mature technology awaiting the next innovation. It does not indicate declining interest or abandonment by manufacturers.

The Path to Widespread Adoption: From 'Unique Selling Proposition' to 'Basic Expectation'.

Looking back, mobile satellite communication generated significant buzz at its debut, with some consumers even arguing that 'no satellite communication means no high-end phone.' Three years on, it has become commonplace in flagships, and consumer enthusiasm has stabilized.

This pattern is not new in smartphone history. NFC was once a major selling point but is now standard even in budget models. Dust and water resistance, once deemed unnecessary by many, have also become ubiquitous. The same applies to 5G and infrared sensors.

Manufacturers reduce promotion because users now understand these low-frequency features well enough that heavy marketing is unnecessary. More critically, operators are still developing 'game-changing' technologies, such as China Mobile's NTN, which could redefine perceptions of satellite communication. However, patience is required.

When mobile satellite communication ceases to be a niche selling point or a tier-defining feature and instead becomes a universal standard, its true value will emerge—ensuring every phone can send distress signals in emergencies.

Source: Leitech

Images sourced from 123RF licensed library. Source: Leitech