Annual Auto Sales Volume Poised to Break Records; CAAM Advocates for Continued Market-Stimulating Policies in the Coming Year

![]() 11/14 2025

11/14 2025

![]() 510

510

On November 11, during the monthly press conference on automobile market sales, Chen Shihua, the Deputy Secretary-General of the China Association of Automobile Manufacturers (CAAM), forecasted that the annual auto sales volume would surpass 34 million units, marking a new all-time high. Simultaneously, the CAAM analyzed and stated, "The upcoming year heralds the start of the '15th Five-Year Plan' period, with promoting consumption remaining a pivotal task."

The policy of trading in old vehicles for new ones has significantly spurred sales; however, the continuation of this policy remains uncertain at present. Given that the purchase tax on new energy vehicles will be halved next year, to mitigate market volatility, the CAAM recommends the ongoing refinement and implementation of relevant policies next year. It also urges the early release and execution of detailed regulations to stabilize market expectations and bolster the industry's smooth operation.

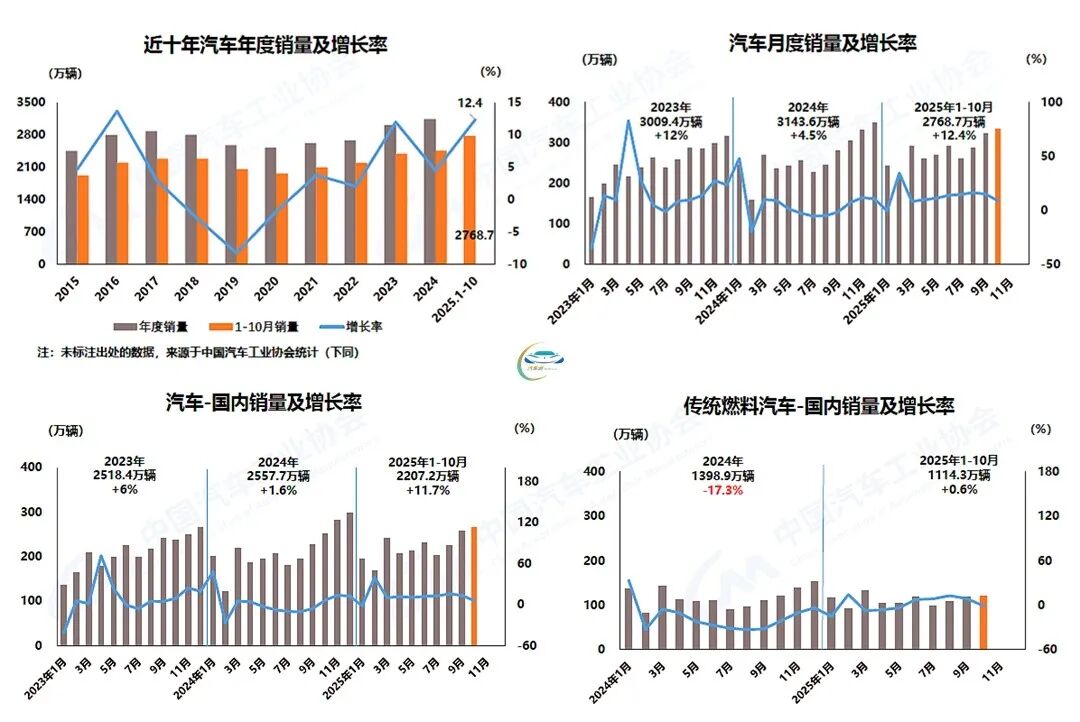

Despite the extended National Day and Mid-Autumn Festival holidays, the CAAM observed that "Automobile manufacturers have capitalized on the year-end policy transition window, maintaining a brisk production and supply pace. Companies continue to roll out new products intensively, and the industry's comprehensive governance efforts are progressing steadily. The automobile market sustains a positive growth trajectory, with monthly production and sales volumes reaching new highs for the same period." According to CAAM data, in October, automobile production and sales volumes reached 3.359 million and 3.322 million units, respectively, showing a 2.5% and 3% month-on-month increase, and a 12.1% and 8.8% year-on-year surge.

From a cumulative standpoint, automobile production and sales volumes hit 27.692 million and 27.687 million units, respectively, with year-on-year increases of 13.2% and 12.4%. The growth rates for production and sales volumes narrowed by 0.1% and 0.5%, respectively, compared to the January-September period.

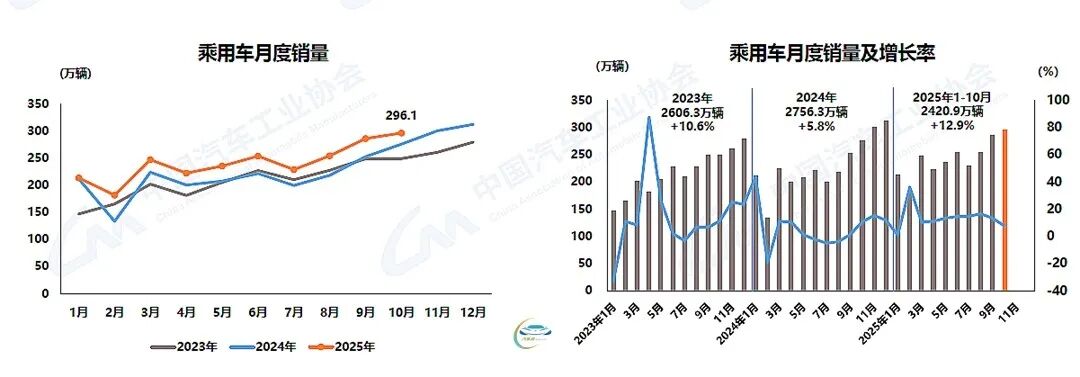

In the passenger vehicle segment, production and sales volumes reached 2.995 million and 2.961 million units, respectively, in October, marking a 3.3% and 3.6% month-on-month increase, and a 10.7% and 7.5% year-on-year rise. Cumulative production and sales volumes stood at 24.237 million and 24.209 million units, respectively, with year-on-year growth of 13.5% and 12.9%.

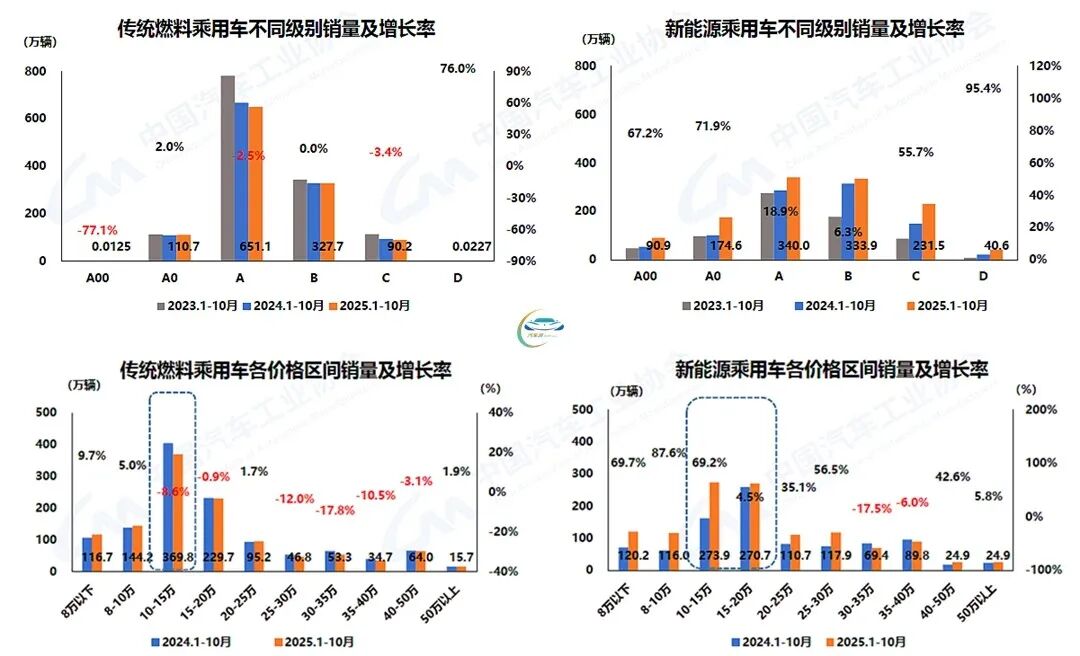

From a market segmentation perspective, among traditional fuel passenger vehicles, sales of A00-class, A-class, and C-class vehicles have seen a decline, with the current primary market focus on A-class vehicles, which have achieved cumulative sales of 6.511 million units, showing a 2.5% year-on-year decrease. Although traditional fuel passenger vehicle sales have experienced an uptick at times, their growth rate remains significantly lower than that of new energy vehicles.

In contrast, sales of new energy passenger vehicles across all categories have demonstrated varying degrees of growth this year, with the current main consumption focus on A-class and B-class vehicles, which have achieved cumulative sales of 3.4 million units and 339,000 units, respectively, showing year-on-year increases of 18.9% and 6.3%. Meanwhile, A00-class and A0-class vehicles have maintained rapid growth, fueled by policies, with growth rates reaching 67.2% and 71.9%, respectively.

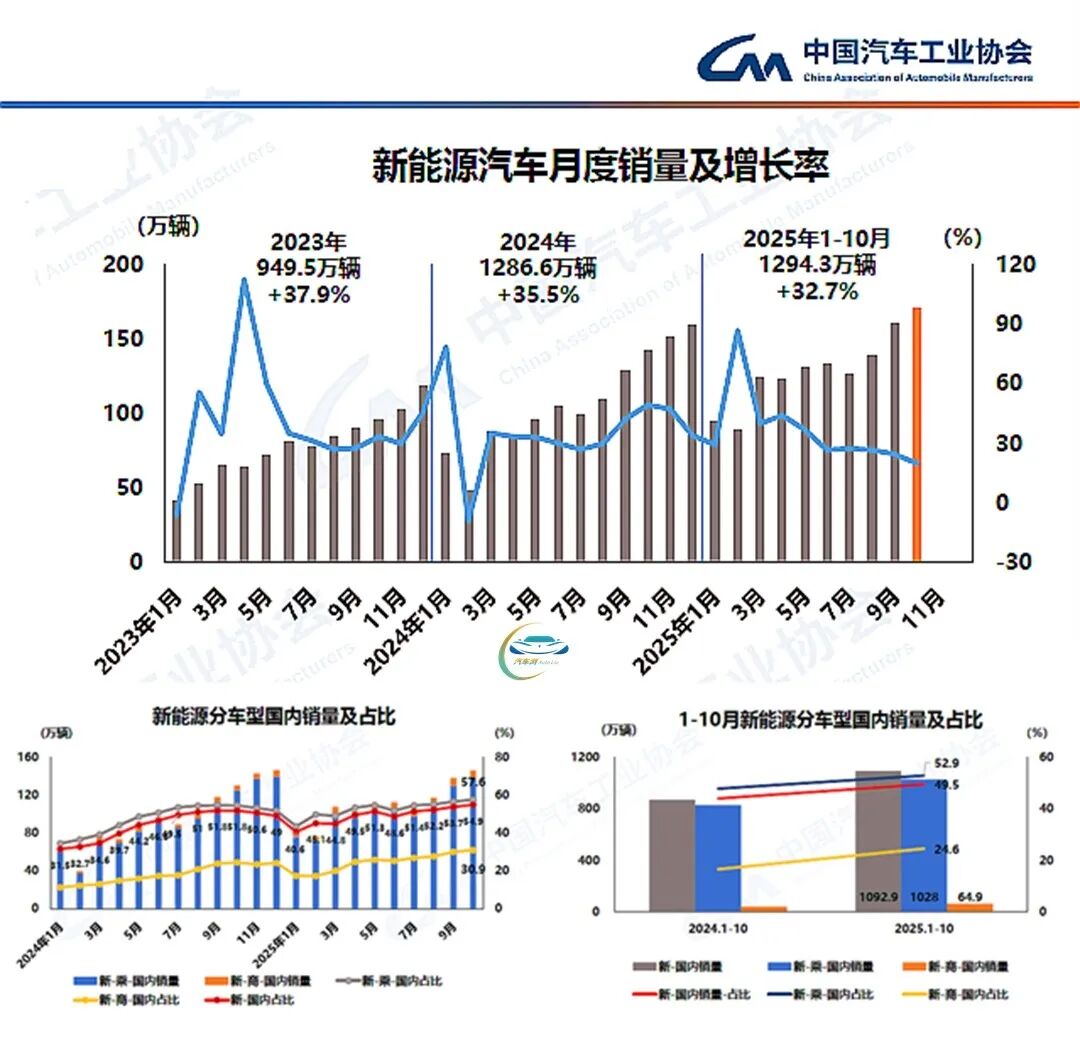

New energy vehicles continue to be the driving force behind market expansion. In October, production and sales volumes of new energy vehicles reached 1.772 million and 1.715 million units, respectively, showing a 21.1% and 20% year-on-year increase, accounting for over half (51.6%) of the total new vehicle sales volume.

From January to October, cumulative production and sales volumes of new energy vehicles reached 13.015 million and 12.943 million units, respectively, showing year-on-year increases of 33.1% and 32.7%, accounting for 46.7% of the total new vehicle sales volume.

Among new energy vehicle sales, battery electric vehicles (BEVs) continue to lead, with sales reaching 1.109 million units in October, showing a 31.7% year-on-year increase, and cumulative sales of 8.33 million units from January to October, showing a 42.9% year-on-year surge. Plug-in hybrid electric vehicles (PHEVs) recorded sales of 605,000 units in October, showing a 3% year-on-year increase, and cumulative sales of 4.61 million units from January to October, showing a 17.8% year-on-year rise.

According to CAAM data, in October, domestic sales of passenger vehicles reached 2.39 million units, showing a 4% month-on-month and 4.4% year-on-year increase. From January to October, domestic sales of passenger vehicles reached 19.436 million units, showing a 12.1% year-on-year increase. Among them, domestic sales of traditional fuel passenger vehicles reached 9.155 million units, an increase of 100,000 units year-on-year, showing a 1.2% year-on-year rise.

In October, domestic sales of new energy passenger vehicles reached 1.377 million units, showing a 6% month-on-month and 10.3% year-on-year increase. From January to October, cumulative domestic sales of new energy passenger vehicles reached 10.28 million units, showing a 24% year-on-year increase. From the perspective of domestic passenger vehicle sales, both traditional fuel and new energy passenger vehicles have shown growth, but new energy passenger vehicles have a higher growth rate.

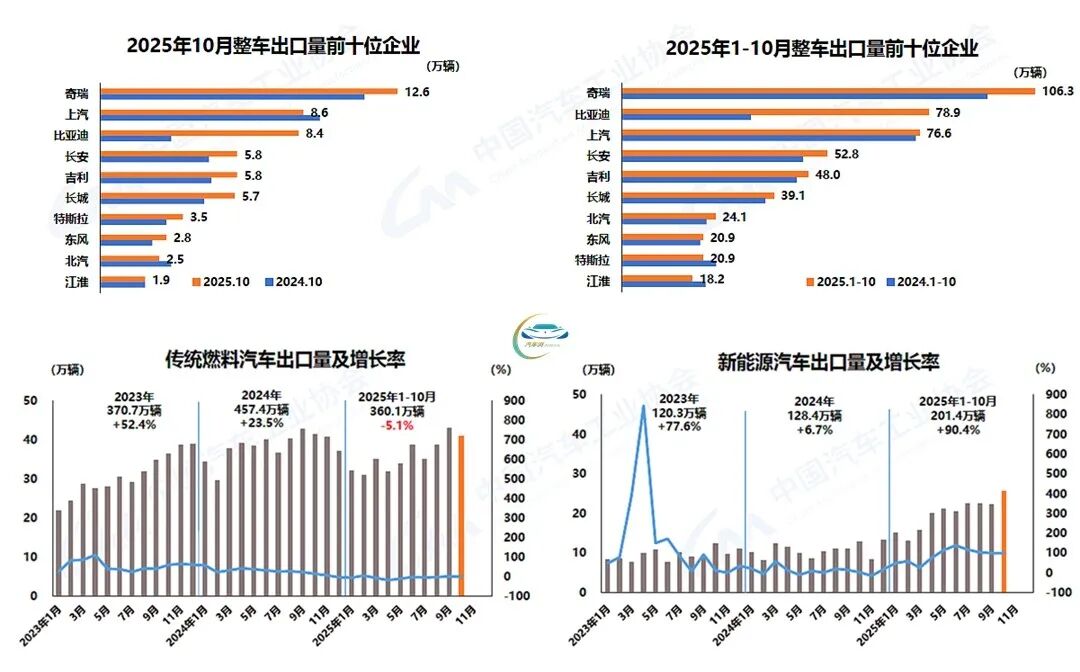

In contrast, in October, passenger vehicle exports reached 571,000 units, showing a 2.1% month-on-month and 22.8% year-on-year increase. From January to October, cumulative passenger vehicle exports reached 4.773 million units, showing a 16.4% year-on-year increase. Among them, exports of new energy passenger vehicles reached 250,000 units in October, showing a 15.3% month-on-month and a doubling year-on-year. From January to October, exports of new energy passenger vehicles reached 1.944 million units, showing an 89.3% year-on-year increase. Thus, new energy passenger vehicles, and even new energy commercial vehicles, have emerged as the fastest-growing export sectors.

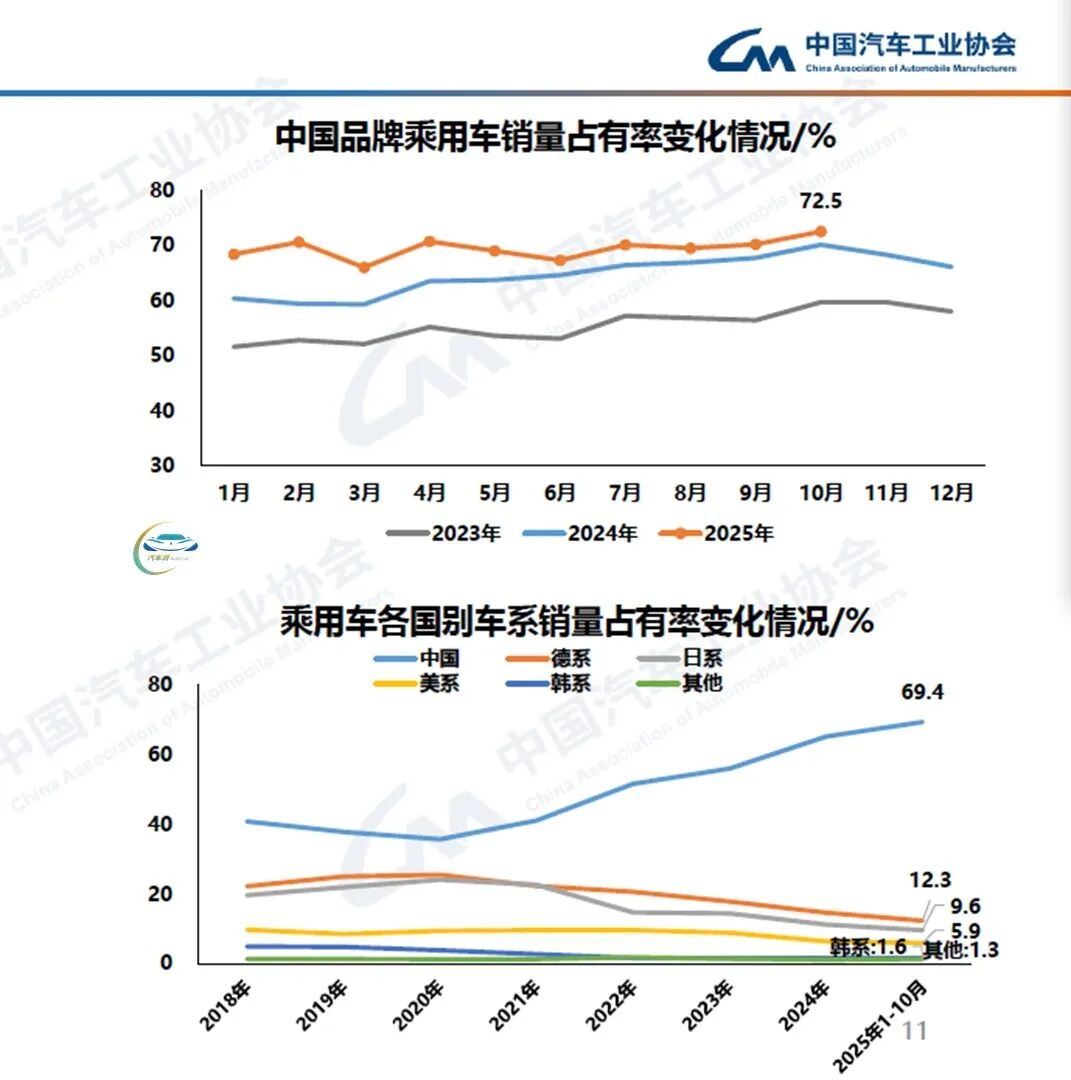

Chinese brand passenger vehicles continue to sustain robust growth, with sales reaching 2.148 million units in October, showing an 11.2% year-on-year increase, and a market share of 72.5%, showing a 2.4% year-on-year rise. From January to October, cumulative sales of Chinese brand passenger vehicles reached 16.799 million units, showing a 21.3% year-on-year increase, with a market share of 69.4%, showing a 4.8% year-on-year rise.

In contrast, the market shares of passenger vehicles from other countries remain relatively stable, with German and Japanese vehicles continuing to dominate.

Overall, both domestic sales and exports of automobiles have demonstrated growth. In October, the total automobile export volume reached 666,000 units, showing a 2.1% month-on-month and 22.9% year-on-year increase. From January to October, automobile exports reached 5.616 million units, showing a 15.7% year-on-year increase.

However, the CAAM also noted, "The current external environment is more complex and challenging." Therefore, sustaining stable growth in automobile exports is indeed no easy feat.

Among the exporting companies vying for market share, Chery maintains a leading edge, with not only whole vehicle exports increasing by 13% year-on-year to 126,000 units in October but also cumulative exports since the beginning of the year reaching 1.063 million units, showing a 12.9% year-on-year increase, accounting for 18.9% of the total export volume. BYD, on the other hand, is rapidly closing the gap: its exports increased by 1.8 times year-on-year in October, and cumulative exports increased by 1.4 times year-on-year.