Q3 Financial Report Unveils the Truth: Can Geely Break Through BYD's Defensive Barrier?

![]() 12/01 2025

12/01 2025

![]() 425

425

Lead | Introduction

During the era of fuel-powered vehicles, Geely stood out as the most brilliant star among independent brands. However, in the race for new energy vehicles (NEVs), it found itself trailing behind BYD. Yet, the landscape is shifting as we approach 2025—Geely is rapidly closing the gap, and the once seemingly insurmountable barrier that BYD had erected is now shrinking fast. The battle for supremacy in China's auto market has reignited, with both contenders vying for the crown.

Published by Heyan Yueche Studio

Written by Zhang Dachuan

Edited by He Zi

Full text: 2,921 characters

Reading time: 4 minutes

With Geely Auto unveiling its third-quarter financial report on November 17, the top two domestic automakers by sales volume, BYD and Geely, have both released their results for the first three quarters. The race for the top spot in the domestic market sales has entered a fierce, head-to-head phase.

△ The competition for the top spot in China's auto market intensifies following the release of Q3 financial reports by Geely and BYD.

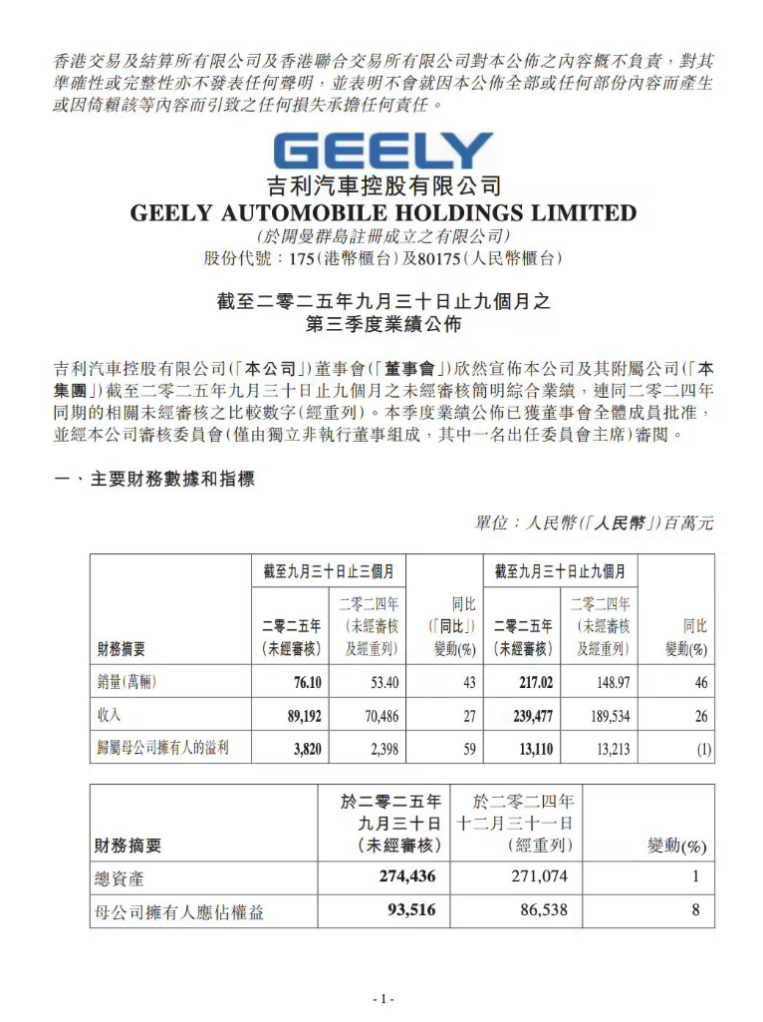

Geely's Q3 Sales Surge 43%, but BYD Still Leads

According to Geely Auto's Q3 financial report, the company sold 761,000 vehicles in the quarter, marking a 43% year-on-year increase. Revenue reached RMB 89.192 billion, up 27% year-on-year, while net profit attributable to shareholders of the listed company was RMB 3.82 billion, a 59% year-on-year surge. Amidst intensifying competition in China's auto market, Geely Auto has demonstrated robust growth across sales, revenue, and profit, showcasing strong business resilience.

△ Geely's Q3 financial report results are highly impressive.

In contrast, BYD's Q3 financial report revealed a sales volume of 1.1142 million vehicles, down 1.82% year-on-year. Revenue stood at RMB 194.985 billion, a 3.05% year-on-year decrease, while net profit attributable to shareholders was RMB 7.823 billion, marking a 32.60% year-on-year decline. Although BYD still leads in overall sales and revenue, several core metrics have seen a year-on-year drop. Meanwhile, Geely Auto has shown strong growth momentum during the same period, narrowing the market competition gap between the two.

BYD's overall sales lead is primarily attributed to its rapid growth in overseas markets. From January to September this year, BYD's cumulative overseas sales reached 697,100 vehicles, up 136% year-on-year, accounting for 21.38% of the brand's total sales.

To strengthen its global presence, BYD arranged the rollout ceremony for its 14 millionth NEV at its Brazilian factory and launched the pure electric microcar BYD RACCO for the Japanese market. In Europe, BYD is accelerating its localization process, with production bases in Hungary and Turkey, and its third European factory expected to be established in Spain.

Compared to the fierce competition in the domestic market, BYD faces less price pressure and lower expansion difficulties overseas, making its international business a key pillar of overall performance growth.

△ Brazilian President Lula attended BYD's 14 millionth NEV rollout ceremony in Brazil.

BYD's Financial Performance Under Pressure, Growth Model Faces Market Scrutiny

According to BYD's Q3 financial report, net profit attributable to shareholders was RMB 7.823 billion, marking a year-on-year decline for the second consecutive quarter. In terms of profitability, BYD's gross margin for the first three quarters was 17.87%, down 2.89 percentage points year-on-year, while net margin was 4.28%, down 0.95 percentage points year-on-year. The gross margin in Q3 alone fell by 2.51 percentage points year-on-year. Additionally, net profit per vehicle in Q3 was RMB 5,800, rebounding slightly from the previous quarter but still showing a year-on-year decline.

In the global NEV market, one of BYD's core strengths lies in its significant cost control advantage through vertical integration of the supply chain. However, with its gross margin continuing to decline, its financial flexibility to initiate or respond to price wars may narrow in the future.

Currently, the factors affecting BYD's profit performance mainly include the following three aspects:

First, intense market competition. Against the backdrop of overcapacity in China's auto market, price competition has become a widespread phenomenon in the industry. Despite relevant guidance documents issued by authorities, automakers still tend to adjust prices to maintain sales volume in a market where supply exceeds demand.

BYD faces competitive pressure from multiple fronts: on one hand, it must contend with market competition from Geely, Great Wall, and joint-venture brands like Volkswagen and Toyota; on the other hand, it is also impacted by brands like Leapmotor and XPENG in the entry-level market. To maintain market share, BYD has introduced subsidy policies for key models such as the Qin PLUS and Song Pro, directly participating in price competition. While this strategy has stabilized sales, it has also directly impacted overall gross margins.

△ Entry-level models from XPENG and Leapmotor have diverted a significant portion of BYD's sales.

In the current market competition, Geely's Galaxy series, positioned as a rival to BYD's Dynasty and Ocean series, is continuously expanding its market influence through a targeted "high-spec, low-price" product strategy. Models in this series generally offer higher specifications than comparable BYD models while being more competitively priced, a differentiated competitive approach that has diverted sales away from BYD.

So far, Geely's Galaxy series has launched multiple models, including the E5, E8, L6, L7, Xingyuan, Xingjian 7EM-i, Galaxy Xingyao 8, Galaxy A7, and Galaxy M9, covering mainstream segments from compact to full-size vehicles and forming a relatively complete product matrix. It has become a key competitor to BYD in the mid-range NEV market.

△ The rapid expansion of Geely's Galaxy series has posed direct pressure on BYD.

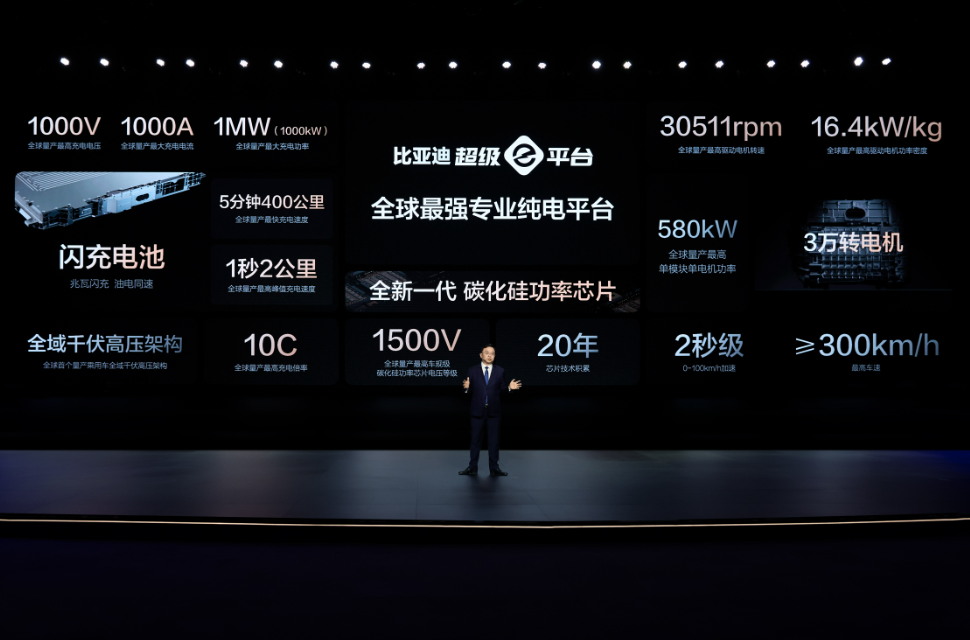

Second, sustained high R&D investment. BYD's continuously increasing R&D expenditure is one of the factors putting pressure on its profit performance. In the first three quarters of this year, the company's R&D expenses reached RMB 43.75 billion, up 31.3% year-on-year, surpassing its net profit of RMB 23.333 billion during the same period and exceeding the R&D investment level of industry leader Tesla.

High-intensity R&D efforts have driven the implementation of multiple technological achievements, including the Super e-Platform integrating megawatt-level flash charging, a 30,000-RPM high-performance motor, and a full-domain kilovolt high-voltage architecture, as well as the fifth-generation DM technology, which reduces fuel consumption during battery depletion to 2.4–2.6L/100km. Additionally, BYD has provided safety guarantees and liability commitments for the intelligent parking function in its "Divine Eyes" advanced driver-assistance system this year.

To maintain its leading position in NEV technology competition, BYD is expected to continue maintaining high levels of R&D investment.

△ BYD's massive investment in R&D has become one of the main reasons dragging down its financial report data.

Third, brand elevation challenges. The low sales proportion of BYD's high-end brands is one of the factors affecting its overall profitability. In the first three quarters of this year, the combined sales of the Fangchengbao, Tengshi, and Yangwang brands reached 223,000 vehicles, up 83.5% year-on-year but accounting for only 6.8% of the brand's total sales.

Increasing the sales proportion of high-end models is an important way to improve profit structure, but competition in the high-end market relies more heavily on brand heritage. Taking AITO and Zeekr as examples, their market performance is closely tied to brand empowerment from Huawei and Geely, respectively. Similarly, Geely's Zeekr brand also faces competitive pressure from competitors like HiPhi.

For BYD, brand elevation must be pursued as a long-term strategy. In the short term, its profit support will still mainly rely on the stable performance of the Dynasty and Ocean series in the mid-range market.

△ The relatively limited sales proportion of BYD's high-end brand models poses challenges to improving its overall profitability.

The Monthly Sales Gap Between the Two Has Narrowed

According to data released by the China Passenger Car Association for October, BYD sold 296,000 vehicles, down 31.4% year-on-year; Geely Auto sold 266,000 vehicles, up 36.8% year-on-year. The monthly sales gap between the two has narrowed to 30,000 vehicles.

From the perspective of market performance in China, the competitive situation of the two companies is approaching parity. Additionally, Geely still maintains a certain scale of fuel vehicle business outside its NEV operations. With the further phase-out of domestic NEV subsidy policies in 2026, Geely's performance in the fuel vehicle market is expected to receive some support.

△ As China's NEV subsidy policies gradually phase out, Geely Auto, which still maintains a fuel vehicle business, is expected to receive some structural support in market competition.

Meanwhile, Geely Auto is accelerating its overseas expansion to narrow its gap with BYD in this area. In the first ten months of this year, Geely's overseas exports reached 337,700 vehicles, up 23% year-on-year; BYD's overseas sales during the same period are expected to exceed one million units. In terms of both total volume and growth rate, Geely still lags behind BYD.

To enhance its global footprint, Geely is promoting localized production through various means: in South Korea and Brazil, it has achieved local production capacity by acquiring stakes in Renault factories; in Malaysia, it is leveraging Proton for technology export. Additionally, Geely recently launched a new model in the UK and set a target of exceeding 100,000 local sales by 2030.

Compared to the fiercely competitive domestic market, overseas NEV markets offer greater growth potential and higher per-vehicle profit margins. To achieve overall competitiveness on par with BYD, Geely needs to make substantive breakthroughs in overseas markets.

△ Geely's EX5 launch event in the UK signals a new round of European market expansion.

Commentary

In China's increasingly competitive auto market, BYD is facing a critical strategic inflection point. In recent years, BYD has allocated more resources to mid-to-high-end brands like Fangchengbao and Tengshi, while its Dynasty and Ocean series, targeting the mainstream market, have lacked significant breakthroughs beyond configuration upgrades. As homogeneous competition intensifies, achieving differentiated breakthroughs in these core volume models has become an urgent issue for BYD. Meanwhile, competitors like Geely are leveraging their latecomer advantage to continuously erode BYD's market share. As the industry enters the "second half" dominated by intelligence, whether BYD can replicate its first-mover advantage in electrification will directly determine its future market position.

(This article is an original work by Heyan Yueche and may not be reproduced without authorization.)