Chuangyuan shares: traditional exports and cross-border e-commerce business grow simultaneously, achieving record revenue in the first three quarters

![]() 10/24 2024

10/24 2024

![]() 674

674

On the evening of October 23, Chuangyuan shares (300703.SZ) released its third-quarter report for 2024. During the reporting period, the company achieved revenue of 553 million yuan, a year-on-year increase of 62.64%. In the first three quarters of this year, the company achieved revenue of 1.385 billion yuan, a year-on-year increase of 38.33%.

Continuous growth in traditional export business and cross-border e-commerce business revenue has pushed Chuangyuan shares to achieve record revenue in the first three quarters in recent years. Among them, the rapid growth of cross-border e-commerce business has undoubtedly become the biggest highlight, and Chuangyuan shares' continued efforts in cross-border e-commerce business have brought substantial returns to the company.

Record revenue in the first three quarters

Lanfu Finance Network notes that Chuangyuan shares' revenue scale has maintained a steady growth trend in recent years.

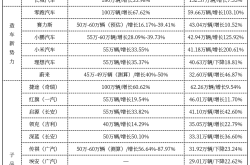

From 2022 to 2023, Chuangyuan shares achieved operating revenues of 1.319 billion yuan and 1.359 billion yuan, respectively. In the first three quarters of 2024, the company's revenue reached 1.385 billion yuan, exceeding last year's total annual revenue and setting a new high in recent years.

Since the beginning of this year, Chuangyuan shares' revenue data has maintained quarter-on-quarter growth. From the first quarter to the third quarter, the company achieved revenues of 325 million yuan, 507 million yuan, and 553 million yuan, respectively. Among them, the third quarter's revenue data set a new high for the same period in history.

Chuangyuan shares stated in its third-quarter report that the growth in the company's operating revenue was mainly due to the increase in revenue from traditional export business and cross-border e-commerce business.

Steady growth in traditional export business

Chuangyuan shares previously stated on an interactive platform that the company's export business accounts for a high proportion of operating revenue. As of the end of June 2024, the company's revenue from North America, Asia (excluding China), Europe, and Oceania accounted for 85.65%, 4.56%, 4.3%, and 1.57% of total revenue, respectively. The steady growth of export business will greatly benefit the company's performance.

It is understood that Chuangyuan shares currently offers six major product categories, including fashion stationery, handcraft puzzles, social emotions, sports and fitness, home living, and others, with over 90 product series. Its sales are primarily targeted at foreign markets.

This year, China's foreign trade has demonstrated strong resilience with increased volume and quality. According to data from the General Administration of Customs, China's total import and export value of goods trade reached 32.33 trillion yuan in the first three quarters of 2024, exceeding 32 trillion yuan for the first time in the same period in history, with a year-on-year increase of 5.3%. Among them, exports totaled 18.62 trillion yuan, up 6.2% year-on-year.

Benefiting from the driving forces on both supply and demand sides, China's import and export have maintained steady growth, and the import and export scale exceeded 10 trillion yuan in all three quarters for the first time in history.

From an international perspective, the trend of diversification has become increasingly evident. In the first three quarters of this year, China achieved trade growth with more than 160 countries and regions worldwide. Among them, imports and exports with traditional partners such as the United States and the European Union increased by 4.2% and 0.9% year-on-year, respectively.

The General Administration of Customs stated that China's economic fundamentals, broad market, and huge potential will continue to drive positive factors for foreign trade development. With the continued efforts of both existing and incremental policies, there is a solid foundation and support for steady growth in import and export in the fourth quarter of this year.

Against this backdrop, Chuangyuan shares' traditional export business is expected to continue to benefit, and the company's revenue data is expected to continue to grow.

Cross-border e-commerce business achieves a 'leap'

While the traditional export business maintains steady growth, Chuangyuan shares' continued efforts in cross-border e-commerce have also yielded pleasant surprises.

According to company disclosures, in the first half of this year, Chuangyuan shares' subsidiary, Ritefeel USA, facilitated a total of 141,500 orders, with sales of $18.595 million through Amazon.com, a year-on-year increase of 147.26%, and sales of $7.7028 million through its official website, a year-on-year increase of 138.88%. Another subsidiary, Zhiyuan USA, facilitated a total of 484,400 orders in the first half of the year and achieved sales of $6.5055 million through Amazon.com, an increase of 1.6% from the same period last year.

Ritefeel USA primarily utilizes external suppliers' supply chains for production, ships products to overseas warehouses for stockpiling, and sells and delivers them to overseas end-consumers through Amazon and its official website platforms. On the other hand, Zhiyuan USA procures products primarily through OBM (Original Brand Manufacturing) mode, ships them overseas for stockpiling, and sells and delivers them to overseas end-consumers through Amazon.

The rapid growth of the cross-border e-commerce business has also become a strong support for Chuangyuan shares' revenue growth.

In recent years, cross-border e-commerce has grown and gradually become a new highlight in the global economic and trade sector and a vital force in China's foreign trade development, providing new opportunities for Chinese brands to go global. In the first three quarters of this year, China's cross-border e-commerce exports reached 1.48 trillion yuan, a year-on-year increase of 15.2%. In the same period, Zhejiang's cross-border e-commerce exports exceeded 250 billion yuan, setting a new high in history for the same period, with a year-on-year growth of over 20%.

Against this backdrop, companies like Chuangyuan shares are increasingly integrating into the development wave of cross-border e-commerce, leveraging it to 'connect' with foreign markets while actively cultivating independent brands and continuously promoting the export of Chinese products.

It is evident that Chuangyuan shares has once again taken the lead in the industry, with its cross-border e-commerce business progressing rapidly. Meanwhile, the rapid development of cross-border e-commerce will also contribute to the company's expansion into overseas markets, achieving a "two-for-one" outcome.

Overall, Chuangyuan shares' traditional export business and cross-border e-commerce business are growing simultaneously, jointly driving the company's continuous revenue growth. Against the backdrop of sustained positive momentum in foreign trade exports, Chuangyuan shares is poised to achieve a new "leap," catching the eye of the capital market.