Can EV Owners Earn Money from the Power Grid?

![]() 09/28 2025

09/28 2025

![]() 472

472

Short-term equipment costs remain high

In August this year, at the Nantaizi Lake Super Charging and Battery Swap Station in Wuhan Economic Development Zone, an EV owner used a V2G charging pile to discharge electricity back to the grid, earning 60 yuan in one hour.

The owner stated that charging the car at home costs 0.45 yuan per kilowatt-hour. According to local V2G discharge revenue rules for large-scale vehicle-grid interaction projects, the price can reach 3 yuan per kilowatt-hour between 16:00 and 24:00.

As V2G charging piles gradually become more widespread, more EV owners are eager to try this emerging technology.

State Grid China Reinsurance Center Vehicle-Grid Interaction Demonstration Station (Photo/Liu Shanshan)

In the B4 parking lot of the China Reinsurance Center in Xicheng District, Beijing, there is also a vehicle-grid interaction V2G demonstration station with nine 15kW DC V2G bidirectional charging piles.

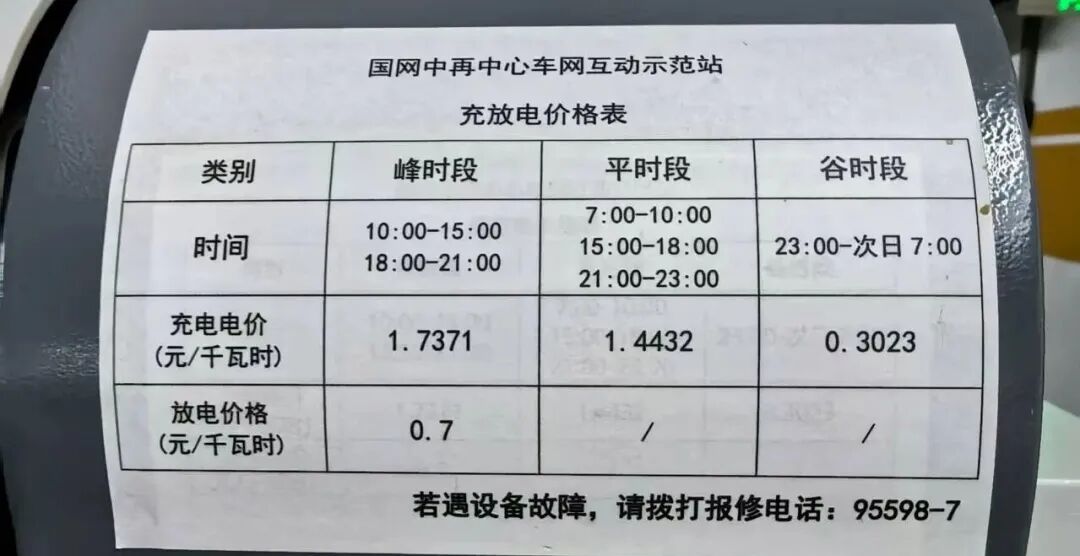

Charging and Discharging Price List at State Grid China Reinsurance Center Vehicle-Grid Interaction Demonstration Station (Photo/Liu Shanshan)

According to the charging and discharging price list displayed on the V2G bidirectional charging piles, a subsidy of 0.7 yuan per kilowatt-hour is provided for discharging. Currently, the electricity tariff for private charging piles in Beijing follows the residential electricity price for combined meter users, which is 0.4733 yuan per kilowatt-hour. Taking an electric vehicle with a battery capacity of 52 kilowatt-hours as an example, after deducting the electricity needed for daily commuting, assuming a discharge capacity of 30 kilowatt-hours each time, and based on one charge-discharge cycle per working day and 250 working days per year, a net annual profit of approximately 1,700 yuan can be achieved.

However, some nearby EV owners have explicitly stated that this profit is not enough to entice them. "I am more concerned about whether frequent charging and discharging will affect battery health," one owner said. Additionally, due to the limited number of V2G bidirectional charging piles currently available, time costs are a significant factor preventing more owners from participating.

What Exactly Is V2G?

V2G (Vehicle-to-Grid), also known as vehicle-grid interaction, primarily involves smart, orderly charging and reverse discharge, enabling bidirectional energy flow between EVs and the power grid through energy interaction modes. New energy vehicle owners can charge and store energy during off-peak periods and "discharge and sell electricity" during peak periods, earning profits from the difference between peak and off-peak electricity prices.

At the 2025 China Automotive Industry Development (TEDA) International Forum, Ouyang Minggao, a member of the National Committee of the Chinese People's Political Consultative Conference and a professor at Tsinghua University, stated in his keynote speech that electric vehicles will achieve free charging and even become profitable tools, with pure electric vehicles dominating the market. Meanwhile, the field of vehicle-grid interaction represents a largely untapped value proposition.

Image Source: China Automotive Industry Development (TEDA) International Forum

Ouyang Minggao noted that automotive lithium iron phosphate batteries, when degraded to 70% capacity, can generally undergo 3,000 full charge-discharge cycles with a calendar life of 10 to 15 years. Based on a single-charge range of 500 kilometers, 500 cycles can meet the total mileage of 10 to 15 years (up to 250,000 kilometers) for a typical family car. The remaining 2,500 cycles of the battery pack (at 70 kilowatt-hours) can store and "trade" electricity for nearly 150,000 kilowatt-hours.

"As green electricity gradually becomes the mainstay of power consumption, electric vehicles will become truly efficient new energy vehicles," Ouyang Minggao predicted. By 2050, he estimates that there will be at least 350 million electric vehicles, with an average battery capacity of 70 kilowatt-hours per vehicle, resulting in a total onboard energy storage capacity exceeding 24 billion kilowatt-hours, equivalent to China's current total daily electricity consumption.

"The importance of V2G will become prominent in the short term and is expected to become one of the hottest topics in China's automotive industry, potentially rivaling the excitement of the 'DeepSeek moment,'" said Li Lili, deputy director of the Photovoltaic, Energy Storage, DC, and Flexible Application Technology Research Institute at the Tsinghua Sichuan Energy Internet Research Institute, at the China Automotive Industry Development (TEDA) International Forum. "However, this emerging topic has not received sufficient attention, with significant gaps in awareness and prioritization." Li Lili called on automakers to increase their focus and investment in the V2G field and actively explore the opportunities behind this major transformation.

Industry experts generally believe that in the future, peak shaving, valley filling, and vehicle-grid interaction will gradually become development trends. Is the era of EV owners "plucking the wool" from the power grid about to arrive?

Pilot Programs Are Gradually Expanding

In April this year, the National Development and Reform Commission, the National Energy Administration, the Ministry of Industry and Information Technology, and the State Administration for Market Regulation jointly issued the "Notice on Announcing the First Batch of Pilot Programs for Scaled Application of Vehicle-Grid Interaction" (hereinafter referred to as the "Notice"). After expert evaluation, nine cities—Shanghai, Changzhou, Hefei, Huaibei, Guangzhou, Shenzhen, Haikou, Chongqing, and Kunming—were included in the first batch of pilot cities for scaled application of vehicle-grid interaction. Additionally, 30 projects, such as the "Beijing Pilot Project for V2G Vehicle-Grid Interaction Coordinated Regulation Based on New Energy Storage," were included in the pilot programs for scaled application of vehicle-grid interaction.

Yu Dexiang, Chairman of Teld New Energy Co., Ltd., stated, "The next three years will be a critical window for vehicle-grid interaction. Technological advancements will focus on three directions: more efficient power semiconductor devices, more accurate battery health assessment algorithms, and more open vehicle-pile-network communication protocols." If breakthroughs can be achieved in these innovations, the technological application threshold will be significantly lowered.

The economic viability of vehicle-grid interaction is closely related to scale. According to calculations by the Energy Research Institute of the National Development and Reform Commission, when the number of participating vehicles reaches 100,000, the unit dispatch cost can decrease by 60%. When the scale reaches one million vehicles, the overall system benefits will grow exponentially. Therefore, business model design must balance short-term feasibility with long-term network effects.

Li Lili predicts that V2G will achieve leapfrog growth: by 2030, the annual sales of V2G vehicles with regular discharge capabilities will exceed 10 million; starting in 2028, all newly sold vehicle models in China will come standard with V2G functionality. This transformation will have a profound impact on the power system: by 2030, V2G's peak-shaving capacity will reach 200 million kilowatts, accounting for 10%-12% of the grid's maximum load. By 2035, the peak-shaving capacity will increase to 800-900 million kilowatts, accounting for nearly 40% of the grid's maximum load, fundamentally resolving short-cycle peak-shaving issues in China's power system (with holiday peak-shaving demands also covered).

Li Lili believes that as the proportion of green electricity increases, V2G will play a crucial role in "charging green electricity and replacing peak electricity." Through price incentives and real-time power market regulation, V2G vehicles will prioritize charging green electricity and replace gas-fired and thermal power generation during peak electricity demand periods. By 2030 and 2035, the emissions reductions achieved through V2G substitution will reach nearly 600 million and 1.7 billion tons, respectively. This will not only drive the low-carbon transformation of the automotive industry but also encourage rigid loads in sectors like steel, industry, and commerce to use more green electricity, fully leveraging the value of energy storage.

What Challenges Must V2G Overcome?

In Li Lili's view, the current core bottlenecks for the large-scale advancement of V2G are concentrated at the production relations level and can be divided into common bottlenecks and differentiated bottlenecks.

Image Source: China Automotive Industry Development (TEDA) International Forum

The common bottlenecks include, first and foremost, the continued high short-term equipment costs. Currently, the cost of a 7-kilowatt AC charging pile is less than 1,000 yuan, while the price of a DC bidirectional charging pile was once as high as over 10,000 yuan. Although, driven by national pilot programs, the cost of DC bidirectional charging piles in some regions has dropped to below 5,000 yuan, a significant decrease, the overall cost remains relatively high.

Secondly, there is a lack of warranty systems. Currently, the battery warranty standards for V2G-related products are mostly 8 years or 160,000 kilometers. For lithium iron phosphate passenger vehicles, for example, users are typically only provided with a warranty for about 300 charge-discharge cycles, far from unlocking their average lifespan potential of around 3,400 cycles. More critically, if battery issues arise while users participate in V2G, they must bear the replacement cost of over 100,000 yuan themselves, which essentially offsets the V2G revenue and suppresses participation willingness. These two bottlenecks fundamentally stem from users' lack of assurance and fear of participation, rather than unwillingness. Improving warranties can significantly reduce these concerns.

Differentiated scenario bottlenecks vary depending on the application scenario. In private scenarios, residential electricity is directly supplied by the grid, and charging piles are equipped with independent meters. However, there are no clear standards for metering, settling, and converting the electricity discharged by vehicles into revenue. Without supportive feed-in tariff policies, users discharging electricity are essentially providing it "for free," making the business model unviable. Additionally, the supporting grid connection, metering, and settlement systems are not yet improve (Note: The original Chinese text has an incomplete phrase here; it likely means "not yet complete" or "not yet established.").

In industrial park scenarios, although time-of-use electricity pricing is implemented and benefits can be gained through "behind-the-meter arbitrage," automakers have been slow to follow up on V2G, resulting in a lack of compatible vehicles and charging piles. Negotiations over parking space occupation and power capacity allocation are difficult to advance due to the lack of "actual demand support." Moreover, parks require "one pile for multiple vehicles" compatibility, and the issue of standard compatibility among different brands of vehicles and charging piles has not yet been resolved.

Public scenarios, although low-difficulty for site construction and thus concentrated areas for V2G pilots, have extremely low actual utilization rates. The core issue is the high participation cost for users: the time costs of driving to the station and waiting to discharge far exceed the discharge revenue, making the commercial feasibility insufficient.

However, even if all common and differentiated bottlenecks are resolved, the "last mile" of vehicle-grid interaction may still be hindered by the invisible barrier of user psychology. Survey data shows that 72% of new energy vehicle owners have concerns about "discharging their beloved cars," with the top three worries being: battery lifespan impact (58%), operational complexity (23%), and safety hazards (19%).

"Aside from concerns about battery lifespan, the biggest cost of V2G is actually time cost. If V2G charging piles are not within your daily radius, making a special trip for it is not cost-effective," said Mr. Gao, an EV owner. He had previously paid attention to V2G news but found it "too troublesome" to implement.

As an EV owner, would you try to "pluck the wool" from the power grid?