Vietnam claims to have become the world's second-largest exporter of mobile phones, with Foxconn rolling its eyes, asking why there are power restrictions?

![]() 07/04 2024

07/04 2024

![]() 503

503

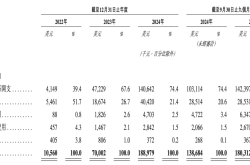

Recently, Vietnamese media reported that Vietnam's exports of mobile phones and components reached US$22.4 billion in the first five months of this year, representing an 11% year-on-year increase, surpassing India to become the world's second-largest exporter of mobile phones, second only to China. Foxconn and Samsung may have different opinions on this.

Undoubtedly, companies such as Foxconn and Samsung have made significant contributions to Vietnam's mobile phone business. Foxconn is continuously shifting production capacity to Vietnam and India. In earlier years, Foxconn announced that it would invest US$2.8 billion in Vietnam to build the largest mobile phone contract manufacturing plant outside of mainland China, taking advantage of India's relatively low labor costs.

Samsung is even more resolute. Samsung has closed all its mobile phone factories in mainland China and is investing heavily in Vietnam and India. Among them, Samsung once announced that it would build its largest mobile phone assembly plant outside of South Korea in Vietnam, with a production capacity of 100 million units. Samsung's investment plan is undoubtedly more ambitious than Foxconn's.

Vietnam is extremely delighted about this, allocating a large amount of land to Foxconn and Samsung and providing convenience. These two companies have also quickly built mobile phone assembly plants in Vietnam. It can be seen from the initial situation that these two companies have received preferential treatment in Vietnam, but subsequently, they encountered troubles in Vietnam.

Samsung's factory in Vietnam was once forced to shut down, and Foxconn requires a large amount of labor, but Vietnam's population is less than 100 million, far less than China's. Since last year, with the huge demand for electricity and other resources from a large number of factories, Vietnam has felt immense pressure and has repeatedly restricted the electricity consumption of these factories. In April this year, it was rumored that Vietnam required Samsung, Foxconn, and others to reduce their electricity consumption by 30% to ensure electricity supply for Vietnamese residents.

For Foxconn, as its factories in Vietnam go into production, Vietnam's labor costs are rising rapidly. Vietnamese workers said that their salaries at Foxconn have exceeded 3,000 yuan, which is not much different from the income of Foxconn workers in China, which is over 4,000 yuan. The gap in labor costs is about to be leveled.

Foxconn has also encountered issues of imperfect industries in Vietnam. In the early days, Foxconn needed to import packaging boxes and other items required for mobile phone production in Vietnam from China. Nowadays, Vietnam's mobile phone accessories still need to be transported from China in large quantities, which not only reduces efficiency but also increases costs.

Foxconn complied with Apple's request to manufacture iPhones in Vietnam and India. However, due to the lack of a complete industrial chain and the low technical level of workers in these two countries, it has led to issues such as low yield rates for iPhones. Apple has recognized this problem and is therefore allocating more iPhone orders to contract manufacturers in mainland China. It is reported that Luxshare Precision of mainland China has obtained 20% of iPhone 15 orders, while the obedient Foxconn has lost more orders.

Samsung is even more direct. Samsung's production in Vietnam has been unsmooth, and Samsung has quietly handed over orders to IDM companies in mainland China, such as Wintek Technology and other Chinese mobile phone contract manufacturers, which together obtained more than 40 million orders from Samsung in 2023. It is expected that they will obtain more than 60 million orders from Samsung this year. Samsung has invested heavily in Vietnam but has found that Made in China is still more reliable.

Vietnam claims that it is becoming the second-largest exporter of mobile phones, second only to China. However, the experiences of Foxconn and Samsung in Vietnam show that Vietnam's mobile phone industry development is not as smooth as it seems. As can be seen from the above data, Vietnam's mobile phone export growth rate is only 11%, while the export growth rate of consumer electronics products such as mobile phones and PCs in Vietnam during the same period has reached more than 30%. Obviously, the export growth rate of mobile phones lags far behind the overall export of consumer electronics products, which also means that Foxconn and Samsung's production capacity in Vietnam is slowing down, and Vietnam's mobile phone exports will soon suffer setbacks.