AutoHome rumored to change hands again, Haier a potential buyer?

![]() 11/21 2024

11/21 2024

![]() 652

652

Poor performance, Ping An Insurance unable to drive growth?

@TechXplore Original

AutoHome may change hands again.

According to insiders, the rumor that Haier Group plans to acquire AutoHome has been officially confirmed, as revealed to "HongParty". If no unexpected situations arise, Haier is expected to officially announce the news soon.

It is reported that this time, Haier plans to acquire a portion of AutoHome's equity with a certain amount of funds to achieve a controlling stake, rather than acquiring a specific business segment as previously rumored. After the acquisition, it is expected to lay off 30% of its employees in January next year.

In addition, the article also reveals that insiders from AutoHome have disclosed that starting from the fourth quarter of this year, AutoHome has been conducting layoffs every month. The relevant Haier team is expected to officially move into AutoHome by the end of this year. At that time, not only will the new retail business be integrated into the new team, but there will also be significant changes in senior management. Haier has even begun searching for a new CEO for AutoHome.

Regarding the reason for the acquisition, the article mentions: At the end of October this year, Haier responded to rumors about its involvement in vehicle manufacturing, clearly stating that it would not enter the vehicle manufacturing industry but instead plans to enter the automotive market from an ecological perspective. This is likely the underlying reason for its current plan to acquire AutoHome.

However, it should be noted that the media outlet "HongParty" has deleted the above article on some media platforms. TechXplore also inquired with relevant personnel from AutoHome and Haier Group, but there has been no response as of now.

01

Worrying Performance

In fact, AutoHome's business performance has been quite dismal in recent years. Financial report data shows that AutoHome's revenue in Q3 2024 was 1.775 billion yuan, a year-on-year decline of 6.90%; net profit attributable to shareholders was only 426 million yuan, a year-on-year decline of 24.52%.

Looking at earnings before interest and taxes (EBIT), which better represents operating capacity, AutoHome's Q3 2024 EBIT was only 14.635 million yuan, a significant decrease of approximately 85.52% from the same period last year's 101 million yuan.

Specifically, AutoHome's operating costs in the third quarter were 407.7 million yuan, a year-on-year increase of 9.1%. In contrast, operating profit decreased sharply by 50.2% year-on-year from 166 million yuan in the same period last year to 82.6 million yuan. This data reflects the challenges the company faces in cost control.

It is worth mentioning that although AutoHome's total operating expenses have declined, from 1.4314 billion yuan in the same period last year to 1.3522 billion yuan, sales and marketing expenses are still as high as 876.5 million yuan, accounting for 49.4% of total revenue. This means that the company is still maintaining high-intensity investment in market development.

A realistic problem is that with the current peak of mobile internet traffic dividends, it is difficult for the monthly active user base of automotive media platforms to grow rapidly.

This is partly due to the fact that the monthly active user base of AutoHome and its competitor platforms has long shown a trend of "one falling as the other rises." On the other hand, with the decentralization of information, user behavior in leaving contact information is also dispersed across various platforms, including both vertical media like AutoHome and content platforms such as WeChat Video, Douyin, and Xiaohongshu.

According to QuestMobile data, as early as the first quarter of 2023, the combined number of automotive soft advertisements on Douyin and Xiaohongshu, two short video platforms, reached over 7,000, and the proportion of short video platforms in automotive advertising is increasing, attracting high attention from automotive brands.

02

Ping An Insurance unable to drive growth

As an automotive vertical media platform, to increase media revenue, it is inevitable to increase advertising placements. However, it is important to note a balance point between contradictions: excessive advertising will inevitably lead to a significant decline in user experience. How to balance this? This is undoubtedly a huge challenge for AutoHome.

Adapting to the consumption trends of young people today may be the only solution. However, the reality is that young people today prefer to obtain automotive information through videos, reviews, and other forms. At this point, it is inevitable that platforms like Douyin, Kuaishou, and Xiaohongshu will divert user traffic. It is a difficult problem for AutoHome to differentiate itself from these emerging platforms and attract the attention of young user groups.

Business issues, to a certain extent, also reflect deficiencies in management.

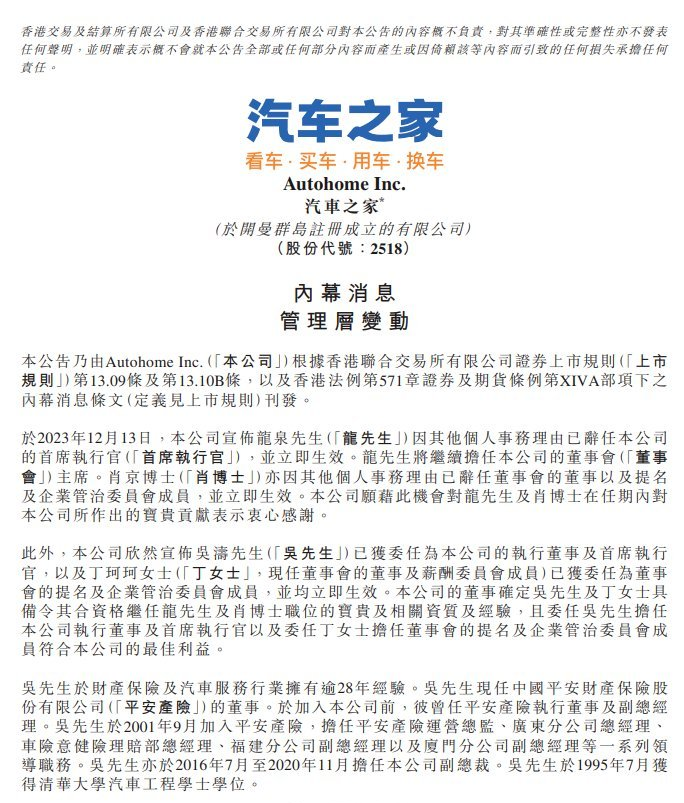

Since China Ping An Insurance took over AutoHome, the resumes of its successive managers have been impressive. Public information shows that Wu Tao, the current "leader" of AutoHome, is a veteran in the automotive industry with over 28 years of experience in property and casualty insurance and the automotive service industry, having a deep understanding of the automotive industry and insurance business. The current chairman, Long Quan, grew up in Ping An Group and is more adept at finance and insurance.

Sina Weibo