Auto Companies 'Compete on Technology,' Making Bold Bets for the Next Decade?

![]() 11/14 2025

11/14 2025

![]() 644

644

Source | Bohu Finance (bohuFN)

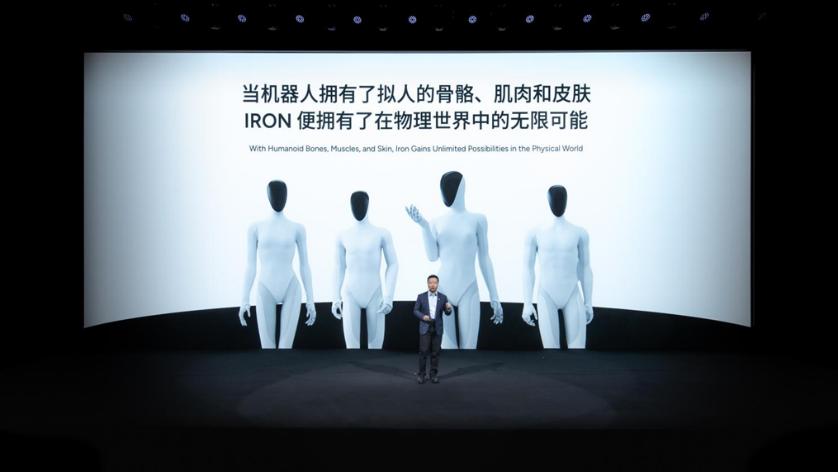

Recently, XPENG Motors unveiled its latest humanoid robot, IRON, at the 2025 XPENG Tech Day. However, the robot's overly polished "catwalk" and lifelike bionic features led many netizens to speculate whether a real person was masquerading as a robot.

The incident quickly became a trending topic on social media, even overshadowing the launch of the XPENG X9 extended-range model the following day. He Xiaopeng admitted, "Prejudices in people's minds are like mountains. Few believe such advanced technology could originate from a Chinese company."

Behind these remarks lies the anxiety and ambition of automakers transitioning into tech companies. Traditionally, the automotive and tech sectors operated in distinct spheres, but the rise of "AI-defined vehicles" is gradually blurring these boundaries.

Yet, as automakers shed their "manufacturer" labels to embrace "tech company" identities, they face a fiercer, more capital-intensive, and longer-term competitive landscape than traditional car manufacturing.

Who will define the "next decade"? This silent battle for future dominance has already begun.

01 The New Frontier of 'Physical AI'

At the 2025 XPENG Tech Day, XPENG Motors introduced four core applications centered around "physical AI," including its second-generation VLA architecture, XPENG Robotaxi, the next-gen IRON robot, and two XPENG AEROHT flight systems. He Xiaopeng declared XPENG's new identity as an "explorer of mobility in the physical AI world and a global embodied intelligence company."

In He's view, AI's true value lies in its ability to interact with the physical world. Only by giving AI a "body"—enabling movement, perception, and interaction—can it revolutionize human production and lifestyles.

Across the globe, Elon Musk praised XPENG's robot video, stating, "I deeply respect Chinese competitors." This cross-border acknowledgment not only validated XPENG but also underscored Musk's endorsement of the "physical AI" concept.

In September, Tesla unveiled its "Master Plan Part 4," shifting focus from electric vehicles and energy to AI and robotics. The goal is to integrate AI on a massive scale into the physical world to create a "sustainable and prosperous" society.

This trend extends beyond Tesla and XPENG. Tech leaders worldwide, including NVIDIA CEO Jensen Huang and Alibaba CEO Eddie Wu, have emphasized "physical AI" as the next phase of innovation. Huang declared, "Physical AI will dominate the next era of AI," while Wu noted, "AI's greatest potential lies in the physical world."

So, what is this "rising star" capturing global attention? Physical AI refers to intelligent systems capable of understanding physical laws and interacting with the real world. Unlike traditional AI confined to digital spaces, physical AI requires systems to perceive, interact with, and transform the physical environment.

This necessitates not just a "brain" but also a "body"—whether through humanoid robots equipped with sensors (eyes) and robotic arms (limbs) or large intelligent platforms like vehicles and aircraft that integrate perception, control, and execution systems.

Different players have emerged in this space: Ecosystem builders like NVIDIA and Google provide foundational physical AI capabilities for upstream and downstream firms; niche players like Baidu Apollo and Unitree Robotics develop scenario-specific solutions; and vertically integrated automakers like XPENG focus on vehicles as large embodied intelligent entities, extending upward to self-developed AI algorithms and chips and downward to cover mobility, industry, and consumption scenarios, forming a closed technological-product-scenario-data loop.

Take XPENG Motors as an example. It has developed a full-stack self-researched physical AI system encompassing chips, operating systems (large models), and intelligent hardware.

Its second-generation VLA large model serves as the "brain," directly learning interaction patterns in the physical world and driving cars, Robotaxis, robots, and flying cars across domains—all acting as "embodied carriers" of physical AI.

Moreover, XPENG will open-source its second-generation VLA for global commercial partners, with AutoNavi becoming its first global ecosystem partner for Robotaxi and Baosteel partnering for the IRON robot, jointly building an open physical AI ecosystem.

Despite differing approaches, all players aim to enable AI to "leap off screens" and, through real-world interactions, break free from virtual computing constraints to become comprehensive intelligent agents capable of perception, reasoning, and executing physical tasks.

02 The Automotive Industry's Collective 'Tech Race'

XPENG Motors and Tesla's shift toward physical AI and embodied intelligence is not isolated. In recent years, more automakers have embarked on cross-border transformations.

Chery's Mojia robot has achieved a technological leap from L2 to L3, featuring multi-modal perception and autonomous task execution. GAC Group unveiled its third-generation embodied intelligent humanoid robot, GoMate, late last year.

Geely and Mercedes jointly established Hangzhou Xingqiong Tensor Technology Co., Ltd., focusing on AI application software development. JAC Motors invested in Zhong'an Zhilian Automotive Technology (Anhui) Co., Ltd., specializing in AI software development and integrated circuit design.

This collective "tech race" has accelerated the influx of tech talent into automakers. For instance, Jiang Hairong, former Chief Marketing Officer of Honor China, joined Changan Automobile as CEO of its Deepal brand. Leapmotor's Chief Operating Officer, Xu Jun, is a Huawei veteran.

The automotive industry's tech content is rising, and automakers' tech transformation routes are becoming clearer, broadly falling into three categories: full-stack self-development (e.g., Tesla, XPENG), ecosystem collaboration (e.g., Geely, GAC), and M&A-driven growth (e.g., Hyundai and other traditional automakers).

Companies like Tesla and XPENG, with full-stack self-development capabilities, boast rapid technological iteration and high system controllability. Firms like Geely, GAC, and Chery, with established self-development foundations, complement their strengths through partnerships with suppliers and tech companies, gaining edge in niche areas. Traditional automakers like Hyundai take shortcuts via acquisitions to rapidly fill gaps.

In this unprecedented tech race, automakers are striving to find their own breakthroughs. Whether they can identify suitable transformation paths has become a critical question for survival in the next phase of industry competition.

First, the "tech halo" significantly enhances brand appeal. Compared to the early days when NIO, XPENG, and Li Auto carved out markets with "tech-new-force" labels, consumers now view intelligence more rationally and are less likely to buy into concepts alone.

Thus, automakers' full-scale upgrade to tech companies not only shapes a more forward-looking and trustworthy brand image but also gains recognition from consumers and capital markets. Players who first navigate this transformation will wield greater influence in the industry.

Take XPENG Motors as an example. After unveiling the IRON robot, its market perception shifted from widespread skepticism to post-clarification endorsement, with its stock price experiencing a sharp rebound within 24 hours. This underscores capital markets' sensitivity to "tech narratives."

Second, technological breakthroughs explore new growth avenues. In recent years, price wars have intensified in the automotive industry, squeezing profit margins for traditional "hardware manufacturers." Automakers urgently need new growth drivers.

For instance, XPENG Motors generated 2.83 billion yuan in technology service revenue in the first half of 2025, with a 60.1% profit margin, through strategic partnerships like its electronic electrical architecture collaboration with Volkswagen. Tesla has pioneered software subscription and value-added services via its FSD autonomous driving system.

These efforts prove that future automakers can diversify beyond "selling products" to monetize technologies independently, shifting from "selling cars" to "selling tech"—a higher-margin revenue stream.

Finally, seizing the robot market boom. According to Morgan Stanley, China's robot market reached $47 billion in 2024 and is projected to grow to $108 billion by 2028, with a 23% CAGR.

Automakers have natural advantages in the robotics sector: core technologies and supply chains for autonomous driving are transferable to robotics, while scaled procurement reduces costs and entry barriers, opening new business growth poles.

More importantly, embodied robots can empower automakers' core businesses. Chery's humanoid robot "Moyin" has been deployed in its 4S stores for sales support, while Tesla envisions its robots entering industrial settings for factory production.

In this automotive tech revolution, new forces are navigating uncharted waters, while traditional automakers are striving to pivot. Nobody wants to fall behind, as doing so could mean permanent exclusion.

03 Restructuring the Automotive Industry's Underlying Logic

Despite the trend of "automakers competing in tech," significant challenges remain. Cost investment and commercialization issues are primary conflicts.

First, commercialization hurdles. High R&D costs and uncertainties in new technologies, coupled with the need for rapid commercialization, place immense pressure on firms to choose tracks, scale investments, and pace their strategies.

Second, insufficient support from the core automotive business. Tech layouts rely on automotive operations, but intense price wars have compressed traditional vehicle profit margins. Some automakers face cash flow constraints, and if core business profitability declines, it could weaken funding for tech ventures and even "drag down" tech operations due to resource dispersion.

Third, internal collaboration challenges. Traditional automakers' management models and operational rhythms clash with the agile, error-tolerant cultures of tech firms. Elon Musk's focus on tech dreams at the expense of automotive operations exemplifies this disconnect. Traditional automakers acquiring tech firms also face integration challenges.

Deeper challenges stem from restructuring the automotive industry's underlying logic. Transitioning from automakers to tech firms requires a complete genetic overhaul.

On one hand, software and data-centric value propositions in smart vehicles are reshaping industrial chain divisions. Traditional automakers may devolve into "assembly integrators" from "vehicle definers," with only cross-industry firms mastering core technologies and leading intelligent ecosystems dominating future smart vehicle products.

Thus, future automotive competition will hinge on tech ecosystems. Firms that lead in core technologies and build open, compatible standards and ecosystems will attract brands to join their camps, sharing tech dividends and forming irreplaceable competitive barriers.

On the other hand, automakers must deliver tangible tech results. While ecosystem layout is vital, it is not the sole survival strategy.

Firms that precisely target core needs in niche areas, concentrate resources, and achieve breakthroughs via irreplaceable single-point technologies can also secure footholds in fierce competition.

For example, Leapmotor insists on full-domain self-development, creating extreme cost-performance advantages. BYD deep dives into new energy's core "three electric" technologies, forming a unique tech moat. SAIC Wuling focuses on micro-new energy vehicles, becoming a benchmark in the segment.

The future automotive industry will increasingly resemble tech platforms, where cutting-edge innovations take root, supporting software services, ecological collaborations, and scenario extensions.

The key challenge for automakers lies in role transformation—finding their place in the new smart mobility ecosystem. Firms that fully commit are securing tickets to the future.

The cover image and illustrations belong to their respective copyright owners. If copyright holders deem their works unsuitable for public viewing or free use, please contact us promptly, and our platform will immediately correct the issue.