Pitfalls of iPhone's Strategy: Can Tesla's $150,000 Model Y Avoid Them?

![]() 08/04 2025

08/04 2025

![]() 548

548

With over 10 items of reduced configuration, could this lead to a price reduction of $100,000?

As spy shots of Tesla's cheaper version of the Model Y undergoing road tests in China are no longer a secret, two key questions remain about this vehicle: how low will the price drop, and what will be the hardware computing power for assisted driving?

In the Chinese auto market, the conventional wisdom is that cheaper cars sell better, but this may not hold true for Tesla's latest offering.

Musk has personally confirmed that the "affordable version" of Tesla will be a reduced-configuration Model Y, set to launch in the fourth quarter of this year. Foreign media reports suggest that Tesla originally intended to develop a new affordable model from scratch, but Musk noticed that the Model 3 and Model Y production lines were underutilized due to reduced market demand. During Tesla's second-quarter earnings call five days ago, Musk bluntly stated, "This is just a Model Y."

Musk pointed out that the decline in Tesla sales is not due to insufficient market demand, but rather limited purchasing power. The goal of the reduced-configuration Model Y is to expand market share.

In the second quarter of 2025, Tesla delivered its worst quarterly report in recent years, with year-on-year revenue declines expanding from 9% in the first quarter to 12%, the largest single-quarter decline since 2012. New vehicle deliveries totaled 384,100 units, a year-on-year decrease of 14%. Following the release of this dismal quarterly report, Tesla's stock price fell by more than 9% at one point.

Shortly after the earnings report was released, spy shots of the cheaper Model Y went viral on Chinese social networks, revealing size reductions and significant configuration downgrades. Musk noted that the cheaper Model Y will boost sales but did not expect it to improve revenue and gross profit margins. Clearly, the price of the reduced-configuration Model Y will be the biggest surprise.

Reduced configuration by more than 10 items, resulting in a price reduction of $100,000?

In the United States, the guide price for the long-range rear-wheel-drive version of the Model Y is close to $45,000 (RMB 325,500). During the earnings call, Musk bluntly stated, "Everyone has a strong desire to buy, but they don't have enough money to do so. So the cheaper our cars are, the better."

How does one create a cheaper version of the Model Y? By reducing the configuration.

From spy shots circulating online, the new car has at least 10 obvious areas of reduced configuration:

Panoramic sunroof changed to steel; leather seats changed to fabric; seat ventilation/heating canceled; rear screen canceled; coat hook canceled; rear seat space suspected to be shorter; body size suspected to be shorter; through-type headlights canceled; diffuse reflection-type rear taillights canceled; A-pillar tweeter canceled; wheel size changed to 19 inches...

As the major cost component, the power battery is expected to be reduced to 50kWh or even lower, with a range of less than 500KM. Recently, Tesla officially announced that its first battery factory in North America dedicated to the production of lithium iron phosphate batteries is nearing completion. Foreign media predict that as early as 2027, lithium iron phosphate batteries made in the United States will significantly reduce the price of the base Model 3/Y and be used on a large scale in new cheaper models.

In the Chinese market, reducing battery costs is even easier. Data released by the China Association of Automobile Manufacturers shows that as of April 2025, the average unit price of domestic power batteries has dropped from 0.65 yuan/Wh in 2024 to 0.42 yuan/Wh, a decrease of nearly 35%.

A rough estimate shows that the cost of a 50kWh battery pack has dropped from 32,500 yuan to 21,000 yuan. The all-electric sedan Zero B01 recently launched by Leapro, with an entry-level model equipped with a 43.9kWh battery, has a price of less than 90,000 yuan.

Furthermore, what the outside world cares most about is whether the cheaper Model Y can support FSD. Musk has previously stated that Tesla will not produce a cheaper version that lacks autonomous driving capabilities. This statement can also be interpreted as Tesla, without intelligent driving capabilities, being uncompetitive in Musk's view.

The key here is whether the cheaper Model Y will be equipped with the same HW 4.0 hardware as the standard Model Y. In March of this year, when FSD entered China, Tesla officially announced that the team was completing the approval process for the intelligent assisted driving software corresponding to the 3.0 and 4.0 hardware respectively. In layman's terms, the HW3.0 hardware can support a watered-down version of FSD.

Price exceeding 150,000 yuan, may not work?

The specific configuration of the cheaper Model Y will mainly be determined by the price. Thanks to supply chain advantages, the price of the cheaper version of the Model Y in China will be more competitive than in other regions. Foreign media reports that the cost of the cheaper version will be at least 20% lower than that of the standard Model Y. Based on this calculation, the overall vehicle premium it brings can be reduced by 30% or even higher. Calculated based on the current price, the price of the cheaper version of the Model Y could fall within the 170,000 yuan range, or even reach the 150,000 yuan level.

Although Tesla's strong brand appeal means that a significant reduction in the starting price will theoretically make the new car more competitive, this strategy of reducing configurations and prices actually runs counter to current domestic consumption trends.

Taking popular new energy vehicle models in the 150,000 yuan range as an example, the Song PLUS and Qin L share a common feature: they maximize configurations through extreme cost control capabilities. The popular model Xiaopeng MONA M03 in the same price range follows the same logic, offering low prices + AI to maximize comfort configurations.

Behind this lies one crucial factor: the lower the price of the model, the less brand power contributes to sales. Among the popular models in the 150,000 yuan range, whether it's domestic new energy vehicles or joint venture automakers such as Passat and Corolla, they are all adept at cost control that can rival Tesla. This is because the more price-sensitive users are, the higher their requirements for configurations, and the easier it is for them to "want it all."

It is foreseeable that the strategy of the cheaper Model Y is to retain Tesla's advantages in core electric systems, energy management, and even AI capabilities, while subtracting from comfort configurations. This is the same tactic used by Apple when it launched the iPhone SE years ago.

The first-generation iPhone SE, introduced in 2016, won the love of many users with its affordable price relative to the standard version and compact body. However, after several generations of upgrades, this cheapest iPhone has been coldly received in the global market. This product, which was supposed to follow the "cost-effective" route, has been criticized by Chinese users as "buying a chip with a free phone."

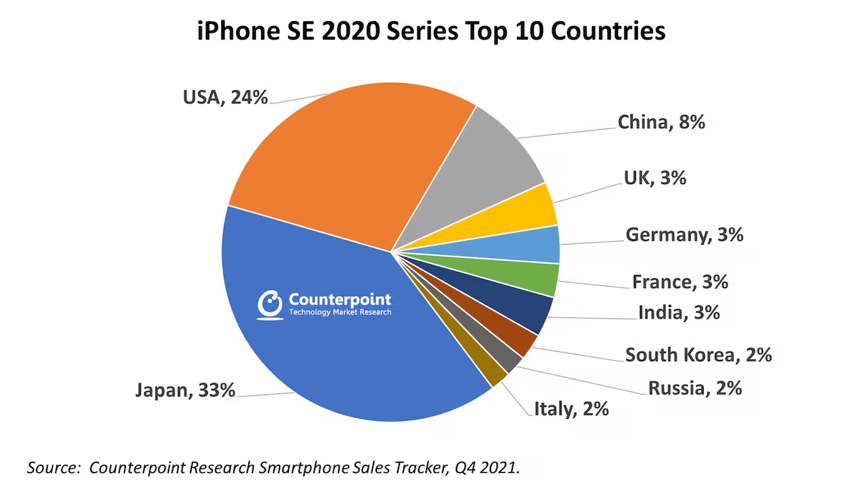

In the Chinese market, the iPhone SE, which starts at over 3,000 yuan, cannot compete with domestic brands that dominate the mid-range market. Statistics show that from 2020 to 2021, the iPhone SE accounted for less than 10% of overall shipments. There is no such thing as a product that cannot be sold; it's just that the price may not be low enough. This truth has actually been proven wrong by the iPhone several times. The sales predicament of the iPhone SE in China proves that it is not necessarily the case that the lower the price, the better it sells.

Musk said that everyone wants to buy a Tesla, but due to financial constraints, a cheaper version is being launched. We have reason to believe that Musk's judgment of the American market is accurate, much like the legendary iPhone SE4, also known as the iPhone 16e. Although Chinese consumers are not interested, it has been a hit in the American market. After all, Chinese consumers have long been raising their thresholds through wave after wave of price reductions and configuration increases, and this trend is difficult to reverse. A price reduction is a good thing, but only if it's significant enough.