Joint Venture Brand Electric Vehicles Face Hurdles: Can Dongfeng Nissan Unleash a Dark Horse?

![]() 12/03 2025

12/03 2025

![]() 431

431

Introduction | Lead

The Dongfeng Nissan N7, a model embodying Dongfeng Nissan's electrification ambitions, has witnessed a dramatic decline in monthly sales, plummeting from over 10,000 units to a rapid fall in the past six months since its debut. Can it make a remarkable comeback? Following the N7, Dongfeng Nissan has now introduced the N6.

Produced by | Heyan Yueche Studio

Written by | Cai Yan

Edited by | He Zi

Full text: 2,217 characters

Reading time: 4 minutes

The new energy vehicle market is fiercely competitive, and with the ascent of domestic brands, joint venture brands are finding it increasingly challenging to carve out a niche.

In October this year, Leapmotor, which clinched the monthly sales crown among new forces for several consecutive months, achieved a record-breaking full-line delivery of 70,289 units, including over 20,000 units of the Leapmotor C10X sold in the same month. In stark contrast, Dongfeng Nissan's inaugural popular new energy model, the N7, sold 6,540 units that month. Including September, sales have hovered around 6,000 units for two consecutive months, marking a 36.83% month-on-month decrease from August's 10,148 units, reverting to the delivery ramp-up level seen in July.

Just when everyone anticipated a Japanese brand to finally unveil a blockbuster model for mass sales, the Dongfeng Nissan N7, after a quarter of sales ramp-up, peaked at August's sales figures. As a model highly regarded by both Dongfeng Nissan and the market, the N7's current sales are neither a blockbuster nor poor.

After all, as Dongfeng Nissan's first model to entrust product leadership to a Chinese partner, and considering the current survival environment of joint venture new energy vehicles in China, according to data from the China Passenger Car Association, the penetration rate of new energy passenger vehicles in China reached 57.2% in October, with domestic brands at 77.9% and mainstream joint venture brands at a mere 7%. The fact that the Dongfeng Nissan N7 can thrive in the current automotive market is commendable.

Especially when compared to the new energy models launched by Dongfeng Nissan before the N7, such as the Leaf sold under the Venucia brand and the ARIYA, which eroded Nissan's remaining confidence. The market confidence instilled by the N7 in Dongfeng Nissan far surpasses its mere sales volume; at least, the Dongfeng Nissan N7 is now widely acknowledged.

Why do Japanese new energy models like the Dongfeng Nissan N7, despite swiftly catching up through 'localization,' consistently fall short in market enthusiasm and sales?

The Rules Have Changed, and So Has the Rhythm

In 2025, nearly all new energy products launched by Japanese brands, except for Honda, are pursuing a cost-effective route. The Toyota bZ3X, Mazda EZ60, and the N6, which officially launched on December 1st, all fall under the category of abundant features at competitive prices in terms of intelligent configurations and pricing.

The Toyota bZ3X, equipped with Huawei's intelligent cockpit and vehicle control, Momenta's intelligent driving, and Xiaomi's ecological interconnection, finally surpassed 10,000 units in sales after six months of ramp-up and adjustments. The upcoming Toyota bZ7 will also adopt a similar strategy.

The Mazda EZ60 comes standard with a 50-inch AR-HUD, a 26.45-inch 5K central control screen, a MediaTek 4NM chip, rear-wheel drive, nine real air ducts, and offers both pure electric and extended-range options, starting at 119,900 yuan. At first glance, this seems to align with the cost-effective approach of Leapmotor, but its actual sales and market enthusiasm have been lukewarm.

When it comes to intelligence, localized Japanese new energy models are heavily stacking features; when it comes to cost-effectiveness, Mazda, Dongfeng Nissan, and Toyota are pricing along the lines of domestic brands. However, there is still a noticeable gap in sales compared to the leading domestic and new force brands.

The reason lies in the fact that Japanese brands have yet to adapt to the rhythm of China's new energy market. To illustrate, placing any of the Toyota bZ3X, Mazda EZ60, or Dongfeng Nissan N7 models in the Chinese market a year ago, with such stacking capabilities and cost-effectiveness, they would likely have gained traction.

However, in 2025, when stacking features has become the norm for new energy models, consumers find it difficult to justify a premium for mere configuration stacking. Looking at the sales rankings, the new energy models that can become blockbusters in 2025 are either sufficiently affordable long-standing favorites or models packed with gimmicks and unique advantages.

As a result, while Japanese new energy models are still stuck in the cost-effectiveness 1.0 era of simply stacking configurations and lowering prices, domestic new energy is already exploring how to excel in uniqueness plus cost-effectiveness.

The XPENG MONA M03 and Geely Galaxy A7 in the sedan segment, and the Leapmotor and Seres S05 in the SUV segment, serve as excellent positive examples, highlighting basic cost-effectiveness while adding unique product attributes.

Of course, it is worth mentioning that with the initial popularity of the Dongfeng Nissan N7 upon its launch and the gradual recovery of Toyota bZ3X sales, it is evident that joint venture new energy products still have a pool of potential customers in the Chinese market and are not as dismissively labeled as 'generic' as some online comments suggest.

Therefore, in an environment where Chinese consumers are still willing to give joint venture new energy products a chance, what joint venture automakers need to do is clarify what kind of products the next stage of users in China's new energy market truly demand.

The N7 Taught Dongfeng Nissan a Lesson

Dongfeng Nissan, which has long been in a trial-and-error phase in its new energy strategy, has shown 'signals of change' in its recently launched two new models.

Especially the Dongfeng Nissan N6, as the first plug-in hybrid model in Dongfeng Nissan's global lineup, represents a crucial judgment: Will Dongfeng Nissan continue to replicate and paste an 'N7 plug-in hybrid version' using old methods, or has it undergone genuine changes at the systemic level?

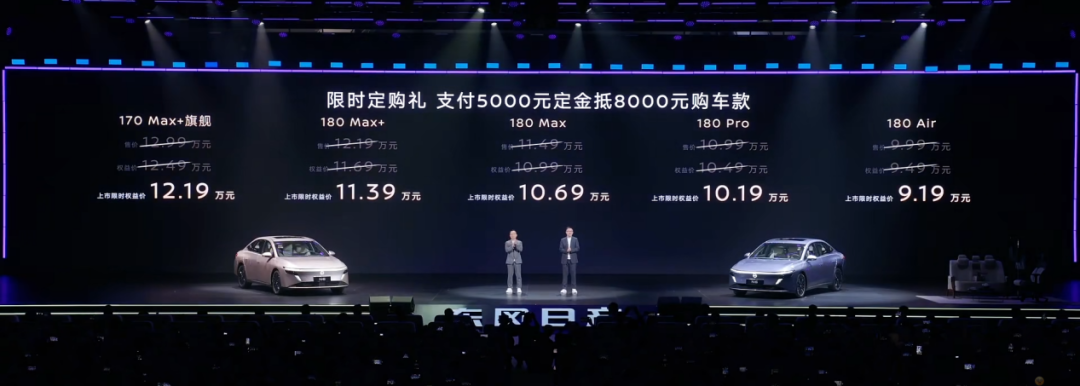

Fortunately, judging by the 'large battery + long range' plug-in hybrid logic, feature-stacked configurations, emphasis on the differentiated label of 'large sofa + comfort,' and the launch price range of 91,900 to 121,900 yuan for the Dongfeng Nissan N6, it not only replicates the successful experience of the N7 but also absorbs the lessons learned from the N7.

Especially in terms of delivery efficiency and after-sales policies, the former has made the commitment of 'immediate delivery upon launch,' while the latter has directly introduced the industry's first self-ignition compensation policy, shared by both the N7 and N6 models, without limiting it to the first owner, whether the vehicle is within the warranty period, or whether it has reached the scrap standard.

These two after-sales policies directly address the core issues of delayed delivery, low product stability, and insufficient battery endorsement experienced by Dongfeng Nissan with the N7.

The market distrust gathered by Dongfeng Nissan with the N7 is being positively resolved through the N6, leveraging the supply chain advantages accumulated by joint venture brands in the Chinese market over the years. Although Dongfeng Nissan has indeed made significant market-oriented adjustments with the N6, it does not mean that Dongfeng Nissan can solely rely on this model to reverse its brand impression and market positioning.

After all, Rome was not built in a day. The significance of the N6 lies in Dongfeng Nissan upgrading from simply 'copying homework' to 'reorganizing a set of market strategies and R&D logic suitable for its current stage.' This is the so-called Glocal approach, adapting 'global technology to the Chinese rhythm.'

It is worth mentioning that the changes brought by the N7 to Dongfeng Nissan are not limited to the new energy sector. In the fuel vehicle sector, Dongfeng Nissan is also gradually moving away from passive following. The 2026 Teana, equipped with Huawei's HarmonyOS cockpit, is the best proof of Dongfeng Nissan's transformation. By combining the stable fuel vehicle attributes of joint ventures with top-tier intelligence in the Chinese market, Dongfeng Nissan is keenly targeting the group of fuel vehicle users whose voices have been drowned out by the new energy wave.

Commentary

Dongfeng Nissan's fierce transformation in the 'Four Modernizations' has actually clarified a rhythm: 'A large ship is hard to turn' is not an excuse. Through a genuine Glocal approach, re-clarifying the 'Chinese rhythm,' joint venture brands can also forge a unique path in the new energy era.

(This article is original to Heyan Yueche and may not be reproduced without authorization.)