Has Chery Become a 'Retirement Home' for Great Wall Executives?

![]() 12/01 2025

12/01 2025

![]() 503

503

Chery has once again recruited executives from within the industry.

According to Sina Auto, Yu Fei, a marketing powerhouse who bid farewell to his role as General Manager of the Marketing Division at Dongfeng eπ on July 22 this year, has discreetly joined Chery after a career hiatus of over three months.

Before him, the threshold of Wuhu was almost overwhelmed by 'fellow townspeople' from Baoding. In just the past year or two, several former key executives from Great Wall Motors have 'transferred' to Chery, leading some to jokingly refer to Chery as Great Wall's 'retirement home.'

Liu Hening, who previously handled marketing for Great Wall's WEY brand, joined Chery in 2024 and took over as General Manager of the Exeed brand's marketing center in September 2025. Zhang Mengyuan, a 'post-85s' rising star and former Deputy General Manager of Marketing for the Haval brand, jumped ship from Great Wall in 2022 and assumed the role of Executive Deputy General Manager of the Jetour Marketing Center at the end of September.

Zhang Jiaming, a veteran of Great Wall Motors' pickup truck business and former Vice President of Great Wall Motors, joined Chery in 2024 as Deputy General Manager of Chery Commercial Vehicles, overseeing the Rely pickup brand division.

If we also include Gong Yueqiong, the Deputy General Manager who moved from BAIC Group to Wuhu in June 2024, and the marketing veteran Xiang Dongping, who joined earlier in September 2023 as Deputy General Manager, Chery's executive team can be described as a 'Great Wall Legion.'

Chery, an established state-owned enterprise, seems to be leveraging its stable platform and substantial resources to become an ideal haven for seasoned professionals weary of the '996 work culture' at 'new forces' and the intense internal competition at traditional automakers, providing a place for them to settle into the latter half of their careers.

Suddenly, these core executives, who have honed their skills in Great Wall Motors' notoriously 'wolf-like culture' for years, are flocking to a state-owned enterprise that appears somewhat 'simple' and 'conservative' to outsiders.

This inevitably raises a significant question: Why have these highly accomplished professional managers, ranging from marketing powerhouses to category experts, as if by prior agreement (all chosen) to join Chery?

01

Veterans Assemble

Wuhu Is Far from Easy

The term 'retirement home' typically refers to enterprises with stagnant business, lack of innovation, internal redundancies, and employees who can comfortably 'coast' until retirement. Early on, there were rumors within Chery about 'lifers' and 'connections' working until retirement.

However, the flow of top talent often serves as a true barometer of industry trends and corporate fortunes. Why have these seasoned veterans of the automotive circle, who have seen it all, collectively set their sights on Chery in 2025?

A glance at Chery's financial reports and sales data reveals a clear upward trajectory.

In 2023, while the entire industry was anxious about price wars and internal competition, Chery Group delivered a 'miraculous' performance: annual sales soared to an astonishing 1.881 million units, a staggering 52.6% year-on-year increase. That year, Chery's annual revenue surpassed the 300 billion yuan mark for the first time, achieving an enviable 'twelve consecutive years of growth' by all peers.

In 2024, this momentum showed no signs of slowing. Annual sales reached a new high of 2.6039 million units, a 38.4% year-on-year increase. Financial data was even more impressive, with revenue for the first three quarters reaching 182.154 billion yuan and net profit at 11.312 billion yuan, up 67.7% and 58.5% year-on-year, respectively. This dual growth in revenue and profit is exceptional in the razor-thin margin automotive manufacturing industry.

By 2025, although full-year data is not yet available, the financial report for the first three quarters shows Chery maintaining strong growth momentum. As of September 30, revenue had reached 214.833 billion yuan, with net profit at 14.365 billion yuan, up 18% and 28% year-on-year, respectively.

Based on this performance, Chery made its debut on the Fortune Global 500 list in August 2024, ranking 385th, and received an AAA credit rating in November of the same year.

The core driving force behind Chery's money-making machine is its incredibly strong overseas market.

For years, Chery has firmly held the crown as the 'export king.' In 2023, export sales reached 937,000 units, doubling year-on-year and accounting for half of total sales. Overseas, especially in markets like Russia and South America, Chery's brand appeal and profit margins far exceed those in the domestic market. This 'cash cow' business provides substantial capital and strategic depth for Chery to compete fiercely in the domestic market.

A behemoth with a compound annual growth rate exceeding 50%, generating thousands of billions in revenue and hundreds of billions in profit, must be a hive of activity internally. For any ambitious professional manager, this is far from a 'retirement home' but rather a land of opportunity, a vast platform to showcase their skills and achieve great things.

However, just as a coin has two sides, behind Chery's meteoric rise (Side A) lies an equally chaotic and challenging Side B. It is this complex Side B that provides the other half of the puzzle to understanding the 'executive exodus.'

02

The B-Side of 'Retirement'

Is a Promised Land of Rapid Growth

In stark contrast to its soaring performance, Chery has long been labeled as 'chaotic' internally. This 'chaos' manifests in two main areas: a complex brand matrix and sluggish new energy transition, as well as frequent organizational restructuring and a turbulent management team.

Firstly, in terms of brand strategy, Chery is a devout follower of the 'have many children to fight' approach. Its portfolio includes four passenger car brands—Chery, Exeed, Jetour, and iCAR—plus the Luxeed brand in collaboration with Huawei, and the recently revived Rely pickup brand, forming a vast and intricate brand family.

The original intention was to cover all market segments from entry-level to premium, and from fuel-powered to new energy vehicles. However, in practice, this often leads to scattered resources, blurred brand positioning, and internal cannibalization.

Especially in the new energy arena, which will determine future success, Chery's performance has been disappointing relative to its industry standing. Despite an early start and deep technical accumulation, its new energy transition has been sluggish.

The highly anticipated iCAR brand saw its first model, the iCAR 03, receive a lukewarm market response, with sales falling short of expectations and brand recognition marginalized. The hybrid-focused Fengyun series, surrounded by formidable competitors like BYD's DM-i and Geely's Thunder, failed to make a significant impact. Chery's overall new energy sales even slipped out of the top ten at one point.

This dilemma of 'starting early but arriving late' has forced Chery to undergo profound internal reforms, leading to its second type of 'chaos'—relentless organizational restructuring.

In the second half of 2025, Chery implemented a major restructuring that could be described as 'drastic.' The company established a new 'Chery Brand Domestic Business Group,' led by Executive Vice President Li Xueyong, and split the original Chery brand into four independent divisions: Exeed, Aihu (comprising the Ruichi and Arrizo models), Fengyun, and QQ.

The purpose of this restructuring was clear: to focus strategies, integrate resources, and strengthen collaboration, particularly to transform the 'Fengyun' division into a vanguard for new energy transition.

This drastic internal overhaul reflects Chery's determination to change but also highlights its management turbulence.

By early November, Exeed had undergone seven rounds of core management adjustments, with executives averaging less than 1.5 years in their roles. Frequent personnel changes have made it difficult to maintain strategic consistency, leaving consumers with the perception that Exeed is merely a high-end version of Chery, failing to establish a distinct brand identity like Lynk & Co's 'trendy' or Zeekr's 'performance' image, thus struggling to solidify its premium positioning.

The Exeed core product line also underwent simultaneous management changes. In July 2025, the brand was fully integrated into Chery's domestic business group and ceased independent operations. The key model, ET5, will be led by Liu Tao, a former Li Auto employee known for his expertise in user operations and scenario-based product design, complementing Liu Hening's marketing experience to form a core team driving both product and marketing.

This combination was initially seen as a critical force injected into Exeed by Chery to break out of its current development rut. However, the single-month sales of the Star era ET and ES models in August were sluggish, reflecting significant challenges in brand market recognition and product competitiveness.

Thus, Chery's image has become multifaceted and contradictory: it is both a rapidly growing, financially robust giant and a 'patient' in need of internal restructuring and breakthroughs in the new energy battle. It possesses the deep heritage of a state-owned enterprise while undergoing the most aggressive market-oriented reforms.

This blend of fire and ice makes Chery a unique 'talent melting pot.' For professionals who feel they've hit a ceiling in mature systems like Great Wall or are uneasy about the cash-burning models of new forces like NIO, Xpeng, and Li Auto, Chery currently offers a unique stage.

03

New Recruits and Veterans

Success Is the Only Criterion

By connecting all the dots, we can uncover the true logic behind the 'retirement home' label: executives are flocking to Chery not to 'retire' but to 'strike gold.' Chery offers them a third option beyond traditional automakers and new forces, filled with uncertainty yet immense opportunity.

Firstly, it provides a platform with 'money, power, and space.'

'Money' is self-evident. Chery's substantial profits from exports give it the confidence to invest in R&D, channel construction, and marketing. Unlike new forces that burn cash and constantly face the risk of capital chain fracture (breakage), Chery's financial strength provides ample 'ammunition' for executives' projects.

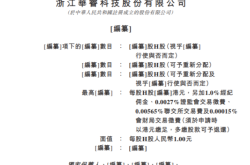

More importantly, Chery's recent listing on the Hong Kong Stock Exchange in September offers enormous stock incentive potential for core executives. Compared to Great Wall, which has been listed for a long time with stable stock prices, or Li Auto, whose stock incentives have largely vested, Chery, as a newcomer to the capital markets, holds immense future appreciation potential for its equity. This is an irresistible lure for any professional manager.

'Power' and 'space' are reflected in Chery's urgent need for 'outsiders.' Faced with the complex task of multi-brand operations and new energy transition, Chery desperately requires seasoned professionals to 'break the deadlock.'

Yu Fei, for instance, is a marketing maverick known for his aggressive tactics in the automotive industry, with a resume spanning Great Wall and Dongfeng. Whether it was leading the rise of Haval's F series at Great Wall or driving the launch of the new eπ brand within Dongfeng, he has demonstrated exceptional pioneering capabilities.

Among the 'Great Wall trio,' Liu Hening was responsible for the premium WEY brand at Great Wall, facing the fiercest market competition; Zhang Mengyuan's track record at Haval, particularly his marketing success with the Haval Big Dog—a blockbuster model—marks him as a typical doer; while Zhang Jiaming was the mastermind behind Great Wall Pickup's continued market dominance, with extensive experience in overseas market expansion.

These executives often arrive at Chery with heavy responsibilities, wielding significant decision-making power to implement strategies and ideas honed from past experiences on a new, resource-rich platform. This opportunity to fulfill ambitions is invaluable for those who may have encountered 'glass ceilings' in their previous companies.

Secondly, it offers a 'startup' platform where risks and rewards coexist.

Joining Chery is no guarantee of a smooth ride. There are the deep-rooted complexities of state-owned enterprise interpersonal relationships (relationships) and cultural barriers, uncertainties from frequent organizational changes, and the intense competitive pressure in the new energy market. Whether these outside executives can adapt to the 'local conditions,' establish themselves amid internal power struggles, and ultimately deliver impressive results are all significant tests.

But high risks often come with high rewards. Successfully helping Chery achieve breakthroughs in areas like premiumization (Exeed), new energy (Fengyun, iCAR), or new categories (Rely pickup) would elevate their personal reputation and careers to new heights. This is essentially a gamble, betting on Chery's future and their own capabilities.

As for 'retirement' or 'striking gold'? Regardless, Chery is aggressively recruiting battle-hardened 'veterans' and 'special forces' from across the industry to form a powerful hybrid legion, aiming to secure a favorable position in the final battle of the smart electric vehicle era.

The flow of executives from Great Wall to Dongfeng serves as a mirror, reflecting profound changes in China's automotive industry. Traditional management models and incentive mechanisms are being disrupted, and the value and flow of talent are reshaping corporate competitiveness in unprecedented ways.

For Chery, the influx of external elites is a double-edged sword. It brings advanced concepts, rich experience, and valuable connections but also tests the cultural inclusiveness and organizational integration capabilities of this established state-owned enterprise.

However, the more crucial and challenging question for Chairman Yin Tongyue is whether he can effectively command this 'combined fleet' and transform external infusions into internal driving forces.