Which Domestic High-End Auto Brand Excels? 20 Auto Brands Compete in an Elimination Round

![]() 12/02 2025

12/02 2025

![]() 420

420

“Monthly Sales Exceeding 10,000 Units Is the Baseline” Author | Zhen Yao Editor | Li Guozheng Produced by | Bangning Studio (gbngzs)

As December begins, major automakers are eagerly releasing their sales figures for November 2025, creating a buzz as they strive to meet year-end targets.

On one hand, next year will see adjustments to NEV purchase taxes, prompting many consumers to make purchases before policy changes. On the other hand, automakers are offering substantial subsidies and promotions. This dual stimulus has led many brands to achieve record-high monthly sales.

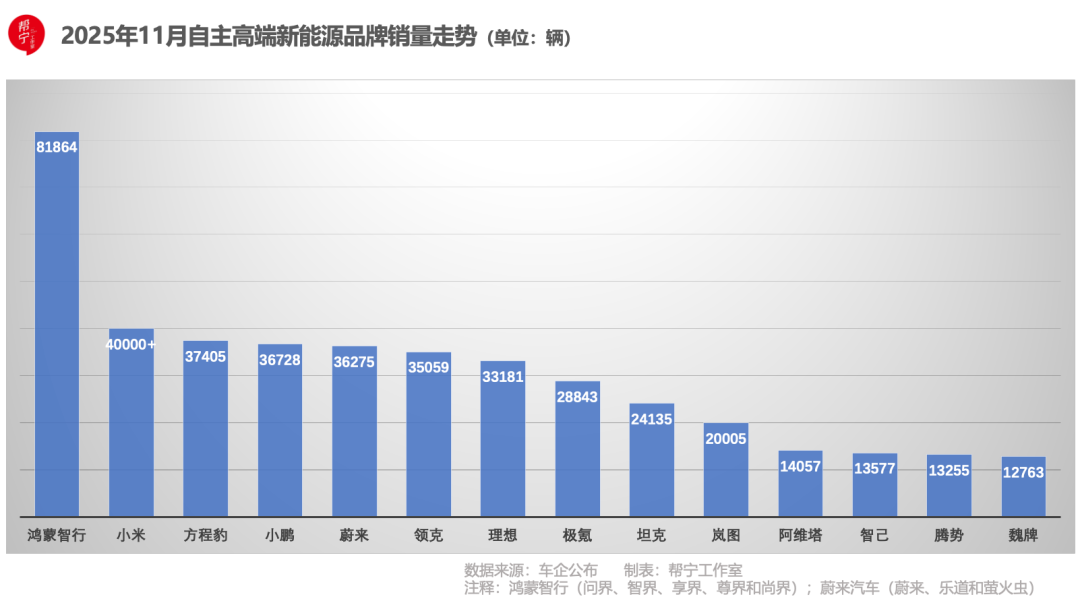

From the announced sales figures, Hongmeng Zhixing leads with 81,864 units, followed by Xiaomi Motors exceeding 40,000 units, Voyah at 20,005 units, Avatr at 14,057 units, and IM Motors at 13,577 units, indicating strong performance among domestic high-end brands.

However, beneath these numbers, automakers are clearly on edge.

The fiercest competition now lies not in the low-end market below RMB 100,000 nor in the luxury market above RMB 1 million, but in the high-end NEV sector above RMB 200,000.

This is the battleground where automakers can least afford to lose. After all, the high-end market not only generates profits but also enhances brand reputation. Those who establish a foothold here will gain the initiative in future competition.

Particularly for traditional automotive groups like Dongfeng, Changan, and SAIC, their OEM-backed brands such as Voyah, Avatr, and IM Motors not only impact their own growth but also their strategic layout (strategic layouts).

Of course, new forces like NIO, Li Auto, XPENG, and Xiaomi Motors dare not slack off.

In November, Li Auto delivered 33,181 units, ranking first in the industry horizontally but experiencing a 31.92% year-on-year decline.

“Initially, the industry expected a year-end surge, with some optimism in late October. However, in November, new orders across the industry dropped significantly, with most consumers adopting a wait-and-see approach,” said Li Bin, Chairman of NIO, at a recent closed-door financial results meeting.

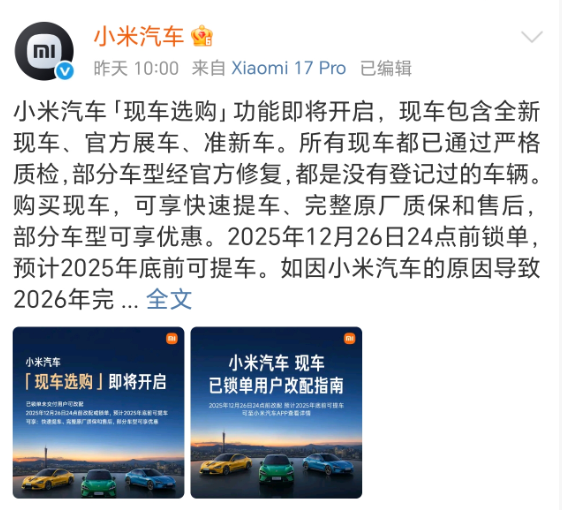

Xiaomi Motors took a more direct approach, announcing “spot vehicle purchases” on December 1. Previously, wait times could extend up to a year, but now customers can purchase vehicles immediately, with discounts available on some models.

December marks the end of 2025 but also a new beginning. The competition in the domestic high-end NEV sector is just heating up.

▍01 Li Auto and Xiaomi Face Pressure as Hongmeng Zhixing Rises

Among the new forces, brand positioning varies.

NIO, Li Auto, and Xiaomi Motors focus on the high-end sector, with average product matrix prices exceeding RMB 200,000. Leveraging technological configurations, brand positioning, and user experience, they cater to mid-to-high-end consumer groups, solidifying their competitive positions in the high-end market.

XPENG adopts a high-low product strategy, launching high-end models like the P7 and X9 extended-range supercars priced over RMB 300,000, while relying on the Mona 03, priced around RMB 100,000, as its main volume driver. The latter accounts for nearly half of its sales, effectively boosting overall sales but diluting the brand's high-end image.

Leapmotor resembles “Uniqlo in the automotive circle,” offering a diverse model lineup covering home commuting and daily travel, but primarily focusing on cost-effectiveness.

November sales reflect this differentiation.

NIO achieved full matrix growth through synergistic brand layout (brand layouts): the NIO brand solidified its high-end position with models like the ES8 and ES6; the Onvo brand demonstrated breakthrough capabilities in the mid-to-high-end market with an average transaction price of RMB 260,000; and the Firefly brand continued to gain traction in the entry-level market, creating a synergistic effect.

XPENG broke through via product iteration and market strategies. X9 deliveries surged 161% month-on-month, with the extended-range supercar version favored by northern users, validating the market adaptability of its dual technology routes. Overseas sales grew nearly 95% year-on-year, becoming a second growth engine, while international layout (international layouts) alleviated domestic competitive pressure.

Li Auto faces transformation challenges. November deliveries declined 31.92% year-on-year, coupled with Q3 revenue and profit pressures, reflecting the daunting task of transitioning from extended-range to extended-range + pure electric models.

Despite over 100,000 cumulative orders for its pure electric models, the i8 and i6, and a 91% penetration rate for its self-developed VLA driver model, short-term production bottlenecks and MEGA recall costs continue to impact performance.

These strategic moves by leading new forces hint at the core directions of next year’s industry competition.

At the financial results conference call, Li Xiang, CEO of Li Auto, reflected on the company’s approach, stating a shift away from the professional manager governance system implemented over the past three years to a startup management model as a pivotal choice for the next decade.

His goal is for Li Auto to become the “best-performing and highest user value” enterprise in embodied intelligence within the next five years.

● Li Xiang, CEO of Li Auto

● Li Xiang, CEO of Li Auto

Li Bin directly stated NIO’s confidence in achieving profitability in Q4 this year, a company operational goal. “By 2026, our aim is to achieve full-year profitability,” he said.

Regarding next year’s market trends, He Xiaopeng, Chairman and CEO of XPENG, predicted: “Every automaker is cautious. The only certainty is that competition in the 2026 automotive market will be even more brutal and bloody.”

Xiaomi Motors, once buoyed by hype, also feels the chill.

On December 1, Xiaomi Motors officially launched “spot vehicle purchases,” honestly stating that some available vehicles were previously ordered but unclaimed, effectively liquidating inventory—a scenario unimaginable for consumers before.

A clearer signal is the shrinking wait times for Xiaomi vehicles. Orders for the SU7-Pro and SU7-Max now take 3-6 weeks to fulfill, while delivery times for the previously long-wait YU7 have advanced by up to 7 weeks.

Over the past three months, Xiaomi has consistently delivered over 40,000 units monthly, yet production capacity has barely increased. This indicates a slowdown in new order growth.

Whether it’s “Wei Xiaoli” (NIO, XPENG, Li Auto) or Xiaomi Motors, their pressure largely stems from a formidable rival—Hongmeng Zhixing.

On December 1, Hongmeng Zhixing announced its November performance: 81,864 units delivered, soaring nearly 90% year-on-year. It set another record, having delivered 68,216 units in October and surpassing 1 million cumulative deliveries among new forces in the shortest time.

Most impressively, Hongmeng Zhixing’s October average transaction price reached RMB 390,000, surpassing traditional luxury brands like BBA and ranking highest among domestic mainstream brands with monthly sales exceeding 10,000 units.

As Huawei’s intelligent automotive technology ecosystem alliance, Hongmeng Zhixing has built a product matrix covering the RMB 150,000-1 million market, encompassing five partner brands: Aito (Seres), Luxeed (BAIC), Smart (Chery), Maextro (JAC), and Shangjie (SAIC), spanning mainstream home use to top-tier luxury markets.

While Li Auto faces declines and Xiaomi’s order growth slows, Hongmeng Zhixing surges ahead, intensifying competition among new forces.

▍02 OEM-Backed Brands Clash in High-End Arena: Monthly Sales Exceeding 10,000 Units Is the Baseline

In the domestic high-end NEV sector, brands incubated by traditional automotive giants have emerged as a core force.

Here, OEM-backed brands like Voyah, Mengshi, IM Motors, Avatr, Zeekr, Wey, Tank, Fangchengbao, and Denza compete fiercely, with most maintaining monthly sales between 10,000-20,000 units, showcasing comparable overall strength.

For traditional automakers, the NEV transformation path reveals a stark contrast: easy volume growth in the low-end market but difficult breakthroughs in the high-end sector. Sales performance in the above RMB 200,000 high-end market directly tests a company’s core capabilities in technology R&D, product design, and brand premium.

The sales of these OEM-backed high-end brands serve as a litmus test for their parent groups’ NEV reform effectiveness, directly impacting future development.

November sales clarified the landscape. Voyah stood out, exceeding 20,000 monthly deliveries for the first time, up 84% year-on-year, becoming a benchmark for high-end NEVs among state-owned enterprises.

Other brands had their highlights:

Geely’s Zeekr Technology delivered 63,900 units in November, with combined efforts from Zeekr and Lynk & Co;

Changan’s Avatr delivered 14,057 units, up 21.4% year-on-year, succeeding in its intelligent high-end route;

Dongfeng’s Voyah exceeded 20,000 units, while its hardcore high-end brand, Mengshi, delivered 2,007 units, up over 38.4% month-on-month;

SAIC’s IM Motors delivered 13,577 units, solidifying its position in the high-end NEV market;

Great Wall’s Wey brand surged 81.14% year-on-year with 12,763 deliveries; Tank dominated the high-end off-road segment with 24,135 units.

BYD’s Fangchengbao delivered 37,405 units in November, up 339% year-on-year, with cumulative sales exceeding 240,000 units and an average transaction price near RMB 240,000.

The collective rise of these OEM-backed brands shatters the bias (bias) that “traditional automakers struggle in high-end NEVs.” Compared to new forces, their strengths lie in mature supply chain systems and manufacturing capabilities. Their breakthroughs stem from rapid responses to NEV consumption trends—from intelligent cockpit iterations to user service upgrades.

However, before these OEM-backed brands could celebrate, a more intense competitive storm brews.

In 2026, the domestic high-end NEV sector will welcome two heavyweight newcomers—at the Huawei Qiankun Ecosystem Conference held on the eve of the 2025 Guangzhou Auto Show, Huawei Qiankun launched the Qijing and Yijing brands, with products set to debut next year.

This means that by 2026, the number of domestic high-end NEV brands will reach 20, intensifying sector crowding and shifting the market from incremental to stock competition.

“An industry consensus has formed,” noted an industry insider. “For each domestic high-end NEV brand, failing to exceed 10,000 monthly sales or lingering around that threshold will lead to direct elimination.”