What is Tesla's "Tang Seng Meat"?

![]() 06/07 2024

06/07 2024

![]() 783

783

Lead

Tesla's last big weapon, FSD, may soon officially begin commercialization in China. Facing declining sales, Tesla needs to find a new edge tool beyond price reductions to reverse its declining trend in the domestic and global markets.

Produced by | Heyan Yueche Studio

Written by | Zhang Dachuan

Edited by | Heyanzi

2235 words in full text

4 minutes to read

Recently, Reuters reported that Tesla China is preparing to submit relevant filing materials for FSD (Full Self-Driving) to Chinese authorities, aiming to officially launch the FSD function in the domestic market by the end of this year.

On April 28, when Musk visited China, the China Association of Automobile Manufacturers (CAAM) issued a "Notice on the Testing of Four Safety Requirements for Automobile Data Processing," pointing out that six automakers, including Tesla, have passed data security-related testing. In China, high-precision maps and road scene data required for autonomous driving are classified as surveying and mapping data. Obtaining certification from CAAM means that policy obstacles for Tesla to carry out commercial operations related to autonomous driving in China have been removed to a certain extent.

△Obstacles for Tesla to conduct autonomous driving-related testing in China have basically disappeared

What is the significance of FSD entering China?

For Tesla, the entry of FSD into the domestic market is significant.

△Tesla FSD strives to enter the Chinese market

From January to April this year, Tesla's sales in China declined by 7.6%. One of the main reasons for this situation is the decline in competitiveness of Tesla models. In terms of battery, motor, and electronic control technology, many domestic automakers compare Tesla when releasing new cars, while Tesla's two main sales models, Model 3 and Model Y, have not undergone a model change for a long time. In terms of intelligent driving, Tesla with only AutoPilot obviously cannot compete head-on with the intelligent driving systems of Huawei, XPeng, and NIO. Under such circumstances, Tesla can regain the favor of domestic consumers by introducing FSD with a higher level of intelligent driving in China.

△Model 3 and Model Y's market competitiveness in China has weakened

Previously, Musk also announced that he would enter the Robotaxi market. And to layout the Robotaxi market, FSD is naturally indispensable. If Tesla can break new ground in the Robotaxi industry, it will find a reliable support for the sustainable development of Tesla's sales in the long term. And to gain a foothold in the Robotaxi market, intelligent driving systems like FSD are crucial. Therefore, whether from the perspective of improving sales in the Chinese market or from the perspective of improving global sales, Robotaxi is also Tesla's "Tang Seng Meat."

The significance of B-end users cannot be underestimated. During XPeng's first-quarter earnings call this year, the technology transfer fees and joint development fees that Volkswagen will pay became a focus of attention. In the current situation where selling electric vehicles is not profitable, technology transfer is also a new channel that can earn considerable revenue. For Tesla, if its FSD can successfully land in China, it is not excluded that it can also sell FSD-related systems to domestic automakers like XPeng, Huawei, and Leapmotor, charging technology transfer fees. Of course, the monthly subscription fee for FSD will also be a considerable income for Tesla.

FSD and Robotaxi still have a long way to go

For Tesla, using Baidu's qualifications to deploy FSD is only the first step in the long march.

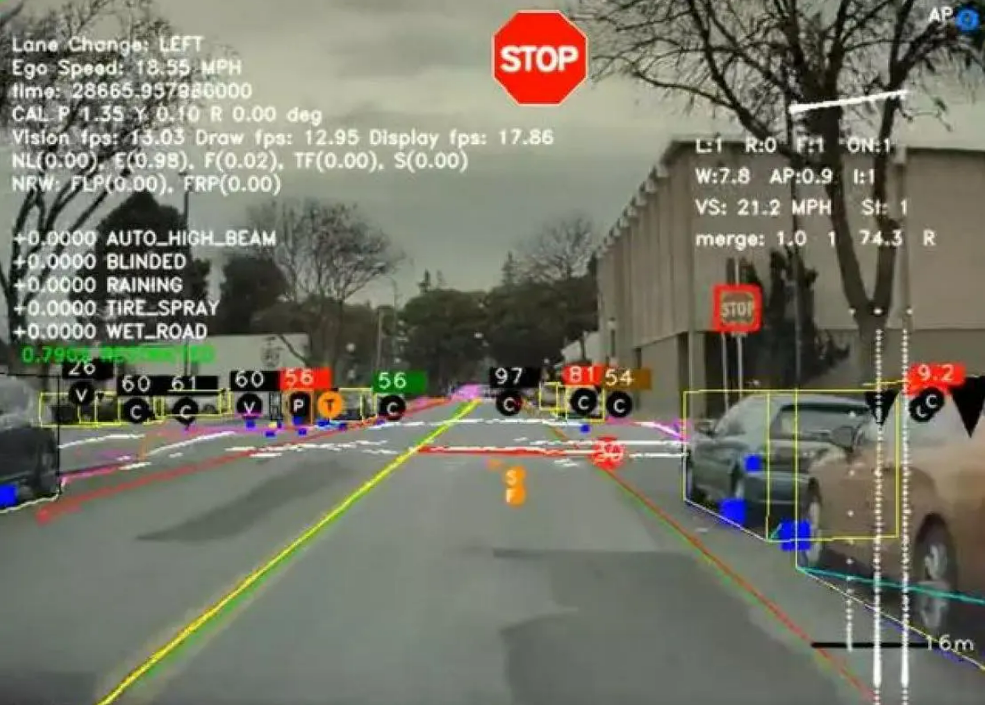

Data collection is not a one-day job. Especially for high-level autonomous driving, collecting massive amounts of data to train the autonomous driving system is necessary to better cope with long-tail scenarios that may be encountered in real-world road scenarios. Even for Tesla FSD Beta V12, although it can rely on neural networks and does not need to set each long-tail scenario in advance, this is the result of Tesla's previous collection of a large amount of data for training. For Tesla, it has not been able to collect data from real-world road scenarios in China before, and there are still significant differences in road scenarios between China and European and American countries. In this case, Tesla still needs some time to make up for the data gap.

△Before FSD lands, it needs to collect massive road scene data

Local supercomputing centers. For Tesla, after collecting a large amount of road scene data, how to train the algorithm locally is also a challenge. Currently, domestic mainstream automakers, including XPeng, Geely, and NIO, have invested heavily in building their own supercomputing centers. At the same time, the United States has imposed export restrictions on NVIDIA's GPU chips used for cloud computing in order to limit the development of China's AI technology. Compared to buying in the United States, Tesla's supercomputing center in China may face the embarrassment of having no rice to cook. It is unknown whether Tesla has stockpiled enough chips before the US export control ban takes effect. If not, it may need to adopt methods such as federated computing to strike a balance between data export and regulatory requirements.

△How Tesla will build a supercomputing center for autonomous driving algorithms remains to be seen

Is this really "the wolf is coming" for Tesla FSD?

Tesla entering the domestic market will be the first to affect two types of companies.

For automakers like Huawei and XPeng, after Tesla makes up for its shortcomings in intelligent driving, it may have a direct impact on domestic automakers. However, as mentioned above, Tesla still needs to collect more data from China, so FSD cannot directly affect leading domestic intelligent driving automakers in the short term.

On the other hand, domestic automakers do not seem to be afraid of Tesla. When discussing the topic of Tesla FSD entering the domestic market, Yu Chengdong, Executive Director of Huawei, Chairman of the Terminal BG, and Chairman of the Intelligent Vehicle Solutions BU, mentioned that through comparative tests, Huawei's intelligent driving system has already outperformed Tesla FSD without using lidar. As Huawei's intelligent driving system begins to be equipped with lidar, related intelligent driving performance will be further enhanced. While Tesla FSD continues to optimize, domestic intelligent driving companies, including Huawei, will not slow down their own iteration and optimization.

△Yu Chengdong is confident in Huawei's ADS 3.0 system

Compared to automakers, the Robotaxi market that Tesla aims to enter poses a significant challenge to companies like Baidu and Pony.AI. However, relevant personnel from Baidu's Robotaxi platform "Luobo Kuaipao" seem relatively confident about this. Whether from the overall Robotaxi business layout or technical maturity, Tesla FSD may not catch up in 3-5 years. After all, Luobo Kuaipao is expected to operate in 65 cities by 2025, and as of April 19, Luobo Kuaipao has cumulatively provided over 6 million autonomous driving service orders to the public, and these first-mover advantages are still very obvious.

△Domestic Robotaxi platforms like Luobo Kuaipao are not afraid of Tesla FSD

Commentary

Just as when Tesla was introduced into China before, there were differences in the industry as to whether it was exerting a catfish effect or "the wolf is coming." Regardless of whether the wolf came or not, the domestic smart electric vehicle industry has become increasingly powerful in recent years, forcing the United States and the European Union to launch trade wars to prevent Chinese electric vehicles from entering. Although Tesla FSD is coming with a vengeance this time, domestic automakers are not afraid at all, and it may not even count as a catfish effect. Competing with Tesla in all aspects at home and abroad, continuously strengthening and expanding themselves, is more conducive to the development of independent automakers.

(This article is originally written by Heyan Yueche and may not be reproduced without authorization.)