Chang'an + CATL + Huawei! Avatr's IPO: What's the Potential for the 'Affluent Offspring' Backed by Three Industry Titans?

![]() 12/01 2025

12/01 2025

![]() 430

430

By Guanchejun

Avatr has finally made its debut on the public market.

On the evening of November 27, the Hong Kong Stock Exchange unveiled the prospectus of Avatr Technology (Chongqing) Co., Ltd., with CITIC Securities and CICC acting as joint sponsors.

In Guanchejun's perspective, Avatr stands out as a unique entity among China's new energy vehicle (NEV) manufacturers.

Unlike NIO and XPeng, which had to start from scratch and navigate through numerous challenges to gain a foothold, nor like BYD, which leverages its own vertically integrated industrial chain, Avatr has a distinct advantage.

This brand, established in 2018, has been endowed with a 'winning formula' from the outset: the manufacturing prowess of Chang'an Automobile, the battery technology expertise of CATL, and the intelligent system capabilities of Huawei. It can aptly be described as an 'affluent offspring'.

This 'golden key' start enabled it to achieve a remarkable leap from zero to an annual sales volume of 60,000 units in just three years. However, it also means that it faces heightened scrutiny, beyond just relying on the support of its 'powerful parents'.

01

Delving into Avatr's prospectus is akin to reading an epic tale interwoven with elements of fire and ice. The data presented is stark and honest, revealing a different facet beneath the halo of this star enterprise.

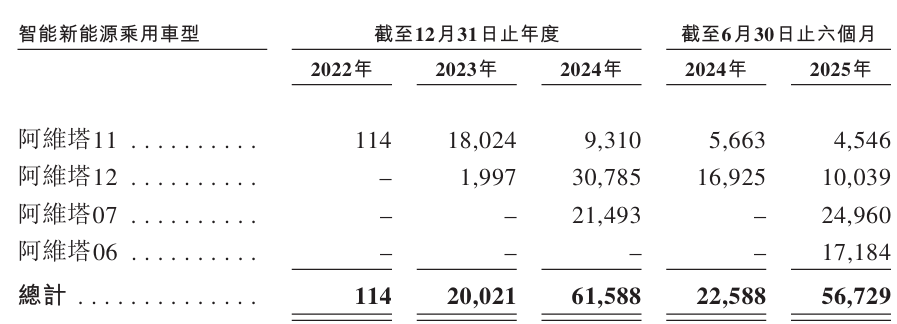

In terms of sales volume, Avatr has demonstrated robust growth: 20,021 units delivered in 2023, escalating to 61,588 units in 2024, marking a surge of 207.6%. As of the six months ended June 30, 2025, deliveries have reached 56,729 units, surpassing 92% of the previous year's full-year tally.

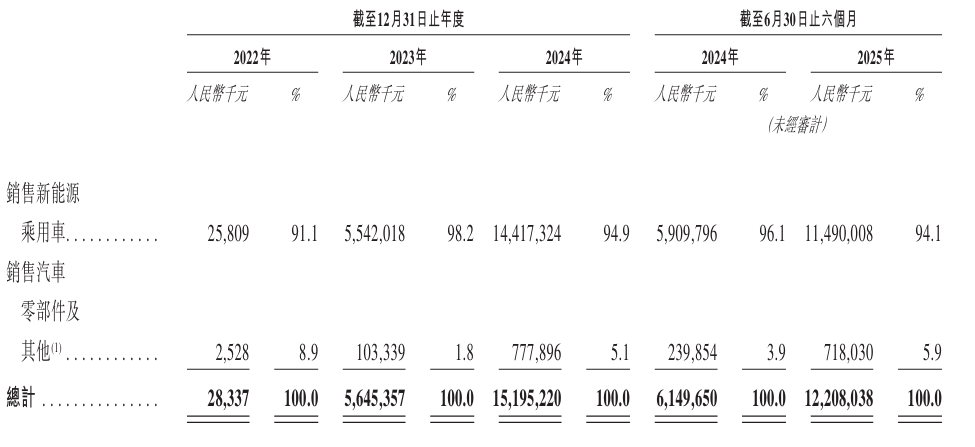

Benefiting from this commendable sales growth, Avatr has also witnessed significant revenue increases in recent years. It soared from RMB 28.34 million in 2022 to RMB 15.195 billion in 2024 (a year-on-year increase of 169%); in the first half of 2025, it reached RMB 12.208 billion, a year-on-year increase of 98.5%.

Regarding revenue by business segment, sales of new energy passenger vehicles increased from RMB 5.542 billion in 2023, accounting for 98.2%, to RMB 14.417 billion in 2024, accounting for 94.9%. In the first half of 2025, it was RMB 11.490 billion, accounting for 94.1%, representing the core revenue stream.

Other businesses, such as parts sales, ecosystems, and after-sales services, contribute a negligible share. Geographically, revenue from mainland China in the first half of 2025 was RMB 11.521 billion, accounting for 94.4%, remaining the primary market.

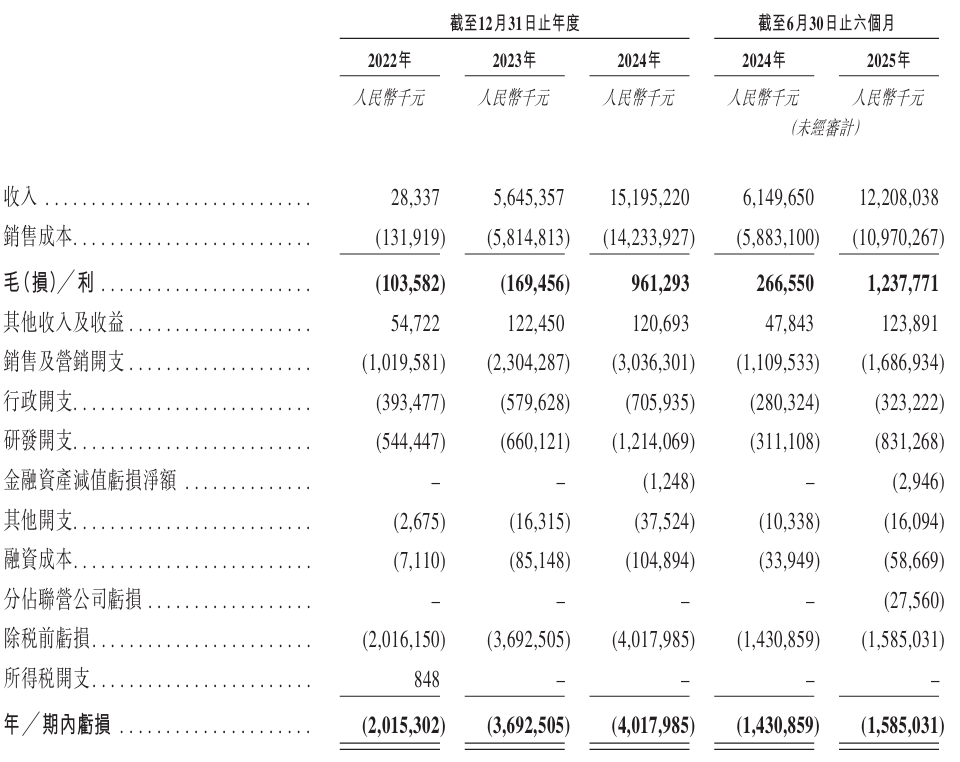

In stark contrast to the rapidly growing sales volume and revenue is Avatr's continuously expanding losses. Financial data reveals that from 2022 to 2024, the company's net losses were RMB 2.015 billion, RMB 3.693 billion, and RMB 4.018 billion, respectively; in the first half of 2025, the net loss was RMB 1.585 billion, with cumulative losses exceeding RMB 11 billion.

A further analysis of the cost structure by Guanchejun reveals that in 2024, Avatr's sales cost was as high as RMB 14.234 billion, accounting for 93.7% of revenue.

Within this, raw material costs amounted to RMB 13.074 billion, accounting for 91.9% of sales costs. This indicates that Avatr still faces substantial pressure in supply chain cost control.

Meanwhile, Avatr's selling and marketing expenses, as well as research and development expenses, remained at a high level during this period, reaching RMB 3.036 billion and RMB 1.214 billion, respectively, in 2024.

This 'high-growth, high-investment, high-loss' fragmented model is also the 'valley of death' that all emerging forces must navigate through.

02

From a product standpoint, Avatr exhibits both remarkable strengths and notable weaknesses. Avatr's 'ace in the hole' is clearly its privileged background; as noted by Guanchejun, it is an 'affluent offspring'. In the realm of intelligent driving, the distinction between 'with Huawei' and 'without Huawei' is almost like comparing two different species. The map-free NCA (Navigated Cruise Assist in urban areas) function enabled by Huawei's ADS 2.0 system is its 'killer app' to outperform competitors. Coupled with Chang'an Automobile's manufacturing capabilities and CATL's energy solutions, the deep integration of these three industry giants forms its strong systemic competitiveness, which cannot be simply reduced to a supplier relationship.

This model also enables it to start with a light asset base in its early stages, quickly launch products, and avoid the financial burden of heavy asset investments. However, the challenges are equally significant.

The first issue is the vague brand identity. Many people wonder: Is Avatr a Chang'an car or a Huawei car? This ambiguity in ownership may hinder the long-term accumulation of its brand value. Especially under Huawei's 'Smart Selection' model, with 'favored sons' like AITO, Luxeed, and STELATO, how Avatr, as a partner in the 'HI mode,' manages the delicate relationship of 'brothers climbing the mountain, each striving their best' is a major test.

Another aspect is the duality of starting with a light asset base. While it avoids financial pressure, it also means that profits are divided at multiple levels, and over-reliance on external technology may lead to a hollowed-out core competency. The fierce market competition goes without saying, as it is a challenge faced by all automakers currently.

03

Finally, Avatr's decision to sprint for a Hong Kong Stock Exchange IPO at the end of 2025 carries profound implications. The most direct and practical reason is the need for capital. The industry generally predicts that 2026-2027 will be the most intense phase of the elimination round for NEV manufacturers. Raising sufficient 'ammunition' through an IPO in advance is not only to 'survive' but also to 'afford to fight' in future competitions. Avatr's prospectus clearly states that the core uses of the raised funds include product development and platform technology iteration, brand and channel construction, and supplementing operational funds. Each item represents a significant financial commitment.

Moreover, choosing the right timing for going public is akin to marketing a product; it should be done when it is most appealing. Avatr's current narrative is undoubtedly enticing: upward performance trends, positive operating cash flow, and a continuously improving product line... Facing investors during such an upward trajectory is far more advantageous than explaining and promising during a performance downturn. Avatr must seize this golden window of opportunity.

Ultimately, Guanchejun believes that Avatr's IPO is not just about a company going public but also a litmus test for a vehicle manufacturing model. It showcases a third path distinct from Tesla and BYD: industrial collaboration and resource integration. This is a high-risk, high-reward gamble. It bets on technology, the market, and, more importantly, execution.

The charts in this article, unless otherwise stated, are sourced from public disclosures through various channels. We hereby acknowledge and express our gratitude! The views expressed in this article are for reference only and do not constitute investment advice.