Tesla Enters Robotaxi Market, Faces 'Three Hurdles'

![]() 06/30 2025

06/30 2025

![]() 780

780

On June 22, Tesla officially entered the Robotaxi market, reigniting the entire sector with renewed excitement.

Although Tesla's Robotaxi model unveiled this time is a 'modified' Model Y, rather than the CyberCab specifically developed for Robotaxi last year, its initial ride experience has been described as 'barely satisfactory' after a few days online.

However, it is evident that the entire Robotaxi industry still views Tesla as an important competitor.

On June 23, Hello officially announced its entry into the Robotaxi market through investments from Hello, Ant Group, and CATL. The collaborative model of the Internet + manufacturing industry endows Hello Robotaxi with the potential for significant scale from its inception.

On the same day, WeRide announced that it had secretly submitted a listing application in Hong Kong. Planning a second listing less than a year after its initial listing indicates that WeRide has also reached a critical point for a new round of scale expansion.

In May this year, Pony.ai signed a strategic cooperation agreement with Uber, marking another significant third-party platform partnership after Ruqi, Gaode Maps, and Alipay. Uber's recognition of Pony.ai's technology and operational capabilities signifies a shift from independently operating Robotaxi to launching a third-party operating platform. Consumers now have the futuristic option of 'virtual drivers' for Robotaxi services on aggregated ride-hailing platforms, alongside express and chauffeur services.

Tesla's entry has also sparked industry discussions on Robotaxi operations.

Even for players consistently ranked in the first tier of global intelligent driving, Tesla's entry into the L4 market must begin with equipping safety officers. There are no shortcuts for the implementation of Robotaxi.

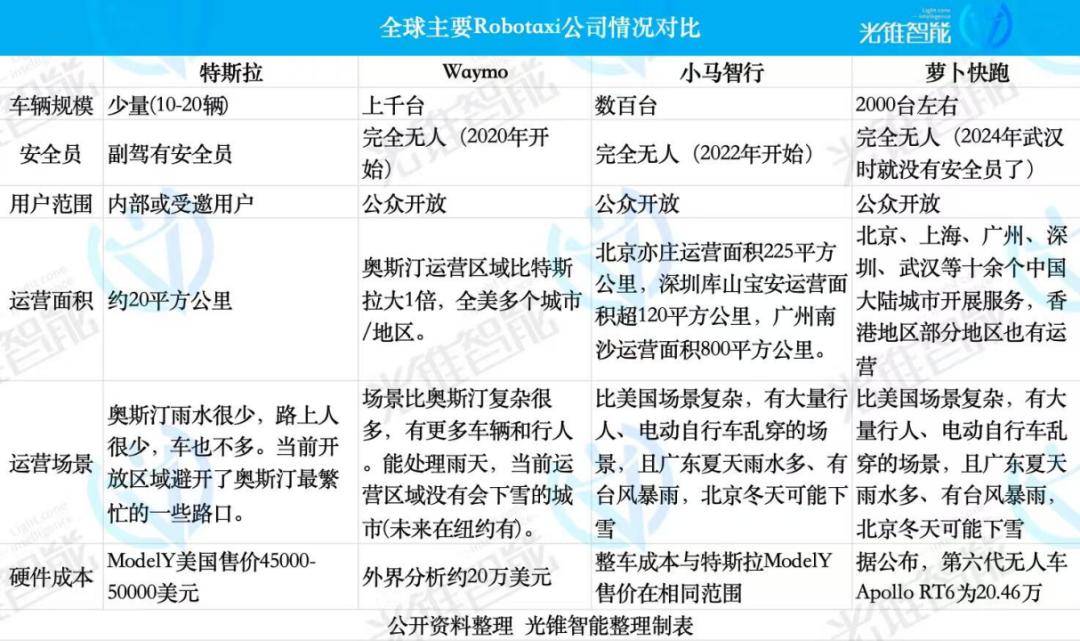

In contrast, global Robotaxi frontrunners like Waymo, Pony.ai, and others have a more than two-year operational 'generation gap' with new players.

On the other hand, the modified Model Y used for Robotaxi boasts a low single-car cost of $40,000, approaching that of mass-consumer passenger vehicles.

With costs continuously declining, the Robotaxi industry has finally reached a new node of scalability.

Undoubtedly, the first year of mass production for Robotaxi has arrived.

Tesla stumbles upon entry, as Robotaxi is already dominated by many players

Tesla's Robotaxi performance within a few days of its launch was a mix of surprise and mediocrity.

The capital market reacted swiftly. On June 22, Tesla launched a limited-edition Robotaxi service in Austin, Texas, exclusively for invited users. Upon this news, Tesla's market value surged by 8%. However, in the following days, Tesla's market value retreated to the level before the announcement.

Within two days, investors' attitudes towards Tesla flipped. This was primarily due to Tesla's Robotaxi performance falling short of expectations. This leading player in the field of intelligent driving did not demonstrate any advanced performance that currently surpasses the Robotaxi industry.

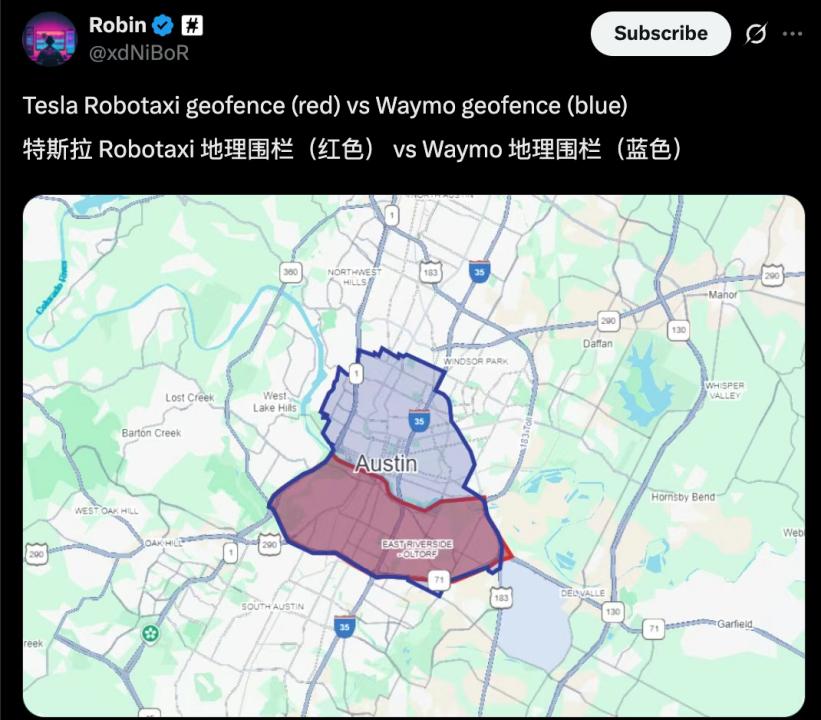

'Musk operates Robotaxi within a limited scope, from an invitation-only system to open operations. This approach instead confirms that Waymo's approach is correct. Austin was Waymo's first place for unmanned operations. It is a place with little rain, and there are basically no pedestrians on the road,' said Lou Tiancheng, co-founder and CTO of Pony.ai.

As summarized by Lou, Tesla's Robotaxi is retracing Waymo's path. Like Waymo, Pony.ai, and other current industry leaders, Tesla must also start from the stage of having safety officers on board and operating in small areas.

Tesla's entry into the market for a week has proven that there are 'no shortcuts' in the Robotaxi industry.

From 'manned to unmanned', from limited areas to open operations, Robotaxi must undergo severalfold safety improvements in the same scenarios at each stage before moving on to the next.

As early as 2021, Pony.ai obtained a Robotaxi unmanned testing license and commenced commercial charging for the first time that year. In its early stages, Pony.ai also started in a small area (Yizhuang Development Zone) and gradually progressed from having a safety officer in the driver's seat, to no one in the driver's seat but a safety officer in the passenger seat, to no one in the car but a 1:1 remote safety officer, and finally arrived at the current stage of only equipping 1:N remote assistance personnel.

Therefore, even with Tesla's entry, it must also 'pass three hurdles'.

Gradually expanding the operating range, reducing human intervention, and increasing the scale of operations, Robotaxi companies are verifying step by step. Only the top players have established fleets of hundreds or thousands of vehicles capable of providing uninterrupted operations in rainy weather in Guangzhou and snowy weather in Beijing.

From this perspective, Tesla, with only 20 Robotaxis, is obviously not yet officially at the 'table' in the Robotaxi industry. However, from a mass production perspective, Tesla is also an important 'disruptor' in the Robotaxi industry.

Because the Robotaxi model launched by Tesla this time is a 'modified' Model Y, not a vehicle specifically redesigned for the Robotaxi business. Tesla aims to use L2+ intelligent driving hardware combined with the cost of mass-consumer passenger vehicles to achieve Robotaxi, which still needs to prove itself through unmanned and large-scale operations.

Only after extreme cost reduction can Robotaxi truly talk about scalability

Autonomous driving technology is mature enough. In the past year, players have focused their efforts on 'cost reduction'.

There has always been a route dispute between the 'pure vision vs. LiDAR' solutions in the Robotaxi industry. To promote cost reduction in Robotaxi, players on different routes have different technical path preferences.

Starting from first principles, the pure vision approach represented by Tesla adheres to the principle of extreme cost reduction—the lower the hardware cost for achieving the same level of autonomous driving, the better. The level of autonomous driving is primarily driven by algorithms. The cost from algorithms will continue to be diluted as cars are sold.

However, players using LiDAR believe that 'safety is the 1, and everything else is the 0s that follow'.

Installing LiDAR can meet the 'diversity and redundancy' of data required for high safety standards. Along with the wave of electrification + intelligence in the Chinese automobile industry, the LiDAR and other industrial chains have undergone significant transformations. The cost of LiDAR has declined very rapidly in recent years. Currently, the cost of a single LiDAR can be as low as the thousand-yuan level. When the cost of LiDAR as a percentage of the total vehicle cost becomes acceptable, the debate between the 'pure vision' and 'fusion perception' routes no longer holds commercial significance.

Besides LiDAR, many Robotaxi players are also using technology to drive cost reduction at more levels. For example, Pony.ai's newly launched seventh-generation Robotaxi has a 70% reduction in the cost of its autonomous driving suite compared to the sixth generation. Among the hardware costs, LiDAR costs have decreased by 68%, and domain controller costs have decreased by 80%.

According to calculations by a securities trader, compared to peer costs, Pony.ai's costs are significantly lower than the approximately $200,000 estimated for Waymo by outsiders. Compared to domestic peers, it is slightly higher than Baidu's sixth-generation driverless vehicle Apollo RT6 at RMB 204,600.

But overall, the costs of China's leading Robotaxi players and Tesla's Model Y solution are at the same level.

However, to achieve continuous cost leadership in the long run, it is ultimately determined by the technical depth of Robotaxi players. At this year's Shanghai Auto Show, Light Cone Intelligence observed that many intelligent driving suppliers are actively trying to use domestic substitutions and technological optimizations to continue reducing the cost of computing hardware.

Only after extreme cost reduction can Robotaxi truly talk about scalability.

So, how many Robotaxis are needed to achieve profitability?

Zhang Ning, Vice President of Pony.ai and head of the L4 Robotaxi business, introduced to Light Cone Intelligence that 'in cities like Beijing, Shanghai, Guangzhou, and Shenzhen, when the number of Robotaxis deployed reaches 1,000, operations will reach the break-even point.' In May 2024, when Baidu disclosed its profit timeline, it also mentioned plans to deploy 1,000 units in Wuhan within the year, achieve break-even by the end of 2024, and achieve full profitability in 2025.

Everyone holds the simple ideal that 'the more invested, the easier it is to make money', and the Robotaxi industry has entered the stage of siege.

2025, Towards Profitability

Various indications suggest that the Robotaxi industry will become profitable in 2025.

On Pony.ai's side, the company's unaudited first-quarter report for 2025 shows total revenue of RMB 102 million, a year-on-year increase of 12%. Among them, Robotaxi business revenue was RMB 12.3 million, a year-on-year increase of 200%. The Robotaxi business has become the main factor driving Pony.ai's revenue growth in the first quarter.

Why can the Robotaxi business significantly increase company performance? The main reason is that ordinary people are using it more and more.

It is understood that Pony.ai's Robotaxi business revenue mainly comes from two categories: passenger fare income and technical solution project income. Pony.ai's passenger fare income increased significantly in the first quarter, with a year-on-year increase of 800%.

The same is true for Luobo Kuaipao. According to Baidu's first-quarter report, Luobo Kuaipao provided over 1.4 million trips globally in the first quarter of this year, a year-on-year increase of 75%. As of May 2025, Luobo Kuaipao has provided over 11 million trips globally.

With the maturity of technology and the increase in user volume, the government is also continuously promoting the implementation of Robotaxi.

Currently, autonomous driving technology has been included in the '14th Five-Year Plan' for digital economy development, with multiple departments jointly promoting the marketization and road access of autonomous vehicles. At the specific operational level, cities like Shenzhen, Shanghai, and Beijing are actively providing policy support in terms of liability determination, road testing, and commercial operations. Shanghai has also proposed that when an accident occurs in a driverless vehicle, the vehicle owner or manager shall first advance the compensation and then may seek reimbursement from the responsible party.

With the introduction of detailed policies, Robotaxi has also eliminated users' original safety concerns, providing an additional layer of assurance for commercial operations.

As implementation accelerates, the entire Robotaxi industry is undergoing a fierce 'land grab'.

In 2024, Baidu conducted large-scale validation in Wuhan, attracting widespread social attention. In 2025, Pony.ai and other industry players are continuously expanding their testing scope.

Baidu's Luobo Kuaipao is 'aggressively' pushing its overseas layout. On March 28, Luobo Kuaipao announced that it would deploy over 1,000 fully driverless vehicles in downtown Dubai to conduct large-scale testing and operational services. On June 18, it was approved to conduct tests on designated road sections and time periods in Tung Chung, Hong Kong. Luobo Kuaipao's current planned layout also includes countries and regions such as Switzerland, Turkey, and Japan.

On Pony.ai's side, it is 'internally and externally refined'. Currently, Pony.ai's Robotaxi serves an area exceeding 2,000 square kilometers in Beijing, Shanghai, Guangzhou, and Shenzhen, covering key transportation hubs such as central urban areas, airports, and high-speed rail stations. In addition, Pony.ai is also rapidly advancing the commercial landing of the global market, not only deploying autonomous driving businesses in countries and regions such as South Korea, Luxembourg, and the Middle East but also establishing strategic partnerships with Uber, Singapore's ComfortDelGro Corporation, and Luxembourg's Emile Weber.

In terms of operation quality, Pony.ai also implements refined operation strategies for different user groups. On Pony.ai's own app, the number of registered users in the first quarter of this year increased by over 20% month-on-month. On third-party platforms with a wider consumer reach, Pony.ai CEO Peng Jun introduced that 'in the past year, 80% of orders came from Pony.ai's own app, and 20% came from third parties'.

In addition, automakers are also actively deploying. For example, Ruqi Travel, a subsidiary of GAC Group, has expanded its Robotaxi business operations from Guangzhou to Shenzhen. Mobility service platforms such as Dongfeng's Enjoy Tech, Geely's Cao Cao Mobility, and SAIC's Enjoy Travel have also successively launched Robotaxi businesses and have obtained demonstration operation permits in cities such as Wuhan, Wuxi, and Suzhou.

2016 was the year when Robotaxi just started. In that year, Waymo operated independently, and General Motors acquired Cruise. Nine years have passed, and Robotaxi enterprises have experienced both highs and lows. In 2025, the great era of Robotaxi has arrived.