Fiscal and Tax Digitization: Who Are the Most Profitable Enterprises?

![]() 07/03 2024

07/03 2024

![]() 439

439

Fiscal and tax digitization refers to the comprehensive utilization of modern information technologies such as artificial intelligence, big data, and cloud computing to digitally transform fiscal and tax work, improving efficiency, accuracy, and policy compliance. The digital transformation of fiscal and tax has nurtured abundant investment opportunities in multiple key areas. For example, cloud computing service providers support the data processing needs of fiscal and tax digitization through data storage and computing services. Big data analytics companies utilize fiscal and tax data to provide insights and assist in decision-making.

Profitability refers to a company's ability to generate profits, typically reflected in the amount and level of corporate income over a certain period. The analysis of profitability is a deep-level analysis of a company's profit margin.

This article is part of the series on corporate value focused on "Profitability." It selects 19 fiscal and tax digitization enterprises as research samples and uses indicators such as return on equity, gross margin, and net margin for evaluation. The data is based on historical information and does not represent future trends; it is provided for static analysis only and does not constitute investment advice.

Top 10 Enterprises in Fiscal and Tax Digitization Profitability:

10th: Aerospace Information

Industry Subdivision: IT Services

Profitability: Return on Equity 5.77%, Gross Margin 26.96%, Net Margin 8.47%

Performance Forecast: No institutional performance forecast for this year

Main Products: Corporate fiscal and tax services are the primary source of income, accounting for 37.12% of revenue, with a gross margin of 46.12%

Company Highlights: Aerospace Information's independently developed artificial intelligence and big data "Starry Sky Series" products provide secure and trusted intelligent application construction for industries such as taxation, public security, postal services, and transportation.

9th: Donggang Shares

Industry Subdivision: Printing

Profitability: Return on Equity 10.50%, Gross Margin 36.69%, Net Margin 14.04%

Performance Forecast: No institutional performance forecast for this year

Main Products: Printing products are the primary source of income, accounting for 65.79% of revenue, with a gross margin of 35.47%

Company Highlights: Donggang Shares actively participates in the promotion of fiscal and tax businesses, leveraging its advantages in the field of electronic invoices and blockchain invoices to keep pace with fiscal and tax reforms.

8th: Digital Certification

Industry Subdivision: Vertical Application Software

Profitability: Return on Equity 6.88%, Gross Margin 52.41%, Net Margin 5.33%

Performance Forecast: No institutional performance forecast for this year

Main Products: Network security services are the primary source of income, accounting for 29.65% of revenue, with a gross margin of 48.16%

Company Highlights: Digital Certification's specific applications in the taxation field include providing digital certificates, electronic signatures, and other services to tax departments.

7th: Yonyou Network

Industry Subdivision: Horizontal General Software

Profitability: Return on Equity 1.00%, Gross Margin 56.12%, Net Margin 0.18%

Performance Forecast: ROE peaked at 10.19% in the past three years, with the latest forecast average of 1.24%

Main Products: Technical services and training are the primary source of income, accounting for 60.83% of revenue, with a gross margin of 25.71%

Company Highlights: In the field of digital fiscal and taxation, Yonyou Network's products fully support the end-to-end management of digital invoices, further enhancing the automation and intelligence of digital fiscal and taxation.

6th: China Software

Industry Subdivision: IT Services

Profitability: Return on Equity -1.56%, Gross Margin 32.69%, Net Margin 1.46%

Performance Forecast: ROE peaked at 3.23% in the past three years, with the latest forecast average of 5.61%

Main Products: Industry solutions are the primary source of income, accounting for 51.33% of revenue, with a gross margin of 9.66%

Company Highlights: China Software focuses on the tax industry, conducting industry-specific management with information system services as the core and organizing the implementation and delivery of products and services.

5th: Changliang Technology

Industry Subdivision: Vertical Application Software

Profitability: Return on Equity 3.96%, Gross Margin 36.57%, Net Margin 3.69%

Performance Forecast: ROE has fluctuated between 1.5% and 8.5% in the past three years, with the latest forecast average of 6.30%

Main Products: Digital financial business solutions are the primary source of income, accounting for 59.88% of revenue, with a gross margin of 36.66%

Company Highlights: Changliang Technology provides tax and invoicing solutions and IT system construction for financial institutions, achieving full-chain management of VAT invoices from sales to purchases.

4th: Shuiyou Shares

Industry Subdivision: IT Services

Profitability: Return on Equity 6.77%, Gross Margin 57.83%, Net Margin 9.11%

Performance Forecast: ROE has continuously declined to 3.42% in the past three years, with the latest forecast average of 9.70%

Main Products: ToB SaaS subscriptions and consulting services are the primary source of income, accounting for 59.32% of revenue, with a gross margin of 73.86%

Company Highlights: Shuiyou Shares' main business is divided into two major segments: To G digital government services and To B SaaS subscriptions and consulting services.

3rd: Pulian Software

Industry Subdivision: Vertical Application Software

Profitability: Return on Equity 13.82%, Gross Margin 44.22%, Net Margin 17.69%

Performance Forecast: ROE has continuously declined to 5.39% in the past three years, with the latest forecast average of 12.23%

Main Products: Group management and control are the primary source of income, accounting for 88.34% of revenue, with a gross margin of 38.90%

Company Highlights: Pulian Software fully integrates financial management models with digital technologies, forming an IT innovation ERP financial product system.

2nd: Boss Software

Industry Subdivision: Vertical Application Software

Profitability: Return on Equity 14.60%, Gross Margin 64.46%, Net Margin 16.55%

Performance Forecast: ROE has continuously declined to 14.06% in the past three years, with the latest forecast average of 14.48%

Main Products: Technical services are the primary source of income, accounting for 75.48% of revenue, with a gross margin of 65.71%

Company Highlights: Focusing on digital invoices, electronic vouchers, and industry-finance-tax collaboration, Boss Software provides assistance and services for enterprise digitization and intelligence.

1st: Zhongke Jiangnan

Industry Subdivision: Vertical Application Software

Profitability: Return on Equity 24.49%, Gross Margin 56.51%, Net Margin 25.02%

Performance Forecast: ROE has continuously declined to 18.21% in the past three years, with the latest forecast average of 18.78%

Main Products: Electronic payment services are the primary source of income, accounting for 53.51% of revenue, with a gross margin of 64.80%

Company Highlights: Zhongke Jiangnan assists clients in establishing a financial fund and business management system that integrates centralized treasury payments and fiscal budget management.

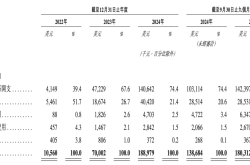

For the top 10 enterprises in fiscal and tax digitization profitability, their return on equity, gross margin, and net margin over the past three years: