Leading the Charge! 35 Automotive Firms Feature in China's Fortune 500 List

![]() 07/31 2025

07/31 2025

![]() 691

691

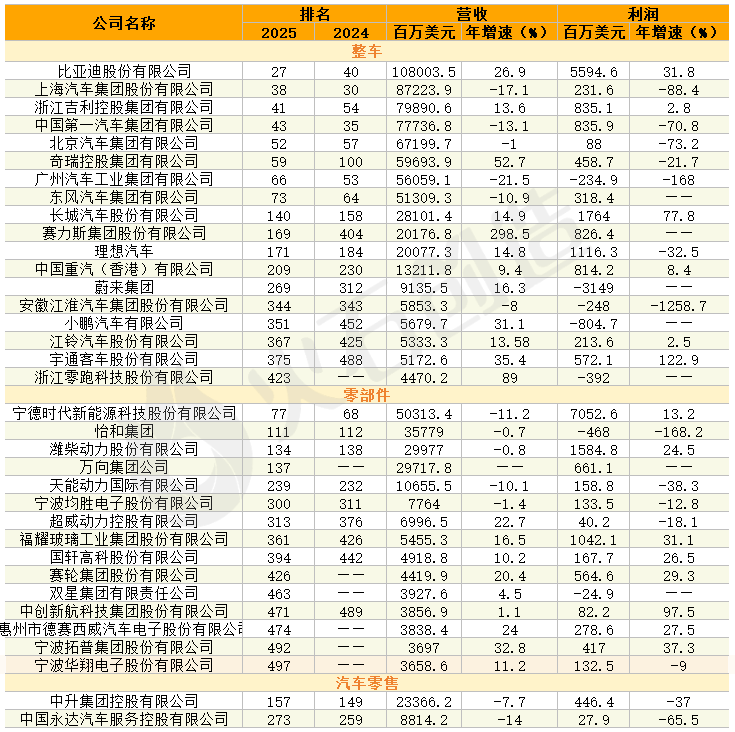

The 2025 Fortune China 500 list showcases 35 automotive industry players, including 18 complete vehicle manufacturers, 15 parts and components suppliers, and 2 automotive retailers. Notably, BYD, SAIC Motor, Geely, FAW Group, BAIC Group, Chery, GAC Group, Dongfeng Motor, and eight other vehicle manufacturers, alongside CATL, are among the top 100. In terms of overall performance, new energy vehicle (NEV) companies continue to exhibit robust growth.

Table: Automotive Industry Firms on the Fortune China 500 List

Source: Firestone Creation, based on industrial data centers

01

Distinct Growth Divergence Between NEVs and Traditional Automakers

BYD tops the list of vehicle manufacturers with $108 billion in revenue, surging from 40th in 2024 to 27th, and recording a profit growth rate of 31.8%. Thalys stands out with its exceptional performance. Amidst the rapid expansion of the NEV market and intensifying competition, Thalys achieved a remarkable 298.5% revenue growth in 2024 through strategic collaboration with Huawei and continuous product matrix expansion and iteration, leaping from 404th to 169th place.

Moreover, emerging automakers such as NIO, XPeng, and Leaping Auto all achieved positive revenue growth, with their rankings improving to varying degrees. Notably, Leaping Auto became the second fastest-growing automaker with an 89% revenue growth rate and debuted on the list.

Traditional large automakers generally face pressure, with significant performance declines. SAIC Motor's revenue fell by 17.1% and profits by 88.4%; FAW Group's revenue decreased by 13.1% and profits by 70.8%; GAC Group's revenue shrank by 21.5%, incurring a loss of $235 million; Dongfeng Motor's revenue fell by 10.9%. Conversely, Great Wall Motor achieved double growth in revenue and profits in 2024, leveraging its strengths in intelligence, off-roading, and globalization.

02

Highlights in Sub-sectors of Parts and Components

In the battery sector, CATL continues to dominate with $50.31 billion in revenue and a profit growth rate of 13.2%, underscoring the resilience of the leading power battery company. China Aviation Lithium Battery Co., Ltd. also achieved double growth in revenue and profits.

Suppliers of intelligent electric core components, such as Top Group (revenue up 32.8%, profits up 37.3%), Desay SV Automotive (revenue up 24%, profits up 27.5%), and Triangle Group (revenue up 20.4%, profits up 29.3%), grew rapidly, emerging as new highlights in the industrial chain.

Fuyao Glass continues to enhance its expertise in automotive glass, achieving a high profit growth rate of 31.1%, reflecting the value of technological advantages in traditional strongholds.

03

Structural Transformation Deepens

Overall, the rapid growth of NEV manufacturers and the general decline of traditional automakers form a stark contrast, indicating that the industry transformation has entered a crucial phase. NEV-related parts and components companies, such as power batteries and automotive electronics, outperform traditional counterparts, leading to a redistribution of value in the industrial chain.

In the current NEV market, technology is at the core of competition. Batteries, range, intelligence, and other factors are crucial for consumer purchases, supported by strategic investments in R&D, marketing, and services. Some NEV companies are experiencing continuous losses, potentially accelerating industry reshuffling.

Looking ahead, the structural transformation of China's automotive industry will continue to deepen, and those companies making significant progress in the transition towards electrification and intelligence are poised to secure broader development opportunities.