Analysis: The Untold Story Behind Musk's $1 Trillion Stock Incentive Scheme

![]() 11/14 2025

11/14 2025

![]() 458

458

In our prior article, "Decoding Musk's Trillion-Dollar Payday: Products and Tech Roadmaps," we explored the products and technological strategies underpinning Musk's colossal compensation package. However, we didn't delve deeply into the intricate structure of this trillion-dollar equity arrangement. Online, the majority of discussions focus on the outcome—the trillion-dollar compensation—while overlooking the composition and inner workings of this monumental deal. Hence, this article aims to unravel: The untold story of Elon Musk's $1 trillion stock incentive plan.

What trends does this compensation plan signal for future growth? Ultimately, it may offer valuable insights and information for entrepreneurs launching new ventures or board members crafting incentive structures for professional managers.

Let's begin with a recap of the context: At the 2025 Tesla Shareholder Annual Meeting, shareholders of the electric vehicle pioneer voted in favor of a compensation plan for CEO Elon Musk, potentially awarding him up to $1 trillion in company stock over the next decade.

This updated plan bears resemblance to Musk's 2018 compensation pact, which was valued at $56 billion but faced legal hurdles that prevented its full realization.

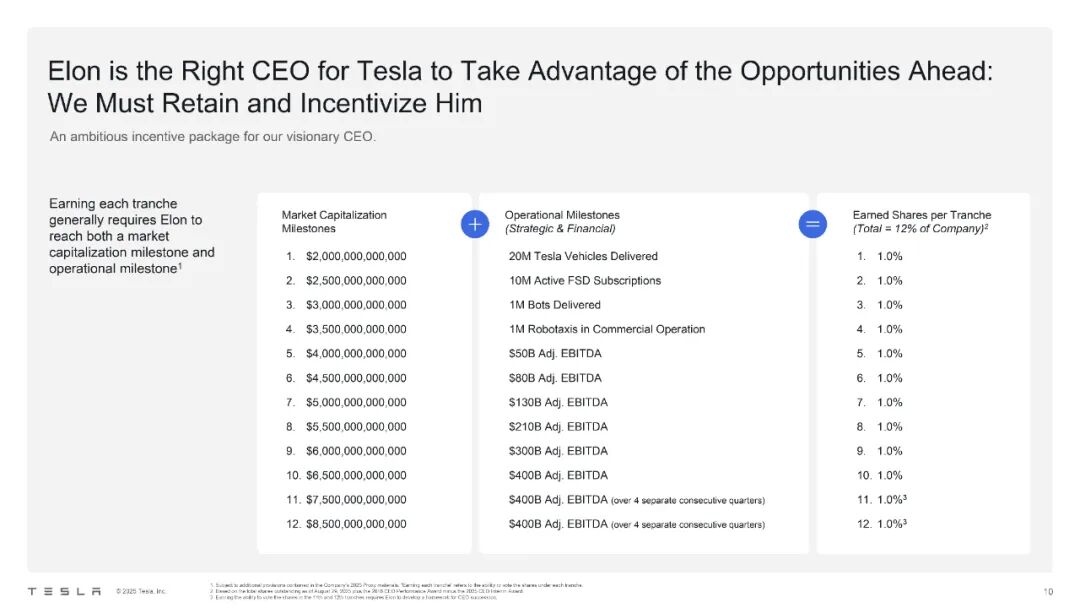

The revised plan is structured into 12 tranches. Each tranche represents roughly 1% of the total shares and will only be awarded upon the attainment of both market capitalization and operational milestones.

Here's a detailed breakdown of Elon Musk's trillion-dollar compensation plan: It comprises two key components—Tesla's stock performance and market valuation, alongside its operational efficiency and profitability.

Market Capitalization Milestones:

Musk's new compensation package is segmented into 12 stages. Compensation for each stage will only be unlocked once Tesla attains specific benchmarks.

Currently, Tesla's market value hovers around $1.5 trillion. Musk will not reap any benefits from this new compensation plan until Tesla's market value surpasses $2 trillion.

Subsequently, for every $500 billion increase in the company's market value, a portion of his compensation will be unlocked.

The ultimate objective is for Tesla's total market value to soar to $8.5 trillion by 2035.

Profitability and Delivery:

Adjusted EBITDA Target: Tesla must achieve $400 billion in adjusted core profit (EBITDA) over four consecutive quarters to unlock the final segment of Musk's compensation plan.

20 Million Vehicles: By 2035, Tesla must have produced a cumulative total of 20 million vehicles. To date, the company has manufactured over 8 million vehicles, implying that Musk must oversee the production of an additional 12 million vehicles—approximately 150% more than Tesla's current total production. This translates to producing roughly 2 million vehicles annually.

1 Million Autonomous Taxis: Tesla must have 1 million autonomous taxis in commercial operation for a minimum of three consecutive months. Presently, the pilot fleet in Austin comprises only a few hundred vehicles.

1 Million Optimus Humanoid Robots: The company must deliver 1 million units of its humanoid robot, Optimus, each priced at approximately $20,000. These robots are currently in the prototype phase.

10 Million Fully Self-Driving (FSD) Subscribers: Tesla must average 10 million FSD subscribers over three consecutive months. As of early 2025, only about 12% of Tesla owners have utilized the FSD service.

Additionally, there are several supplementary clauses:

CEO Succession Plan: The final two tranches of Tesla's stock issuance plan necessitate the board to devise and approve a CEO succession plan. Although specifics remain undisclosed, this clause prevents Musk from indefinitely retaining unvested shares post-resignation.

Musk Must Remain CEO: Elon Musk must continue to serve as CEO or in another executive capacity to receive each tranche of shares. Should he depart from Tesla before the 10-year term concludes, unvested shares will be forfeited unless extraordinary circumstances, such as a change in control, arise.

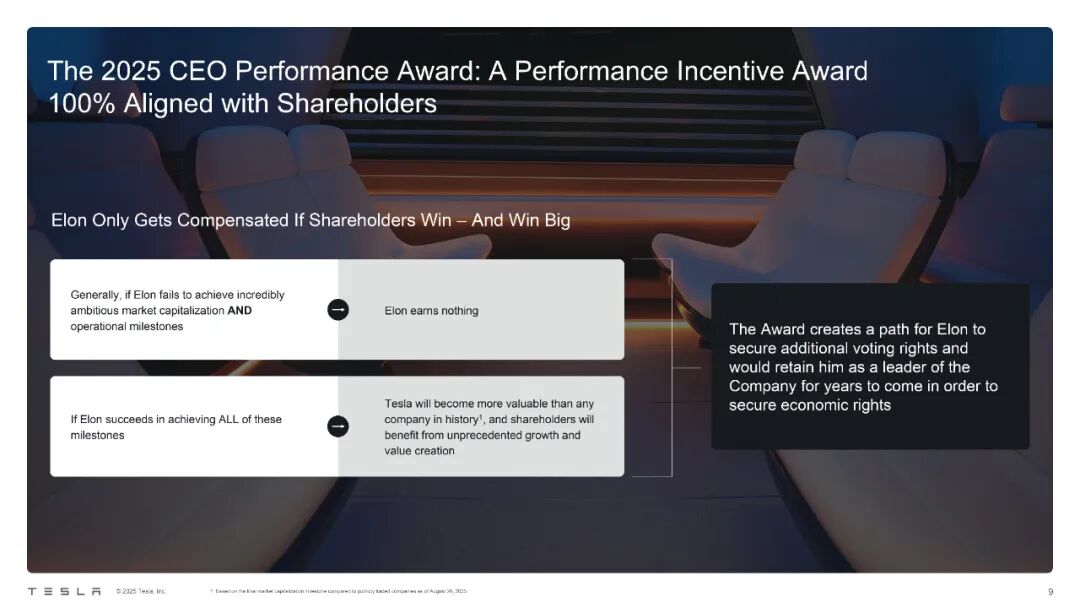

Tesla has publicly declared that under this plan, Musk will not receive any salary or bonuses; its value is entirely contingent upon performance-based share unlocks.

Ultimately, Musk's trillion-dollar compensation plan has emerged as the largest corporate compensation scheme in history, primarily reflecting investors' acknowledgment of his vision to transform the electric vehicle manufacturer into an artificial intelligence and robotics powerhouse.

Reference Articles and Images

Tesla Shareholder Meeting PPT - October 2025

*Reproduction and excerpting strictly prohibited without permission - How to obtain reference materials for this article: