Lifan Metamorphoses into a 'Golden Phoenix': Qianli Technology's Sales Surpass 70,000 Vehicles. Is Its Focus Truly on Car Sales?

![]() 10/13 2025

10/13 2025

![]() 441

441

Why Did Qianli Technology Incorporate Geely Auto's Sales Models into Its Data?

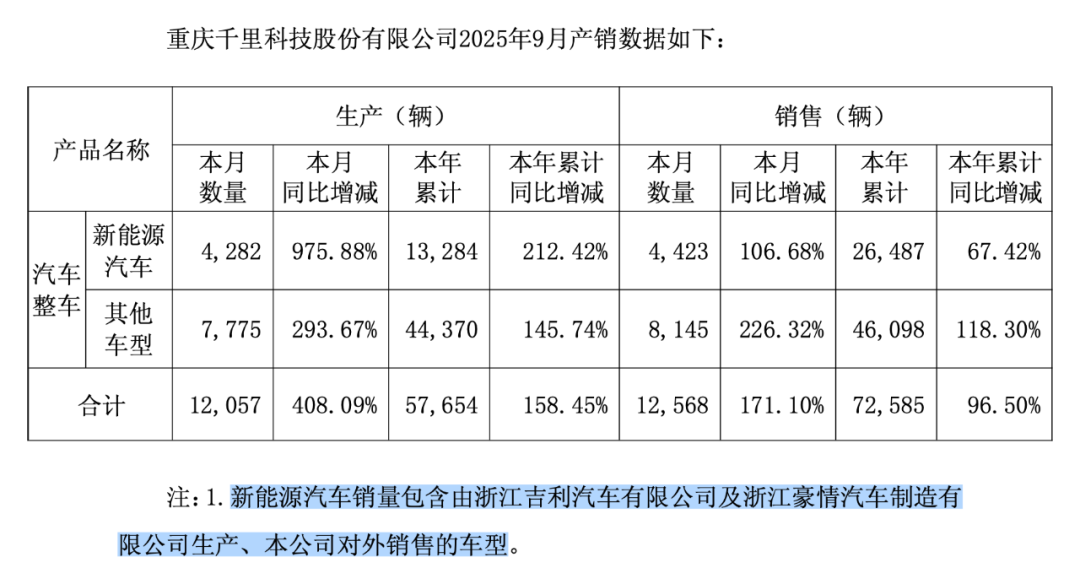

Recently, Qianli Technology entered the arena by revealing its monthly automotive sales figures. The data for September 2025 was truly remarkable, with roughly 12,000 vehicles produced, marking a more than fourfold surge compared to the same period the previous year. Sales were equally robust, nearing 13,000 units, almost tripling from the previous year.

In particular, both new - energy and fuel - powered vehicles fared well. Sales of new - energy vehicles exceeded 4,400 units, more than doubling, while sales of other models, mainly fuel vehicles, surpassed 8,100 units, more than tripling.

Taking a look at the cumulative figures from January to September of this year, over 57,000 vehicles were produced, and over 72,000 were sold. Production increased by 1.5 times, and sales nearly doubled. It's clear that their passenger vehicle business is gradually getting on the right track.

However, there's a crucial detail to note regarding passenger vehicles. The company specifically stated in its announcement that its new - energy vehicle sales statistics encompass models produced by two Geely - affiliated companies, Zhejiang Geely and Zhejiang Haoqing, and sold by Qianli Technology itself.

What does this imply? In simple terms, Zhejiang Geely's new - energy vehicles mainly come from the Ruilan brand, such as the Ruilan 7 and Ruilan 9. Zhejiang Haoqing serves as a production base for Geely, manufacturing popular models like the Emgrand GL and Boyue.

Vehicles produced by Qianli Technology itself are those from its pre - renaming phase when it was known as Lifan Technology, such as the Lifan 520 and Lifan 320. The brand name 'Lifan' is still in use by Qianli Technology.

But do you really believe that Qianli Technology's sole objective is to sell over 10,000 vehicles each month? Certainly not; their ambitions are far more extensive.

Their grand strategy becomes apparent from the changes in actual control, the replacement of the boss, and the subsequent renaming during Lifan Technology's restructuring.

In July 2024, during Lifan Technology's restructuring, an individual named Yin Qi, through his company, invested over 2.4 billion yuan to acquire nearly 20% of Geely's shares, becoming the second - largest shareholder and the actual controller.

By December 2024, Yin Qi directly assumed the role of the company's legal representative and chairman. The former chairman, Zhou Zongcheng, was reappointed as the manager. Yin Qi is no ordinary person; prior to founding the AI company Megvii, he had been engaged in artificial intelligence research. Megvii later became one of the 'AI Four Dragons,' gaining significant recognition. However, its path to going public has been rocky due to ongoing losses and various regulatory issues.

In February 2025, Lifan Technology officially changed its name to Qianli Technology. Behind this new name lies a significant development: its subsidiary, Qianli Intelligent Driving, was established in March of the same year, effectively integrating Geely Holding's intelligent driving business.

On March 2, Geely Auto and Qianli Technology jointly announced that they, along with several partners, had signed a 'Vehicle BU Investment Framework Agreement' to establish a joint venture focused on AI and intelligent driving, namely Qianli Intelligent Driving.

According to the agreement, Qianli Technology, Geely, and a company named Chongqing Maichi each hold a 30% stake. Chongqing Maichi is the main entity behind Maichi Intelligent Driving, a smart driving brand established by Megvii in 2021.

The agreement's name, 'Vehicle BU,' naturally draws comparisons to Huawei's 'Vehicle BU' (which was later independently established as 'Intelligen'), suggesting a competitive stance against Huawei. It aims to develop intelligent driving technology for Geely while also being prepared to take on projects from other automakers. Yin Qi himself has stated that Qianli Technology aspires to be an open third - party platform, with Geely as its first client but hopes to attract more automakers in the future.

Apart from Geely, even Mercedes - Benz got involved. On September 25, Qianli Technology announced that the former Lifan Holding had transferred a 3% stake in the company to Mercedes - Benz (Shanghai) Digital Technology Co., Ltd., to settle debts. This move made Mercedes - Benz the fifth - largest shareholder of Qianli Technology.

Lifan Auto's transformation has indeed been extraordinary. According to Qianli Technology's plans, they will concentrate on three key businesses in the future: intelligent cockpits, intelligent driving, and Robotaxi (autonomous taxis). Yin Qi stated that an L3 - level intelligent driving solution would be launched by the end of the year, with the intelligent driving business expected to start generating significant profits by 2026. The intelligent cockpit business is also anticipated to achieve a breakthrough from scratch in 2026. The Robotaxi business plans to complete its initial layout within the next 18 months, deploying in 10 cities globally and operating at least 1,000 autonomous taxis in one city.

Judging by these key milestones, Qianli Technology's stock has been on a consistent upward trajectory. In June 2024, Qianli Technology's stock price hit a phased low of 2.73 yuan per share. Currently, it has risen to 11.81 yuan per share, with a peak of 13.86 yuan per share during the period, representing a maximum increase of 407%.

The plans are ambitious, and the capital market has responded favorably. However, Qianli Technology still needs to deal with the legacy of the former Lifan Auto, with automobile manufacturing remaining its core business. In 2024, the company's total revenue exceeded 7 billion yuan, with over 4.2 billion yuan coming from passenger vehicles and parts, motorcycle and parts contributing over 2.1 billion yuan, and internal combustion engines and parts accounting for over 400 million yuan. In the first half of 2025, total revenue exceeded 4.1 billion yuan, a 40% increase year - on - year, with almost all of this growth driven by the automotive and motorcycle businesses.

By the way, when announcing the sales figures, Qianli Technology also casually mentioned that on September 30, it had received a government subsidy of 7 million yuan, accounting for about 17.5% of its net profit last year. The company stated that it would recognize this amount in accordance with accounting standards, with the specific accounting treatment and impact on profits pending the final audit results.