Sudden! The 'King of African Mobile Phones' Sees a Surprise Plunge in Performance

![]() 10/30 2024

10/30 2024

![]() 668

668

Source | Shenlan Finance

Written by | Wu Ruixin

The 'King of African Mobile Phones' has entered a troubled period.

After experiencing the "deep-sea fishing" incident involving its financial director being investigated by the Zhen'an District Supervisory Committee in Dandong City for over a month, Transsion Holdings has fallen into new trouble.

On the evening of October 28, Transsion Holdings disclosed its latest financial report, and the results were shocking!

Compared to the previous mid-year report's double-digit growth in revenue and net profit, Transsion Holdings suddenly experienced a reversal in performance in the third quarter, with both revenue and net profit declining, and net profit falling by a staggering 41.01% year-on-year!

Is the 'King of African Mobile Phones' no longer selling well?

1

Performance bombshell: Even the King of African Mobile Phones is anxious

What's going on exactly?

First, let's look at the financial report. In the third quarter of 2024, Transsion Holdings achieved revenue of 16.693 billion yuan, a year-on-year decrease of 7.22%; net profit attributable to shareholders of the parent company was 1.051 billion yuan, a year-on-year decrease of 41.02%; and net profit attributable to shareholders of the parent company after deducting non-recurring items was 820 million yuan, a year-on-year decrease of 52.72%.

Due to the drag of the third quarter, in the first three quarters of this year, Transsion Holdings' revenue was 51.251 billion yuan, with year-on-year growth slowing to 19.13%, and net profit attributable to shareholders of the parent company was 3.903 billion yuan, with growth slowing to 0.50%, already approaching the tipping point of net profit decline.

In fact, there were early signs of Transsion Holdings' performance bombshell.

In the first half of this year, Transsion Holdings achieved revenue of 34.56 billion yuan, an increase of 38.07% year-on-year; net profit attributable to shareholders of the parent company was 2.852 billion yuan, an increase of 35.70% year-on-year.

On the surface, Transsion Holdings' performance appears impressive, but upon closer inspection, its second-quarter revenue was 17.12 billion yuan, already showing a decline compared to the previous quarter's 17.44 billion yuan. Sales growth was clearly weakening.

Net profit even fell by 22.31% year-on-year to 1.226 billion yuan, a decrease of 24.6% compared to the first quarter's 1.626 billion yuan. The further decline in revenue and net profit in the third quarter directly exposed Transsion's difficulties.

Regarding the reason for the sharp decline in net profit, Transsion Holdings explained that it was mainly due to the combined impact of market competition and supply chain costs, resulting in a decrease in revenue and gross margin in the third quarter of 2024, leading to a year-on-year decrease in gross profit.

This is indeed reflected in the financial report. In the first three quarters of 2024, Transsion Holdings' net profit margin was 7.69%, a year-on-year decrease of 15.48%; gross margin was 21.59%, a year-on-year decrease of 13.01%. In the first half of 2024, these two figures were 8.29% and 21.53%, respectively. This means that Transsion's overall profitability this year is further declining.

The decline in revenue more straightforwardly demonstrates Transsion Holdings' weakness and pressure on the sales side in the market competition.

2

Are African consumers starting to abandon Transsion?

As the "King of African Mobile Phones," Transsion, like its title suggests, occupies a significant market share in Africa.

According to IDC data, in the first half of 2024, Transsion Holdings had a 14.4% market share in the global mobile phone market, ranking second among global mobile phone brands. Its market share in the African smartphone market exceeded 40%.

However, with major domestic mobile phone manufacturers now focusing on the African market, African consumers indeed have more options than before.

But for mobile phone manufacturers, especially Transsion, the fierce competition in the African smartphone market has put significant pressure on the company.

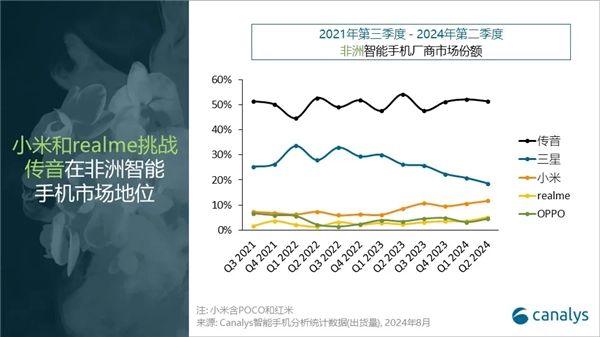

According to the latest report from market analysis firm Canalys, Transsion's market share in the African smartphone market slightly declined in Q2 2024 compared to Q1 2024. In contrast, Xiaomi, OPPO, and realme's shares are gradually increasing.

While revenue and net profit declined in the third quarter, Transsion's ranking in the global mobile phone market also fell.

Recently, IDC released the latest data. In the third quarter of 2024, global smartphone shipments reached 316 million units, an increase of 4% year-on-year, marking five consecutive quarters of shipment growth. Among them, the top five vendors were Samsung, Apple, Xiaomi, OPPO, and vivo.

Transsion Holdings, which had been consistently ranked among the top five for several quarters, slipped to sixth place in the third quarter of 2024.

3

Frequent share sales by shareholders

Compared to the performance bombshell, investors are more concerned about the decline in share prices.

Starting on April 19th of this year, Transsion Holdings' share price suddenly ended its more than year-long uptrend, plunging to a low of 71.00 yuan per share at one point, a maximum decrease of 41.37% compared to the April 18 closing price of 121.10 yuan per share.

Fortunately, after several months of continuous volatility, a bull market arrived, and as of October 29's close, Transsion's share price rebounded to 92.80 yuan per share, but it was still down 23.37% from its previous high.

On the other hand, Transsion shareholders began to frequently reduce their holdings during the share price decline.

On May 23, Transsion Holdings announced that its controlling shareholder, Shenzhen Transsion Investment Co., Ltd., had reduced its shareholding in the company by 8.065652 million shares, or 1% of the company's total share capital, through a price inquiry transfer. Based on the transfer price of 125.55 yuan per share at the time, Transsion Investment realized a cash-out of 1.013 billion yuan.

According to Wind data, the shareholding ratios of Transsion Holdings' employee stock ownership platforms, Chuanli Enterprise Management, Chuancheng Enterprise Management, and Transsion Enterprise Management, decreased from 2.76%, 2.13%, and 2.61% in the second quarter of 2023 to 2.12%, 1.53%, and 1.47% at the end of the first quarter of this year, respectively. It can be estimated that these three shareholding platforms collectively realized a cash-out of approximately 2.47 billion yuan over the past few months.

Transsion Holdings' founder, Zhu Zhaojiang, holds shares in all four of the above-mentioned companies. In other words, Zhu Zhaojiang was the biggest beneficiary of the previous share reductions. Among them, Zhu Zhaojiang, who holds a 20.68% stake in Transsion Investment, received 209 million yuan from this share reduction alone.

4

Continuous turmoil

Amid the performance bombshell, Transsion Holdings has also been embroiled in controversies related to its business operations.

In July of this year, it was reported that Qualcomm filed a lawsuit against Transsion Holdings Group in the Delhi High Court in India for allegedly infringing on four non-standard essential patents. Qualcomm stated that while Transsion Holdings had recently signed a licensing agreement with Qualcomm for some of its products, the vast majority of its products remained unlicensed and were still infringing on Qualcomm's valuable patent portfolio.

In response, Transsion stated that it had signed a 5G standard patent licensing agreement with Qualcomm and was fulfilling its obligations under the agreement. However, considering that in over 70 emerging markets such as Africa and South Asia, some patent holders do not possess or only possess a small number of patents but demand globally uniform high licensing fees, ignoring regional development differences, patent holdings, and different royalty rates in legal precedents.

However, to date, Qualcomm's lawsuit has not yet reached a verdict, and its impact on Transsion Holdings remains uncertain.

At the beginning of September this year, Transsion Holdings' Chief Financial Officer Xiao Yonghui was suddenly placed under detention and placed under investigation by the Zhen'an District Supervisory Committee in Dandong City. However, Xiao Yonghui was soon released from detention. The reason for his detention was not mentioned in Transsion Holdings' announcement.

One wave has barely subsided before another arises. Now, with Transsion's third-quarter performance bombshell, it means that as domestic mobile phone giants flock to the African market and competition intensifies, Transsion's easy money-making days are coming to an end.