Debt, Loss, and Profit: Which of the Three Central SOE New Energy Brands Emerges Victorious?

![]() 12/05 2025

12/05 2025

![]() 569

569

Introduction

When compared to emerging automotive forces, the losses incurred by central SOE new energy brands are relatively contained.

Not long ago, Avatr Technology's application to list on the Hong Kong Stock Exchange unveiled a set of figures that seemed alarming at first glance: cumulative losses of RMB 11.312 billion over three and a half years. Yet, what many overlook is that this heavily loss-making automaker still boasts over RMB 13.4 billion in cash and equivalents on its balance sheet.

This seemingly contradictory scenario precisely exposes a neglected core logic within the competitive landscape of the new energy vehicle (NEV) industry. For Avatr, VOYAH, and Shenlan—brands backed by major automotive central SOEs like China Changan Automobile Group and Dongfeng Motor Corporation—the surface-level loss figures do not tell the whole story.

Once stereotyped as sluggish and innovation-averse, central SOE new energy brands have now shed this outdated image. With the financial reports of Avatr, VOYAH, and Shenlan made public, it becomes evident that between 2022 and 2025, these three central SOE-backed new energy brands have charted three distinct development paths, showcasing vastly different financial performances and market dynamics.

Their losses can be likened to strategic investments made by the groups to secure future market dominance and technological leadership, with risk boundaries firmly anchored by the groups' robust resources. Amidst the cacophony of money-burning wars in the NEV sector, the development models of central SOE-affiliated brands offer diverse examples of traditional state-owned enterprises' transitions to new energy.

01 Differentiated Paths

When discussing the new energy transitions of central and state-owned enterprises, it becomes apparent that many brands are still in the process of fully forming their identities. For instance, FAW, SAIC, Chery, and others continue to pursue hybrid oil-electric models. In contrast, Changan's Avatr and Shenlan, Dongfeng's VOYAH, GAC's Aion, and BAIC's Arcfox represent pioneers in achieving full electrification.

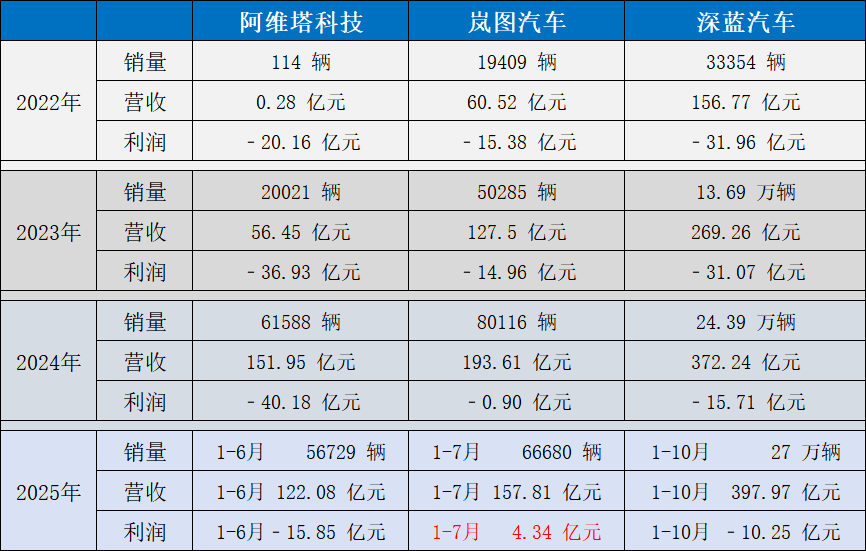

Avatr adopts a long-termist approach centered on high-end intelligence, characterized by a typical pattern of high growth paired with significant losses. In 2022, its revenue stood at a mere RMB 28.34 million, soaring to RMB 12.208 billion in the first half of 2025—a remarkable surge in revenue scale. However, during the same period, losses reached RMB 1.585 billion, with cumulative losses exceeding RMB 11.3 billion.

By the end of 2024, Avatr secured over RMB 11 billion in a single round of Series C financing, led by its controlling shareholder Changan Automobile, which introduced diversified state-owned capital. Chen Zhuo, President of Avatr Technology, openly stated that the establishment of its parent group, China Changan Automobile Group, provided a higher platform, bringing broader resources in financial support, supply chain coordination, market expansion, and technological development.

This enables Avatr to focus on product definition and brand building without being burdened by heavy fixed assets. Wang Jinhai, Vice President of Avatr Technology, publicly declared, "Avatr's goal for the next five years is to join the ranks of annual sales exceeding one million units."

To achieve this target, Avatr insists on building core competitiveness through technological collaboration. In August 2024, it acquired a 10% stake in Huawei's Shenzhen Yiwang Technology Co., Ltd. for RMB 11.5 billion, achieving deep capital-level binding and deepening co-creation in product definition, development, and channel sharing.

In terms of channel layout, as of the first half of 2025, Avatr boasts 313 dealers and 16 self-operated stores, laying a solid foundation for promoting high-end products. For global expansion, Avatr plans to enter over 80 countries and regions by 2030, establishing more than 700 overseas sales channels. While its export revenue was just RMB 220 million in 2024, it surged to RMB 686 million in the first half of 2025, demonstrating rapid growth potential.

In stark contrast to Avatr, VOYAH Automobile follows a balanced development path, achieving a clear trajectory from losses to profitability and becoming the first profitable central SOE new energy brand.

In 2022, VOYAH's revenue was RMB 6.052 billion, jumping to RMB 19.361 billion in 2024, with a compound annual growth rate of 78.9%. Its losses rapidly narrowed from RMB 1.538 billion in 2022 to RMB 91 million in 2024, achieving a net profit of RMB 434 million in the first seven months of 2025. While this profitability is primarily subsidy-driven, it also reflects the brand's improving self-sufficiency.

Lu Fang, Chairman of VOYAH Automobile, firmly advocates for "not engaging in price wars but relying on product strength," refusing to follow the trend of price cuts that erode social value and adhering to a long-termist approach. More importantly, VOYAH maximizes the group's asset-light support, particularly by revitalizing existing assets.

By taking over and upgrading Dongfeng Motor Group's Golden Factory, Yunfeng Factory, and other existing production capacities, VOYAH saved billions of yuan in new factory construction costs, achieving the miracle of "increasing production by 100,000 units in seven months." This strategy not only optimizes the allocation of internal group resources but also transforms the group's support from mere capital infusion into a catalyst for enhancing its self-sufficiency.

Thus, the confidence behind Dongfeng Group's complex capital operations for VOYAH, including privatization and subsequent spin-off listing, stems from the robust improvement in VOYAH's business fundamentals.

Shenlan Automobile occupies a middle ground, implementing a scale-first, goal-driven strategy. From 2022 to 2024, Shenlan's revenue grew from RMB 15.677 billion to RMB 37.224 billion, while its net profit losses narrowed from RMB 3.196 billion to RMB 1.571 billion. As of October 31, 2025, its net profit remained at -RMB 1.025 billion.

Notably, Shenlan's total liabilities reached RMB 30.193 billion, with an asset-liability ratio as high as 117.5%, indicating financial pressure from expansion. Deng Chenghao, Chairman of Shenlan Automobile, adopts a highly goal-oriented development approach, stating that Shenlan has achieved phased profitability in some months. Meanwhile, Zhang Deyong, Board Secretary of Changan Automobile, noted that "break-even can be achieved when monthly sales reach 30,000 units."

To achieve its scale target, Deng Chenghao plans to "reach an annual sales target of 360,000 units this year, with explosive growth in products and technologies next year," while undertaking the task of contributing 2 million units to Changan Automobile's goal of 5 million sales by 2030. Behind this lies the group's overall coordination in global manufacturing and supply chains.

For instance, Shenlan's "planned" takeover of Beijing Hyundai's Chongqing Factory exemplifies the integration of capacity expansion into the group's overall planning. This model enables Shenlan to pursue market positioning with greater boldness, even with high leverage, as its risks are deemed controllable within the group's strategic framework.

02 Asset-Light Model Backed by Group Resources

The sustained progress of the three brands' strategic practices hinges on the comprehensive resource empowerment provided by their central SOE parent groups. For self-started new automotive forces, sustained losses pose existential threats, with each financing round being a matter of survival. However, for Avatr, VOYAH, and Shenlan, losses represent strategic investments at the group level, with risks firmly contained by group resources.

This asset-light expansion model, relying on the parent group, constitutes their core competitive logic distinct from independent new forces. It is a systematic endeavor to secure market positioning and technological breakthroughs with lower risks and higher efficiency within the group's safety boundaries. Thus, their competition is essentially an extension of their parent groups' systemic competitiveness.

The group's support endows the three brands' losses with entirely different connotations. As a high-end intelligent electric brand under China Changan Automobile Group, Avatr incurred cumulative losses exceeding RMB 11.3 billion from 2022 to the first half of 2025. However, its Series C financing in late 2024 exceeded RMB 11 billion, with Changan Automobile, as the controlling shareholder, not only increasing its own capital but also leading the introduction of diversified investors such as national and local industrial funds.

As Dongfeng Group's flagship transformation project, VOYAH received full nurturing from the group in its early stages. Dongfeng even cleared capital obstacles through complex operations, including privatizing its Hong Kong-listed platform and subsequently spinning off VOYAH for an independent listing. The group provided not only funding but also an existing manufacturing system. VOYAH's strategy of taking over and upgrading Dongfeng's idle factories epitomizes the core of asset-light operations, ultimately achieving a profitable transition.

Shenlan fully enjoys the resource dividends of Changan Automobile Group. Zhu Huarong, Chairman of Changan Automobile, explicitly stated, "We provide personnel, funding, and resources as needed." In July 2025, after Changan Automobile was upgraded to a first-tier central SOE under China Changan Automobile Group, Shenlan's brand endorsement and resource integration capabilities further surged. Its collaborative partnerships with CATL and Huawei stem from group-level strategic support, enabling it to boldly declare a global sales target of 2 million units by 2030.

In reality, each brand has a clear positioning within the group's grand strategy, with its profit and loss performance evaluated within a broader, long-term group value context. The State-owned Assets Supervision and Administration Commission (SASAC) conducts separate assessments of the NEV businesses of central SOE automakers, focusing on technology, market share, and development potential rather than short-term profits. This policy approach alleviates their absolute concerns about short-term profitability.

In other words, the losses of central SOE brands differ fundamentally from the survival-driven losses of independent new forces. The latter's losses entail continuous cash flow depletion, with financing failure spelling doom. In contrast, the former's losses occur within a strategic framework featuring controllable resources, clear objectives, and defined timelines.

The group's support frees these national team players from cash flow anxieties, enabling them to focus on building long-term value. This represents a more profound and resilient competitive model led by state capital and industrial giants, collectively forming diverse samples of state-owned enterprises' new energy transitions.

Editor-in-Chief: Shi Jie; Editor: He Zengrong

THE END