New Battleground for Smartphones: Xiaomi Presses Forward, Huawei Nowhere to Be Seen

![]() 07/16 2024

07/16 2024

![]() 457

457

The smartphone market is ushering in a new transformation.

Produced by | Zhuyi Finance

The smartphone market is once again facing a new transformation.

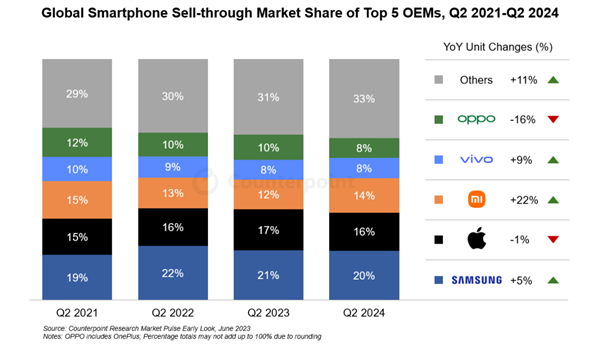

Recently, market research firm Counterpoint Research released its latest statistical report, indicating that the global smartphone market is experiencing new changes—in the just-concluded second quarter, the global smartphone market witnessed a significant growth rate of up to 6% year-on-year.

According to Counterpoint Research, this growth rate is the highest since 2021. Amidst the global economic downturn and sluggish consumer market, this growth rate holds immense significance for the global smartphone industry, supply chain, and consumer sectors, potentially signaling a recovery in the global consumer economy to some extent.

New Landscape in Smartphones: Samsung Dominates, Huawei Absent

Based on Counterpoint Research's statistics, Samsung remains the leading player in the global smartphone market. Although Samsung's presence has dwindled in the Chinese market, its global market share for smartphones still stands at an impressive 20%.

Moreover, in this round of growth, Samsung ranked fifth with a growth rate of up to 5%. While Apple preceded Samsung, Counterpoint Research's data shows that Apple's global market share is only 16%, indicating a significant gap despite both being top two smartphone brands globally.

However, Apple's strong appeal and loyal fan base will continue to be its winning formula.

In Counterpoint Research's statistics, although Apple experienced a 1% decline compared to the same period last year, its market position remains solid. Apart from Samsung, few other competitors can shake Apple's status.

Among domestic brands, OPPO, vivo, and Xiaomi are all on the list, but Huawei is nowhere to be seen.

Xiaomi is the fastest-growing smartphone brand, with a market share of 14% in the second quarter of 2024, second only to Apple's 16%, according to Counterpoint Research.

Although Xiaomi lags behind Samsung and Apple in terms of market share, its growth has been remarkable. Counterpoint Research's report shows that Xiaomi was the fastest-growing among the top five brands in the second quarter of 2024, while OPPO and vivo, the other two domestic brands, saw a decline of 16% and a growth of 9%, respectively.

Previously well-received brands like Huawei and Honor did not make it to the top five list. However, in May this year, reports from data and research firms such as IDC, Canalys, and TechInsights on Chinese smartphone shipments showed that Apple was surpassed by Huawei in all aspects. In IDC's data, Apple even lagged behind Huawei and Honor, which tied for first place with market shares of 17.1% and 17%, respectively, while OPPO also slightly outpaced Apple with a market share of 15.7%.

But within just two months, Apple not only surpassed its competitors but also relegated Huawei and Honor to the "others" category.

However, Huawei and Honor's absence from the top five list might be related to the fact that neither brand released any new models during this period.

New Dynamics in the Smartphone Market: A Tale of Two Halves

Although Apple's numbers in Counterpoint Research's data are not eye-catching, it doesn't mean that Apple is starting to fade away.

According to recent foreign media reports, Apple has increased its confidence in the iPhone 16, and the media revealed that Apple has already increased its production volume of the iPhone 16 to approximately 95 million units.

Apple's confidence in the iPhone 16 stems primarily from the Apple Intelligence feature introduced at the WWDC 2024 event, which is currently limited to the iPhone 15 Pro/Pro Max and subsequent models. This means that the iPhone 16 will be one of the two smartphones, apart from the iPhone 15 series, capable of experiencing the Apple Intelligence feature in its entirety.

This could become a new driver for sales growth of the iPhone 16 series, prompting Apple to adjust its production volume from 92 million to 95 million units.

Apart from Apple, Huawei, which didn't make it to the list, is also sharpening its knives.

Since its comeback with the Mate 60 last year, Huawei has been actively launching new products. Not only did it release the Pura70 series in the first half of this year, but rumors suggest that Huawei will launch the Mate70 series by the end of this year. Judging from the enthusiasm generated by the Mate60 series, the Mate70 series is also expected to bring new sales and public attention to Huawei.

More importantly, Huawei has a high probability of launching a pure-blooded version of the HarmonyOS operating system this year. This independently developed operating system by Huawei already boasts over 5,000 native applications, which will undoubtedly boost Huawei's smartphone sales.

As for Xiaomi, vivo, and OPPO, Xiaomi, which has ventured into the automotive business, is not lagging behind in its traditional field of smartphones. Apart from upcoming new products like the K70 Supreme Edition, the launch of the Xiaomi 15 series is also highly anticipated. Vivo and OPPO continue to prioritize new product iterations and updates as their primary strategies.

Judging from the current situation, although the smartphone market has undergone several rounds of reshuffling over the years, with the initial landscape now set, the competition among different smartphone brands remains fierce within the industry. With Apple on the outside and Huawei on the inside, small and medium-sized smartphone brands caught in between may face an even more challenging market environment.

The Future of Smartphones: A New Ecosystem of Car-Phone Interconnection

Among the mainstream smartphone players, Xiaomi and Huawei have ventured into the automotive sector in all aspects, and they are supported by actual automotive products in terms of the car-phone ecosystem.

In the future, as the "home-car-person" integration strategy is fully implemented, smartphones will undoubtedly become the hub connecting these three entities. For Huawei and Xiaomi, their smartphone products will serve as the control centers for this new ecosystem.

On the hardware side, future smartphones will be equipped with more advanced sensors and communication technologies to achieve wireless and seamless connection with cars. Whether it's Bluetooth, Wi-Fi, or 5G/6G networks, they will all be fully utilized to ensure real-time and stable data transmission. At the same time, smartphones themselves will possess more powerful processing capabilities to meet the increasingly complex needs of car-phone interconnection.

On the software side, future smartphones will have more intelligent operating systems and applications. These applications will not be limited to traditional functions like navigation and music playback but will cover more life scenarios such as home control and health monitoring. Through deep integration with cars, users can easily control smart devices at home or monitor their and their family's health status while driving.

Furthermore, the trend towards autonomous driving in future cars is undeniable, and the accumulation of AI capabilities and application experience in smartphones will empower cars to achieve more precise iterations in autonomous driving technology.

All these factors point to the inevitability of smartphones in the automotive industry, and smartphone brands with the "home-car-person" ecosystem advantage may well be the next choice at the cusp of this new trend.