Suzhou Tianmai, the Mysteriously Disappeared Founder, and its Surging IPO

![]() 07/24 2024

07/24 2024

![]() 742

742

On July 12, the IPO registration of Suzhou Tianmai Thermal Technology Co., Ltd. (hereinafter referred to as "Suzhou Tianmai") at the Shenzhen Stock Exchange became effective.

Founded in July 2007, Suzhou Tianmai focuses on the research and development, production, and sales of thermal dissipation materials and components. Its main products include heat pipes, vapor chambers, thermal interface materials, graphite films, etc., which are widely used in consumer electronics such as smartphones and laptops, as well as in security monitoring equipment, automotive electronics, communication equipment, and other fields.

The sponsor of Suzhou Tianmai is Essence Securities Co., Ltd. The proposed fundraising amount of Suzhou Tianmai is 395 million yuan, which will be used primarily for the following aspects:

1. Thermal dissipation product production base construction project: 295 million yuan is planned to be invested to expand production scale and enhance the production capacity and market competitiveness of thermal dissipation products.

2. New R&D center project: 50.2 million yuan is planned to be invested to strengthen technological research and development and innovation, improving the technical content and added value of products.

3. Supplementary working capital: 50 million yuan is planned to be invested to support the company's daily operations and business development.

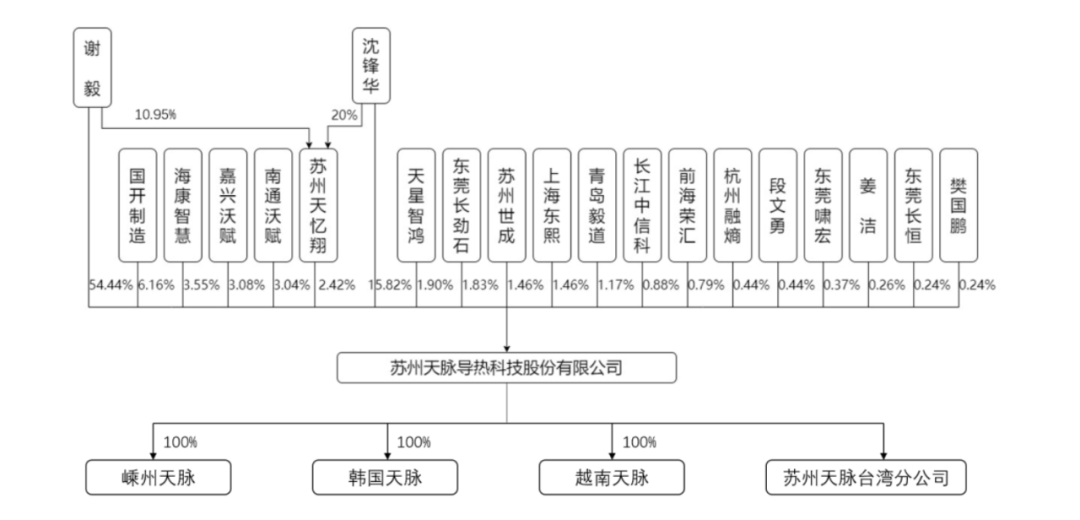

The actual controllers of Suzhou Tianmai are Xie Yi and Shen Fenghua, who are husband and wife. Xie Yi directly holds 54.44% of the shares of Suzhou Tianmai and is the controlling shareholder of the company. Shen Fenghua directly holds 15.82% of the company's shares. The predecessor of Suzhou Tianmai was Suzhou Tianmai Thermal Technology Co., Ltd. (hereinafter referred to as "Tianmai Limited"), which was jointly established by natural persons Xie Yi and Chen Songqing. However, in the subsequent development of the company, Chen Songqing transferred 50% of his equity in the company to Xie Yi, making Xie Yi the sole shareholder of the company.

It is noteworthy that after founding the company with a 50% stake, the founder Chen Songqing mysteriously disappeared, and the details of his exit were not found in the prospectus.

In addition, during the 12 months prior to Suzhou Tianmai's IPO application, six external investors, including CDB Manufacturing, made last-minute investments and signed risk-based gambling agreements with the company. However, in the subsequent handling of these agreements, a series of complex and tortuous situations arose, requiring further clarification and resolution.

In recent years, Suzhou Tianmai's revenue and net profit have shown a steady growth trend. From 2021 to 2023, Suzhou Tianmai's operating revenues were 708 million yuan, 841 million yuan, and 928 million yuan, respectively, with a compound annual growth rate of 14.45%. After deducting non-recurring gains and losses, the net profits attributable to shareholders of the parent company were 64.5305 million yuan, 112 million yuan, and 151 million yuan, respectively, with a compound annual growth rate of 54.09%.

As Suzhou Tianmai's revenue grows, its net profit is also increasing year by year. For example, in 2021, 2022, and 2023, the company's net profits attributable to shareholders after deducting non-recurring gains and losses were 64.5305 million yuan, 112 million yuan, and 151 million yuan, respectively.

From the perspective of revenue structure, the vapor chamber business is the company's largest business, accounting for 62.49% of revenue. The revenue shares of other products such as thermal interface materials, heat pipes, and graphite films are 15.65%, 13.61%, and 4.61%, respectively.

In terms of customer relationships, Suzhou Tianmai has established stable cooperative relationships with seven of the top 10 global smartphone brands and has become a major supplier of similar products to these customers.

Suzhou Tianmai expects its revenue for the first half of 2024 to be 452 million yuan, roughly the same as the same period last year. The net profit attributable to shareholders after deducting non-recurring gains and losses is expected to be 88 million yuan, an increase of 38.53% compared to 63.52 million yuan in the same period last year.

Suzhou Tianmai's net profit is also increasing year by year as its revenue grows. For example, in 2021, 2022, and 2023, the company's net profits attributable to shareholders after deducting non-recurring gains and losses were 64.5305 million yuan, 112 million yuan, and 151 million yuan, respectively.

In terms of fundraising purposes and revenue growth, Suzhou Tianmai plans to raise 395 million yuan, of which 295 million yuan will be used for the construction of a thermal dissipation product production base. The implementation of this project will add 1,000 tons of thermal interface materials, 12 million sets of heat dissipation modules, and 60 million vapor chambers (VC) to the company's production capacity. This will help the company further expand its market share and increase its revenue.

In the field of smartphone thermal dissipation, Suzhou Tianmai's vapor chambers and heat pipes have a relatively high combined shipment share in the global smartphone market, specifically 8.15%, 10.09%, and 9.45% (data from different years). In terms of thermal interface materials, Suzhou Tianmai has a rich product line and achieved sales revenue of approximately 145 million yuan, accounting for about 8.63% of the domestic market share, leading the industry.

Compared with other companies, in 2022, Suzhou Tianmai's revenue was 841 million yuan, with a growth rate of about 10.39%.

It is located between Siquan New Materials (423 million yuan) and Zhongshi Technology (1.592 billion yuan). Siquan New Materials had a total revenue of 423 million yuan in 2022, and its revenue in 2023 increased slightly by only 1.1 million yuan compared to 2022. Zhongshi Technology's total revenue in 2023 was 1.258 billion yuan, a decrease of 334 million yuan compared to 2022.

From a revenue scale perspective, Zhongshi Technology has the highest revenue among the three, followed by Suzhou Tianmai, and Siquan New Materials has the lowest.

Suzhou Tianmai's vapor chambers and heat pipes are primarily used in smartphones, while its graphite films are primarily used in laptops. Global smartphone shipments in the first quarter of 2022 were 311.2 million units, a year-on-year decrease of 13.01%. Shipments in the second quarter decreased by 3.17% year-on-year. Global smartphone shipments in the third quarter were 297 million units, a year-on-year decrease of 9.2%. Global laptop shipments decreased by 11.43% and 19.00% year-on-year in the first half and third quarter of 2022, respectively.

Against the backdrop of declining global shipments of smartphones and laptops, Suzhou Tianmai's performance has maintained high growth, unlike comparable companies.

Meanwhile, from the first half of 2019 to 2022, Suzhou Tianmai's main business gross margins were 35.18%, 34.12%, 25.35%, and 29.00%, respectively, with an increase in gross margin in the first half of 2022. Public information shows that in 2021 and the first half of 2022, the main business gross margins of comparable company Zhongshi Technology were 26.95% and 26.04%, respectively, while those of Flytech were 17.72% and 12.58%, respectively, both showing declines. It is noteworthy that Suzhou Tianmai did not compare the gross margins of vapor chambers and thermal interface materials with those of comparable companies.

In response, the regulatory authorities raised questions, requiring Suzhou Tianmai to explain the rationality of the company's revenue and gross margin growth in the first half of 2022, as well as the reasons for the differences with comparable companies, in light of factors such as declining global shipments of smartphones and laptops, industry competition, and market changes. The authorities also requested an explanation of the differences and reasons for the gross margins of Suzhou Tianmai's vapor chambers and thermal interface materials compared to those of comparable companies, and whether there is a risk of significant drops in product selling prices and gross margins in the future.

Suzhou Tianmai explained that although the growth rate slowed down in 2022, the company believes this was primarily due to factors such as the global pandemic, chip shortages, and geopolitical tensions, as well as declining shipments of smartphones and laptops.

However, with the trend towards higher performance and thinner designs of electronic products, the power consumption and thermal dissipation demands of these products continue to increase, leading to a sustained growth in the market demand for the company's core products such as vapor chambers, heat pipes, and graphite films. At the same time, Suzhou Tianmai's products are widely used in many well-known brand terminal products such as Samsung, OPPO, vivo, Huawei, Honor, Hikvision, etc. Despite the downturn in the smartphone industry and the sharp decline in shipments from the company's major smartphone customers, the company's cooperation with downstream customers has continued to deepen and stabilize, and the overall business development trend is good. These factors collectively drive the further growth of the company's revenue in 2022, which is reasonable.

In addition to the above issues, Hikvision, as one of the company's shareholders, is both a customer and a shareholder, raising concerns about potential benefit transfers. Since 2014, the company has officially started business cooperation with Hikvision, and both parties have established a long-term and stable cooperative relationship. Hikvision was Suzhou Tianmai's third, fourth, and fourth largest customer in 2019, 2020, and 2021, respectively.

Hikvision Wisdom invested in Suzhou Tianmai in June 2020, holding a 3.55% stake.

It is noteworthy that the fund manager of Hikvision Wisdom, CETC Hikvision (Hangzhou) Equity Investment Management Co., Ltd., and the company's customer Hikvision are both controlled by CETC Hikvision Group Co., Ltd. Hikvision holds a 3.55% stake in Suzhou Tianmai through Hikvision Wisdom, making it both a customer and a shareholder. However, Suzhou Tianmai did not analyze the fairness of transaction prices in its prospectus.

The regulatory authorities have also paid attention to this and have requested Suzhou Tianmai to analyze and explain the fairness of the sales prices to Hikvision, including the main products sold, amounts, unit prices, and gross margins, and to compare them with similar products sold to other customers, to determine whether there are any instances of benefit transfers.