Jieru Digital's Significant Performance Volatility

![]() 06/24 2024

06/24 2024

![]() 587

587

Shi Zifu, Port Business Observer

On May 22nd, Shandong Jieru Digital Technology Co., Ltd. (hereinafter referred to as Jieru Digital) and its sponsor, Guoxin Securities, disclosed the replies to the third round of inquiries, continuing to advance the listing process on the Beijing Stock Exchange.

Since submitting its application in June 2023, the regulatory authorities have issued three rounds of audit inquiry letters, focusing on issues such as Jieru Digital's peer competition, related-party transactions, the rationality of fundraising, and post-period performance fluctuations. The company's path to listing has been overshadowed.

01

Performance Fluctuations Under Scrutiny

Founded in 2000, Jieru Digital is an industrial internet company driven by digital twins, assisting enterprises in digital transformation and enabling digital change. Jieru Digital's main businesses include integrated digital center services, digital twin industrial internet services, and digital marketing integration services.

Jieru Digital's prospectus was filed in June 2023. According to the prospectus, from 2020 to 2022 (hereinafter referred to as the reporting period), Jieru Digital achieved revenues of 111 million yuan, 153 million yuan, and 178 million yuan, with net profits attributable to shareholders for the period of 17.9332 million yuan, 24.3293 million yuan, and 35.5297 million yuan, respectively. After excluding non-recurring items, the net profits attributable to shareholders were 14.3926 million yuan, 17.1039 million yuan, and 26.1737 million yuan, respectively.

From a business structure perspective, the integrated digital center business accounted for more than half of Jieru Digital's total revenue during the reporting period, generating revenue of 61.103 million yuan, 97.7614 million yuan, and 97.8164 million yuan, representing 55.09%, 64.17%, and 55.57% of the company's primary revenue, respectively.

The second-largest contributor to revenue was the digital twin industrial internet business, accounting for approximately 30% of the company's primary revenue during each period. Specifically, the revenue generated was 33.2692 million yuan, 36.3321 million yuan, and 63.0489 million yuan, representing 30.00%, 23.85%, and 35.82% of the primary revenue, respectively.

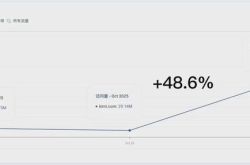

According to the filing information and audit inquiry letters, in the first quarter of 2023, Jieru Digital achieved revenue of 32.3524 million yuan, an increase of 80.27% compared to the same period last year; however, the net profit was -5.5988 million yuan, a year-on-year decrease of 428.12%. Jieru Digital attributed the significant decline in net profit to the relatively low gross profit margin of projects accepted during the period and increased expenses.

From January to June 2023, Jieru Digital achieved revenue of 105 million yuan, representing a year-on-year increase of 24.40%; net profit was 15.0016 million yuan, up 14.89% year-on-year; and non-recurring net profit was 9.7315 million yuan, representing a year-on-year increase of 23.48%.

Meanwhile, Jieru Digital expects to achieve revenue of 116 million yuan and net profit of 25.8169 million yuan from July to December 2023, with a non-recurring net profit of 22.587 million yuan.

In the first round of audit inquiry letters, the Beijing Stock Exchange required Jieru Digital to explain whether the trend of declining performance had been reversed, whether there were still significant adverse effects on its ability to continue operating, and to fully disclose the risks of declining performance. In the second round of inquiry letters, Jieru Digital was required to provide estimated 2023 performance data and its main production and business plans for 2023. In the