Broken on the first day of listing, how will Dida achieve greater value?

![]() 07/01 2024

07/01 2024

![]() 566

566

It's just over, and it's just the beginning!

Source: Shoucai - The First Financial Research Institute

Persistence eventually pays off.

On June 28, Dida Chuxing officially listed on the main board of the Hong Kong Stock Exchange, marking the birth of the first shared mobility stock. It is reported that the public offering received 112.9 times subscription during the offering phase, with 19,815 subscribers. The final offering price was set at HK$6 per share, raising a net amount of approximately HK$182 million through the global offering.

Looking back at the journey to listing, it was filled with twists and turns. The first attempt dates back to 2020, followed by frequent submissions of prospectuses over the past four years, revealing the company's persistent desire for the capital market.

It is said that good things come to those who wait, but at least from the first showing on the market, it was not well received: the stock price broke below its offering price on the opening day, reporting at HK$5.23 and closing at HK$4.65, with a decline of 22.50%.

Listing is only the first step of the "long march," and the key to a value marathon is whether it can tell a new story that convinces capital.

1

Has the strategy of winning by speed failed?

Getting the listing ticket is congratulatory. However, four years have passed, and the industry landscape has long since changed.

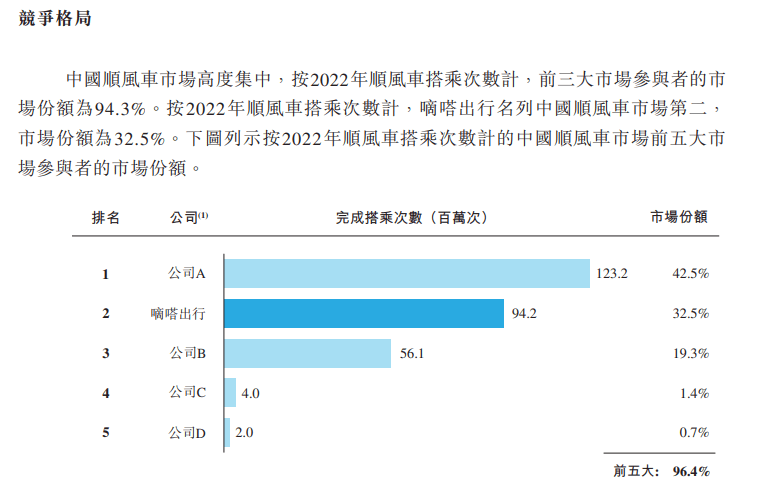

According to Frost & Sullivan's report, in 2019, Dida Chuxing occupied a 66.5% market share in ride-sharing, making it the largest ride-sharing platform in China.

However, updated data in the prospectus shows that in 2023, Dida Chuxing operated the second-largest ride-sharing platform in China, with a total transaction value of RMB 8.6 billion and 130 million rides. It had a 31.8% market share in terms of total transaction value and a 31.0% market share in terms of rides. It is worth noting that in 2021, Dida Chuxing still ranked first with a 38.1% market share. The turning point occurred in 2022, when its market share plummeted to 32.5%, falling behind Company A and taking second place.

Even more glaring is that despite declining market share, business dependence continues to increase. According to the prospectus, from 2021 to 2023, Dida Chuxing's ride-sharing business revenue was RMB 695 million, RMB 515 million, and RMB 774 million, accounting for 89.0%, 90.5%, and 95.0% of total revenue, respectively.

Industry analyst Sun Yewen said that thanks to the light asset model of ride-sharing, Dida Chuxing has become the only profitable ride-hailing platform currently. However, as companies like Didi and Hello Mobility increase subsidies, Dida Chuxing is also facing dual pressures of profit compression and insufficient driver scale.

According to official data disclosed by Dida, as of June 30, 2023, the company's ride-sharing service has been launched in 366 cities across the country, with approximately 15.2 million certified private car owners. Meanwhile, Hello Mobility's 2023 ESG report stated that as of the end of the year, it had over 30 million certified ride-sharing drivers.

To attract and retain drivers, Dida has spared no effort in increasing subsidies. The prospectus shows that from 2021 to 2023, the company's subsidy costs for private car owners accounted for 5.9%, 12.4%, and 13.8% of the total.

Unfortunately, despite these efforts, Dida Chuxing still faces a decline in market share and lags behind in driver size. Is there room for improvement in input efficiency and operational refinement?

Looking at the pressured gross margin, it is not overly demanding. From 2021 to 2023, it was 85.4%, 79.5%, and 75.9%, respectively. Dida Chuxing said that the decline was due to increased subsidies for private car owners and higher insurance premiums.

Founder Song Zhongjie favors "winning by speed." According to NetEase Tech, as early as the initial stage of Dida's startup in 2016, Song Zhongjie said that the company aimed to capture the largest market share in the shortest possible time, regardless of cost, as being in the top three was crucial in the internet industry.

The latest prospectus shows that Dida Chuxing expects to use 50% of the net proceeds from its initial public offering for expanding its user base and strengthening marketing/promotional activities, 35% for enhancing technological capabilities and improving safety mechanisms, and 15% for enhancing monetization capabilities.

Obviously, Dida Chuxing still intends to win by speed and scale after listing. However, the industry has already entered a red ocean period of存量. Facing declining market share, fierce competition, and its own profit pressure, how difficult will it be? How much will the market buy into it?

According to Frost & Sullivan's report, in 2021, 2022, and 2023, the total subsidies for Dida ride-sharing drivers and rewards for ride-sharing passengers only accounted for 1.8%, 1.9%, and 1.8% of the total transaction value of the ride-sharing platform in the same year, far below the average level of 16.7% for online car-hailing.

2

Declining taxi revenue and market share

Who will shoulder the "second curve"?

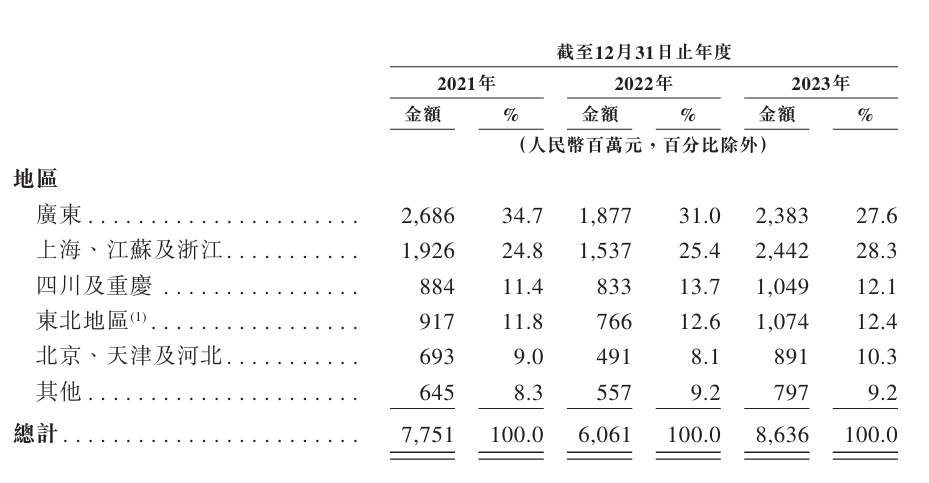

In addition to being highly dependent on ride-sharing, Dida's market is concentrated in Guangdong, Shanghai, Jiangsu, and Zhejiang, with cumulative revenue accounting for over 55% in these four regions, indicating strong geographical concentration. With capital support after listing, breaking the nationalization deadlock and finding a second curve will be crucial for determining value trends.

Ride-sharing is a profitable business, but there are doubts about its future growth potential.

According to Frost & Sullivan's report, in 2023, the total transaction value of China's automotive passenger transport market was dominated by traditional taxis and online car-hailing, accounting for 54.2% and 41.4%, respectively, while ride-sharing only accounted for 4.4%.

This is not good news for Dida Chuxing. Relying on ride-sharing to establish and rapidly grow into a leading position in the first 10 years, Dida must seriously consider how to proceed in the next 10 years and what new stories it can tell as it stands at a new starting point for listing.

In fact, the company has also been thinking ahead and preparing for rainy days. To break the shackles of business singularity and geographical concentration, it has been continuously developing its smart taxi business in recent years.

The prospectus shows that the specific model of this business is: Dida provides taxi drivers with online car-hailing solutions through its platform app, charging them service fees based on order volume, local taxi prices, distance, etc. As of December 31, 2023, Dida's taxi online car-hailing service has covered 91 cities across the country and has reached strategic cooperation with 79 cities.

The achievements are noteworthy, but the corresponding revenue is still weak, even declining: from 2021 to 2023, Dida's revenue from providing smart taxi services was RMB 32.6 million, RMB 19.4 million, and RMB 11.3 million, accounting for only 4.2%, 3.4%, and 1.4% of total revenue, respectively. It facilitated approximately 35.5 million, 21.5 million, and 12.1 million taxi online rides.

With declining core data, how about market competitiveness? What about the industry situation and future development prospects? Can it shoulder the banner of new growth?

Upon closer inspection, one of the main reasons for not meeting expectations may be the increase in average service fees. According to Ifeng Tech, these fees were 3.9%, 4.5%, and 5.1% over the same period, respectively.

Industry analyst Wang Yanbo said that unlike Didi's self-operated business, charging traditional taxis for services poses more difficulties. Dida's user base is not dominant, making charging taxis a poor choice. Currently, taxis, online car-hailing, and ride-sharing are the main modes of public transportation. After encountering obstacles in trying taxi business, it is unknown whether Dida will test the waters of online car-hailing in the future, but judging from the current market landscape, there are still considerable difficulties.

Not exaggerating. Since 2023, cities such as Sanya, Zhuhai, and Jinan have successively issued early warnings about the saturation of online car-hailing capacity, and some cities have suspended the acceptance of transportation certificates.

On April 11, 2024, the Shenzhen Transportation Bureau issued a risk warning that the online car-hailing market was becoming saturated. On April 16, the Chongqing Transportation Commission also stated that the existing order volume scale was actually difficult to support all 118,000 online car-hailing vehicles in the central city participating in operational services, with vehicle capacity far exceeding actual demand.

Faced with market saturation pressure, platforms are also not at ease, launching another wave of subsidies to compete for a larger market share. On June 24, Ruqi Travel passed the listing hearing of the main board of the Hong Kong Stock Exchange. It is expected to continue generating net losses and net cash outflows from operations from 2024 to 2026.

It can be foreseen that the market will usher in a new round of fierce competition, and who will come out on top remains unknown. What is certain is that blindly expanding in a粗放 manner will lead to a zero-sum game. Exploring a high-quality, sustainable, and healthy new path is urgent.

Industry analyst Wang Tingyan believes that currently, there are limited options for ride-hailing platforms to differentiate their development. Compared to Hello Mobility's platform advantage and Didi's one-stop travel service, Dida Chuxing still lacks a strong moat of differentiation. In addition to continuing to deepen its ride-sharing business, it may be difficult to achieve better growth in the taxi and online car-hailing markets in the short term. After listing, what it relies on to gain investor recognition is a soul-searching question for Song Zhongjie.

3

Consolidating the foundation of compliance

The key lies in integrating knowledge and action

Indeed, forewarned is forearmed.

From a business environment perspective, compared to the strictly regulated online car-hailing business, according to the official Weibo of the Ministry of Transport, currently, running ride-sharing does not require any special qualifications.

The relatively extensive development status means profit margins, but also various uncertainties.

In fact, the lack of effective industry regulations is also an important consideration for the slow growth and low market share of ride-sharing in recent years. According to Dida's publicly disclosed information, its ride-sharing business has always followed the guiding principle of "meeting the owner's own travel needs as a prerequisite, and the owner does not aim to profit."

In December 2022, the Inter-ministerial Joint Conference Office for the Coordinated Regulation of New Forms of Transportation organized a reminder-style interview with ride-sharing platform companies such as Dida and Hello Mobility.

The interview pointed out that recent media reports have repeatedly mentioned issues related to products from ride-sharing platform companies such as Dida and Hello Mobility, mainly involving the "nearby orders" function deviating from the essence of ride-sharing, suspected of engaging in illegal online car-hailing business under the guise of ride-sharing, and potential safety hazards in areas such as displaying user avatars by gender and providing long-distance intercity services.

In addition, there have been concerns about cost-sharing, with individual drivers being exposed to doubts about taking multiple orders and carpooling on multiple platforms. According to a report by Xin Kuai Bao in April 2024, there were cases of ride-sharing drivers in Shenzhen engaging in illegal multi-platform pickup behavior. After consumers contacted the platform to complain, and the platform confirmed the driver's violation, the consumer only received a refund compensation of RMB 8.9.

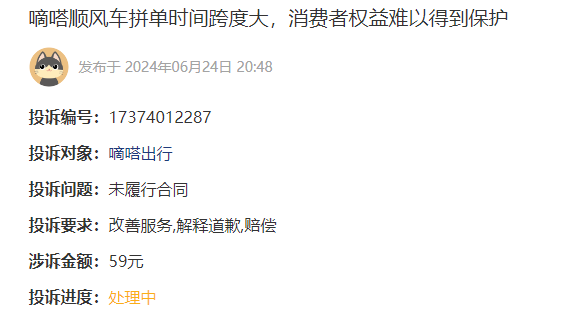

Browsing Heimao Complaints, as of June 28, 2024, Dida Chuxing has accumulated 17,993 related complaints. These mainly focus on disputes over deductions, untimely customer service handling, and opaque charges by ride-sharing drivers.

For example, on June 24, complaint number 17374012287 showed that a consumer claimed that on June 23, they carpooled from Zhongshan to Guangzhou. The driver was scheduled to pick them up at 13:05, but the driver did not arrive on time. After repeated reminders, the driver said they would not depart until all passengers were picked up an hour later. The platform operator failed to fulfill its responsibility to protect consumer rights, leading to the consumer not being able to depart at the agreed time, ultimately causing a series of losses.

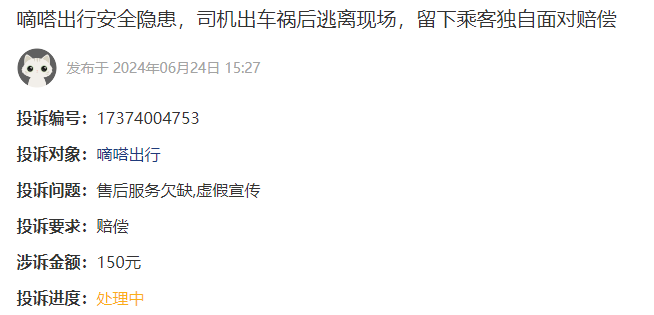

Another complaint, number 17374004753, showed that a consumer claimed that the ride-sharing driver they took had a bad attitude and illegally parked in a no-parking area, leading to an accident that injured a third party. After the accident, the driver refused to report the insurance and fled the scene. After reporting to the police, the platform did not provide driver information, hiding the driver's details, leaving the passenger to compensate the injured party with RMB 300 for vehicle repairs and hospital fees alone.

(All the above complaints have been reviewed by the platform.)

In fact, compensation difficulties due to traffic accidents during rides with "ride-sharing" are not uncommon. Regarding legal issues related to compensation.

Huang Qirui, the chief lawyer of Beijing Hongsha Law Firm, believes that if a passenger is injured in a traffic accident involving ride-sharing, they can file a lawsuit against the car owner, the platform company, and the insurance company that underwrites the compulsory and commercial insurance for ride-sharing as co-defendants. In terms of liability, if it belongs to the responsibility of the ride-sharing party, the insurance company that underwrites the compulsory insurance for ride-sharing shall compensate first; for the insufficient part, the insurance company that underwrites the commercial insurance for ride-sharing shall compensate in accordance with the provisions of the insurance contract; if there is still insufficient compensation or no commercial insurance is purchased, the ride-sharing owner shall compensate. If the platform company and the ride-sharing owner are in the same legal position as the carrier, they shall jointly bear joint and several liability.

Undoubtedly, it is not realistic for everyone to be satisfied with every user, and the above complaints may be biased and one-sided. As the saying goes, if the foundation is not solid, the ground will shake. Product experience and user reputation are the cornerstone of enterprise development. Standing at the new stage of listing, compliance and safety are the first foundation of value. Whether it can be consolidated determines the future stability and valuation direction of the enterprise. From the business model to the fundamental aspects of product and service, there is nothing wrong with Dida's efforts to fill in gaps, enhance constraints, and reduce uncertainty in violations.

It is worth mentioning that in June 2024, at the Safety Conference and Safety Production Month kickoff meeting, Song Zhongjie pointed out that as an enterprise, any business achievement is meaningless if safety work is not done well. He called on all employees to remember the twelve character policy of the Safety Production Law: safety first, prevention first, comprehensive management, and extreme execution in work. Safety awareness should be deeply rooted, and the safety alarm bell should be sounded in both work and life. The idea of safety first should always be kept in mind.

Luo Xiang said that the greatest pain for humans is the inability to bridge the gap between "knowing" and "doing". How many shortcomings do Dida Chuxing still have to address in terms of compliance and consumer safety?

four

The market needs new stories

What makes achieving greater value?

All answers are hidden in the time answer sheet.

A new starting point and new journey, how to break through the business ceiling, how to strengthen compliance certainty, how to develop the second curve, Dida Chuxing needs a new story.

Fortunately, there is no shortage of space for movement. As of the end of 2023, Dida Cash and cash equivalents amounted to 1.42 billion yuan. Coupled with this IPO to boost profits, abundant cash reserves are the foundation for future transformation.

From 2021 to 2023, the research and development expenses of Dida Chuxing have been increasing year by year, reaching 60.1 million yuan, 89 million yuan, and 121.7 million yuan respectively. In 2023, the company launched eight new research and development projects, mainly involving artificial intelligence algorithm design, sales and marketing management, big data technology, map information point (POI) search, and route planning.

Song Zhongjie believes that as AI enters an explosive period, Dida Chuxing will deeply utilize cutting-edge technological means such as big data, artificial intelligence, and advanced algorithms to achieve many new breakthroughs in innovative ways to improve the efficiency and intelligent safety of the ride hailing experience, promote the digitalization of ride hailing carbon emissions reduction, innovate and empower the digital transformation and upgrading of the entire chain of traditional cruise rentals, and promote the digital governance of taxi services.

The prospectus shows that Dida Chuxing will continue to focus on its main business in the future, further consolidating its market position and enhancing its brand influence in the ride hailing industry; Continue to expand smart taxi services and promote the digital transformation of the taxi industry; Enhance monetization ability and enrich monetization channels; Enhance technical capabilities and operational efficiency, especially by investing in artificial intelligence and machine learning technologies, while promoting user experience and security mechanism upgrades; In addition, more strategic alliances, investments, and acquisition explorations will be made in terms of capital.

At the listing ceremony, Song Zhongjie stated that going public is an important milestone and a new starting point. We will continue to move forward with stronger beliefs, more innovative thinking, and a more determined spirit. Double our efforts to create greater value for society, users, shareholders, and employees, and achieve the vision of 'making the road empty' earlier.

With careful consideration of words and phrases, there is still a lot of enthusiasm for the Dida trip. Continuing to deepen the cultivation of ride hailing, driving taxis, and betting on AI, our strategic determination and trend positioning are worthy of recognition.

However, as the saying goes, there is often a gap between ideals and reality that needs to be bridged. Sorting out the above problems, the corresponding challenges and crux are also visible to the naked eye. It is said that every 10 years, Dida Chuxing will celebrate its 10th birthday in 2024. Standing at a new starting point for listing, can we use AI to eliminate accumulated shortcomings and showcase new looks, and overtake on curves? How to tell through old stories, tell new stories, resolve hair breaking awkwardness, and achieve greater value leap?

Everything has just ended, everything has just started again!