SYNAGISTICS Files Prospectus

![]() 07/04 2024

07/04 2024

![]() 631

631

The proposed valuation is HK$3.5 billion.

This article is originally created by IPO Early Know

Author | Stone Jin

WeChat Official Account | ipozaozhidao

According to IPO Early Know, SYNAGISTICS PTE. LTD. plans to merge with HK Acquisition Corporation, a SPAC company initiated by Hui De Acquisitions, to list on the Hong Kong Stock Exchange.

This means that SYNAGISTICS has become the third company intending to land on the Hong Kong Stock Exchange through a De-SPAC transaction.

According to the merger agreement, the proposed valuation of SYNAGISTICS is HK$3.5 billion. At the same time, HK Acquisition Corporation and SYNAGISTICS have signed nine investment agreements with nine PIPE investors, with a total subscription amount of approximately HK$601 million for PIPE investments. Among them, Ruber Capital subscribed for HK$160 million; Celestial Link, an indirect wholly-owned subsidiary of PCCW (00008.HK), subscribed for HK$280 million; China Oriental International Asset Management subscribed for HK$23 million, as well as several individual investors.

It is worth noting that before the completion of the De-SPAC transaction, Alibaba Singapore was the largest external investor in SYNAGISTICS, with a direct stake of 47.22%. In addition, Gobi Ventures holds a 22.17% stake in SYNAGISTICS.

Founded in 2014, SYNAGISTICS is a D2C enterprise focused on the beauty, body, and infant care sectors. It has gradually begun to provide e-commerce and electronic logistics distribution services to some of its suppliers and has now developed into a leading data-driven digital commerce solutions platform in Southeast Asia.

According to data from China Insights Consulting, in terms of revenue in 2023, it ranks second among all digital commerce solutions platforms in Southeast Asia.

Specifically, SYNAGISTICS provides comprehensive digital commerce solutions to brand partners covering both D2B and D2C business models. Under the D2B business model, SYNAGISTICS provides data-driven digital commerce solutions to brands, covering all aspects of digital commerce. It has now served over 600 brand partners, unifying consumer experiences across all major digital touchpoints. Under the D2C business model, SYNAGISTICS leverages its database and real-time analytics technology to sell brand products directly to Southeast Asian consumers through digital touchpoints such as Lazada.

Currently, the business of SYNAGISTICS and its brand partners covers multiple areas, including fashion and apparel, high-end beauty and healthcare, as well as high-end lifestyle and living areas. Its business covers six major economies in Southeast Asia, namely Singapore, Malaysia, the Philippines, Vietnam, Thailand, and Indonesia, and it is also strategically expanding its global business outside of Southeast Asia.

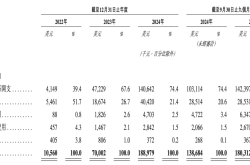

From 2021 to 2023, SYNAGISTICS' revenue was HK$497 million, HK$652 million, and HK$732 million, respectively, representing a compound annual growth rate of 21.4%. During the same period, SYNAGISTICS' gross profit margins were 27.6%, 27.2%, and 25.1%, respectively.

This article is originally written by the WeChat public account IPO Early Know (ID: ipozaozhidao). Please contact Uncle C for reprinting permissions.