Haier's Acquisition of Autohome: Rumor or a Leading Fairy Tale?

![]() 11/21 2024

11/21 2024

![]() 630

630

Although the Guangzhou Auto Show is in full swing, there hasn't been any groundbreaking news from the event.

Instead, major developments have come from outside the show, with rumors that Haier Group may take over Autohome, a leading automotive portal media platform. Sina Finance sought confirmation from Haier Group, and insiders responded that they were "not aware" of any such plans. Haier Group declined to comment on market rumors when questioned by Beijing News. Additionally, the whistleblower "HongParty" has since deleted the relevant articles.

Based on multiple sources, the matter remains ambiguous as of this writing.

So, is this acquisition rumor a myth or a leading fairy tale?

// Haier Group's Ambitions and Ping An Group's Restraint

It is both difficult and straightforward to dissect the veracity of an unconfirmed business development. After all, any significant business move is filled with both contingency and inevitability.

Let's make bold assumptions and proceed with caution to explore these "inevitabilities":

From Haier Group's perspective, we analyze in two steps:

Step 1: Haier Group's strategic path.

Those who follow Haier Group will notice that acquisitions have been a key strategy in recent years:

Acquisition of Shanghai RAAS: On December 29, 2023, Haier Group acquired a 20% stake in Shanghai RAAS Blood Products Co., Ltd., held by Grifols, one of the world's four largest blood products giants, for a total of 12.5 billion yuan, gaining a combined 26.58% voting rights and becoming the actual controller of Shanghai RAAS.

Acquisition of Carrier's Commercial Refrigeration Business: On December 14, 2023, Haier Smart Home acquired 100% of the equity of Carrier's global commercial refrigeration business through its wholly-owned subsidiary for approximately $640 million.

In July of this year, the company acquired Electrolux's water heater business in South Africa to help expand its presence in the market. In October, it successfully completed the acquisition of Carrier's commercial refrigeration business, expanding Haier Smart Home's operations from household refrigeration to the commercial refrigeration market.

........

The group is in an acquisition and expansion strategy, indicating such strategic intent. Therefore, if Haier does intend to acquire Autohome, it has a strategic foundation that aligns with the group's expansion plans.

Step 2: Haier's Automotive Dream

Some find it inconceivable that Haier would acquire Autohome. That's because in consumers' minds, Haier is primarily known for its home appliances like refrigerators, TVs, and washing machines. However, Haier Group's business extends far beyond home appliances, encompassing healthcare, industrial internet, and even biotechnology.

Of course, it also includes automobiles. Haier Group has a significant presence in the automotive sector:

As early as 2015, Haier's open platform HOPE signed a cooperation agreement with Faurecia for open innovation, aiming to integrate and share resources across the entire innovation chain, including users, needs, ideas, and technological resources. At the time, Haier Smart Home's official Weibo account stated, "Perhaps in the future, cars can really be made on Haier's HOPE platform. Who knows?"

In 2018, Haier's COSMOPlat industrial internet platform established a cooperation platform with Kang Pai Si, a Weihai RV brand. Through customized interaction, open research and development, precision marketing, modular procurement, intelligent manufacturing, smart logistics, smart services, and the entire smart industry process, they transformed Kang Pai Si into the first large-scale customized factory model in the national RV industry.

In 2020, Haier Group invested in Shanghai Botai Auto Internet as a strategic investor. Additionally, Haier Capital has led investments in companies such as Feichi Magnesium (an automotive internet technology company), Saihe Intelligence (an automotive testing equipment manufacturer), and Tongming High-Tech (an automotive parts manufacturer).

Relying on its COSMOPlat industrial internet platform, Haier Group is jointly building a sub-platform for the automotive industry with related automotive enterprises, aiming to empower the digital transformation of automotive industry chain enterprises. Management has planned three major segments: automotive ecology, personalized customization, and core technology (solutions), with core technologies including charging technology, home-car interconnection, and smart cockpits.

Apart from not officially announcing its own car manufacturing, Haier Group has a significant presence in the automotive sector.

In summary, Haier Group has a strategic foundation for expansion and harbors an automotive dream. It would not be surprising if it were to acquire Autohome. If it does, there is no need for excessive surprise. While it may seem like a bold move, there are clear signs leading up to it. Of course, having value and capability does not necessarily mean taking action. Whether or not the acquisition will occur remains to be seen, and we will have to wait for the final outcome.

Now, let's shift our focus. After analyzing whether Haier is "worth buying," let's consider whether Ping An Group is "worth selling."

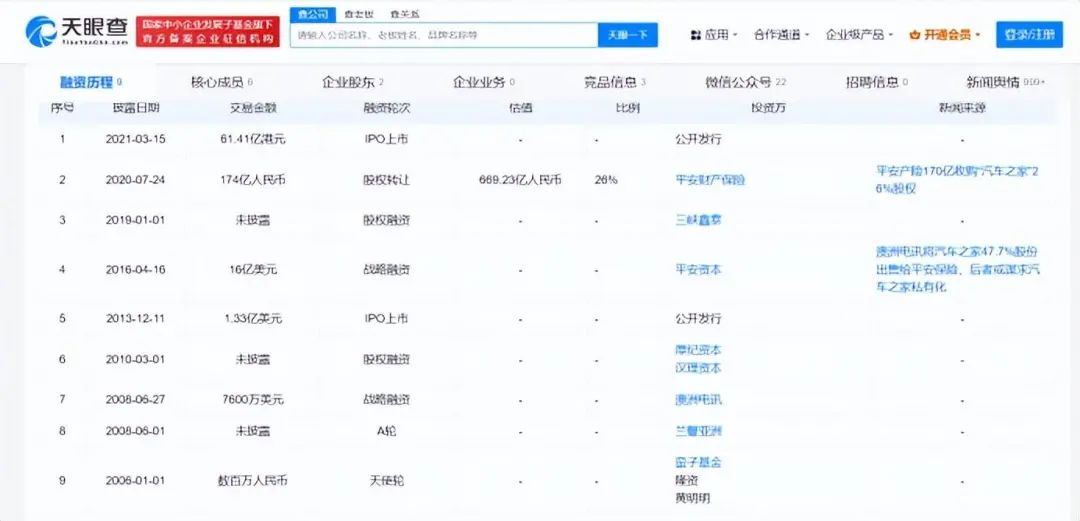

From Ping An Group's perspective, Tianyancha APP shows that in April 2016, Ping An Group acquired a 47.4% stake in Autohome for $1.6 billion, officially becoming its largest shareholder.

As a diversified group, Ping An Group had already made significant inroads into the automotive sector before acquiring Autohome:

However, this acquisition was controversial: Autohome did not want to sell. Internal shareholders had previously proposed privatization, offering a higher price than Ping An, but ultimately, Autohome could not resist the influx of foreign capital. The privatization failed, and after officially becoming the majority shareholder, Ping An Trust overhauled Autohome's management.

Founder Li Xiang also criticized the move:

However, under Ping An Group's leadership, Autohome also enjoyed its heyday. In 2020, the company's revenue reached 9.086 billion yuan, with a record-high net profit of 3.405 billion yuan and a basic earnings per share of 7.13 yuan.

However, revenue plummeted to 7.531 billion yuan in 2021, a year-on-year decrease of 17.11%, and net profit fell to 2.149 billion yuan, a year-on-year decrease of 36.9%. This downturn continued into 2022, with revenue further declining to 7.268 billion yuan.

Ping An Group's unaudited financial results for the third quarter ended September 30, 2024, show that total revenue for the quarter was 1.7745 billion yuan, a year-on-year decrease of 6.9%, and net profit attributable to shareholders was 441.3 million yuan, a significant year-on-year decrease of 23.7%.

// Autohome with Multiple Owners: Strategic Value Exceeds Monetization Value

From a commercial perspective, the media business has limited imagination. Despite Autohome's declining business, its ceiling is still relatively high among listed media companies, as it can generate sales leads rather than purely brand-level promotion.

When viewed as a business, the media industry has low monetization value and an extremely low ceiling.

Although the media business may not be lucrative, its strategic significance cannot be underestimated:

In earlier years, capital giants' involvement in the media industry became an industry norm:

A typical example is Alibaba.

Of course, to date, Alibaba has exited the shareholder ranks of many media companies.

Rupert Murdoch once said, "Owning a newspaper is like owning power." The Times, 21st Century Fox, National Geographic, The New York Post, The Sun, and Sky TV are all world-renowned media outlets, but they all share the same owner: Rupert Murdoch.

The hottest sector today is undoubtedly new energy vehicles. Some scholars, like Ren Zeping, even argue that not investing in new energy now is like not buying a house 20 years ago.

Backed by the vast new energy sector, media or information platforms, as traffic entry points that influence user perceptions, would be underutilized if they relied solely on advertising for monetization. Therefore, leading automotive information platforms are excellent scenarios for influencing user perceptions for groups aiming to enter the new energy vehicle sector, allowing them to leverage more resources for monetization.

Tech giant ByteDance entered the automotive market with its platform Dongchedi, while Baidu has Youjia. When Ping An Group acquired Autohome, it was also attracted by these resources.

Now, unconfirmed rumors suggest that Haier Group intends to take over Autohome. Could it be for the same reasons?

Currently, neither Ping An Group nor Haier Group has given a clear response. Let's wait and see the final outcome.

Disclaimer: This article is based on publicly disclosed information and the company's statutory disclosures. However, the author does not guarantee the completeness or timeliness of this information. Additionally, stock market investments carry risks, and investors should proceed with caution. This article does not constitute investment advice, and investors must make their own decisions.