Negotiations Break Down, ZTE Involved in Patent Lawsuit, Q3 Performance Under Pressure

![]() 11/01 2024

11/01 2024

![]() 450

450

A patent dispute has made Lenovo and ZTE (000063.SZ), two technology giants, the focus of public opinion.

Stockstar has noticed that both Lenovo and ZTE have responded to this matter. It can be seen from their responses that there are differences in patent licensing fees between the two companies, leading to litigation. Behind Lenovo's lawsuit against ZTE is the rapid development of Lenovo's mobile phone business this year, which will lead the company to face more patent fee payments.

For ZTE, the company is not only facing patent litigation with Lenovo, but is also troubled by issues such as slowing net profit growth and pressure on its pillar business in the domestic market.

01. Disagreement on Patent Licensing Fees Becomes the Focus

On October 21, Lenovo filed a patent infringement lawsuit against ZTE (000063.SZ) with the High Court of England and Wales (EWHC), case number HP-2024-000038.

The plaintiffs involved in this lawsuit include Lenovo Group, Lenovo (US), Lenovo Technology (UK) Ltd., Motorola Mobility LLC, Motorola Mobility UK Ltd., and Lenovo Innovation Ltd. (Hong Kong). The defendants are ZTE, ZTE (UK) Ltd., Nubia Technology Co., Ltd., and three British distributors.

As for the specific patent content involved in this lawsuit, it has not been disclosed as of now. According to industry insiders, in addition to ZTE, the target of Lenovo's lawsuit also includes Nubia. Undoubtedly, this is a patent lawsuit targeting mobile terminals and communications. ZTE has been negotiating with Lenovo to reach a patent license agreement, but has been unsuccessful. This lawsuit may be one of Lenovo's countermeasures.

In response to this matter, ZTE responded on October 30, stating that the company and Lenovo have been negotiating on patent licensing issues for several years, hoping to resolve disputes between the two parties through efficient and reasonable means. Based on trust in Lenovo as a Chinese company, ZTE has maintained a cautious and restrained attitude towards taking legal measures other than negotiation. It is difficult for us to understand but we respect Lenovo's decision to file a lawsuit in the UK. This lawsuit by Lenovo will not change ZTE's determination to safeguard its legitimate rights and interests.

Lenovo also responded to the media on the same day, stating that the company is committed to advancing related licensing negotiations in a fair and transparent manner and is seeking a ruling from the UK courts to determine the rates and terms for cross-licensing between Lenovo and ZTE based on the "Fair, Reasonable, and Non-Discriminatory" (FRAND) principle.

It can be seen that the disagreement between the two parties on patent licensing fees is the key reason for the stalemate in negotiations and the resulting lawsuit.

Stockstar has noticed that the rapid development of Lenovo's mobile phone business this year has also exposed Lenovo to more patent fee payments, which is also one of the important reasons for Lenovo's lawsuit against ZTE. Data shows that Lenovo-Motorola maintained the eighth position in global smartphone shipments in Q2 this year, and Lenovo's moto phone sales increased by nearly 30% in Q3, with the fastest growth rate among the top ten manufacturers and the highest quarterly sales ever.

Judging from the patent reserves of both parties, as of the end of June 2024, ZTE had approximately 91,500 global patent applications and a cumulative total of approximately 46,000 globally licensed patents, with its 5G standard essential patent declaration volume ranking among the top five globally. In contrast, Lenovo's share of essential 5G standard patents is not as high as ZTE's, so Lenovo is the payer of royalties in its relationship with ZTE.

It is worth noting that since the UK is not the main market for Lenovo and ZTE, why Lenovo chose to sue ZTE in the UK is also a focus of market discussion.

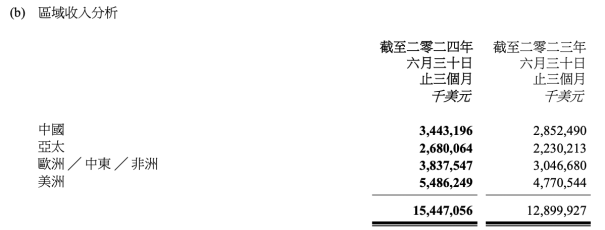

Regionally, according to Lenovo's latest earnings report, the combined revenue from the European, Middle Eastern, and African markets accounts for 25% of the company's total revenue, while the revenue from the Chinese market accounts for 22%. In the first half of the year, ZTE's revenue from the Chinese market accounted for 68.91%, while revenue from Europe, the Americas, and Oceania only accounted for 14.23%.

Some market observers believe that this is mainly related to Lenovo's previous successful patent lawsuits in the UK against companies such as InterDigital and Ericsson. The rulings in these cases may have given Lenovo some confidence, as they saved hundreds of millions of dollars in license fees compared to the original amounts, although a certain amount still had to be paid. This may also be one of the reasons why Lenovo chose the UK as the venue for suing ZTE this time.

It is reported that Lenovo has had disputes with multiple SEP patent holders such as Ericsson and InterDigital regarding patent technology licensing rates. In these two cases, the license rates ruled by the UK courts were closer to the rates advocated by Lenovo.

02. Q3 Revenue and Net Profit Both Decline

In fact, with the widespread application of 5G technology in recent years, the patent competition in the communications industry has become increasingly fierce, and disputes arising from patent licensing fees are common. In terms of outcomes, most of these lawsuits have led to settlements. Currently, ZTE has reached patent licensing agreements with mobile phone manufacturers including Apple, Samsung, OPPO, and Tianlong.

It should be noted that in the highly standardized market of the communications industry, a company's patent portfolio directly relates to its market position. Stockstar has noticed that ZTE maintains annual R&D investment exceeding ten billion yuan. Through continuous R&D investment and patent layout, the company is able to generate certain revenue from intellectual property rights.

According to the "China Communications Industry and Intellectual Property Market Report" previously released by JLL, the value of ZTE's patent assets has exceeded 45 billion yuan, and it is estimated that the company's intellectual property income will reach 4.5 to 6 billion yuan from 2021 to 2025.

Stockstar has noticed that in addition to being involved in the lawsuit with Lenovo, ZTE's recently released third-quarter report is mixed.

According to the information, ZTE is a company that provides ICT (Information and Communication Technology) technology and product solutions to telecommunications operators and government and enterprise customers, as well as terminal products to individual consumers. Based on customer segments, the company's main business segments are operator networks, consumer business, and government and enterprise business.

According to the third-quarter report, the company's revenue for the first three quarters was 90.045 billion yuan, a year-on-year increase of 0.73%; net profit attributable to shareholders was 7.906 billion yuan, a slight year-on-year increase of 0.83%. In fact, compared to the 14.97% increase in the same period last year, the company's net profit growth rate is slowing down significantly.

It should be noted that the slight increase in the company's net profit is partly due to the reduction in period expenses, which fell by 2.75 percentage points year-on-year to 28.087 billion yuan. On the other hand, it is due to the increase in software tax refund income. The company's revenue from VAT refunds on software products in the first three quarters was 1.686 billion yuan, a year-on-year increase of 42%, contributing over 20% of the company's profits.

At the same time, the company's pillar business, the operator network business, is under pressure in the domestic market due to the investment environment. On a quarterly basis, the company experienced a double decline in revenue and profit in Q3, with revenue of 27.557 billion yuan, a year-on-year decrease of 3.94%; and net profit attributable to shareholders of 2.174 billion yuan, a year-on-year decrease of 8.23%. (This article was originally published on Stockstar, authored by Li Ruohan)

- End -