The "Cash Cow" of the Great Wall Collaboration: A BMW Electric Model with 242 Monthly Sales

![]() 10/15 2025

10/15 2025

![]() 549

549

Source: YuanAuto

On October 13th, BMW's entire electric MINI lineup underwent its annual minor refresh. Many "MINI aficionados," armed with cash and watching from the sidelines, had hoped for a pleasant pricing surprise, especially given that the prevailing theme of price wars in the automotive market shows no signs of abating. However, the starting price of the new electric MINI COOPER, set at a limited-time offer of 153,800 yuan, dampened the enthusiasm of fans.

Compared to its predecessor, the starting price of the new electric MINI COOPER has risen by 5,000 yuan. In December of the previous year, the limited-time offer price for the electric MINI COOPER E Classic stood at 148,800 yuan. It's worth mentioning that, despite being officially labeled as a limited-time offer, this price has remained consistently available.

"Although the new model is priced 5,000 yuan higher, owners will now receive COOPER coins worth 5,000 yuan, which can be redeemed for items like charging cards in the mall," a salesperson at a BMW 4S store in Guangdong informed YuanAuto on October 14th. In addition to the 5,000 yuan worth of COOPER coins, the new model, priced over 150,000 yuan, also qualifies for a higher tier of local trade-in subsidy policies.

Despite the implementation of these welfare policies as a countermeasure, the price increase of the electric MINI remains unexpected, as it will at least increase the difficulty for salespeople in explaining the price hike to potential buyers. In September, sales of the electric MINI had already plummeted to 242 units. Is it truly so out of touch with market competition?

01 BMW and Great Wall's Covert "Cash Cow"

Before delving into the electric MINI, it's crucial to understand that, unlike its fully imported gasoline counterpart, it is a domestically produced electric vehicle manufactured by Spotlight Automotive. Spotlight Automotive is a joint venture between BMW Group and Great Wall Motors, established with an equal 50:50 shareholding ratio.

According to public information, Spotlight Automotive is currently the sole global manufacturer of the electric MINI COOPER and MINI ACEMAN. These domestically produced electric MINIs are not only supplied to the domestic market but also exported to multiple overseas markets, including Germany, the UK, France, Japan, and Thailand.

Data reveals that from January to August this year, Spotlight Automotive exported 34,142 new vehicles to Europe, marking a year-on-year increase of 15.6%. Additionally, in June of this year, the 100,000th pure electric MINI produced by Spotlight Automotive rolled off the assembly line. Considering the combined domestic sales of the electric MINI COOPER and MINI ACEMAN, which were less than 8,400 units from March to September this year, there is reason to believe that over 90%, or even more, of the electric MINIs produced by Spotlight Automotive are sold overseas.

With robust overseas market demand, it's no surprise that BMW and Great Wall Motors, the backers of Spotlight Automotive, remain unfazed, allowing the electric MINI to raise prices despite its meager monthly domestic sales figures. It's worth noting that not only is the overseas demand for the electric MINI on an upward trajectory, but its profitability may also significantly surpass that in the domestic market.

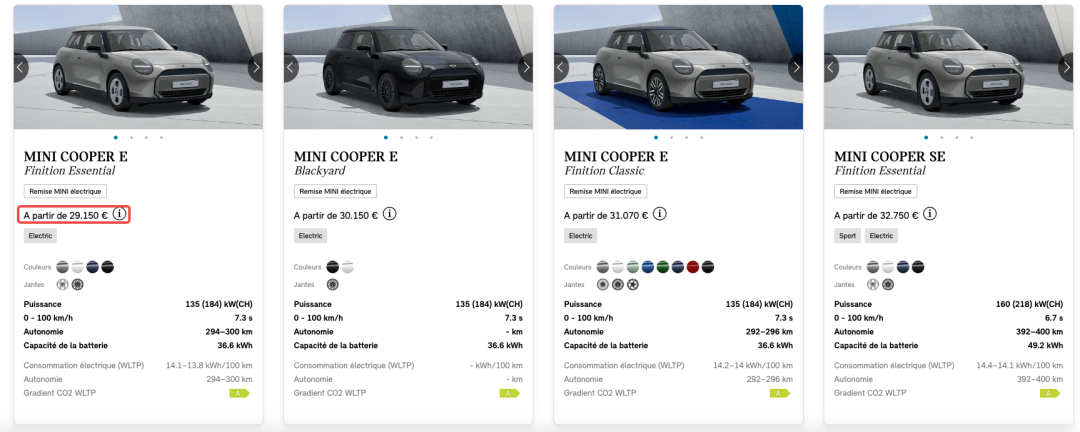

According to YuanAuto's analysis, China represents the global price trough for the electric MINI COOPER and MINI ACEMAN. Taking the former as an example, its starting price in the UK is £25,400, approximately 240,000 yuan; in France, it's €29,000, roughly 240,000 yuan; and in Thailand, it's 960,000 Thai baht, about 210,000 yuan.

Compared to overseas prices, even the domestic starting price of the electric MINI, which has increased by 5,000 yuan to 153,800 yuan, appears highly competitive. Leveraging China's mature and cost-effective electric vehicle supply chain for manufacturing, combined with brand premium to profit from overseas markets, BMW and Great Wall Motors have certainly made a strategic move.

02 NIO and smart Both Eye a Slice of the Market

Currently, the market segment occupied by the domestically produced electric MINI can be considered a blue ocean, but industry peers are already making moves.

"Firefly plans to enter 16 countries and regions across five continents globally by 2025." At this year's Shanghai International Auto Show, NIO announced the overseas expansion plan for its third sub-brand, Firefly, which directly competes with MINI. Overseas markets, including Europe and Southeast Asia, are on Firefly's expansion radar.

Domestically, Firefly has already surpassed the electric MINI as the representative of high-end electric compact cars. At least in terms of sales volume, Firefly has significantly outpaced the electric MINI.

Data shows that since its launch on April 19th this year, Firefly's cumulative sales have exceeded 20,000 units, with monthly sales in September surpassing 5,700 units, 16 times the combined sales of the two electric MINI models during the same period.

However, it's important to note that Firefly has a substantial price gap compared to the electric MINI, with a starting price of 119,800 yuan. If purchased through a battery leasing scheme, the vehicle price can be further reduced to a starting price of 79,800 yuan.

When comparing Firefly and the electric MINI, there are notable differences in exterior design and driving experience, but both offer similar levels of perceived value and emotional appeal to owners, which is crucial for high-end electric compact cars.

For Firefly, the biggest challenge in its future expansion to markets like Europe and Southeast Asia will be brand recognition, an area where the electric MINI holds a significant advantage.

From this perspective, smart may pose an even greater threat to the electric MINI.

Similar to how the electric MINI relies on BMW and Great Wall Motors for domestic production, smart is currently backed by Mercedes-Benz and Geely. Geely-produced smart electric vehicles have already been sold to over 30 countries and regions in Europe, the Middle East, Southeast Asia, Oceania, and Latin America.

In September of this year, smart announced that it will launch a new model, smart#2, in 2026 to enter the electric compact car market. In this segment, smart's global recognition is on par with that of MINI. Reports indicate that by the time the smart for two was officially discontinued in 2024, cumulative sales of this compact car had exceeded 1.5 million units.

Although smaller in size, its price positioning is no lower than that of MINI, with the domestic price of the smart for two reaching over 200,000 yuan at its peak. It can be expected that the new electric smart#2 will become the most direct competitor to the electric MINI on a global scale.

With Firefly and smart closing in, the electric MINI is far from being truly carefree.

Some images sourced from the internet. Please notify us for removal if there is any infringement.