Cross-border payment concept is popular! Concept stocks released (list)

![]() 10/14 2024

10/14 2024

![]() 594

594

On October 11, both the Shanghai and Shenzhen stock exchanges opened low and closed low, and the Shanghai Composite Index even fell below 3,200 points at one point during the session. Although the Shanghai Composite Index recovered to 3,200 points before the close, the number of declining stocks in both exchanges still approached 4,700. In terms of sectors, only two sectors in the concept sectors of the two exchanges rose.

Among them, the cross-border payment sector led the gains in both exchanges with an increase of 2.19%, and several stocks within the sector even hit their daily limits.

On the news front, at the 27th China-ASEAN Leaders' Meeting, China expressed its willingness to actively promote infrastructure cooperation with ASEAN in areas such as railways and ports, accelerate the signing and implementation of the China-ASEAN Free Trade Agreement (CAFTA) 3.0, strengthen the connection of cross-border payment systems, and expand the scale of local currency settlement.

Furthermore, in terms of data, the People's Bank of China's "RMB Internationalization Report 2024" shows that the scale of cross-border use of the RMB has grown steadily. From January to August 2024, the total amount of cross-border RMB receipts and payments handled by banks on behalf of clients amounted to 41.6 trillion yuan, representing a year-on-year increase of 21.1%.

This policy support and data growth have attracted considerable funds to focus on this sector. After the close on October 11, several cross-border payment concept stocks appeared on the day's dragon and tiger list due to their significant daily gains.

Among them, Sifang Jingchuang topped the Shenzhen Stock Exchange's dragon and tiger list due to a closing gain of over 15%. Data showed that renowned speculative funds, represented by the Beijing Headquarters Securities Business Department of CITIC Securities Co., Ltd. under the Hujialou seat, had a net buy of over 140 million yuan. In contrast, two institutions collectively sold over 40 million yuan, ranking first and second on the sell list.

China Oil Capital also appeared on the Shanghai Stock Exchange's dragon and tiger list due to a daily gain deviation of 7%. Data showed that renowned speculative funds gathered on China Oil Capital's dragon and tiger list. CITIC Securities Beijing Chaowai Street Business Department, also under the Hujialou seat, had a net buy of over 160 million yuan. Meanwhile, Fangxinxia and Sangtian Road ranked second and third on the buy list, respectively. On the sell list, CITIC Securities Beijing Jianguomen and Caitong Securities Putuoshan Business Department topped the sales rankings.

It is worth noting that the Hujialou seat also appeared on the dragon and tiger list for Colan Software, which belongs to the same sector. Public data shows that the Hujialou seat has frequently appeared on dragon and tiger lists recently, including in popular stocks such as Runhe Software, Changshan Beiming, and Yingshisheng. Its presence on the buy lists of multiple cross-border payment concept stocks yesterday also underscores the market's enthusiasm for this sector.

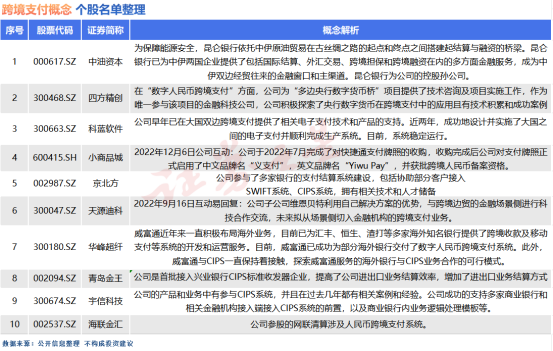

Here, the author has compiled a list of select stocks that are highly relevant to the cross-border payment concept, hoping to provide assistance to investors.

However, the performance of cross-border payment concept stocks is influenced by various factors, including the global economic environment, monetary policy, and exchange rate fluctuations. These factors can lead to significant fluctuations in the prices of related stocks. Additionally, some companies classified as cross-border payment concept stocks may not have cross-border payment as their primary business. Market speculation can cause stock prices to diverge from company fundamentals. Following short-term surges, investors need to make rational judgments about stocks within the sector and be aware of risks.

- End -