Achieving L3 Autonomous Driving Doesn't Automatically Win in the Automotive Industry

![]() 07/30 2025

07/30 2025

![]() 707

707

The 2025 World Artificial Intelligence Conference (WAIC) does not support the ambition of mass-producing L3 autonomous driving vehicles in the automotive industry by the second half of the year.

Increasingly, automakers are realizing that simply achieving L3 autonomous driving is not a guarantee of success in the market.

With two months left before the purported turning point for the automotive industry, policies are continuously evolving, significantly impacting the pace of progress among automakers, particularly in research and development. Two core changes are evident: first, L3 autonomous driving may not establish a definitive leadership position for automakers; second, technology, like consumers, is returning to a period of calm.

For instance, automakers like Geely and BYD are focusing more of their R&D efforts on cabin-driving integration. Moreover, the aggressive L3 autonomous driving goals set earlier this year are no longer a focal point in public discourse.

With the convening of WAIC 2025, all major players have unveiled their latest advancements, prompting both insiders and outsiders to reconsider the landscape of "autonomous driving".

Cabin-driving integration: A consumer imperative

Automakers are increasingly recognizing that even low-cost L3 autonomous driving does not necessarily translate into robust sales. Therefore, many are revisiting unfinished courses at this stage.

Cabin-driving integration is not a new concept. As early as 2023, many automakers began promoting systematic projects for this integration. While automakers view it as a key technological breakthrough for the next stage, for the average consumer, it is less exciting than intelligent driving assistance or urban intelligent driving assistance. Few pay special attention to it because it is largely imperceptible.

As a product manager puts it, "There are no scenario applications."

Cabin-driving integration integrates the cabin domain and the intelligent driving domain into a high-performance computing unit, supporting both intelligent driving and intelligent cabin functions. This effectively shortens the development cycle and reduces vehicle costs.

Upon reading this, it becomes clear that this has little to do with end-users and is more of a B2B game. However, due to the rapid development and iteration of intelligent driving assistance and autonomous driving technologies, as many automakers set 2025 as the year for L3 autonomous driving, cabin-driving integration has once again become a crucial consideration.

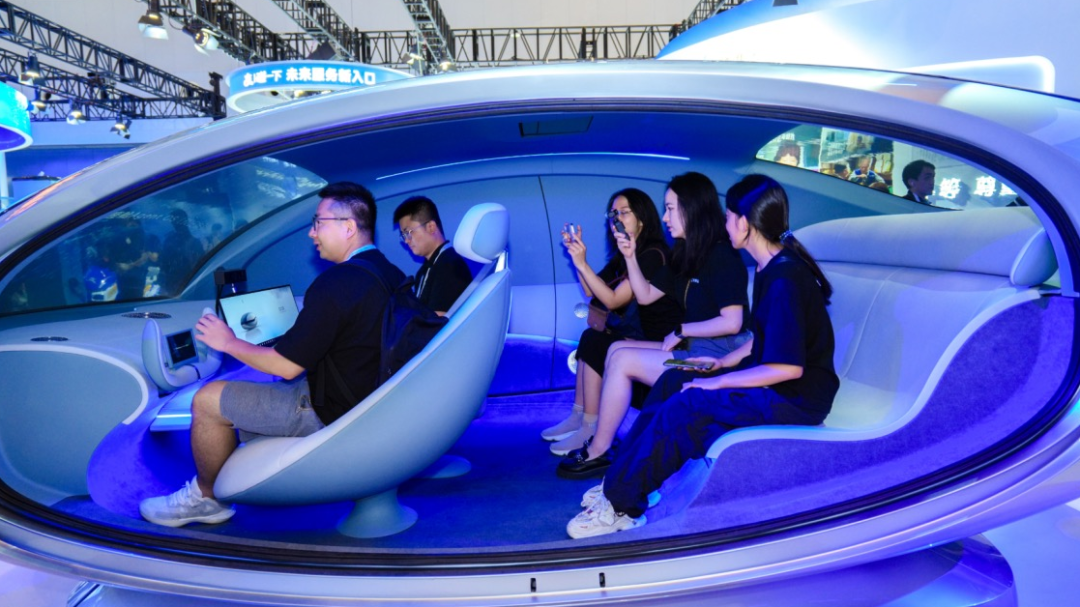

When vehicles can truly perform autonomous driving with human supervision at certain speeds, telling consumers what they can do in the car becomes a compelling sales pitch.

After all, using a mobile phone in the car conflicts with current laws and regulations. Moreover, once vehicles reach a state where minimal attention is required, if the large in-car screen is merely decorative, it will not only be criticized but may even hinder sales.

Regarding solutions, the current technical path is essentially clear. Companies like Lixiang Auto and Geely Auto have already proposed their approaches, with BYD expected to announce theirs soon. Their approach involves providing an AI Agent that actively serves humans or operates like a human.

If you currently drive a car with intelligent cabin functionality, you can easily understand the power of an AI Agent. The existing logic is that humans issue commands to the infotainment system through voice or gestures, and the system executes controls such as navigation, multimedia, air conditioning, and televisions.

With an AI Agent, all humans need to do is propose ideas, and the vehicle coordinates various cabin functions. The most intuitive benefit is faster response and execution speeds.

At a more advanced level, functions that many previous infotainment systems could not achieve or did not perform well will be optimized. For example, you can simply ask to watch a movie on a specific platform, and the system will quickly complete the task.

Additionally, when the vehicle's autonomous driving function is activated, in-car scenarios can be expanded to include watching movies with VR, among other things. This provides a clear answer to why achieving L3 autonomous driving alone is insufficient to boost sales and why ecosystem construction is crucial.

Ultimately, the goal is for the cabin and intelligent driving assistance (autonomous driving) to share a single, highly powerful chip, significantly improving smoothness compared to current systems. In short, more and more players are presenting their solutions.

At WAIC 2025, Geely integrated a series of large models into a preview version of Agent OS, with cabin, entertainment, AR, and other functions already implemented. The infotainment system can also create songs and copywriting using AI. Geely's Galaxy M9 will be released soon, followed by the Zeekr 9X at the end of the year, which will have many application scenarios due to its L3 autonomous driving capability. According to our information, BYD's flagship brand, Yangwang, is also expected to release related cabin-driving integration technology in the near future.

L3 autonomous driving: Not yet a sales guarantee?

It's important to note that leading automakers Geely and BYD have an annual sales volume of nearly 10 million units in the Chinese market. Their actions collectively serve as signals that will influence the subsequent development of the industry.

In the realm of cabin-driving integration, several new players have also performed well, including Tesla, Lixiang, XPeng, NIO, and Leapmotor. Xiaomi is likely to join in the future, but currently, there is limited information available.

From a technological iteration perspective, there is currently a distinction and generational gap. Cabin-driving integration requires extremely high local AI computing power, which was previously estimated to be achievable with chips in 2026-2027.

For example, automakers are now competing for Qualcomm Snapdragon chips. Therefore, the latest application logic for automakers without the 8797 chip is to add an AI domain controller for the cabin, like XPeng. This requires significant AI optimization to assist with cabin functional applications.

Currently, the core issue is that despite the popularity of AI, there is still a significant distance from realizing scenarios after truly achieving autonomous driving. Only a few automakers, such as Geely, BYD, XPeng, and Tesla, have showcased such technology and made progress. Many others rely on the Qualcomm Automotive Platform Premium (QAM8797P), including Lixiang, NIO, Leapmotor, and Hozon Auto.

Autonomous driving and cabin-driving integration are like watching a movie with sound. Having only autonomous driving without cabin-driving integration is akin to watching a silent movie.

Within two months, we will witness the launch of the first batch of L3 autonomous driving vehicles, with Huawei's Kunlun ADS4 being the first to release. Its top-of-the-line Ultra version will introduce a commercial solution for L3 autonomous driving, which Yu Chengdong has already hyped at the World Intelligent Connected Vehicle Conference in October 2024.

Currently, Huawei faces significant challenges: first, implementing autonomous driving and defining its technical parameter limits; second, possessing sufficient cabin-driving integration capabilities; and third, pricing and the ability to perform autonomous driving in urban areas.

Let's address the most important question first: what technical limits can Huawei's Kunlun ADS4 offer? In the initial SAE classification, L3 autonomous driving operates at a speed of 60km/h. However, considering Huawei's latest official statement at the China Auto Forum in July that "a high-speed commercial solution for the L3 technical architecture will be launched in September,"

Yu Chengdong has mentioned multiple times that ADS 4 will achieve high-speed L3 commercialization in the fourth quarter of this year and high-speed/low-speed urban L4 after 2026. Huawei's first L3 autonomous driving application scenario is on highways. Mercedes-Benz's current L3 DRIVE PILOT allows drivers to use it at speeds of up to 95km/h under specific conditions. Both Mercedes-Benz and BMW currently have a research and development goal of 130km/h as the maximum speed for L3 autonomous driving.

Given Huawei's consistent benchmarking against Mercedes-Benz and BMW, it is highly likely that it will exceed the speed of 95km/h, making the system practical for daily use, as driving at speeds of 90km/h on Chinese highways is well-understood.

The second challenge is cabin-driving integration. While more new vehicles are applying HarmonyOS Cabin 5, compared to leading automakers, it cannot yet be considered absolutely leading. The operating speed has improved significantly, but there is still room for improvement in the entertainment ecosystem. For example, social media software is not connected, the full range of film and television resources is not integrated, and large language models cannot yet recognize in-vehicle activities. Additionally, although Huawei entered the VR glasses market in 2019, subsequent progress has been insufficient.

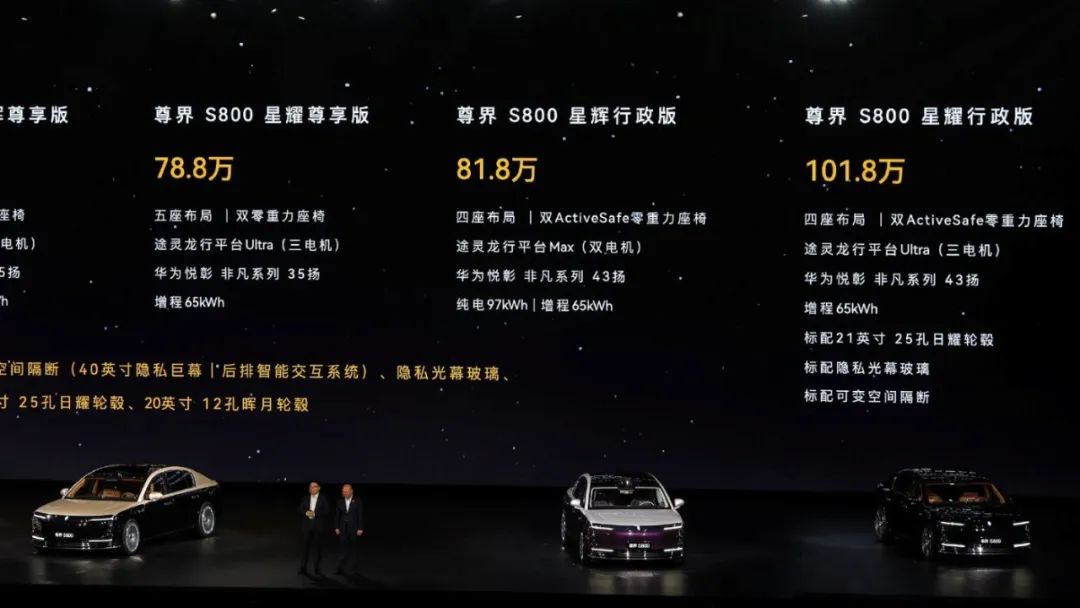

The third challenge is less significant as Huawei's in-depth cooperation products in the automotive industry currently show a trend of "the more expensive, the better the sales." The million-yuan-level Zunjie S800 has added approximately 700 large orders per week. For this demographic, the price of L3 autonomous driving is not an issue.

Besides these, Huawei also faces challenges in providing drivers with property guarantees beyond technology before relevant regulations are released.

In summary, as the leading enterprise in related fields in China, Huawei's Intelligent Automotive Solutions BU is also facing numerous challenges. These challenges collectively demonstrate that achieving L3 autonomous driving alone does not guarantee success.

Even top-tier enterprises are encountering such challenges, and the gap between other enterprises and Huawei is evident, suggesting they will face even greater obstacles.

The following automakers have officially announced their L3 autonomous driving goals:

Huawei's Kunlun ADS4 will be released in September, with the Zenith S800 as the first model to feature it, but current promotional materials have not yet clarified the autonomous driving-related solutions;

XPeng Motors stated that by the end of 2025, it will launch autonomous driving with true L3-level software and hardware redundancy capabilities;

Li Auto stated that it hopes to achieve L3 supervised intelligent driving within 2025;

BYD stated that it is expected to be the first to push L3 autonomous driving capabilities on the Yangwang model in 2025 (subject to legal permissions);

Geely Auto stated that Zeekr plans to equip its new model, the 9X, with a system capable of L3 autonomous driving;

Guangzhou Automobile Group stated that it will launch the mass production and sales of its first L3 autonomous driving model within 2025;

Changan Automobile stated that by 2026, Chang'an Tianshu Intelligent Driving will achieve full-scenario L3 autonomous driving;

Chery Automobile stated that it plans to achieve mass production of L3 technology in vehicles by 2026.

Upon examination, it becomes evident that certain automakers' statements include varying degrees of qualification. Given the recent shift in automakers' R&D priorities, many of them currently lack the capability to fully integrate cabin and driving systems, leading to a noticeable technological disparity.

Written at the end

Could it be that the launch of L3 autonomous driving will occur later than anticipated by the public?

The answer, in fact, can be discerned. Firstly, autonomous driving alone struggles to form a robust business closed loop or offers relatively low cost-effectiveness for enterprises due to limited cash-in capabilities. For instance, before the full realization of cabin-driving integration, its appeal remains average.

Secondly, numerous automakers' statements inherently contain a plethora of qualifiers, providing flexibility regarding the exact timing of implementation.

Furthermore, at the World AI Conference (WAIC) 2025, automakers' promotional strategies have exhibited a return to a more measured and calm approach.