Li Xiang Reflects During Tough Times, Unveils New Decade Strategy: Three Pillars for LI Auto's Future | MINGJINGpro

![]() 12/01 2025

12/01 2025

![]() 582

582

"Over the past three years, my entrepreneurial team and I have delved deep into the management frameworks of professional managers, pushing ourselves to adapt to a myriad of changes. Yet, we've found ourselves performing worse than before," Li Xiang, CEO of LI Auto, candidly remarked at the company's Q3 2025 financial results briefing on November 26. LI Auto transitioned from profitability to a loss in Q3 2025, largely due to the early recognition of costs associated with the MEGA recall, sparking concerns among market analysts about the company's future trajectory.

In response to the short-term operational setbacks, Li Xiang succinctly noted, "We've grappled with challenges stemming from product cycles, PR issues, supply chain scaling, policy shifts, and more, all of which have impacted our delivery volumes and operations." Subsequently, Li Xiang dedicated a significant portion of his time to outlining his "long-term vision," detailing how LI Auto intends to navigate its future.

Li Xiang segmented LI Auto's development into two ten-year phases, with this year's Q3 marking the inaugural quarter of the second decade. After navigating this initial period, Li Xiang unveiled his latest strategic insights, visionary concepts, and long-term objectives, providing a glimpse into LI Auto's plans for the next decade.

From Li Xiang's perspective, the three most pivotal keywords for the second decade are organization, products, and technology—key areas where LI Auto's future decisions will be concentrated. "These three critical choices will lay the groundwork for our second decade, which promises to be even more challenging than the first," Li Xiang stated. The latest buzz surrounds LI Auto's decision to abandon its pursuit of emulating Huawei.

Li Xiang explained that during the first decade, LI Auto embraced a startup management model for the initial seven years. As the company expanded, it transitioned to a professional manager model in 2022, a period dubbed externally as the "comprehensive Huawei learning phase." So, why the shift away from this model?

Li Xiang elaborated that the professional manager model is more apt for industries and technologies with relatively stable cycles, where companies hold a leading and stable market position, and founders have stepped back from day-to-day operations. Given LI Auto's current development stage and industry environment, this management philosophy and its components are clearly not a fit. Hence, LI Auto has decided to revert to a founder-led management approach. "In today's landscape, where AI is reshaping industries, our environment and characteristics align more closely with those of a startup," Li Xiang remarked.

The entrepreneurial model transcends the literal definition of a "startup." Its essence lies in fostering deep communication, prioritizing user value, enhancing efficiency, and identifying key issues. In essence, it involves continuously meeting user needs in a fiercely competitive and rapidly evolving environment through a more direct and efficient approach. This philosophy is also credited as one of the reasons behind LI Auto's initial success. After several years of adjustments, Li Xiang's assessment is that companies like NVIDIA and Tesla continue to operate as startups today—if the world's leading companies adopt a startup management model, then LI Auto has no reason to abandon its most adept approach.

Organizational alignment is crucial, but the more pressing question is what problems LI Auto truly aims to solve for its users: what products will it offer, and where is its technological focus?

01 Gazing Ahead: Product and Technology Choices to Capture the Next Trillion-Dollar Market

In its first decade, LI Auto redefined the family SUV segment, creating a new blue ocean market through product innovation and creative enhancements in extended-range technology. Blockbuster products like the LI ONE and LI L series garnered widespread market and user acclaim upon launch, swiftly propelling LI Auto to the forefront of the new energy vehicle sector, achieving revenue exceeding 100 billion yuan and profitability ahead of its peers.

Starting in 2024, LI Auto adopted a dual-track product strategy encompassing extended-range and battery electric vehicles (BEVs). Notably, LI Auto achieved success in its BEV business this year, realizing a two-pronged approach. In 2024, LI Auto introduced the BEV MPV model MEGA. Despite initial design controversies, after a year of market recognition for its high reputation and product strength, LI Auto secured the top position in the high-end BEV market, particularly in the 500,000+ yuan segment. The launch of the 2025 MEGA Home further validated LI Auto's product definition capabilities.

Particularly noteworthy are the two BEV SUVs launched by LI Auto this year, catering to the mainstream and high-end family BEV markets. Currently, cumulative orders for these BEV SUVs exceed 100,000 units. After Xiaomi, LI Auto has emerged as the most successful new entrant in the BEV market.

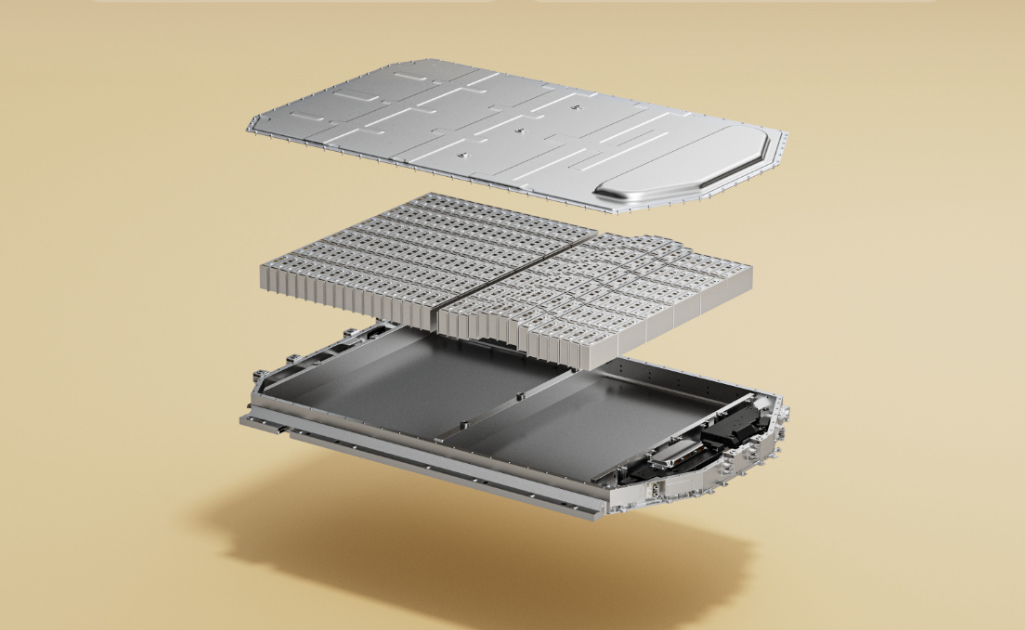

Ma Donghui, President of LI Auto, announced at the financial results briefing on November 26 that the i series has achieved significant breakthroughs in penetration rates in key regions, particularly Shanghai, Beijing, and the Jiangsu-Zhejiang area. Orders for the i series in these core BEV markets surged in September. Additionally, in response to current supply chain constraints, LI Auto initiated a dual-battery supplier model for the i6 starting in November. Ma Donghui assured that battery performance and quality standards would remain consistent between the two suppliers.

LI Auto is currently fully engaged in ramping up production capacity, with expectations to steadily increase monthly production capacity of the i6 to 20,000 units by early next year. This signifies that the BEV segment will enter a volume growth phase in 2026, laying the foundation for long-term stable growth in LI Auto's BEV business and complementing its extended-range offerings.

However, automobiles are just the first step. Over the next decade, LI Auto is truly aiming for embodied AI. "When products remain as 'electric vehicles,' the competition logic devolves into a parameter war—ranging from driving range to body length and lower prices. If we choose to be intelligent terminals, we'll focus more on what's inside the screen, inevitably repeating smartphone functionalities," Li Xiang said. He predicts that over the next decade, the most valuable products in embodied AI will be automobiles with autonomous and proactive capabilities. LI Auto aims to achieve revenue exceeding 100 billion yuan in this field.

From automobiles to automotive robots, and then to embodied AI, Li Xiang has a clear technological roadmap. He believes that to excel in embodied AI, constructing an AI system distinct from linguistic intelligence is paramount. Building such a system requires numerous urgent changes. For this reason, LI Auto embarked on its journey three years ago, which is why it chose to self-develop the M100 chip. "Our technological reserves for a complete embodied AI system over the past three years fill us with confidence for our next-generation products," Li Xiang said.

02 Staying Grounded: Accelerating Product Matrix Updates to Regain Market Leadership

If the decade-long plan represents LI Auto's ambition, then the strategies for the L and i series constitute pragmatic measures to safeguard its foundation, expand markets, and respond to competition. LI Auto's core product strategies revolve around three keywords: return, accelerate, and personalize. Ma Donghui stated that for the L series, LI Auto will return to a streamlined SKU model, balancing market coverage and supply efficiency, ensuring a full-featured core experience across the range, and eliminating the pain point of compromised entry-level versions.

Personalization entails deviating from previous template designs. On one hand, it will continue the family's classic design genes while enhancing luxury texture to balance high brand recognition and fresh user experiences, creating product forms that better cater to family needs. Technologically, the entire lineup will feature standard 5C ultra-fast charging, expanding the ultra-fast charging network to alleviate range anxiety. Subsequently, in terms of overall vehicle product strength and systematic AI capabilities, it will surpass the leading standards set by the LI L9 era in 2022. With core self-developed chips and 5C batteries integrated into new products, LI Auto's competitiveness becomes even more anticipated.

Simultaneously, the pace of updates for the LI L series will accelerate—previously, LI Auto's slow product launch speed was considered the primary reason for recent pressures faced by the L series. Through these actions, LI Auto aims to further solidify its brand recognition as the leader in extended-range technology while expanding incremental markets in the BEV sector. "By 2026, we are confident in achieving a historical breakthrough in delivery volumes, leveraging product strength and user value to navigate cycles and consolidate our leading position in the high-end market," Ma Donghui said. With next year's new product lineup, comprehensive upgrades in extended-range product strength, and continued expansion in BEV products, LI Auto has a strong chance of regaining market leadership.

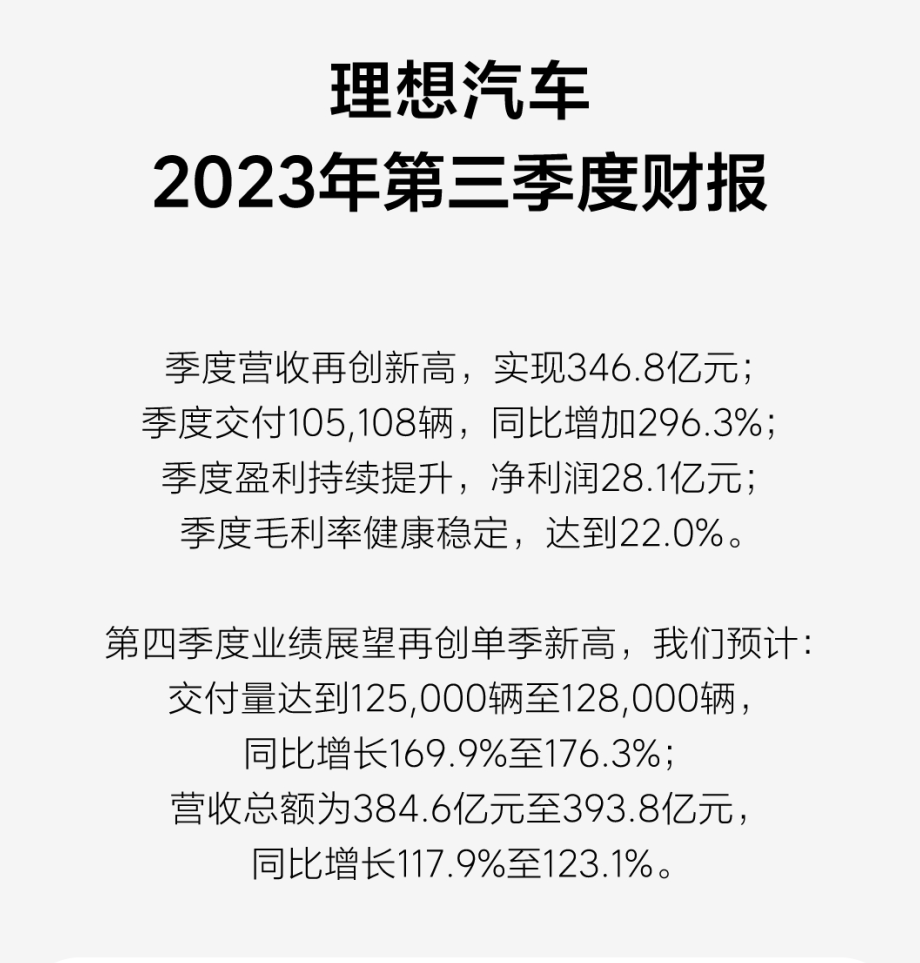

In reality, judging by LI Auto's Q3 financial report, after excluding the financial impact of the MEGA recall, overall performance slightly exceeded market expectations. For instance, the true gross profit margin from car sales this quarter was 19.8%, a slight 0.4 percentage point increase from the previous quarter, generally aligning with LI Auto's projected range of 19%-20%. This was primarily due to Q3 car sales revenue of 25.9 billion yuan, surpassing market expectations. According to analyst estimates, the core reason was that LI Auto's BEV Mega and i8 models drove the continued upward shift in the model mix, with the average selling price per vehicle increasing by 17,000 yuan from the previous quarter.

Driven by the sequential increase in true gross profit margin, despite continued growth in R&D expenses, the "true" net profit after excluding the MEGA recall impact was 490 million yuan, slightly exceeding market expectations. Q3 revenue reached 27.4 billion yuan, maintaining a leading position among new energy vehicle manufacturers. In comparison, NIO reported 21.79 billion yuan, XPENG reported 20.38 billion yuan, and Leapmotor reported 19.45 billion yuan for the same period.

03 Building New Moats: Continuously Strengthening Technological Investment to Seize the Intelligence Vanguard

For LI Auto, Q4 will also be a period of adjustment. However, LI Auto's speed of self-adjustment and product definition capabilities constitute its unique competitive edge. Historically, whether it was the LI ONE, LI L series, LI MEGA, or LI i series, LI Auto has consistently chosen to break conventions rather than follow, innovating fundamentally based on user needs. Moreover, the LI i series fully demonstrates its rapid market response capabilities, going from a comeback with the Mega and i8 to becoming a top market product.

Many are learning from LI Auto, but they merely replicate its product paths without acquiring its innovative capabilities in market creation and product definition. Furthermore, LI Auto's substantial R&D investments will soon become its second moat.

LI Auto's R&D investment for 2025 is projected to be between 11 and 12 billion yuan, with over 6 billion yuan allocated to AI, accounting for nearly half of the R&D expenditure. Approximately 2.7 billion yuan will be invested in AI infrastructure (45% of AI investment), including foundational models, inference chips, operating systems, terminal computing power, and cloud computing power. Meanwhile, 3.3 billion yuan will be invested in AI product technology R&D (55% of AI investment), covering VC large models, LI Assistant, intelligent agents, intelligent cockpits, intelligent industry, and intelligent commerce.

On the software front, LI Auto upgraded its VLA large model in Q3, enhancing stability, flexibility, comfort, and user interaction capabilities, now integrated into all new models. Simultaneously, Ma Donghui revealed that on the hardware front, LI Auto is increasing its investment in self-developed chips, with the self-developed M100 chip currently in large-scale testing. It is designed to collaborate with LI Auto's foundational models, compilers, and software systems to achieve the highest efficiency in AI capabilities, potentially offering a threefold improvement in cost-effectiveness for the next generation of products. Ma Donghui stated that the chip will enter mass production in 2026 and be equipped in LI Auto's models.

From being the least favored among the "Three Little Dragons" of new energy vehicle startups (due to skepticism towards extended-range technology and facing the toughest funding challenges) to successfully reversing its fortunes with blockbuster products like the LI ONE and LI L9 to become an industry leader, LI Auto has consistently been an independent and distinct automaker, synonymous with ultimate efficiency and strong innovation. However, every company experiences peaks and troughs in development. As competitors swarm in, LI Auto must readjust its stance to face challenges. Li Xiang said that future competition hinges not on immediate gains but on long-term directional choices and sustained investment resolve.

Capitalizing on its robust financial base and unwavering focus, LI Auto, when it realigns with its core ideals, is poised to effortlessly ride through economic cycles, spearhead technological advancements, and evolve into a company that continually generates enduring value for both its users and society at large.