The Automotive Industry Launches Comprehensive Rectification to Combat 'Involution'

![]() 12/25 2025

12/25 2025

![]() 489

489

Dianchehui reported: "Prior to 2019, domestic automotive brands were relatively underdeveloped. When competing against 'dominant' foreign brands, while their competitiveness varied, the majority maintained at least some ethical standards, barring a few extreme exceptions. However, post-2019, as foreign brands' dominance waned, many domestic brands abandoned even their fundamental ethical boundaries. They resorted to cost-cutting measures, exploiting supply chains, hiring online trolls to manipulate public opinion, cyberbullying users, and launching attacks on competitors. They preach virtue while engaging in the most despicable acts! Fortunately, a 'restoration of order' is on the horizon! Starting in 2026, the healthy development of China's automotive industry will officially commence!" These remarks were posted on social media by a former manager who once worked at an automotive company in Shenzhen. Although he has since transitioned from the vehicle manufacturing sector to the investment circle, he believes that under the national strategy of promoting the construction of a unified national market, and as one of the core industries supporting China's industrial economic development, the automotive industry's 'anti-involution' rectification is poised to begin. This movement sees 'anti-involution' evolving from an industry consensus to a macro-governance issue with institutional binding force.

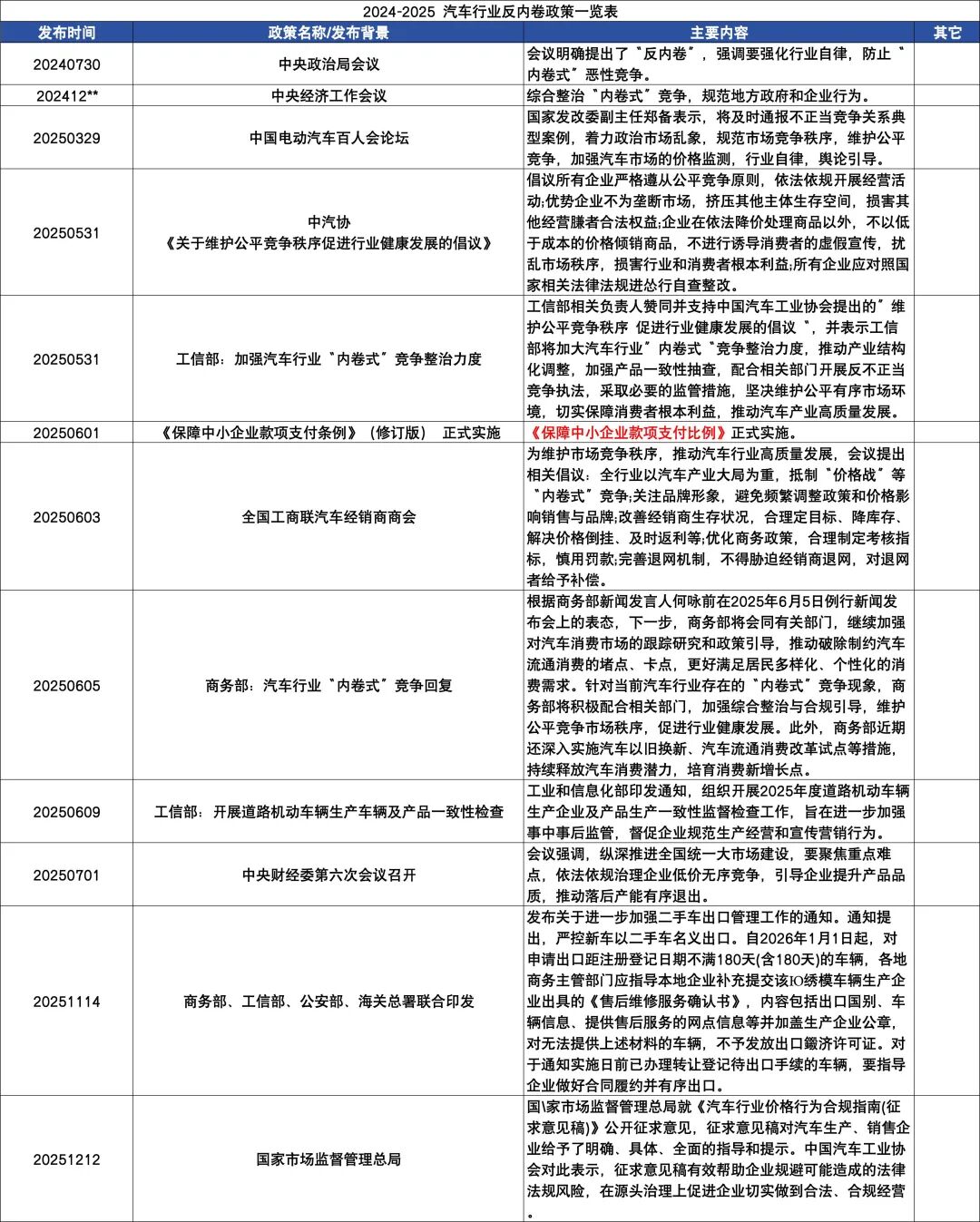

The Central Economic Work Conference, held from December 10 to 11, explicitly proposed to 'deeply advance the construction of a unified national market and thoroughly rectify 'involution-style' competition.' For the first time, it also proposed formulating regulations on the construction of a unified national market, emphasizing the promotion of the free flow of factors and unified rules. Unlike previous emphasis on 'comprehensive rectification,' this statement elevates 'anti-involution' to 'thorough rectification,' with a clearer policy direction—guiding industrial competition logic from low-level price wars to value-based competition centered on technology, efficiency, and services.

On December 12, 2025, the State Administration for Market Regulation promptly released the 'Compliance Guidelines for Price Behavior in the Automotive Industry (Draft for Comments),' targeting the industry's disorderly price wars. The draft comprises five chapters and 28 articles, focusing on three main aspects: refining price behavior norms for automotive manufacturers, clarifying price behavior requirements for automotive sales companies, and guiding the establishment of robust internal compliance management systems. The 'Draft for Comments' initially refines price behavior norms for manufacturers, clarifying price compliance requirements across all stages, from vehicle and spare parts production to pricing strategies and sales behaviors. This includes implementing full-process price management, requiring the establishment of a comprehensive price management system covering vehicle sales, financial services, and other links; regulating promotional and pricing behaviors, mandating clear and contractually agreed rebate policies, and respecting dealers' autonomous pricing rights; legally combating unfair price behaviors and detailing various manifestations; strengthening fair pricing constraints, prohibiting price discrimination against operators under equal trading conditions, and banning price collusion among producers and spare parts enterprises; and regulating spare parts and functional charges, clarifying that 'paid unlock' functions must disclose free periods and charging standards to safeguard consumers' right to information.

The 'Draft for Comments' also mandates that the sales prices of vehicles and spare parts should generally not fall below production or purchase costs, detailing various disguised low-price sales behaviors. This aims to curb 'below-cost' vicious competition from the source of price formation and promote the industry's shift from 'price involution' to 'value competition.'

Personnel from the China Association of Automobile Manufacturers stated that the 'Draft for Comments' provides clear, specific, and comprehensive guidance and tips for automotive production and sales companies, helping them avoid specific operational behaviors that may breach legal boundaries. This effectively assists companies in mitigating potential legal and regulatory risks and promotes lawful and compliant operations from the outset.

Another institution highlighted that the release of these guidelines aims to fully implement the spirit of the Central Economic Work Conference and takes the lead in initiating the rectification of 'involution-style' competition in China's automotive industry. The irrational decline in corporate profit margins caused by price wars in the automotive industry is expected to decelerate, and market competition will shift more toward healthy dimensions such as product strength, technological innovation, and service systems. This is particularly advantageous for leading automotive companies and industry chain leaders with established scale and brand advantages, and the expectation of overall industry profit stability is expected to rise.

In fact, as early as November this year, in an interview report on the 'Fanglue' program featuring renowned investor Duan Yongping by Dianchehui, Duan publicly shared his industry analysis of the automotive industry, particularly the rapidly growing new energy vehicle (NEV) sector. In Duan's view, aligning with Warren Buffett's stance against investing in 'four-wheeled (automotive) businesses,' even with the advent of intelligent driving, this will not fundamentally alter the automobile's core attribute as a driving tool. Therefore, achieving profitability will be challenging due to intensified price competition. Even if the industry evolves to a point where only one or two automotive brands remain, and these automakers reach a tacit agreement and form price monopolies, earning substantial profits will still be difficult. Regarding intelligent driving, Duan believes that from the perspective of basic computing power and development toolchains, current intelligent driving companies are constrained by Google or a few other basic development platforms, leading to severe homogenization of their intelligent driving products. Without differentiation, achieving significant profits will be arduous.

This analysis, from another perspective, resonates with the widespread involution reality in the current automotive industry. According to Dianchehui's survey data on the aforementioned viewpoints, a report by the renowned consulting firm AlixPartners stated that among the 129 brands selling electric and plug-in hybrid vehicles in the Chinese market, only 15 will achieve financial sustainability by 2030. According to the report's data, the number of NEV brands sold in the Chinese market in 2025 has decreased from 137 in 2023 to 129, with many brands selling less than 1,000 units annually. Meanwhile, the number of brands selling over 100,000 units is on the rise, and market concentration is gradually improving. The report predicts that by 2030, the surviving leading brands are expected to achieve an average annual sales volume of 1.02 million units each.

Regarding how to enhance the profitability of NEV companies, Duan Yongping further emphasized the profit core of product platformization and differentiation, using Tesla products as an example. He believes that the profitability of any enterprise largely hinges on product differentiation. The fundamental reason why the NEV business will not be highly profitable is the limited differentiation among products, making profitability a challenging endeavor.

According to data referenced by Dianchehui from the China Association of Automobile Manufacturers, from January to November 2025, China's NEV sales reached 9.85 million units, continuing rapid growth while further enhancing industry concentration. Competition among enterprises has shifted from price wars to all-encompassing competition in new products, new technologies, and services. Monthly sales of 50,000 units have become a crucial threshold for the survival of NEV companies. Companies failing to reach this scale will be at a disadvantage in cost control, technological research and development, and other aspects, and are likely to be phased out by the market.