Significant Rise in New Energy Vehicle Credits: What Future Holds for Fuel-Powered Vehicles?

![]() 11/12 2025

11/12 2025

![]() 527

527

The adjustments to new energy policies are, in essence, a reflection of market pressures being passed down.

As consumers express concerns about the 2026 adjustment to the purchase tax on new energy vehicles, a notice issued by the Ministry of Industry and Information Technology (MIIT) on November 7 has stirred up fresh anxiety among many automakers.

According to the notice, the required proportions of new energy vehicle credits for passenger car companies are set to rise to 48% in 2026 and 58% in 2027.

For numerous automakers, this undoubtedly presents a formidable challenge. Following the phased withdrawal of subsidies for new energy vehicle purchases, many had expected the introduction of new subsidy policies. Instead, they now face even more ambitious targets for new energy vehicles.

Since the implementation of the new energy credit policy in 2017, the domestic new energy vehicle market has witnessed rapid growth. However, as market dynamics have evolved, consumers have noticed that competition in the new energy vehicle sector has increasingly focused on peripheral aspects, neglecting the core element of product competitiveness.

Particularly after the sales share of new energy vehicles exceeded 50%, the challenge of fostering orderly competition within the domestic new energy vehicle market has emerged as a new concern.

A Decade of Transformation

The roots of the new energy credit policy can be traced back to 2013. To improve the fuel efficiency of domestic fuel-powered vehicles, five departments—the Ministry of Industry and Information Technology, the National Development and Reform Commission, the Ministry of Commerce, the General Administration of Customs, and the General Administration of Quality Supervision, Inspection, and Quarantine—jointly formulated the 'Measures for the Calculation of Average Fuel Consumption of Passenger Car Enterprises' and established a system for calculating and reporting the average fuel consumption of passenger car enterprises.

This marked the beginning of a framework aimed at promoting energy-efficient development in the domestic passenger car sector. With the initial emergence of new energy vehicles, and to encourage automakers to produce such vehicles, the five departments jointly issued the 'Parallel Management Approach for Average Fuel Consumption of Passenger Car Enterprises and New Energy Vehicle Credits' in 2017, commonly known as the dual-credit policy.

The primary goal of the dual-credit policy was to incentivize automakers to increase their investment in new energy vehicles. Data from that year reveals that domestic new energy vehicle production stood at a mere 335,000 units.

The technical standards of the credit policy at the time provided a strong incentive for new energy vehicles. For instance, pure electric vehicle models could achieve the maximum credit score of 5 points by meeting an NEDC range requirement of over 350 km, while plug-in hybrid models needed only a pure electric range of 50 km to qualify.

Subsequently, significant adjustments were made to the original standards in 2020 and 2023. The 2020 revision, in particular, laid the groundwork for the current direction of the dual-credit policy.

After the enactment of the dual-credit policy, the domestic new energy vehicle market indeed entered a period of rapid growth. However, it also exposed a multitude of issues. Despite substantial government subsidies being disbursed, end consumers failed to witness the anticipated convenience of new energy vehicles. On one hand, vehicle prices remained high; on the other, various needs were left unmet, especially when compared to international standards.

The 2020 revision primarily targeted pure electric vehicles, raising the range requirement to 500 km under the CLTC driving cycle and reducing the credit score to 1 point for models with a range of less than 150 km.

Simultaneously, the maximum credit scores for both pure electric and plug-in hybrid models were lowered.

Beyond the challenges posed by revised vehicle standards, the most significant transformation was the allowance for the carryover of new energy credits and the establishment of a credit trading policy. This enabled positive subsidies to be allocated through economic means to enterprises excelling in new energy vehicle development.

The policy reform also adjusted the credit ratio requirements for new energy vehicles over the next three years, mandating an increase to 18% by 2023.

Following this policy adjustment, the domestic new energy vehicle market experienced rapid growth. According to statistics, the production volume of domestic new energy vehicles complying with the credit policy reached 6.036 million units in 2022, a 17-fold increase from 2016. Additionally, electricity consumption per 100 kilometers decreased by 21.5%.

Receiving positive feedback, the five departments once again revised the credit policy in 2023. On one hand, they reduced the credit score per vehicle and raised the credit standards for new energy vehicles. On the other hand, they substantially increased the credit ratio requirements for new energy vehicles, setting targets of 28% and 38% for 2024 and 2025, respectively.

It is precisely due to these significant adjustments in the new energy credit ratio that the new energy vehicle market has witnessed rapid growth in the past two years. According to the latest data, domestic new energy vehicle sales reached 12.943 million units in the first ten months of this year, accounting for 46.7% of the total market. In October alone, the sales share of new energy vehicles soared to 51.6%.

Under the impetus of the dual-credit policy, automakers have placed greater emphasis on the development of new energy vehicles, reversing the previous situation where high subsidies yielded minimal results.

New Standards, New Targets

Amidst the sustained positive trajectory of the new energy vehicle industry, the new energy credit policy has undergone further adjustments. According to the latest standards announced on November 7, automakers are required to meet credit ratio targets of 48% and 58% for new energy vehicles in 2026 and 2027, respectively.

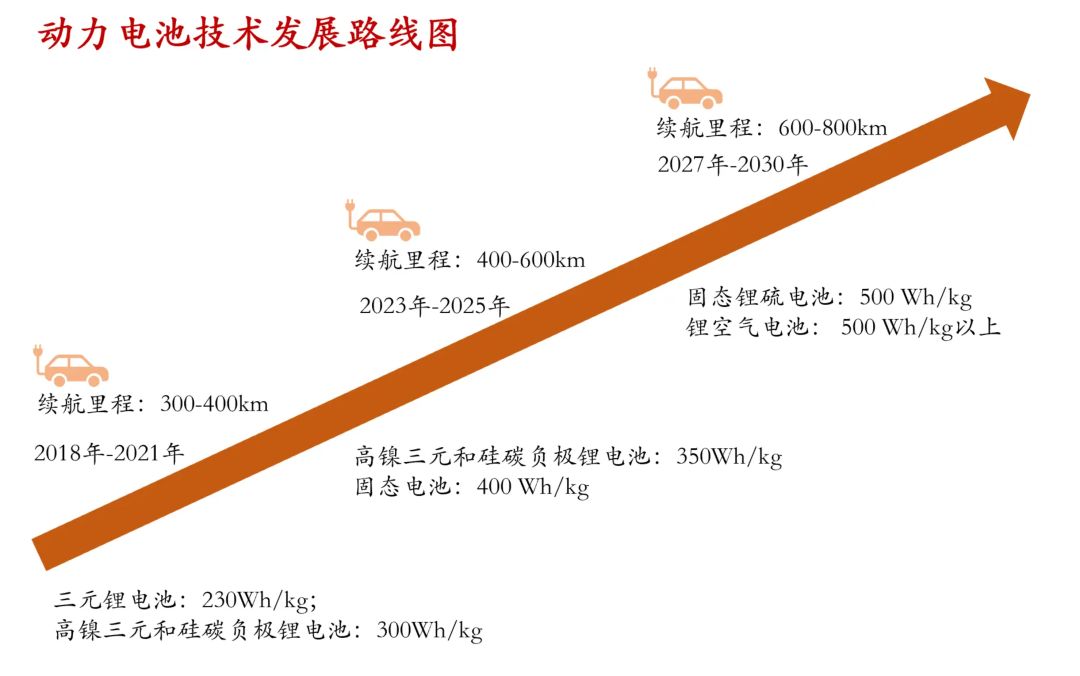

Simultaneously, new adjustments have been made to the credit policy. Firstly, for pure electric vehicle models, only those with a range exceeding 300 km are eligible for 1 credit point, while models with a range below 100 km receive 0 points. Additionally, specific requirements have been set for battery energy density, with a coefficient of 1 only for batteries with an energy density exceeding 125 Wh/kg; batteries below this standard will result in a corresponding reduction in credit points.

Furthermore, models with a low-temperature range decay of less than 35% are granted a 1.2 times credit multiplier. Similar adjustments have been made for plug-in hybrid vehicles, aiming to reduce fuel and electricity consumption, with a maximum credit allocation of 0.5 points.

While changes to the credit rules may be relatively manageable for enterprises, as they can largely be addressed by procuring high-standard batteries and motors to meet the new criteria, the substantial adjustment in the credit ratio poses a greater challenge for automakers.

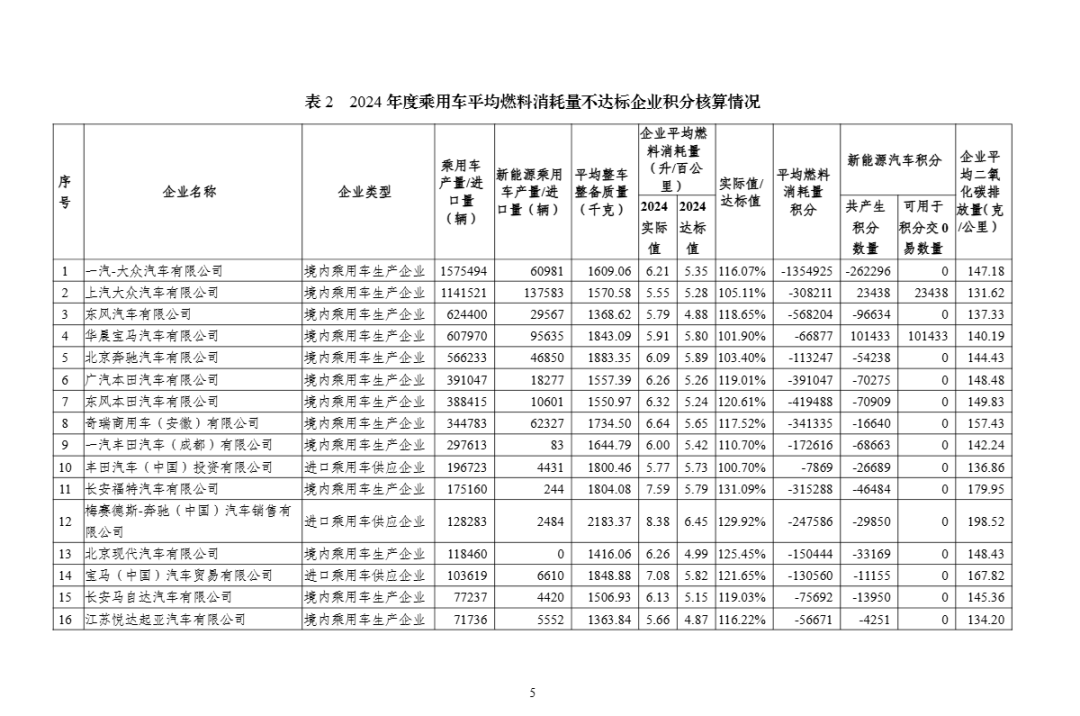

According to the 'Announcement on the Average Fuel Consumption and New Energy Vehicle Credits of Chinese Passenger Car Enterprises in 2024' released on July 3 of this year, 52 domestic enterprises failed to meet the average fuel consumption standards for passenger cars, with the majority being traditional joint-venture automakers.

These enterprises are also burdened with a negative credit balance of 1.01 million new energy vehicle credits and 5.847 million fuel consumption credits that need to be offset. Based on the current market trading price of 200 yuan per credit point, these automakers would need to spend nearly 1.4 billion yuan purchasing credits from other new energy vehicle manufacturers to offset the credit deficit.

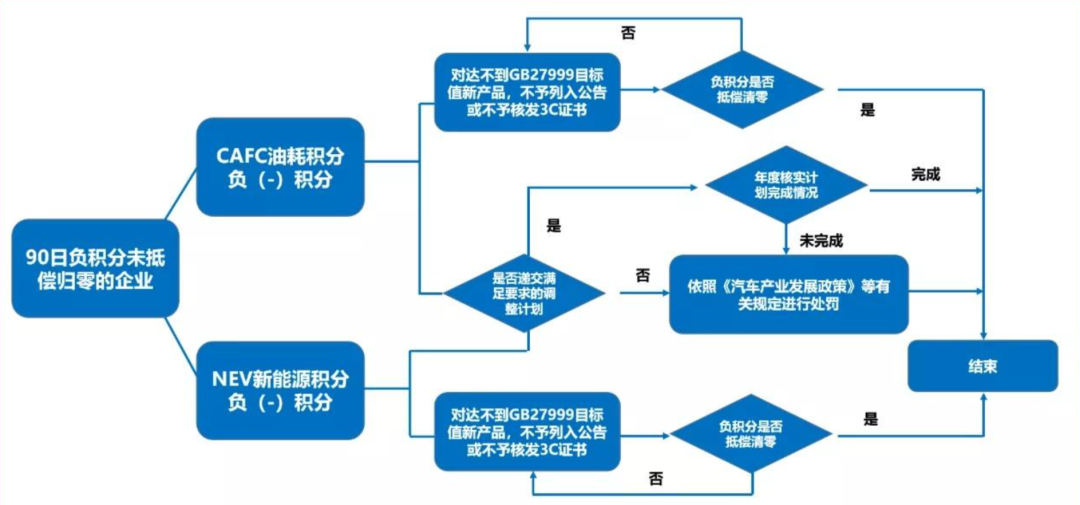

Failure to offset negative credits may result in the Ministry of Industry and Information Technology suspending the declaration and production of high fuel-consuming vehicle models in accordance with regulations, thereby limiting the production of fuel-powered vehicles. This would constitute a devastating blow to automakers.

For manufacturers of fuel-powered vehicles with substantial volumes, such as Volkswagen and Toyota, meeting the future credit ratio target of 58% necessitates a significant increase in the production and sales scale of pure electric vehicle models. This implies that these companies must not only accelerate the launch of competitive electric vehicle models but also potentially adjust their product lineups and consider temporarily reducing the production of high fuel-consuming traditional vehicle models.

For joint-venture automakers in the midst of transformation, the next two years will be an arduous battle, requiring not only a transition to new energy vehicles in terms of product offerings but also achieving significant breakthroughs in sales volume.

Under the new credit standards, the domestic market is expected to achieve the goal of surpassing 50% new energy vehicle penetration by 2027. New energy vehicles will transition from being policy-driven to being driven by both market and technological advancements, becoming the true mainstream of the market.

The adjustment of the credit policy will compel enterprises to pursue higher technological standards, rather than merely being satisfied with the large-scale production of low-end electric vehicles. This will drive the concentration of resources on core technologies such as high energy density batteries, extended range capabilities, and intelligence, while also promoting the upgrading of the entire industry chain.

It is foreseeable that competition in the Chinese automotive market will intensify over the next two years, accompanied by an accelerated industry reshuffle.

Note: The images are sourced from the internet. In case of any copyright infringement, please contact us for removal.

-END-