ASML Q3 results shocked, orders only reached half of expectations

![]() 10/17 2024

10/17 2024

![]() 590

590

Compiled by Semiconductor Industry Landscape (ID: ICVIEWS)

Due to factors such as US-Dutch export controls on China and weak upstream demand, ASML, the chip lithography giant, is under pressure.

Today, ASML released its third-quarter financial report for 2024.

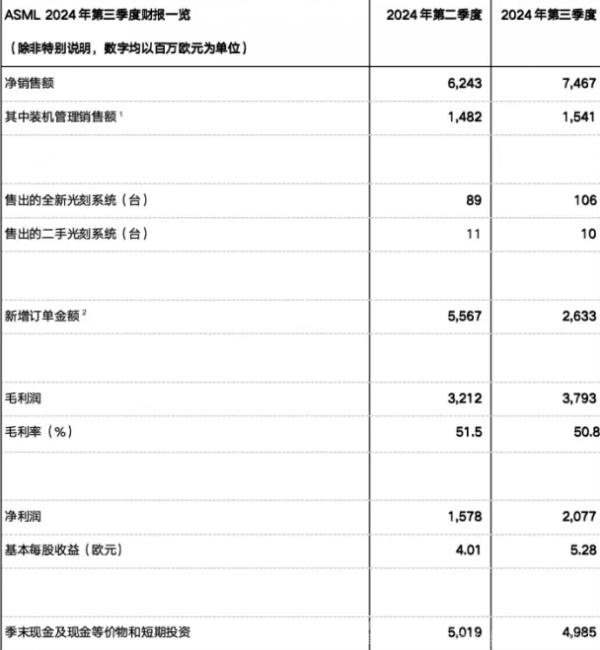

In the third quarter, ASML achieved net sales of €7.47 billion, a 20% quarter-on-quarter increase, exceeding analysts' expectations of €7.17 billion. Gross margin was 50.8%, in line with analysts' expectations of 50.7%. Net profit reached €2.08 billion, a 32% quarter-on-quarter increase, exceeding analysts' expectations of €1.91 billion.

The value of new orders in the third quarter of this year was €2.63 billion, a 53% quarter-on-quarter decrease, and analysts had expected €5.39 billion. Among them, €1.4 billion was for EUV lithography machine orders. ASML expects net sales in the fourth quarter of 2024 to be between €8.8 billion and €9.2 billion, with a gross margin ranging from 49% to 50%. For the full year 2024, net sales are expected to be approximately €28 billion. ASML also expects net sales for 2025 to be between €30 billion and €35 billion, with a gross margin ranging from 51% to 53%.

(1) Cumulative installed base management sales equal the sum of net service and upgrade package (field option) sales. (2) Orders include all system sales orders and inflation adjustments, all of which have been confirmed in writing. Figures have been rounded for reader convenience.

According to ASML, there are two reasons for the poor financial performance: first, the recovery of the semiconductor market was slower than expected, and upstream customer demand weakened; second, US export controls on China led to a decline in revenue share.

CEO Statement and Outlook

Christophe Fouquet, President and CEO of ASML, said, "Our third-quarter net sales of €7.5 billion exceeded expectations, primarily due to increased sales of DUV lithography systems and installed base management. The quarter's gross margin of 50.8% met our expectations."

"While the AI sector continues to show strong momentum and growth potential, recovery in other segments has been slower. The current situation indicates that the semiconductor market is recovering more slowly than previously anticipated. This recovery process is expected to continue into 2025, leading customers to be more cautious in their decision-making. In the logic chip sector, competition among foundries has slowed the development of new technology nodes for some customers, resulting in delays in certain fabs' plans and impacting the timing of demand for lithography equipment, especially for EUV lithography machines. In the memory chip sector, we see limited new capacity additions, and the focus remains on technological transitions to meet demand for AI-related high-bandwidth memory (HBM) and DDR5."

Furthermore, Fouquet added, "ASML expects net sales in the fourth quarter of 2024 to be between €8.8 billion and €9.2 billion, with a gross margin of 49% to 50%. This includes the first revenue recognition of two High NA EUV lithography systems upon customer acceptance, marking new advancements in imaging, overlay accuracy, and contrast. Research and development costs are expected to be approximately €1.1 billion, and selling, general, and administrative expenses are expected to be approximately €0.3 billion in the fourth quarter. We expect full-year 2024 net sales to be approximately €28 billion. Based on recent market trends, ASML anticipates net sales for 2025 to grow to between €30 billion and €35 billion, within the lower half of the range we provided at our 2022 Investor Day. We expect a gross margin of 51% to 53% in 2025, lower than previous expectations due to delays in demand for EUV lithography systems."

Meanwhile, the official website also released the contents of ASML CFO Roger Dassen's earnings call. He mentioned that revenue from the Chinese market is expected to account for approximately 20% of total revenue next year, lower than the previously consistent figure of around 25%. However, he emphasized, "We do see that China's share of our business is trending towards a more historically normal level, which is in line with its performance in our backlog."

However, for the market, this figure requires further explanation from management.

Dassen emphasized, "Once again, anything related to AI is powerful, but beyond that, there is limited capacity demand growth. In summary, the long-term trend remains very strong and positive, showing good signs of growth. However, developments over the past few months and the specific customer situations I mentioned have now led to a flatter growth curve for our business."

According to SEMI, global semiconductor sales are expected to grow by 16% in 2024 from $526.9 billion in 2023 to a record $611.2 billion. Global semiconductor market size is projected to further grow by 12.5% in 2025 to reach $687.4 billion.

SEMI predicts that by 2030, the global semiconductor industry will reach two trillion milestones: global semiconductor and foundry market sales will reach $1 trillion, and the number of chip transistors will also reach one trillion.

However, currently, not only ASML but also chip giants such as NVIDIA, Intel, and Samsung are facing difficult times. The entire chip semiconductor industry is still grappling with weak demand and ineffective cost reduction and efficiency enhancement efforts.

*Disclaimer: This article is originally created by the author. The content reflects the author's personal views. Our reproduction is solely for sharing and discussion and does not necessarily endorse or agree with the author's opinions. For any objections, please contact us.