Over Five Straight Months of Over 10% Growth: CAAM Reports September Auto Production and Sales Hit 3 Million Units for the First Time

![]() 10/14 2025

10/14 2025

![]() 497

497

This year's "Golden September" has proven to be even more lucrative than in previous years.

On October 14, the China Association of Automobile Manufacturers (CAAM) officially released the production and sales data for September's auto sector. Not only did September mark over five consecutive months of over 10% growth in auto production and sales, but it also set a historic milestone by surpassing 3 million units in both production and sales in the same month.

Examining the global auto market, data reveals that China's auto market has performed exceptionally well, both overall and in segments like new energy vehicles. China continues to hold the title of the best auto market globally.

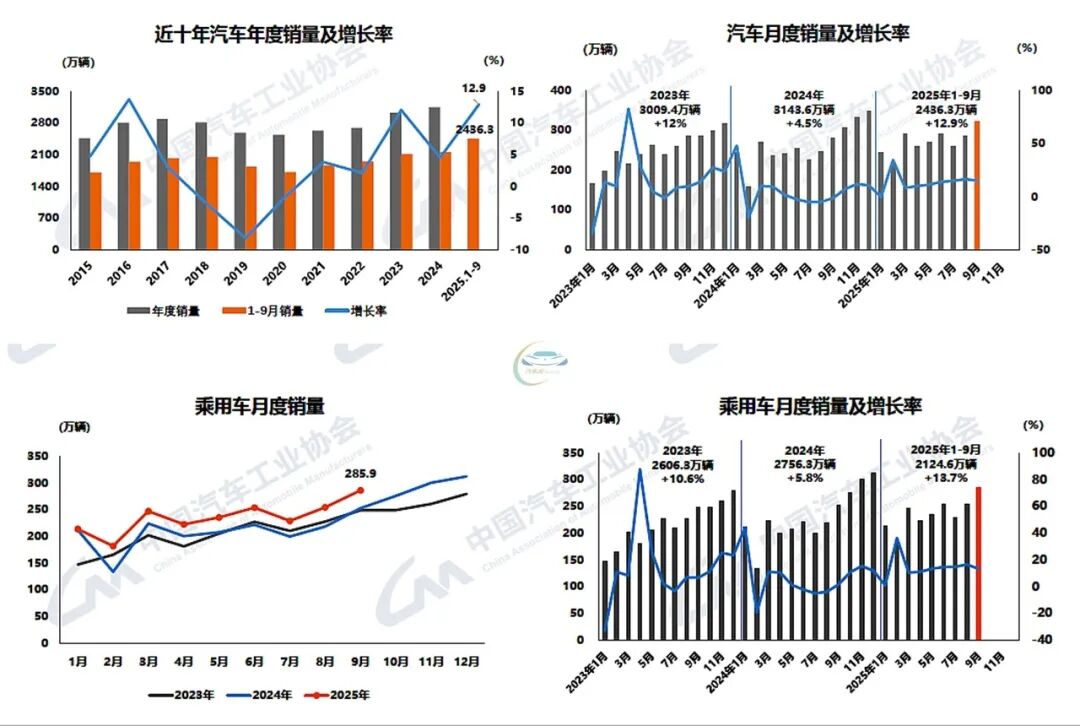

According to CAAM data, in September, auto production and sales reached 3.276 million and 3.226 million units, respectively, showing month-on-month increases of 16.4% and 12.9%, and year-on-year increases of 17.1% and 14.9%. From January to September, cumulative auto production and sales hit 24.333 million and 24.363 million units, respectively, with year-on-year increases of 13.3% and 12.9%. Compared to January-August, the growth rates for production and sales expanded by 0.6 and 0.3 percentage points, respectively.

Analyzing September's performance, CAAM noted that various regions and departments have intensified the implementation of more proactive macroeconomic policies. They have actively strengthened the domestic economic cycle, maintained policy continuity and stability, enhanced flexibility and foresight, and promoted steady economic progress. The sustained improvement of the macroeconomy has played a pivotal role in driving the stable operation of the auto market.

"Recently, the auto trade-in policy has continued to show effectiveness, with some regions that had suspended operations resuming. Positive progress has been made in the industry's comprehensive efforts to address 'involution.' Additionally, factors such as local auto shows and the intensive launch of new products have driven continuous growth in the auto market.

CAAM also highlighted that eight departments, including the Ministry of Industry and Information Technology, jointly issued the 'Work Plan for Stabilizing Growth in the Auto Industry (2025-2026).' The plan outlines 15 measures across four dimensions: expanding domestic consumption, enhancing supply quality, optimizing the industrial development environment, and boosting international openness and cooperation. These measures provide a clear roadmap for stabilizing growth and achieving high-quality development in the auto industry, ensuring sustained improvement in the auto market.

In other words, not only is this year's performance robust, but it is also anticipated that China will continue to be the best global auto market in the future.

Breaking down the figures, the passenger vehicle market, as the main growth driver, maintained double-digit growth both month-on-month and year-on-year. In September, passenger vehicle production and sales reached 2.9 million and 2.859 million units, respectively, showing month-on-month increases of 16% and 12.5%, and year-on-year increases of 15.9% and 13.2%. From January to September, passenger vehicle production and sales hit 21.241 million and 21.246 million units, respectively, with year-on-year increases of 13.9% and 13.7%.

Of course, the commercial vehicle market performed even more outstandingly. In September, commercial vehicle production and sales reached 376,000 and 368,000 units, respectively, showing month-on-month increases of 19.3% and 16.3%, and year-on-year increases of 27.7% and 29.6%.

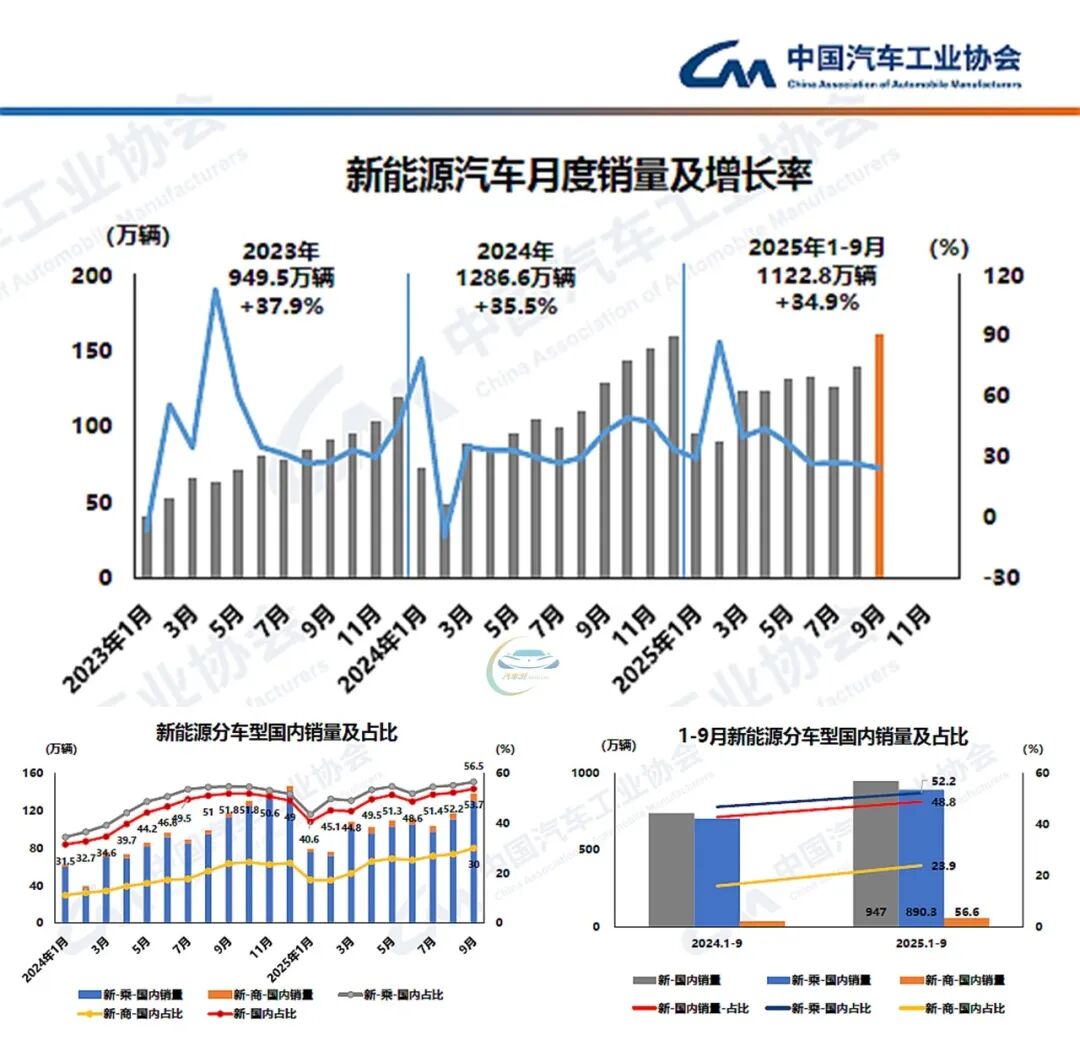

Compared to the overall market data, new energy vehicles saw even more significant growth. In September, new energy vehicle production and sales reached 1.617 million and 1.604 million units, respectively, with year-on-year increases of 23.7% and 24.6%. New energy vehicle sales accounted for 49.7% of total new vehicle sales.

From January to September, new energy vehicle production and sales reached 11.243 million and 11.228 million units, respectively, with year-on-year increases of 35.2% and 34.9%. New energy vehicle sales accounted for 46.1% of total new vehicle sales.

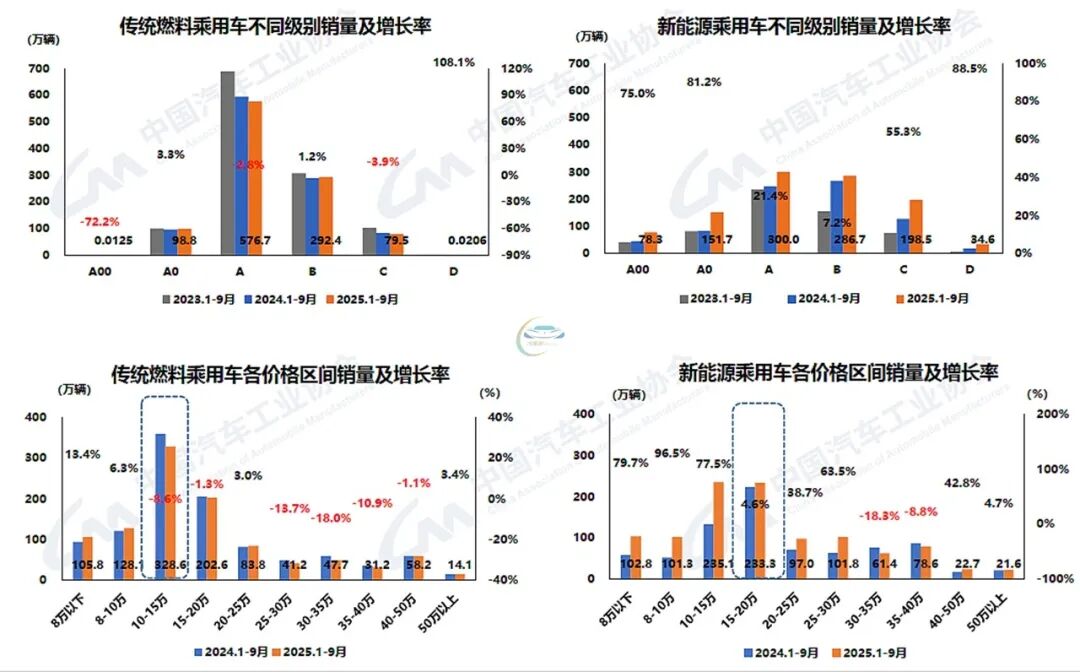

When discussing the proportion of new energy vehicles, it seems they are tantalizingly close to 50%, but they have not yet crossed this 'threshold.' The reason is that sales of traditional fuel vehicles are also growing simultaneously. In September, domestic sales of traditional fuel passenger vehicles reached 1 million units, an increase of 60,000 units compared to the same period last year, with a month-on-month increase of 10.9% and a year-on-year increase of 6.4%. Cumulatively, from January to September, sales of traditional fuel passenger vehicles reached 8.141 million units, an increase of 136,000 units compared to the same period last year, with a year-on-year increase of 1.7%.

Breaking down new energy vehicles, battery electric vehicles (BEVs) still hold the largest share. In September, BEV sales reached 1.058 million units, with a year-on-year increase of 36.4%, while plug-in hybrid electric vehicles (PHEVs) reached 546,000 units, with a year-on-year increase of 6.7%.

From January to September, cumulative BEV sales reached 7.22 million units, with a year-on-year increase of 44.7%, while cumulative PHEV sales reached 4.005 million units, with a year-on-year increase of 20.4%.

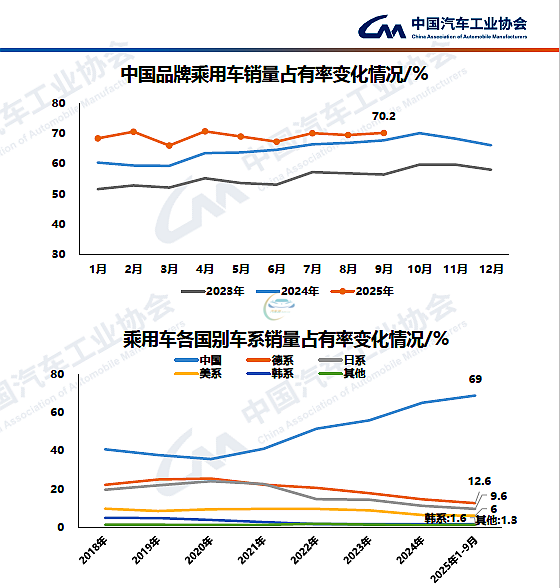

Another notable data point comes from the performance of national brands. In September, Chinese brand passenger vehicle sales accounted for over 70% of the market, with monthly sales reaching 2.007 million units, a year-on-year increase of 17.4%, and market share increasing by 2.5 percentage points. From January to September, Chinese brand passenger vehicle sales reached 14.651 million units, a year-on-year increase of 22.9%, with market share increasing by 5.1 percentage points to 69%. This means that out of every 10 car buyers, 7 chose a new Chinese brand vehicle.

Sharing in the overall market's over five consecutive months of over 10% growth, auto exports also maintained steady growth. In September, auto exports reached 652,000 units, with a month-on-month increase of 6.7% and a year-on-year increase of 21%. From January to September, auto exports reached 4.95 million units, with a year-on-year increase of 14.8%.

Among these, in September, traditional fuel vehicle exports reached 430,000 units, with a month-on-month increase of 11.1% and a year-on-year increase of 0.5%. New energy vehicle exports reached 222,000 units, with a month-on-month decrease of 0.9% and a year-on-year increase of 100%. From January to September, traditional fuel vehicle exports reached 3.192 million units, a year-on-year decrease of 5.6%, while new energy vehicle exports reached 1.758 million units, a year-on-year increase of 89.4%.

Breaking it down further, in September, passenger vehicle exports reached 560,000 units, with a month-on-month increase of 5% and a year-on-year increase of 22.4%. From January to September, passenger vehicle exports reached 4.201 million units, with a year-on-year increase of 15.6%.

In terms of export enterprise rankings, Chery maintained its leading position in vehicle exports, with cumulative export volume nearing 1 million units. In September, Chery's exports reached 141,000 units, a year-on-year increase of 29%. BYD's export growth was particularly significant, with September exports reaching 71,000 units, a year-on-year increase of 1.2 times, and cumulative export volume increasing by 1.3 times year-on-year.