Analyzing Automakers' First-Half Sales: A Three-Tiered Market with Mixed Fortunes

![]() 07/28 2025

07/28 2025

![]() 485

485

By Li Xia

Produced by Five-Star Car Reviews

The first-half sales figures for complete vehicle enterprises have been unveiled, revealing a three-tiered market structure based on sales volume: over 1 million vehicles (Tier 1), 500,000-1 million vehicles (Tier 2), and below 500,000 vehicles (Tier 3). These tiers not only exhibit clear size differences but also share common characteristics in growth momentum, strategic focus, and development pressures, reflecting China's evolving automotive competitive landscape.

Tier 1 (over 1 million vehicles): Scale as Foundation, Autonomy and Globalization as Key Drivers

Seven automakers belong to Tier 1, having sold over 1 million vehicles in the first half. They form the backbone of China's auto market. These companies leverage their substantial scale to expand growth through autonomous brands or global strategies, though their target achievements and growth quality vary due to strategic differences.

BYD (2.146 million vehicles): Leading with a significant advantage, BYD reported a year-on-year increase of about 33.0%, completing about 39.0% of its annual target of 5.5 million vehicles. Its core feature is "domestic pressure, overseas explosion" — domestic sales dipped by about 8.0% year-on-year, while overseas sales surged by about 229.8%. The stability of overseas market prices supports its profitability.

SAIC (2.053 million vehicles): With a year-on-year increase of about 12.4%, SAIC has completed about 45.6% of its 4.5 million vehicle target, marking six consecutive months of sales growth, reversing the decline seen in 2024. Post-leadership reforms in 2024 have taken effect, with autonomous brand sales accounting for about 63.5% and new energy vehicle sales increasing by about 40.2%, driving growth.

Geely (1.931 million vehicles): Geely Automobile saw a year-on-year increase of about 30.0%, raising its annual target from 2.71 million to 3 million vehicles, with a completion rate of about 47.0%. The "returning to one Geely" strategy has facilitated resource integration, and the synergy among sub-brands has made it one of the few automakers daring to increase targets.

FAW (1.571 million vehicles): With a year-on-year increase of about 6.1%, FAW has completed about 45.5% of its 3.45 million vehicle target. The joint venture sector remains the primary sales driver, but autonomous brand sales reached about 450,000 vehicles (a year-on-year increase of about 8.5%), and autonomous new energy sales surged by about 95.5%, demonstrating the effectiveness of "strengthening autonomy".

Changan (1.355 million vehicles): Changan reported a slight year-on-year increase of about 1.6%, reaching an eight-year high and completing about 45.2% of its 3 million vehicle target. The highlight is "reducing reliance on joint ventures," with autonomous brands accounting for about 84.9% and new energy sales of about 452,000 vehicles (a year-on-year increase of about 48.8%), making it the most autonomous enterprise among the six major groups.

Chery (1.26 million vehicles): Chery saw a year-on-year increase of about 14.5%, marked by "four breakthroughs" — record sales for the same period, exports of about 550,000 vehicles maintaining the top position, new energy growth of about 98.6%, and technological advancements promoting product upgrades, laying the groundwork for a Hong Kong IPO. (Note: Chery Group has not specified an annual target for specific figures, so target completion is not discussed here.)

Dongfeng (1.116 million vehicles): Dongfeng has recovered month-by-month in terminal sales, completing about 37.2% of its 3 million vehicle target. The proportion of autonomous brands has increased to about 60.0%, and autonomous new energy exports have surged by about 229.0%. It aims to sprint towards 1.88 million vehicles in the second half, accumulating growth through brand integration.

Common Characteristics: All prioritize autonomous brands as their core growth engine (or are strengthening autonomy), with new energy and overseas markets as key breakthroughs. Strategic adjustments (like reforms, resource integration, and brand integration) are vital for growth activation. Despite leading in scale, some enterprises still have room for improvement in target completion due to domestic market challenges.

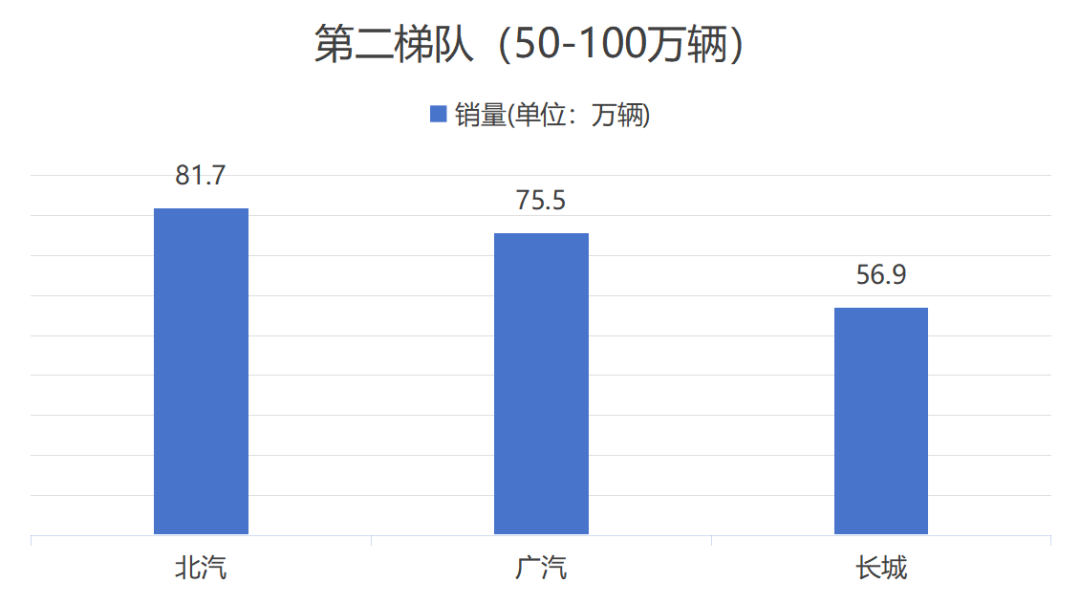

Tier 2 (500,000-1 million vehicles): Pressure and Transformation Coexist, Breaking Deadlocks Requires a Core Fulcrum

Three automakers fall into Tier 2, having sold between 500,000 and 1 million vehicles in the first half. They face the pressure of slowing sales growth or low target completion rates, with joint venture dependence or strategic adaptation issues prominent, necessitating clear transformation directions to break deadlocks.

BAIC (817,000 vehicles): With a year-on-year increase of about 6.0%, BAIC has completed about 33.6% of its 2.43 million vehicle target. While its overall scale is not as large as its peak, autonomous brand sales reached about 466,000 vehicles (a year-on-year increase of about 24.0%), gradually reducing reliance on joint venture brands like Beijing Benz, with a clear trend of "autonomous succession".

GAC (755,000 vehicles): GAC reported a year-on-year decrease of about 12.5%, completing about 32.8% of its 2.3 million vehicle target, making it one of the few automakers with declining sales. Operating indicators are under pressure, with expected non-deductible net profit losses of about 2.12-3.2 billion yuan, necessitating urgent product and strategy adjustments to reverse the decline.

Great Wall (569,000 vehicles): With a slight year-on-year increase of about 1.8%, Great Wall has only completed about 14.2% of its 4 million vehicle target, making the "2025 Strategy" set in 2021 unachievable. Adhering to the strategy of "not sacrificing quality for price reductions" has preserved brand tone, but sales growth is weak, necessitating new fulcrums in product positioning and market penetration.

Common Characteristics: Generally, there is a gap between goals and reality, with some enterprises experiencing double declines in sales or profitability. Transformation directions focus on "reducing joint venture dependence" (BAIC), "contracting and focusing business strategies" (GAC), and "adapting strategic goals to the market" (Great Wall). Finding core growth fulcrums (like flagship products, niche markets) is crucial for the second half.

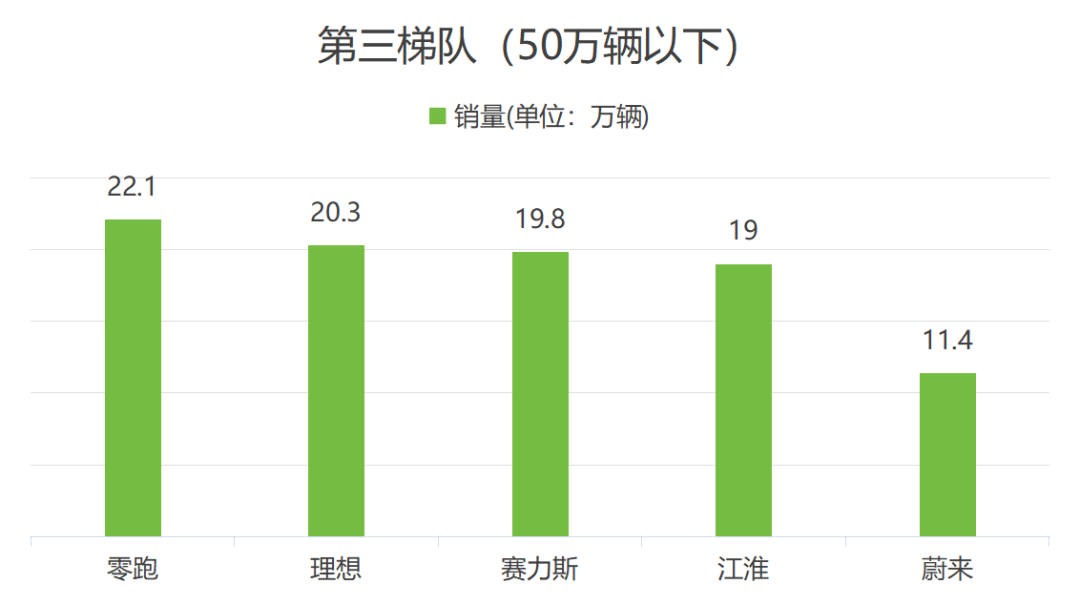

Tier 3 (below 500,000 vehicles): New Forces Dominate, with "Blockbusters" and Survival Lines as Keywords

Seven automakers belong to Tier 3, having sold below 500,000 vehicles in the first half. This tier primarily comprises new automotive forces but also includes some transitioning traditional automakers. They exhibit significant differentiation — leading new forces achieve rapid growth through "blockbusters," while others struggle on the brink of survival, and balancing profitability and scale is the core challenge.

Leap Motor (221,000 vehicles): With a year-on-year increase of about 155.7%, Leap Motor has completed about 44.3% of its 500,000 vehicle target, ranking first among new forces. It has tapped into the market with "high cost-effectiveness," but annual sales need to stabilize above 500,000 vehicles to enter Tier 2 or the "safe zone," currently still in a critical survival period.

Li Auto (203,000 vehicles): Li Auto reported a year-on-year increase of about 7.9%, completing about 31.7% of its 640,000 vehicle target (revised downward from 700,000). Focusing on the luxury market but with slowing growth, it still has a significant gap from its goal of "being the top-selling Chinese luxury brand," requiring faster product iteration.

Thalys (198,000 vehicles): Thalys reported a year-on-year decrease of about 15.7% without announcing an annual target. Relying on the AITO brand to establish a foothold in the luxury market, but the dispersion of Huawei resources has led to insufficient momentum. However, profitability is outstanding, with net profit expected to be about 2.7-3.2 billion yuan, an increase of about 66.2%-96.9% year-on-year, achieving a unique pattern of "decreasing sales but increasing profitability".

XPeng Motors (197,000 vehicles): XPeng Motors reported a year-on-year increase of about 224.0%, completing about 49.3% of its 400,000 vehicle target, with over 30,000 vehicles delivered for eight consecutive months. He Xiaopeng's strategic adjustments have taken effect, with sales exceeding the entire year of 2024, making it the fastest-recovering representative among new forces.

JAC (190,000 vehicles): JAC reported a year-on-year decline of about 7.5%, completing about 44.2% of its 430,000 vehicle target, continuing to lose money (net profit expected to be about -680 million yuan). The first month of reservations for the JAC-Huawei collaboration model Zunjie S800 reached about 6,500 vehicles, becoming a potential growth point, but the issue of sustained profitability needs addressing.

Xiaomi Automobile (157,000 vehicles): As a "newcomer," Xiaomi Automobile performed impressively, completing about 44.9% of its 350,000 vehicle target. The SU7 and YU7 have become "blockbusters," and "Lei's marketing" has helped quickly increase sales, but the excessively long delivery cycle restricts growth, making capacity expansion a top priority.

NIO (114,000 vehicles): With a year-on-year increase of about 30.6%, NIO has completed about 25.7% of its 444,000 vehicle target, recording the lowest sales. The goals of "doubling annual sales" and "profitability in the fourth quarter" are extremely challenging, and the upcoming delivery of the Ledao L90 is highly anticipated for a "turnaround".

Common Characteristics: New forces dominate this tier, with "blockbuster products" and "marketing strategies" being key to rapid growth (like XPeng and Xiaomi). Some enterprises face the dilemma of "scale versus profitability" (like Leap Motor needing to increase volume, and Thalys being profitable but with declining sales). Established new forces (like NIO) and transforming traditional automakers (like JAC) need to break through with new products or collaborations, or they may be further marginalized.

Summary: The "Matthew Effect" in China's auto market continues to intensify. Tier 1 relies on scale, autonomy, and globalization to consolidate its position, shaping the industry's foundation. Tier 2 is the "key layer of transformation," and addressing strategic deviations and joint venture dependence will determine their ascent or descent. Tier 3 is an "area where vitality and risks coexist," with rapid iteration by new forces and struggling transformation by traditional automakers making this tier's ranking the most volatile. In the second half, regardless of tier, "domestic brand competitiveness," "new energy vehicle penetration," and "overseas market breakthroughs" will be core battlegrounds, ultimately determining automakers' final annual rankings.

------- The end -------