Patent War: Comparison of Strengths and Strategic Analysis between Lenovo and ZTE

![]() 11/01 2024

11/01 2024

![]() 476

476

In the increasingly fierce global technological competition, intellectual property disputes have become an important battlefield for corporate competition.

On October 21, Lenovo filed an intellectual property lawsuit against ZTE in the High Court of England and Wales. This move not only caused a huge uproar in China but also had a significant impact internationally.

Early in the morning of October 30, ZTE officially responded, stating that they have always respected any legal actions taken by companies within the legal framework but expressed deep regret regarding Lenovo's actions.

ZTE noted that they had been negotiating with Lenovo on patent licensing issues for several years, always holding the utmost goodwill and seeking reasonable compensation for their research and development innovations. They hoped to resolve disputes through efficient and reasonable means. "Based on trust in Lenovo as a Chinese company, ZTE has always been cautious and restrained in taking legal actions beyond negotiation. We find it difficult to understand Lenovo's decision to file a lawsuit in the UK but respect it. This lawsuit will not change ZTE's determination to protect its legitimate rights and interests."

Although Lenovo's senior management team is primarily American, the company is still Chinese. Disputes over standard-essential patents (SEP) between the two Chinese companies should be resolved in China first. Why did Lenovo choose to file a lawsuit in the UK? Moreover, both companies' primary markets are in China, not the UK, raising questions about Lenovo's motivations and the impact this will have on Chinese technological innovation enterprises, represented by ZTE.

The Game Behind Lenovo's Lawsuit Against ZTE

As a leading global provider of integrated information and communication technology solutions, ZTE has invested heavily in research and development in the field of communication standards.

According to financial reports, ZTE's research and development expenses as a percentage of revenue have steadily increased from 13.8% in 2019 to 20.7% in Q3 2024. Its patent portfolio significantly surpasses Lenovo's, especially in the area of SEP.

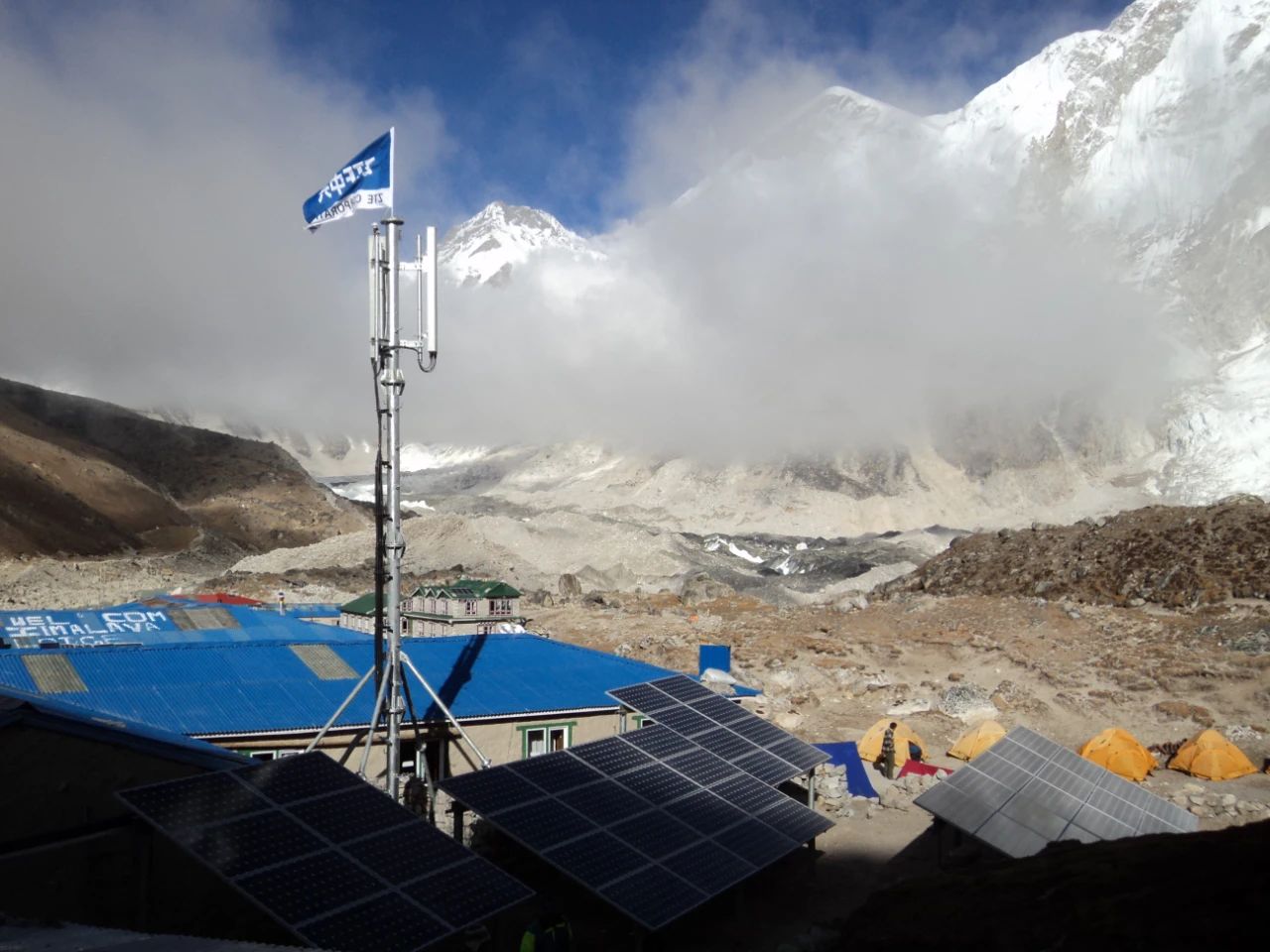

According to the latest report on Global 5G Standard Essential Patents and Standard Proposals by the China Academy of Information and Communications Technology (CAICT), as of March 31, 2024, ZTE accounted for 6.97% of global valid 5G patent families, ranking fifth, while Lenovo did not appear in the top 10 list.

Before acquiring Motorola, Lenovo was at a disadvantage in the patent field. Although Lenovo achieved remarkable success in the PC business, its patent accumulation in smartphones and mobile communications was relatively weak. The acquisition of Motorola indirectly provided Lenovo with some patent resources. After the acquisition, Lenovo obtained over 2,000 Motorola patents, which, although not numerous in the communications field, were a valuable asset for Lenovo.

Even so, comparing Lenovo and ZTE's SEP portfolios in the cellular field, Lenovo lags significantly behind ZTE in both 4G and 5G technologies.

Faced with ZTE's vast patent portfolio, Lenovo-Motorola, as the world's eighth-largest smartphone manufacturer, may choose to respond to ZTE's patent licensing claims through litigation after weighing global market context and self-interest.

Therefore, it is speculated that there are two reasons behind Lenovo's lawsuit against ZTE.

On the one hand, Lenovo's lawsuit accusing ZTE of patent infringement may be a direct response to ZTE's previous patent licensing offers or potential lawsuits.

Lenovo-Motorola's global market performance has been consistently robust, with its market share currently stable at around 5%. Especially in North America, Motorola has successfully secured the third position in the market, demonstrating strong growth momentum. However, with the continuous expansion of its business and market share, Lenovo-Motorola has also had to face licensing demands from multiple patent holders in recent years.

Lenovo may be using this approach to respond to ZTE's licensing offers. Considering similar cases in UK courts, this action may coerce the defendant to accept global patent licensing terms decided by the UK court through injunctions. Hence, filing the lawsuit in the High Court of England and Wales is expected to obtain more favorable global licensing rate rulings.

Interestingly, based on public information, it has been found that ZTE has reached licensing agreements with multiple major domestic and foreign companies, further affirming its strength in intellectual property, with its patent value highly recognized in the industry. In contrast, according to public information searches, Lenovo currently only has records of paying licensing fees to overseas companies and has never paid licensing fees to any Chinese rights holders.

On the other hand, it is Lenovo's usual practice to delay licensing agreements through litigation and other means.

For example, Lenovo's negotiations with InterDigital spanned 16 years, beginning in 2008 and only partially concluding in 2023, with some patents still in litigation. In the litigation with InterDigital, the UK court's final licensing rate was closer to Lenovo's offer, making Lenovo more inclined to let the UK court decide its global licensing rate.

Additionally, Lenovo's negotiations with Ericsson have lasted 17 years, beginning in 2008 and still unresolved. In 2023, Lenovo once again sued Ericsson in the UK, requesting the court to confirm Ericsson's infringement and issue an injunction unless Ericsson agreed to license terms under the FRAND (Fair, Reasonable, and Non-Discriminatory) principles as ruled by the UK court.

Lenovo's decade-long delaying tactics have not only harmed both parties' interests but also raised doubts about Lenovo's sincerity in intellectual property protection.

II. Filing a Lawsuit in the UK: Lenovo's Last Resort or Strategic Choice?

Lenovo's decision to file a lawsuit in the UK is inherently fraught with irrationalities.

From a market perspective, the UK is not a primary market for either Lenovo or ZTE.

According to Lenovo's financial data for August 2024, the combined revenue from Europe, the Middle East, and Africa accounted for only 25% of its total revenue, while the Chinese market accounted for 22%. In the cellular field, Lenovo's mobile phone shipments in the UK accounted for only 1.52% of its total shipments in 2023. It is evident that Lenovo's primary market is still domestic rather than the UK.

Similarly, the Chinese market accounts for 68.91% of ZTE's revenue, while Europe, the Americas, and Oceania combined account for only 14.23%. The UK is not a primary market for ZTE, contributing minimally to its revenue in recent years.

Therefore, bringing the patent dispute between the two companies to the UK court clearly lacks market logic support.

From the perspective of trust in China's judiciary, as a Chinese company, Lenovo should first trust and respect China's judicial system rather than choosing to bring disputes to overseas courts. This action reflects Lenovo's distrust in China's judicial system and undermines the overall image of China's communications industry.

As the incident escalates, the stereotype of "Chinese companies distrusting domestic regulatory authorities" will have a significant negative impact on the international cooperation of China's communications industry. This will not only harm the interests of Chinese communications enterprises but also affect China's position and influence in the global communications industry.

Meanwhile, the UK court cannot consider the realities of the Chinese communications market as comprehensively as Chinese judicial authorities. If this case becomes a precedent, the practical factors of the Chinese market in SEP relief will be ignored by more and more rights holders. This will lead to an increase in overseas lawsuits targeting communications entities while ignoring the realities of the Chinese market, causing losses to the development of China's communications industry.

So, why did Lenovo choose to sue ZTE in the UK? The author speculates that Lenovo may have considered the following points:

Firstly, the influence of historical precedents. Given Lenovo's frequent legal conflicts with SEP holders such as IDCC and Ericsson in multiple jurisdictions like the UK, the US, and Germany in recent years, Lenovo considers the UK court as the focal point for its SEP patent disputes.

Notably, Lenovo has achieved remarkable results in litigation against InterDigital and Ericsson in the UK, with the court-ruled licensing rates being closer to Lenovo's offers. Taking the lawsuit between Lenovo and InterDigital as an example, information disclosed in the first-instance judgment in 2023 and the subsequent second-instance judgment in 2024 shows that the total global patent licensing fees Lenovo needs to pay are closer to its offer of USD 80 million rather than InterDigital's claim of USD 337 million.

Secondly, the FRAND principle. Lenovo mentioned the FRAND principle in the lawsuit, hoping to achieve cross-licensing through legal means to ensure mutual benefit and win-win results for both parties in the market. The UK court may pay more attention to the application of the FRAND principle when handling such cases, which is beneficial to Lenovo's claims.

Thirdly, global influence. As one of the essential legal systems globally, the UK's rulings may impact the patent licensing landscape in the global communications industry. By choosing to sue ZTE in the UK, Lenovo provides a platform for the UK legal system to enhance its global influence, indirectly promoting negotiations and resolutions on patent licensing issues between the two parties.

Finally, market layout. Although Lenovo's primary market is not the UK, it has a strong presence in the North American market. Filing a lawsuit against ZTE in the UK may be Lenovo's decision after weighing its global market layout and self-interest. Through this lawsuit, Lenovo may hope to exert pressure on ZTE in one of its primary markets, Europe, forcing it to make concessions on patent licensing issues.

Conclusion

As a Chinese company, Lenovo should deeply reflect on its actions and re-examine its attitude and strategy towards intellectual property protection. At the same time, we should also strengthen cooperation and exchanges in the field of intellectual property protection to jointly promote China's more active role in global intellectual property governance.

Only in this way can we ensure that China's position and influence in the global communications industry are not compromised, creating a more favorable international environment for the development of China's communications industry.