Wei Peng Mi Embarks on a 90-Day Challenge

![]() 10/13 2025

10/13 2025

![]() 662

662

As the fourth quarter approaches, the crucial battle for profitability among emerging automakers has commenced.

Li Bin and He Xiaopeng have both predicted profitability in the fourth quarter, while Lei Jun also anticipates the automotive business achieving profitability in the third and fourth quarters.

Why the fourth quarter? Because it represents the most urgent golden season for essential buyers in recent years.

Traditionally, "Golden September and Silver October" have been peak sales seasons for automobiles. This year, two additional keywords come into play: purchase tax and subsidies.

Originally, models priced under 339,000 yuan were exempt from purchase tax. Starting next year, this tax will be halved. For example, a 300,000 yuan car will incur approximately 13,300 yuan in taxes.

Local trade-in and scrappage subsidies are also being phased out, with the regions eligible for subsidies and the subsidy amounts sharply declining. This translates to a potential loss of up to 15,000-20,000 yuan in benefits.

Therefore, if consumers do not act quickly to purchase vehicles in the remaining time of the fourth quarter, they could theoretically lose out on up to 33,300 yuan in savings.

Image Source: Heiban Jun

During the National Day holiday, Heiban Jun observed unusually high attendance at auto shows, with many families in attendance. Automotive sales were brisk, and purchase tax and subsidies were among the primary concerns of buyers.

With these factors in play, automobile sales should receive a boost. Which emerging automaker will seize the opportunity to break through to profitability?

01 Why the Urgency to Achieve Profitability?

To those unfamiliar with emerging automakers, the urgency may seem puzzling: Are there really companies not eager to achieve profitability?

Consider NIO and XPeng, both founded in 2014 and now 11 years old. Even Xiaomi Motors, the newest entrant, was established in 2021 and is approaching its fifth anniversary.

Yet, none have achieved profitability.

Of course, a few years ago, the lack of profitability was not a significant issue.

At that time, the market was flush with capital, and companies were focused on seizing the opportunity in the new energy vehicle sector. Burning through cash on research and development and market capture was the primary strategy.

When funds ran low, they would simply raise more capital. Falling behind competitors in market timing was not an option.

Image Source: HiPhi Motors

However, in recent years, the new energy vehicle market, particularly in the domestic sector, has rapidly entered a red ocean phase. Coupled with a decline in investment and financing activity, simply burning through cash is no longer viable.

Consider BYD, the global leader in new energy vehicle sales for two consecutive years, with impressive profits. Ideal Auto and Leapmotor, which have accurately targeted the market, have also reached the profitability threshold.

Many automakers that relied solely on burning cash without generating sales have collapsed, including Jiyue, HiPhi, Hoctron, and Neta, all of which have experienced cash flow disruptions.

To be responsible to investors, employees, and consumers, "survival" has become a paramount concern for every automaker.

02 Some Rejoice, Others Worry

Even the college student next door knows that NIO's business model is heavily weighted.

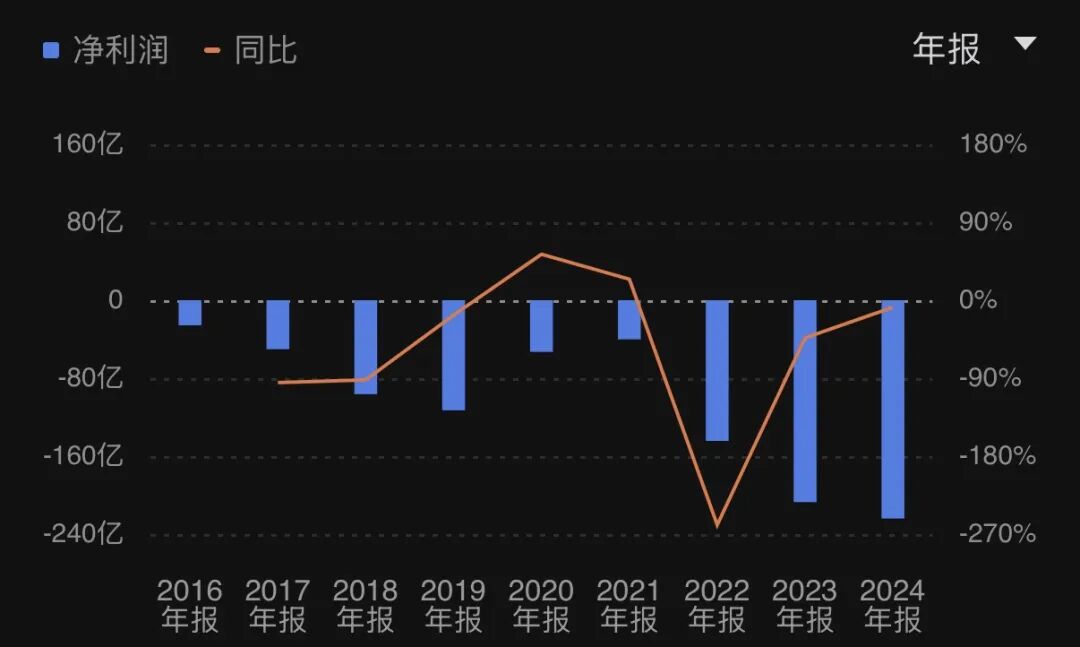

In its 11 years of operation, NIO has delivered a cumulative total of 870,000 vehicles across its three brands. However, since its listing in 2018, cumulative losses have exceeded 109.3 billion yuan.

In other words, for every vehicle sold, NIO incurs a loss of 125,000 yuan.

Therefore, Li Bin emphasized twice in internal speeches, at the beginning of the year and on August 29, the need to achieve single-quarter profitability in the fourth quarter.

NIO's Historical Losses Image Source: IFEng.com

In contrast, He Xiaopeng faces less pressure.

In 2024, XPeng Motors was teetering on the brink, but internal restructuring led by He Fengying and the launch of blockbuster products like the MONA M03 and P7+ have revitalized the company.

In September 2025, XPeng's monthly sales exceeded 40,000 units for the first time, and the net loss in the second quarter was reduced to just 480 million yuan.

Considering He Xiaopeng's prediction in March during an earnings call that annual sales would double and profitability would be achieved in the fourth quarter, this goal now seems within reach.

However, with competitors rapidly catching up with XPeng's blockbuster strategy, He Xiaopeng cannot afford to be complacent.

As for Lei Jun, Xiaomi Motors also achieved monthly deliveries exceeding 40,000 units in September, and the operating loss for its innovative businesses, including smart electric vehicles and AI, was only 300 million yuan in the second quarter.

Given a gross profit margin of 26.4%, Xiaomi Motors has a high likelihood of achieving Lei Jun's goal of profitability in the third and fourth quarters. The main challenge lies in delivery speed, which is indeed a fortunate dilemma.

The urgency for the automotive business to achieve profitability essentially revolves around Xiaomi's overall valuation and the direction of the group's development.

On September 25, following the launch of the "Tribute to Apple" Xiaomi 17 series, Xiaomi Group's Hong Kong stock price peaked at 59.9 Hong Kong dollars on that day but then fluctuated and declined to 52.05 Hong Kong dollars by October 10.

Of course, Xiaomi's stabilizing factor also includes its chip business, but that is another story.

03 What Are Their Financial Standings?

Ultimately, every company has its own set of challenges.

By achieving profitability, automakers can always find opportunities to turn the tide. However, the means to reach profitability vary.

To achieve profitability, NIO has abandoned its once-lofty brand image and even gone so far as to "betray" its loyal customers to please new ones.

On September 20, at NIO Day, the third-generation ES8 was launched with a starting price nearly 100,000 yuan lower than the previous generation. The battery rental price even broke the 300,000 yuan barrier, dropping to as low as 298,800 yuan.

Li Bin anticipates that the third-generation ES8 will achieve delivery targets of 40,000 units in the last three months.

Combined with the L90 from the Leapmotor brand, which achieved the fastest delivery to surpass 10,000 units, the Firefly model with 5,775 units sold in September, and models like the 5566 on the NT2.0 platform, NIO is determined to reach a delivery target of 150,000 units in the fourth quarter, 1.7 times that of the third quarter.

It is worth mentioning that Li Bin stated that despite the lower price of the third-generation ES8, it offers better gross profit performance than the second-generation ES8.

Image Source: Li Bin's Social Media

The peak in research and development expenditures for the third-generation platform has passed, with a 14.6% sequential decline in R&D expenses in the second quarter.

The implementation of the basic business unit (CBU) mechanism since the first quarter has allowed each CBU to autonomously control costs, resulting in a 12.6% sequential decline in selling, general, and administrative expenses.

Overall, NIO's operating loss in the second quarter was 4.9089 billion yuan, a 23.5% sequential improvement, and the net loss was 4.9948 billion yuan, a 26.0% sequential decline, indicating significant improvement.

While the third-quarter data may not be as impressive, with strong deliveries of the Leapmotor L90 and third-generation ES8, NIO's chances of achieving profitability in the fourth quarter are increasing.

As for XPeng, it essentially entered the cost-performance route, trading price for volume, earlier than NIO.

The two new models launched in the latter half of last year have swept the 100,000 yuan and 200,000 yuan pure electric sedan markets with their high cost-performance.

The XPeng MONA M03 has achieved monthly deliveries exceeding 10,000 units for 12 consecutive months and has been the best-selling pure electric A-class sedan for the same period. The XPeng P7+ has also been the best-selling mid-to-large pure electric sedan for 10 consecutive months.

In the fourth quarter, XPeng is expected to launch extended-range versions of its models, including the X9, G6, and P7+, which have already been revealed by the Ministry of Industry and Information Technology.

The timing of their launch and delivery has become a suspense (cliffhanger) for the year-end sprint.

According to data from the China Passenger Car Association, the share of pure electric vehicles rose from 56% to 64% in August. While the share of plug-in hybrid and extended-range electric vehicles declined, they still hold a significant market, especially in northern regions where battery performance is poorer in winter.

By adding extended-range models to the same platform as its pure electric vehicles, XPeng can increase sales while saving on R&D expenses, further enhancing its chances of achieving profitability, especially if launched in winter.

As for Xiaomi, based on its second-quarter financial report, its automotive gross profit margin has already reached 26.4%, far surpassing its peers.

Calculated per vehicle, the average revenue is 253,700 yuan, with a gross profit of 67,000 yuan. After deducting amortization costs, the loss per vehicle is approximately 6,000 yuan.

Amortization costs mainly include R&D, factory construction, channel establishment, and after-sales services. With Xiaomi Motors steadily delivering 30,000 to 40,000 units per month, it is believed that amortization costs will rapidly decline, and profitability may even be achieved in the third-quarter financial report.

The persistent issue constraining Xiaomi's profitability and development is production capacity.

According to the official website of the Beijing Municipal Government, the acceptance of the R&D complex building of Xiaomi Motors' Phase II factory has not been passed, which may affect the upcoming surge in production capacity.

Image Source: Screenshot from the Official Website of Relevant Beijing Authorities

Especially since Xiaomi's extended-range SUV is currently undergoing road tests.

Furthermore, as orders for Xiaomi Motors are currently placed, deliveries may not catch the window period for full exemption of subsidies and purchase tax, which may lead some buyers to switch to other brands.

04 NIO's Make-or-Break Opportunity

Ultimately, except for Xiaomi, which is constrained by production capacity, both NIO and XPeng are pursuing a strategy of reducing prices to enhance cost-performance.

With accumulated strength and breakthroughs, sufficient R&D investment in the early stages, a complete production line, and increased sales, the cost per vehicle can naturally be diluted.

However, compared to XPeng, which has already left the intensive care unit (ICU), NIO is still on its way out, considering its net loss approached 5 billion yuan in the second quarter.

Currently, NIO is streamlining its operations, integrating channels, and focusing all efforts on ensuring the delivery of the Leapmotor L90 and third-generation ES8.

If necessary, it is believed that Li Bin could further reduce prices for the mature NT2 platform models like the 5566 to boost sales.

It can be predicted that the fourth quarter of 2025 will be the best window period for automakers to strive for profitability, as consumer demand has been brought forward.

Sales may cool down in the first quarter of next year due to uncertain subsidy policies.

Image Source: Heiban Jun

To retain customers, automakers such as NIO, Li Auto, and Seres have introduced purchase tax guarantee plans. If consumers place orders and the vehicles are delivered next year, the automakers will subsidize the difference in purchase tax.

The challenge of achieving profitability is also a matter of corporate survival.

Among the half-year reports of 17 listed automakers, seven reported losses, accounting for 41%.

Of course, even if they overcome the profitability hurdle, it does not mean they can rest easy, as market competition remains fierce.