European Electric Vehicle Rankings for Q3 2025: Chinese Brands Stage a Major Comeback, BYD Leads, Leapmotor Surges Over 100-Fold

![]() 10/14 2025

10/14 2025

![]() 574

574

Unexpectedly, Chinese electric vehicles emerged as the biggest highlight in Europe during the first three quarters of this year.

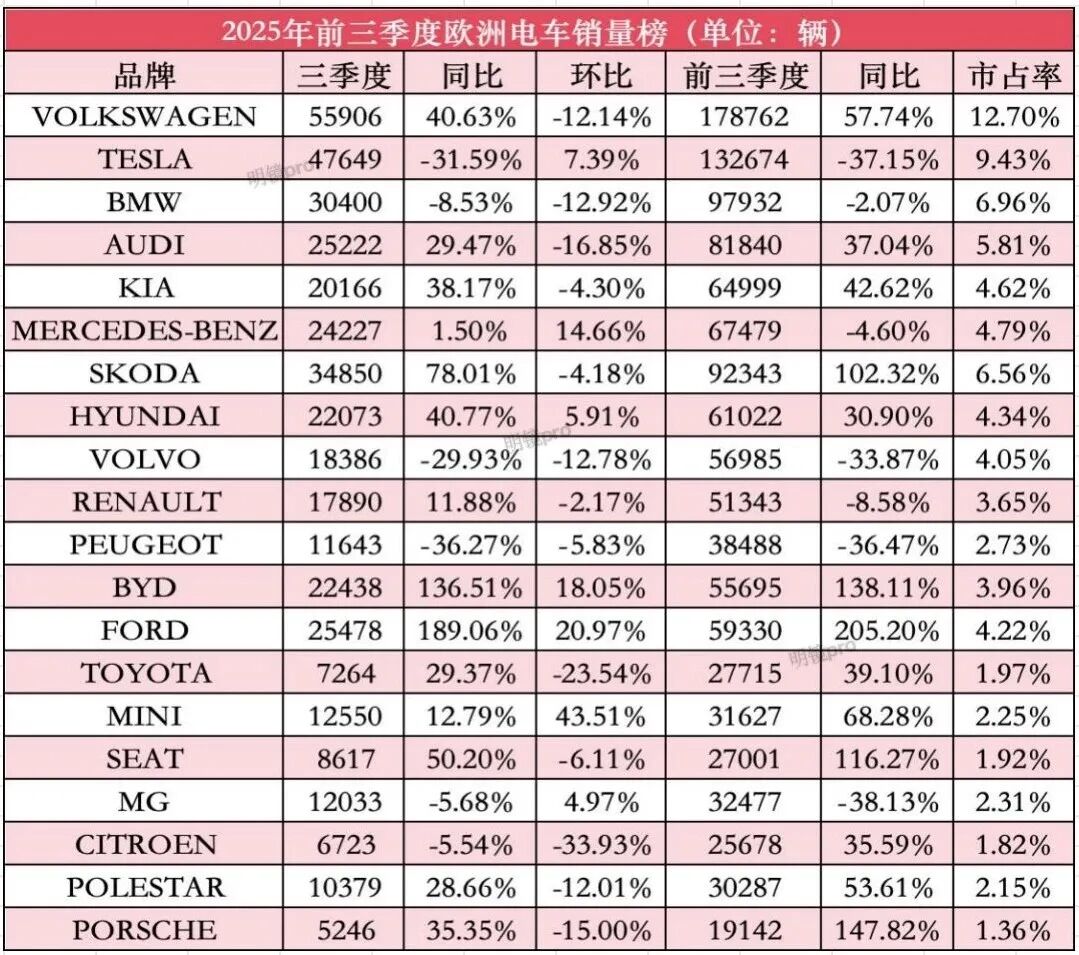

According to data compiled by European media, in the third quarter of this year, EV sales in 14 key European countries (including the UK, Norway, the Netherlands, Spain, Sweden, Denmark, Germany, Italy, Switzerland, Ireland, Finland, Austria, Portugal, and France) reached 477,749 units, up 10.67% year-on-year but down 2.49% quarter-on-quarter. Despite fluctuations, overall sales for the first three quarters maintained positive growth. From January to September, EV sales in these 14 countries totaled 1,407,505 units, a 7.44% increase year-on-year.

Chinese brands sold 124,140 EVs in these 14 European countries during the first three quarters, up nearly 40% year-on-year, far outpacing overall market growth. Their market share rose to 8.82%. Including Volvo, Lotus, and Polestar, Chinese EV brands sold 212,563 units in Europe during this period, capturing over 15% of the market.

01 Chinese Brands Lead with Strong Growth

Chinese brands generally experienced robust growth in Europe, with most seeing significant sales increases. Only a few, such as MG, Great Wall, NIO, and Dongfeng Sokon, saw year-on-year declines. This led to shifts in the rankings of Chinese EV brands in Europe. BYD surpassed MG to claim the top spot, while Leapmotor's sales grew rapidly, overtaking XPENG to rank third and becoming the biggest dark horse among Chinese brands exporting to Europe.

First, let's look at BYD. In Q3, BYD sold 22,438 units, up 136.51% year-on-year and 18.05% quarter-on-quarter. It overtook Hyundai and Kia to rank eighth in European EV sales, its highest position yet. From January to September, BYD sold 55,695 units, capturing 3.96% of the market.

This success is attributed to BYD's diverse product lineup in Europe. The company has launched over 10 models, including SEALION, SEAL, ATTO 3, DOLPHIN, ATTO 2, TANG, ETP3, E-BUS, HAN, and ATTO. The DOLPHIN led sales with 5,811 units, while SEALION and SEAL each sold over 4,000 units in Q3. ATTO 3 sold 2,465 units. BYD is just 3,000 units behind fifth-placed Ford in Q3 sales. If it maintains this growth, it could enter the top five by Q4.

MG ranked second but saw a 5.68% year-on-year decline in Q3 European sales, totaling 12,033 units, though it rose 4.97% quarter-on-quarter, placing it 14th overall. The MG4 remained the best-selling Chinese model in Europe. However, MG's overall performance lagged behind its 2023 strong showing. Despite the decline, MG was the only Chinese brand to sell over 10,000 units in Q2. From January to September, MG sold 32,477 units in Europe, capturing 2.31% of the market.

Leapmotor not only saw rapid growth in China but also performed exceptionally well in Europe. Leveraging Stellantis' distribution network, Leapmotor sold 4,894 units in Q3, up 11,835.59% year-on-year and 53.13% quarter-on-quarter, climbing to 24th place. The T03 electric compact car led sales, rising from over 1,500 units in Q1 to 3,506 units. The C10's sales grew from just over 100 units to 846 units, while the B10 began contributing to sales in Q3. From January to September, Leapmotor sold 10,018 units, becoming the only brand to exceed 10,000 units within three years. With localized production set to begin in Europe next year, Leapmotor is poised for even greater sales breakthroughs.

XPENG sold 3,115 units in Q3, up 59.17% year-on-year but down 11.81% quarter-on-quarter, ranking 27th. The G6 and G9 remained its top sellers, with 2,070 and 698 units sold, respectively. Other models sold in single or double digits. From January to September, XPENG sold 9,185 units in Europe. Compared to other brands' rapid growth, XPENG's performance was steady. Chery's OMODA sold 2,131 units in Q3, up 940% year-on-year and 13.28% quarter-on-quarter. From January to September, OMODA sold 4,895 units.

Brands like Zeekr, Maxus, Dongfeng, VOYAH, Seres, and JAC also saw rapid sales growth in Q3, though their volumes remain small compared to leading brands. Zeekr sold 1,329 units, up 168.48% year-on-year; Maxus sold 1,242 units, up 191.55%; Dongfeng sold 406 units, up 8,020%; and Seres sold 210 units, up 213.43%.

NIO sold 372 units, down 8.37% year-on-year; Great Wall sold 344 units, down 35.34%; Dongfeng Sokon sold 7 units, down 66.67%; and ORA sold 6 units, down 96.69%. Aiways, Neta, and Zhidou, which had minimal sales earlier, reported no sales data in Q3.

02 Volkswagen and Tesla Face Intense Pressure

As Chinese brands aggressively expand, competition in Europe's EV market has intensified. Leading brands Volkswagen, Tesla, and BMW saw their market shares decline, with sales dropping across various metrics. Volkswagen, leveraging popular models like ID.3, ID.7, ID. BUZZ, and ID.4, sold 55,906 units in Q3, up 40.63% year-on-year but down 12.14% quarter-on-quarter. Its market share fell from 13.5% in Q1 to 11.7% in Q3. From January to September, Volkswagen sold 178,762 units, up 57.74% year-on-year, capturing 12.7% of the market.

Tesla, which lost its top spot in European EV sales, faces even greater pressure. In Q3, Tesla sold 47,649 units, down 31.59% year-on-year but up 7.39% quarter-on-quarter. From January to September, Tesla sold 132,674 units, down 37.15% year-on-year, capturing 9.43% of the market. Between 2022 and 2024, Tesla's market share in Europe dropped from 14.7% to 17.4% and then to 15.7%.

BMW ranked third, selling 30,400 EVs in Q3, down 8.5% year-on-year and 12.92% quarter-on-quarter. From January to September, BMW sold 97,932 units, down 2.07% year-on-year, capturing 6.96% of the market. Last year, its market share was 7.6%. The declining market shares of these three giants highlight the fierce competition in Europe's EV market.

Skoda emerged as a strong contender in Europe this year, stable ranking fourth. It sold 34,850 units in Q3, up 78.01% year-on-year but down 4.18% quarter-on-quarter. From January to September, Skoda sold 92,343 units, up 102.32% year-on-year, capturing 6.56% of the market, closing in on BMW. Previously, its market share was below 4%. Audi sold 25,222 EVs in Q3, up 38.17% year-on-year but down 4.30% quarter-on-quarter. From January to September, Audi sold 81,840 units, capturing 5.81% of the market, ranking fifth. Including Skoda and Audi, Volkswagen Group's market share in Europe exceeds 25%.

Mercedes ranked sixth, selling 24,227 units in Q3, up 1.5% year-on-year and 14.66% quarter-on-quarter. From January to September, Mercedes sold 67,479 units, up 37.04% year-on-year, capturing 4.79% of the market, also down from previous years. Hyundai and Kia, two South Korean brands, saw positive sales growth in Europe's EV market but declining market shares, falling out of the top five. Kia sold 64,999 units from January to September, up 42.62% year-on-year, capturing 4.62% of the market, ranking seventh. Hyundai sold 60,122 units, up 30.90% year-on-year, capturing 4.34% of the market, ranking eighth.

After Hyundai and Kia, other brands sold fewer than 60,000 EVs in the first three quarters. Ford sold 59,330 units, up 205.20% year-on-year, capturing 4.22% of the market, ranking ninth. Ford had the highest growth rate among the top ten. Volvo sold 56,985 units, capturing 4.05% of the market. Renault sold 51,343 units, down 8.58% year-on-year, capturing 3.65% of the market. Peugeot sold 38,448 units, down 36.47% year-on-year, capturing 2.73% of the market. These two French brands, previously in the top ten, have now fallen out.

In terms of individual models, the Tesla Model Y remained Europe's best-selling EV, with 73,841 units sold in the first three quarters. The Volkswagen ID.7 and ID.3 ranked second and third, with 45,444 and 44,161 units sold, respectively. The Skoda ELROQ saw sales rise to 42,797 units, ranking fourth. The Model 3 followed with 42,780 units sold. Another Skoda model, the ENYAQ, sold 42,686 units, jointly driving Skoda's market performance. Additionally, models like the BMW iX1, Audi Q4 e-tron, and Q6 e-tron performed well.