Xiaomi SU7 has been exposed to a high motor failure rate, is it Infineon's fault, or Tesla's old wound?

![]() 06/17 2024

06/17 2024

![]() 592

592

From major issues like car breakdowns and brake failures to minor issues like a loose screw or a stain on the seat, the Xiaomi SU7 has been under scrutiny since its launch, almost like being examined under a magnifying glass or even a microscope. The power of online attention has been demonstrated vividly by the Xiaomi SU7. This led to Zhiji Automobile being ridiculed when it mistakenly labeled the front motor of the Xiaomi SU7 as non-SiC, while trying to "蹭流量" (蹭 refers to leveraging someone else's popularity for one's own benefit). However, the controversy surrounding the use of SiC in Xiaomi's vehicles has not subsided. Recently, news has emerged that the yield rate of SiC chips used in the Xiaomi SU7 is low, leading to safety hazards in the vehicle. If this is true, should Xiaomi Automotive take the blame, or is it the supplier system?

The LOOKAR drive system is the core contradiction, and the "blame" cannot be placed on the supplier?

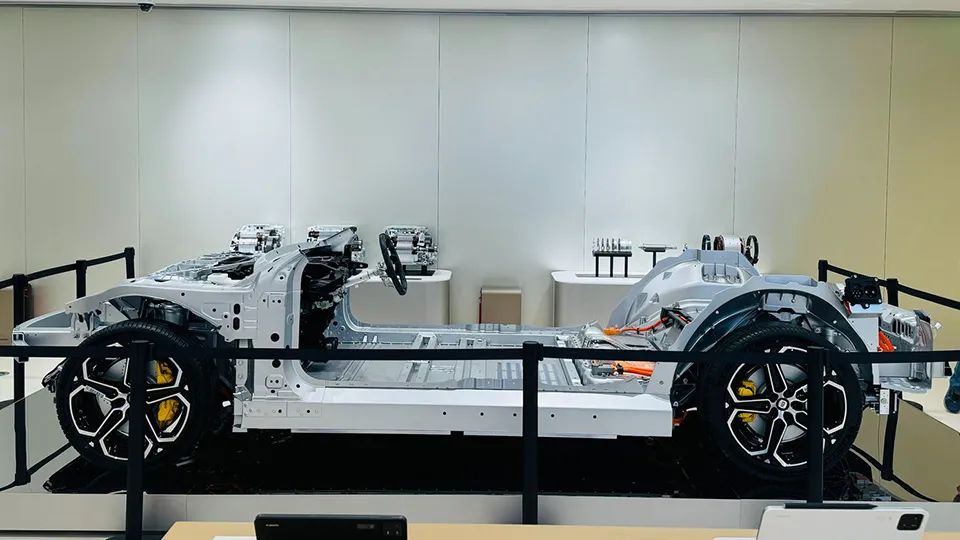

From online reports, we can see that the contradiction is relatively concentrated in the drive system of the Xiaomi SU7. For example, in May, a car owner in Fujian purchased a Xiaomi SU7 that encountered a drive system failure with only 39km on the odometer. Since SiC materials have obvious advantages in terms of breakdown voltage, switching frequency, and thermal characteristics, the use of SiC chips has begun to be popularized on high-voltage platforms for pure electric vehicles. Even if it's not a high-voltage platform of 800V level, in order to improve the efficiency of the drive system and reduce energy consumption, companies like Xiaomi and Tesla will also use SiC chips on 400V voltage platform models.

So, will the "blame" come from the supplier of SiC chips? According to known information, the top-of-the-line dual-motor version of the Xiaomi SU7 uses Infineon's SiC chip products, while the single-motor version uses a solution from United Automotive Electronic Systems. Infineon is naturally one of the leading companies in the SiC chip field, and at first glance, the finger seems to be pointing at United Automotive Electronic Systems. However, the information exposed online precisely directs the finger at the top-of-the-line dual-motor version of the Xiaomi SU7. As for the SiC chips in the single-motor version, they have become a "secondary contradiction".

Of course, there can be another explanation. As we all know, only the top-of-the-line dual-motor all-wheel-drive version of the Xiaomi SU7 uses a high-voltage platform. All single-motor rear-wheel-drive versions use a 400V voltage platform. Therefore, is there a possibility that high voltage makes Infineon's SiC chips more unstable? But as mentioned earlier, Infineon's SiC chip products are industry-leading. Not only are there many automakers that procure from them, but 800V high-voltage platforms are nothing new. If their product yield rate was significantly lower than automotive-grade requirements, the issue should not have only been exposed with the Xiaomi SU7.

Based on this logic, the contradiction in the issue returns to Xiaomi Automotive itself. For example, the vehicle's MCU tuning ability can be analogized to a problem with the computer's motherboard and BIOS tuning. Therefore, the blame cannot be placed on the chip itself. However, before drawing any conclusions, another case may provide more reference.

Tesla's precedent, is the "root cause" too aggressive performance?

As early as 2022, Tesla filed a recall plan in China involving over 127,000 Model 3 vehicles. This covered some imported and domestically produced models from early 2019 to early 2022. At that time, Tesla stated that there may be small manufacturing differences in the power semiconductor components of the rear motor inverter, causing the inverter to fail to control the current properly, which may result in the vehicle failing to start or losing power while driving. This explanation directly pointed to the rear motor, which was the first to adopt SiC chips, while the front motor used conventional IGBT semiconductor components. Therefore, although Tesla did not explicitly state it at the time, the industry still pointed the finger at the consistency issues of SiC chips.

Interestingly, Infineon, which is involved in this round of Xiaomi Automotive issues, is one of the two giants, along with STMicroelectronics, that supply Tesla with SiC semiconductors. Of course, this does not mean that the blame should be placed solely on Infineon. The lack of clarity in this matter back then was largely due to the global semiconductor material production capacity constraints at that time. Obviously, it was not a time for Tesla and its suppliers to blame each other. But if related safety hazards are still emerging today, it is necessary to clarify the matter.

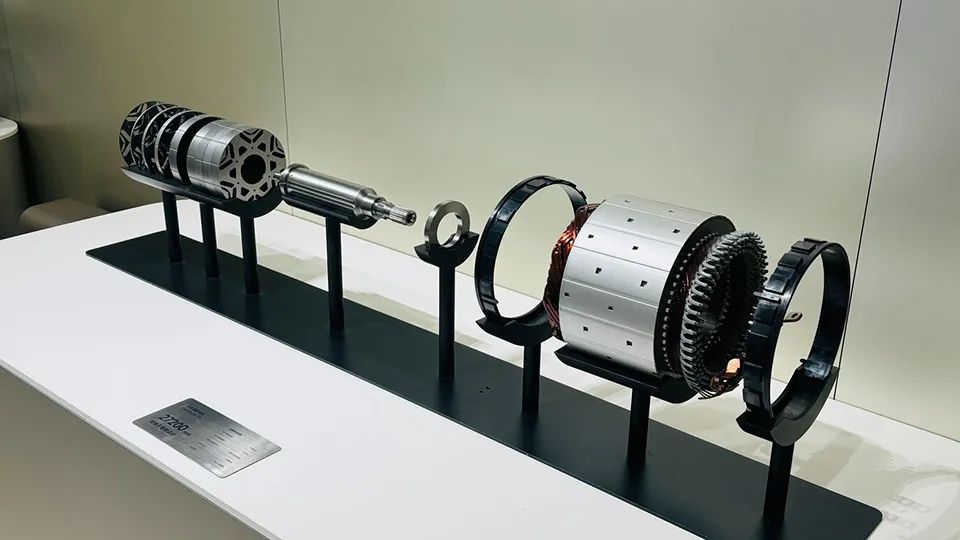

The simplest logic is through reverse control variable thinking. Since the drive system chip supplier, voltage platform, etc., are not fixed values in both "cases," and excluding the possibility of Xiaomi and Tesla making similar errors in MCU tuning over a span of more than 2 years, the commonality between the two is actually the use of SiC-based drive motors. To be more specific, both Tesla and Xiaomi were industry leaders in ultra-high-speed motors during the time periods when the incidents were exposed. Based on this calculation, it can be roughly summarized as ultra-high-speed motor + SiC chip = instability. We can further break it down, and under the context of DC motors and relatively fixed voltage, high-speed operating conditions can be equivalent to high current demand. Then, the final answer should be ultra-high speed (ultra-high current) + SiC chip = instability.

OTA can alleviate the issue, but rooting it out requires supplier support

So how can this issue be resolved? We can first refer to how Tesla addressed it back then. At that time, Tesla adopted the OTA solution, which is popular with automakers and relatively reassuring for consumers. By remotely upgrading and optimizing the motor control software and monitoring it, the rear inverter could be replaced after related failures occurred. Obviously, the so-called "optimizing motor control software" can also be described more familiarly as "downclocking." Of course, motor performance cannot be sacrificed like 3C digital products, where downclocking would significantly impact performance. But sacrificing some extreme performance to extend the lifespan of SiC chips is clearly necessary.

Returning to the Xiaomi SU7, if it encounters a similar issue, Tesla's OTA approach from back then can also be replicated. However, to eradicate this issue, it ultimately comes down to another key factor, which is improving the yield rate and quality of SiC chips. After all, high-speed motors are an inevitable development direction for pure electric vehicles. Including Xiaomi, the threshold has been raised to over 20,000 rpm. The follow-up Xiaomi V8s motor can even push the speed to 27,200 rpm. Since drive technology is progressing, semiconductor technology must also keep up with the pace.

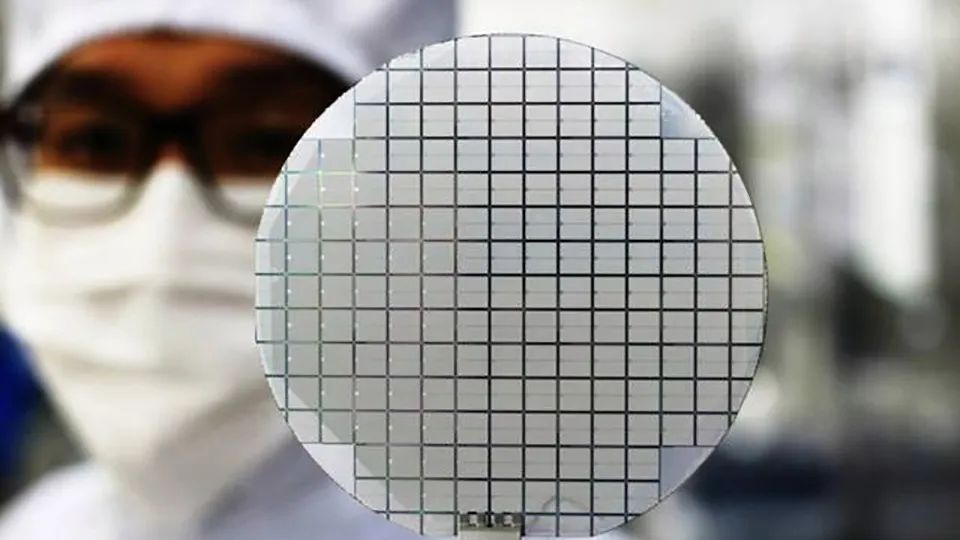

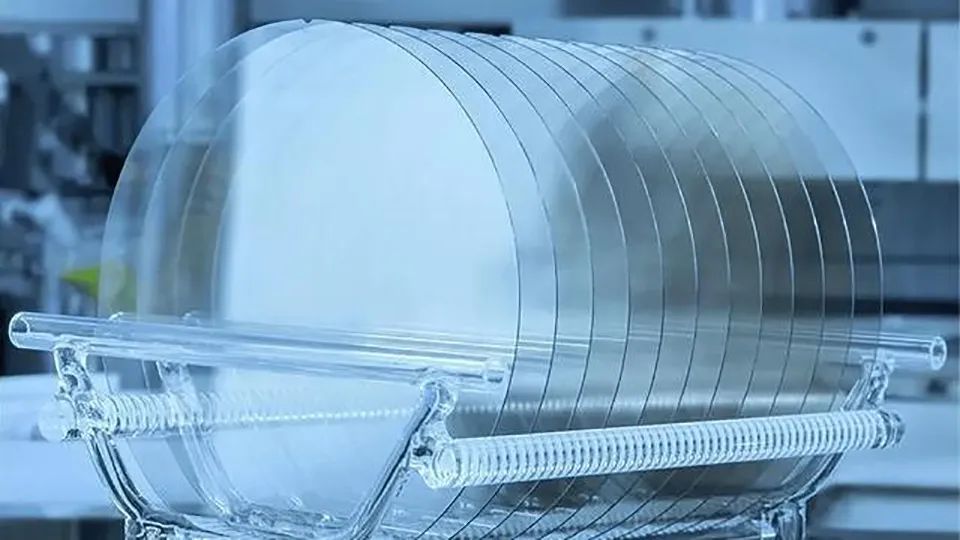

The problem is that Infineon, as an industry giant and Xiaomi's supplier of high-performance semiconductor materials, has never been an IDM (Integrated Device Manufacturer) company. This actually aligns with the general operation of the semiconductor food chain, except that the up-and-coming Wolfspeed "does not follow the rules" and covers the entire process from raw material substrates to chip manufacturing. Returning to Infineon, since it does not manufacture its own substrates, as an industry giant, it must increase its procurement channels for SiC wafers to ensure its shipment volume and cost. In recent years, Infineon has enriched its substrate supply system, including multiple Chinese suppliers.

Infineon's consistent approach is to adopt a black box treatment for all substrate supplies. That is, purchasers cannot know which substrate supplier their goods come from. Even excluding possible quality fluctuations among different suppliers, in the current situation where 6-inch substrates are still the absolute mainstream, whether the SiC chips obtained by automakers could potentially come from 8-inch substrates with higher yields is unclear.

However, based on the "backdoor" left by Infineon, core customers may still have the privilege of selecting the source of substrates. This is clearly good news for the Xiaomi V8s motor. After all, according to the production schedule, this motor is expected to hit the market next year (2025). And Infineon's previously disclosed timeline for the launch of 8-inch SiC wafers is almost synchronized with it. It's hard to say whether there is tacit understanding between the two companies in this regard. Compared to Tesla, which ultimately chose to downplay the application of SiC, Xiaomi Automotive seems to be betting big on higher-speed drive performance.

Author: Ruan Song