GAC Honda Seeks Revival with 2.5 Billion Yuan Capital Boost to Secure Core Supply Chain

![]() 11/12 2025

11/12 2025

![]() 608

608

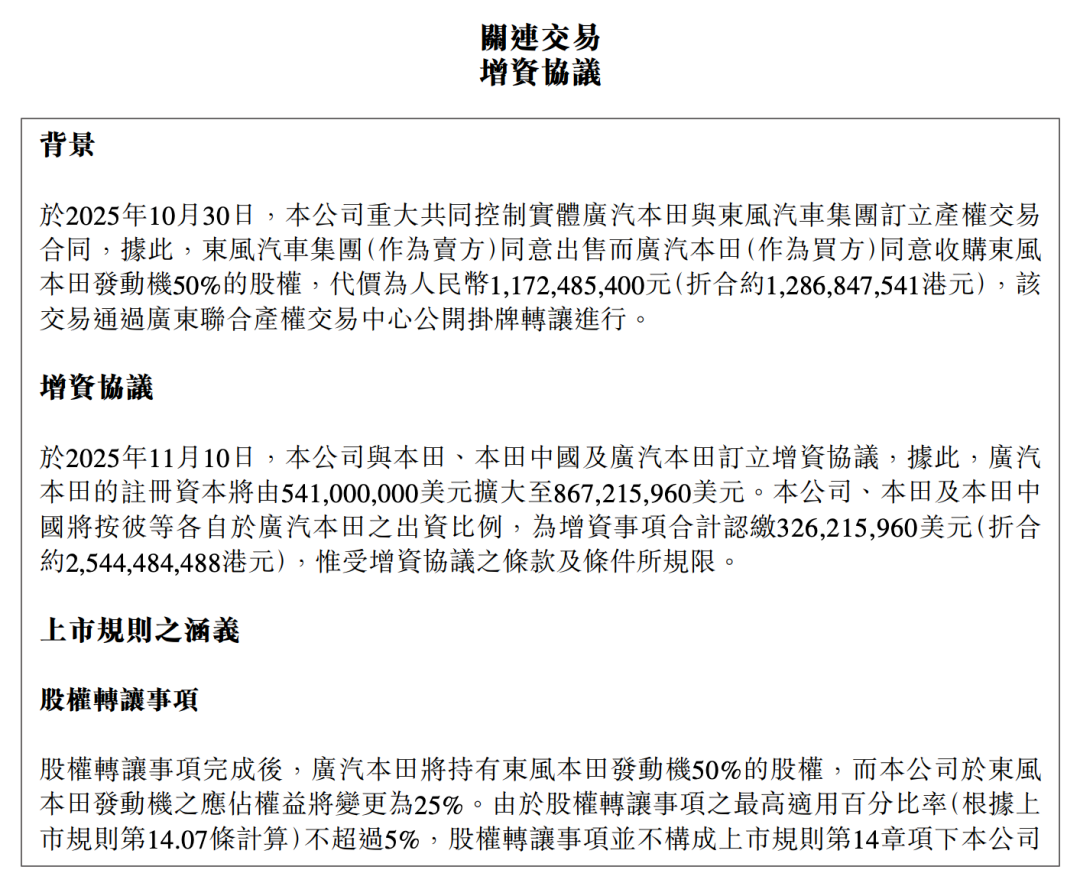

On November 10th, GAC Group unveiled a substantial capital injection for GAC Honda, elevating its registered capital from $541 million to $867 million, marking a $326 million surge (approximately HK$2.544 billion). This significant financial move underscores GAC Honda's strategic pivot in response to plummeting sales and setbacks in its new energy transition.

This capital infusion is intricately tied to GAC Honda's acquisition of a 50% stake in Dongfeng Honda Engine, a pivotal step in its electrification overhaul. Amidst escalating competition in the new energy vehicle sector, this $2.5 billion capital surge is not just about supply chain integration for GAC Honda; it's a determinant of its ability to break through in this fiercely competitive industry transformation.

Tripartite Capital Increase Paves the Way for Full Ownership of Engine Firm

This capital maneuver comprises two interlinked parts, showcasing GAC Group's strategic foresight in capital deployment. According to GAC Group's announcement, GAC Honda will acquire a 50% stake in Dongfeng Honda Engine from Dongfeng Motor Group for 1.172 billion yuan, a price aligned with the assessed value, ensuring transactional fairness.

Subsequently, GAC Honda will receive a capital boost from its three shareholders, totaling $326 million, raising its registered capital from $541 million to $867 million, a jump exceeding 60%. The ingenuity of this capital operation lies in its funding approach—GAC Group contributes 1.172 billion yuan in cash, while Honda and Honda China inject their 40% and 10% stakes in Dongfeng Honda Engine, respectively, as part of the funding. This astute arrangement alleviates the financial burden of substantial direct cash outlays for all parties and facilitates effective asset restructuring.

Post-transaction, GAC Group, Honda, and Honda China retain their 50:40:10 shareholding ratio, preserving the joint venture's equity stability while granting GAC Honda 100% ownership of Dongfeng Honda Engine.

For GAC Group, which reported a net loss of 4.312 billion yuan in the first half of the year, leveraging 1.172 billion yuan in cash to drive a 2.5 billion yuan-level supply chain integration is undeniably a meticulously calculated capital move. A senior industry analyst noted that this equity contribution method is rare in Honda China's joint venture history. It not only eases cash pressure on all parties but also achieves core asset restructuring and integration, reflecting GAC Group's innovative capital operation thinking.

Through this transaction, GAC Honda will gain complete control over its engine supply chain, laying a solid foundation for its subsequent electrification transformation. Notably, Dongfeng Honda Engine, a longstanding engine supplier to GAC Honda, will be fully integrated into the GAC Honda system, transforming the past 'one project, two companies' cooperation model and enabling integrated operations from complete vehicles to core powertrains. This integration is crucial for enhancing GAC Honda's responsiveness and production efficiency in the fiercely competitive market.

Declining Sales and Electrification Transformation Setbacks

GAC Honda's urgent need for transformation is underscored by its deteriorating market performance in recent years. According to the latest sales data, in the first 10 months of 2025, GAC Honda's cumulative sales were merely 259,600 units, a 26.16% year-on-year decline, continuing the downward trend of recent years.

Based on the full-year trend forecast, GAC Honda's 2025 sales are likely to hover around 340,000 units, a stark contrast to its heyday—in 2020, it achieved a record annual sales volume of 805,800 units. Now, its sales are less than half of that, highlighting the severe challenges the company faces.

More alarmingly, GAC Honda's sales have declined for four consecutive years since 2021, with the decline rate widening. In 2021 and 2022, GAC Honda's sales were 780,300 units and 741,800 units, respectively, down 3.17% and 4.93% year-on-year. In 2023 and 2024, the downward trend intensified, with only 640,500 units and 470,600 units sold, respectively, down 13.66% and 26.52% year-on-year.

In terms of electrification transformation, GAC Honda's performance has also been lackluster. As the first strategic product in GAC Honda's electrification transition, the P7 was officially launched in April this year and was highly anticipated, but the market response fell far short of expectations. As of September, the P7's listed sales volume was just over 1,400 units, with an average monthly sales volume of just over 200 units, a significant gap compared to competitors in the same price range.

To boost sales, GAC Honda had to launch a promotion in October, offering a 50,000 yuan discount across all models, lowering the starting price of the P7 to 149,900 yuan, in an attempt to increase sales volume through price reductions. However, the effectiveness remains to be seen. Strategic hesitation has already placed GAC Honda in a passive position in the electrification wave. This capital increase and acquisition can be viewed as a correction of its past strategic missteps, but whether it can turn the tide remains to be tested by the market.

Supply Chain Integration and Industry Breakthrough

Faced with severe practical challenges, GAC Honda's capital increase and acquisition are essentially a supply chain integration and electrification transformation breakthrough move concerning the company's future.

After achieving full ownership of Dongfeng Honda Engine, GAC Honda will achieve integrated operations in the engine field, significantly enhancing the stability and autonomy of its supply chain. Dongfeng Honda Engine is no ordinary asset. Founded in 1998, the company specializes in the manufacture of automotive engines and components and has been one of GAC Honda's most important suppliers for a long time.

Although its main business has traditionally focused on fuel technology, its performance has improved markedly in recent years—revenue surged from 9.566 billion yuan to 17.852 billion yuan in 2024, turning from a net loss of 228 million yuan to a profit of 84 million yuan, demonstrating strong operational improvement capabilities. According to an independent valuer's assessment using the asset-based method, the total equity value of Dongfeng Honda Engine's shareholders was assessed at 2.345 billion yuan, an appreciation of 316 million yuan from the book value, with an appreciation rate of 15.60%, proving its asset quality and future potential.

Post-acquisition, GAC Honda will be able to reduce a significant amount of related-party transactions, optimize production processes, and lower production costs, thereby improving overall operational efficiency. An industry analyst familiar with GAC Group said, 'After the transaction, Dongfeng Honda Engine will be included in the scope of GAC Group's consolidated financial statements using the equity method, providing stronger component support for the group's intelligent and electrification transformation and helping to better achieve strategic transformation amid industry changes. Especially in the hybrid field, Dongfeng Honda Engine's technological accumulation will form a synergistic effect with GAC Honda's complete vehicle manufacturing, creating conditions for the subsequent mass production of hybrid models.'

GAC Group also clearly stated in its announcement that this transaction aims to 'drive GAC Honda to achieve integrated operations in the engine field,' thereby 'enhancing supply chain stability and autonomy, reducing related-party transaction costs, and improving management efficiency in the production of core components,' clearly indicating the strategic intent of this capital operation.

For GAC Honda, full ownership of the engine company is not just a supply chain integration but also a crucial part of its electrification strategy. Through this integration, GAC Honda will not only be able to reduce component procurement costs but also directly control the research, development, and production pace of core components, which is of great significance for quickly responding to market changes and shortening product iteration cycles. Especially in the hybrid technology field, Dongfeng Honda Engine's technological accumulation can form an effective synergy with GAC Honda's complete vehicle manufacturing capabilities, providing strong product support for the company during the transition period before pure electric technology fully matures.

Conclusion:

The capital increase is set, and the acquisition awaits completion. After completing this capital operation, GAC Honda will gain control over its core component supply chain, obtaining a crucial foundation for its electrification transformation. However, the challenges ahead for GAC Honda remain formidable—with strong pressure from leaders like Tesla and BYD ahead and relentless pursuit from new forces like NIO and XPENG Motors behind, GAC Honda's transformation path is destined to be arduous.

With a $326 million capital increase in place and the fully owned engine company about to be merged, all these elements point to GAC Honda's determined stance for a last-ditch effort. However, after the funds and assets are in place, what matters more is whether the company can truly grasp the market pulse, launch electrified products that meet consumer needs, and reshape its brand competitiveness in the new energy era. GAC Honda's fight for a turnaround has just begun.