"Swindling national funds is extremely despicable" Wei Jianjun fiercely criticizes the phenomenon of "zero-kilometer used cars"

![]() 12/25 2025

12/25 2025

![]() 508

508

Introduction

The phenomenon of "zero-kilometer used cars" is a microcosm of the growing pains experienced by China's automotive industry as it transitions from rapid growth to high-quality development.

"What I find extremely despicable is...zero-kilometer used cars, which defraud national subsidies and exploit government incentives."

On December 22nd, Wei Jianjun, Chairman of Great Wall Motor, fiercely criticized the phenomenon of "zero-kilometer used cars" at the launch event for the new WEY Blue Mountain model, stating that "zero-kilometer used cars" are harming the automotive industry.

We all know that the automotive industry is developing at an increasingly rapid pace, with intensifying competition. However, alongside the progress of the automotive industry, there are also some negative phenomena, such as exaggerated promotions by automakers and industry-wide price wars. Additionally, one particularly notable phenomenon is the emergence of "zero-kilometer used cars."

The so-called "zero-kilometer used cars" refer to "nearly new cars" that display zero kilometers on their odometers but have already completed vehicle registration. Legally, these vehicles are classified as used cars, allowing them to enter the market at prices significantly lower than the manufacturer's suggested retail price for new cars. Physically, they are almost identical to new cars on display in showrooms, with protective films intact, interiors in pristine condition, and no actual driving history.

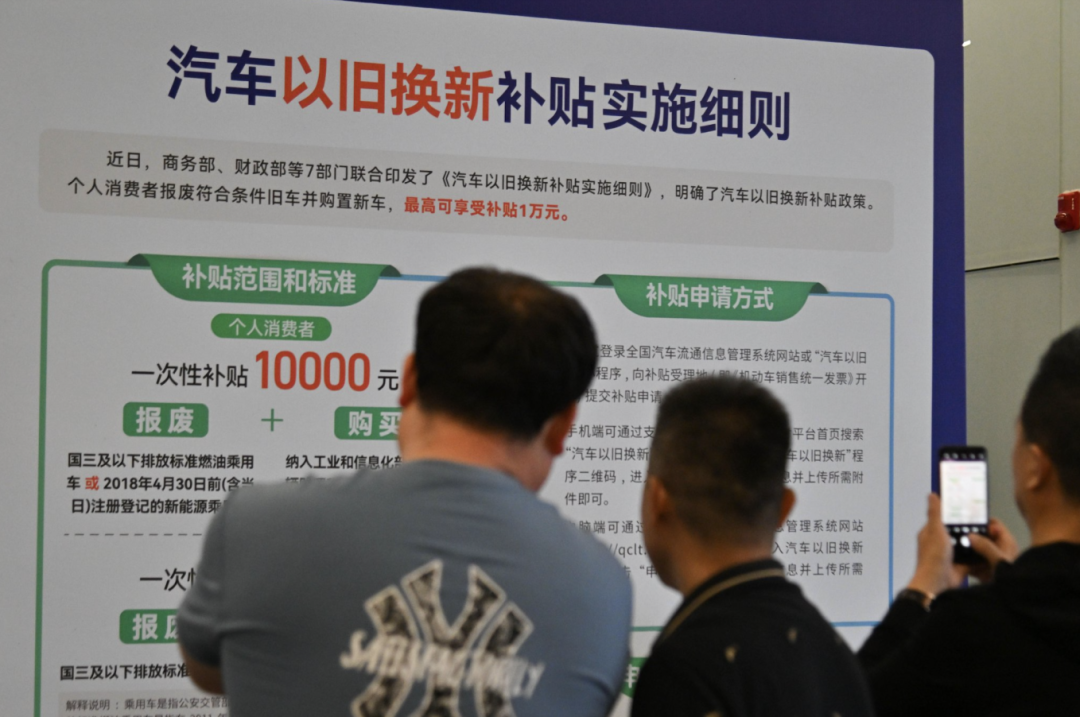

Although these vehicles are sold with substantial discounts, the harms associated with the "zero-kilometer used cars" phenomenon are significant. For example, it distorts genuine market supply and demand data, erodes national fiscal resources, disrupts the pricing system and market order, and shifts risks to consumers. Wei Jianjun specifically criticized the aspect of this phenomenon that involves defrauding national subsidies.

It is worth mentioning that this is not Wei Jianjun's first criticism of "zero-kilometer used cars." He previously pointed out the irrationality of this phenomenon in an interview in late May this year. Not only Wei Jianjun but also several industry leaders and automakers have spoken out this year, firmly opposing the sale of "zero-kilometer used cars."

Clearly, the consecutive statements from these industry leaders and automakers are not impulsive but represent a public interrogation of long-standing industry issues. When "zero-kilometer used cars" appear on major automotive trading platforms at astonishing discounts, we cannot help but express genuine concern: Are these the products of market innovation or deformity (malformed) products born out of industry cutthroat competition?

01 Who is Creating False Prosperity?

"There is a strange phenomenon called 'zero-kilometer used cars.' They are registered as if sold but end up back in the used car market. Platforms like Dongchedi, Guazi Used Cars, and Xianyu have thousands of merchants selling such vehicles."

In an interview on May 23rd, Wei Jianjun referred to "zero-kilometer used cars" as a "strange phenomenon." His remarks acted like a thunderbolt, tearing away the veil that had long concealed the gray industrial chain in the automotive industry.

Currently, "zero-kilometer used cars" have become a highly prevalent category on major automotive platforms. Numerous vehicles labeled as "brand new, untouched," "protective films still intact," and "registered but never driven" are being sold at discounts ranging from 60% to 80%, with some prices dropping to shockingly low levels.

For example, a domestically produced new energy vehicle model with an official guide price of 160,000 yuan is listed on a second-hand platform for only 85,800 yuan, roughly a 50% discount. The seller even emphasizes in the details: "The vehicle is brand new, with interior and seat protective films still intact. It has only been registered and has zero kilometers." Similar cases abound, including models originally priced at the 200,000-yuan level now available for 120,000 yuan, and luxury brand nearly new cars priced above 300,000 yuan often circulating at around a 70% discount.

What is even more alarming is that this practice has formed a systematic and large-scale gray industrial chain. Industry insiders reveal that its operational model primarily consists of two paths: inventory conversion and data beautification.

Inventory conversion refers to automakers or dealers, facing slow-moving models, registering new cars as used vehicles to avoid long-term inventory tying up capital. They then sell them at low prices through affiliated channels. This not only quickly recoups funds but also achieves sales on financial statements, completing sales targets set by manufacturers and earning rebate rewards.

Data beautification, on the other hand, involves some automakers creating an illusion of strong sales and supporting capital market performance by registering newly produced vehicles through affiliated companies or cooperative channels immediately after they roll off the assembly line, including them in monthly sales data, and then transferring these "sold vehicles" to the used car market for digestion. Extreme cases show that some vehicles even complete registration procedures before leaving the factory, achieving the absurd circulation of "from the production line directly to the used car market."

So, why has the "zero-kilometer used cars" phenomenon spread rapidly in a short period?

Obviously, its root cause lies in the unprecedented inventory pressure and cutthroat competition in the automotive industry. Data shows that the national passenger vehicle inventory reached a near-two-year high in 2025, with the new energy vehicle sector particularly severe. The inventory of pure electric vehicles increased by nearly 30% compared to early 2024. Although leading brands can maintain healthy inventory levels due to brand effects and channel advantages, many small and medium-sized automakers and dealers of second- and third-tier brands have inventory backlog rates consistently above 50%, teetering on the brink of a financial crisis.

Under such intense pressure, "zero-kilometer used cars" have become a distorted "self-help measure." Dealers, to meet sales targets and obtain quarterly rebates, have no choice but to sell new cars and then resell them. Automakers, to present impressive financial reports to the capital market, may also tacitly approve or even covertly promote such practices. Meanwhile, used car dealers see arbitrage opportunities—by cooperating in the old car trade-in process, they can receive national subsidies ranging from 15,000 to 20,000 yuan and attract consumers under the guise of "subsidy discounts," converting these subsidies into their own profits.

This has created a vicious cycle with no winners: False data misleads corporate decision-making, a disordered pricing system damages brand value, the loss of fiscal subsidies undermines policy effectiveness, and ultimately, the entire industry's foundation of integrity is being eroded.

02 Harms, Governance, and Reflection

Looking back, the phenomenon of "zero-kilometer used cars" has a long history.

In the realm of internal combustion engine vehicles, the concentrated outbreak of the "zero-kilometer used cars" phenomenon is closely related to the upgrade from China V to China VI emission standards between 2019 and 2020. To cope with inventory pressure, some automakers and dealers registered new cars in advance and then sold them as used vehicles. This period became a critical juncture for the large-scale emergence of this phenomenon.

In the electric vehicle sector, the prototype (embryonic form) of "zero-kilometer used cars" can be traced back to around 2013, coinciding with the early stages of new energy vehicle subsidy policies. Some automakers inflated sales figures by registering new cars in bulk to claim subsidies. However, large-scale development mainly occurred after 2020, driven by accelerated technological iterations and the subsidy phase-out policy in 2022.

Today, the phenomenon of "zero-kilometer used cars" is by no means a harmless market innovation. Its harms to various industry participants and market order are gradually becoming apparent.

For automakers, the short-term beautification of sales data dilutes brand value. When consumers discover a large number of identical new cars being sold at 50% or 60% discounts, the brand's premium capability will plummet, making the sale of genuine new cars increasingly difficult. In the long run, this data bubble will also mislead corporate product planning and capacity layout, potentially leading to more severe resource misallocations.

For dealers, this practice is akin to drinking poison to quench thirst. Although it may alleviate inventory pressure and meet sales targets in the short term, long-term involvement in gray transactions will damage their reputation and undermine trust with manufacturers. Some dealers have already found themselves trapped in a dilemma: "Not participating makes survival difficult, but participating violates business ethics."

Ultimately, consumers who purchase these low-priced vehicles also face multiple hidden risks. For example, warranty benefits may be reduced, as many brands use the registration date as the starting point for warranties, and consumers may have already lost a significant portion of the warranty period upon purchase. The vehicle's legal status, being between (between) new and used cars, makes it difficult to clearly define three-pack responsibilities. Additionally, subsequent rights protection becomes challenging, as manufacturers may refuse to provide equivalent services once quality issues arise, citing the vehicle's resale status.

From a broader perspective, the harms of "zero-kilometer used cars" to the automotive industry are even more profound. This includes distorted sales data affecting policy formulation and industry judgment, a malfunctioning price mechanism leading to disordered market competition, and the exploitation of subsidy policies resulting in the waste of public resources... Ultimately, the industry's integrity system is damaged, raising transaction costs for all market participants.

Therefore, the phenomenon of "zero-kilometer used cars" urgently needs to be stopped.

Amid the consecutive statements from industry leaders and major automakers, the Department of Consumption Promotion under the Ministry of Commerce convened a symposium with industry giants such as the China Association of Automobile Manufacturers, Dongfeng Motor Group, BYD, and Guazi Used Cars to study regulatory measures for "zero-kilometer used cars." Of course, while national-level action is crucial, eradicating the chaos of "zero-kilometer used cars" still requires efforts from the entire industry.

Overall, "zero-kilometer used cars" are a microcosm of the growing pains experienced by China's automotive industry as it transitions from rapid growth to high-quality development. As the market shifts from incremental competition to stock competition, some enterprises have failed to adjust their development models in a timely manner and still attempt to maintain sales through "shortcuts." However, a truly healthy industry ecosystem must be built on genuine demand, honest transactions, and sustainable competition.

Addressing the issue of "zero-kilometer used cars" is not merely a technical operation to rectify market order; it is a systematic project concerning the reshaping of values in the automotive industry. Only when the entire industry collectively upholds its principles can China's automotive industry truly achieve a qualitative transformation from large to strong and steer toward a healthier and more sustainable future.

Editor-in-Chief: Li Sijia Editor: He Zengrong

THE END