The Auto Industry’s ‘Resurrection Race’: Who’s Extending Their Lifespan, and Who’s Faking a Comeback?

![]() 12/05 2025

12/05 2025

![]() 426

426

For automakers teetering on the edge of collapse, revival attempts may amount to little more than ‘extending their lifespan,’ while true ‘rebirth’ demands transformative changes.

Since the second half of this year, the automotive sector has witnessed a flurry of resurrection attempts, leaving industry observers both dazzled and skeptical.

The most sensational case is WM Motor, a once-silent newcomer in car manufacturing, which has suddenly announced its ‘full resurrection,’ adding a touch of absurdity to the revival drama.

Following closely are the ‘zombie automakers’—brands struggling on the ‘brink of death.’

Zotye Auto has repeatedly taken center stage in bankruptcy liquidation proceedings, yet the audience never leaves; Hengchi Auto keeps issuing announcements about ‘seeking strategic investors,’ resembling a micro-business spamming its WeChat Moments; Neta Auto seems to be playing ‘hide and seek,’ with rumors of a $100 million investment from Middle Eastern capital circulating for three months, only to leave no trace.

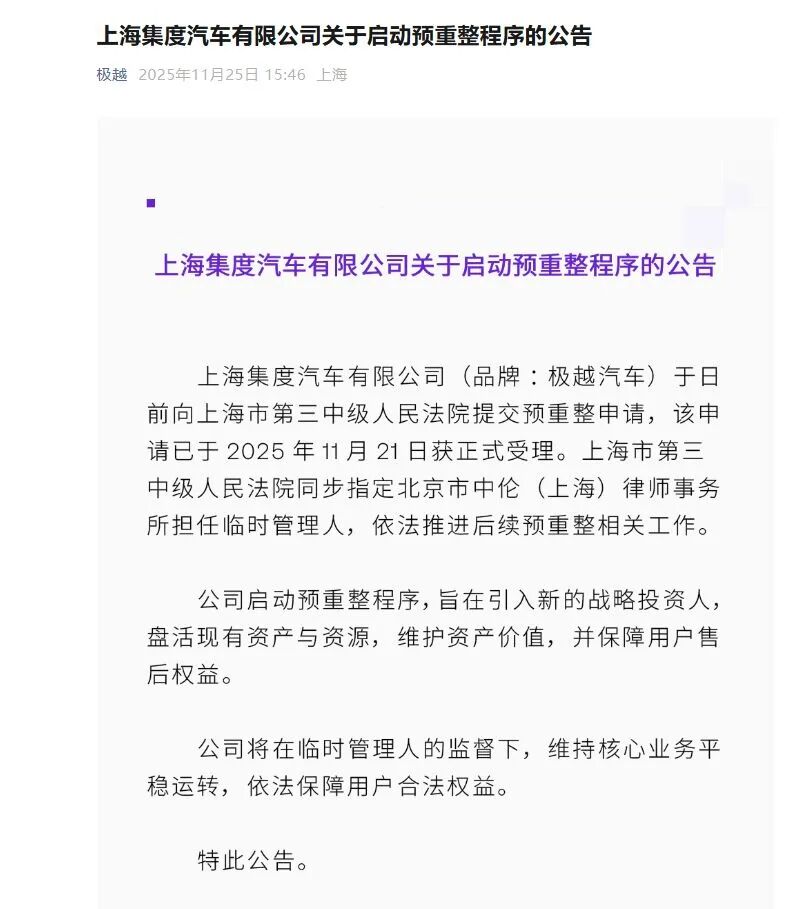

Recently, JiYue Auto, which ‘collapsed’ at the end of last year, has also joined this ‘resurrection race.’

Its parent company, Jidu Auto, issued an announcement regarding the initiation of pre-reorganization proceedings, but its script may be even more convoluted than those of the aforementioned automakers. Pre-reorganization can be seen as the last-ditch effort before bankruptcy, but given the experiences of Zotye and Hengchi, JiYue's chances of finding a ‘white knight’ are virtually zero.

However, why do these ‘zombie automakers,’ which should have been directly eliminated by the market, fall into a paradoxical survival situation? In other words, why is it difficult to completely exit, yet equally far-fetched to truly revive?

Capital Game or ‘Last Gamble’?

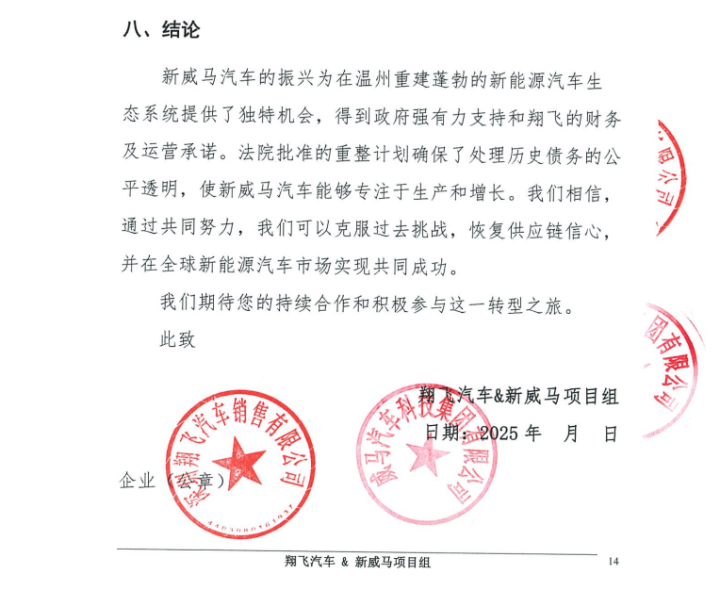

On September 6th, WM Motor's official WeChat account released the ‘Supplier White Paper,’ announcing that under the operation of Shenzhen Xiangfei Auto Sales Co., Ltd. (hereinafter referred to as ‘Xiangfei’), production at the Wenzhou base will resume in September, with a guaranteed output of 10,000 units and a target of 20,000 units of EX5/E.5 models this year.

In the ‘White Paper,’ Shenzhen Xiangfei revealed that, according to the reorganization plan approved by the Shanghai Third Intermediate People's Court in April 2025, the company has taken over the four core companies of WM Motor, becoming their reorganization investor and new shareholder, and is fully committed to restarting the production of WM EX5 and E.5 models at the Wenzhou base.

This ‘resurrection declaration’ also outlined a ‘three-step’ plan from 2025 to 2030, with ambitious targets ranging from 100,000 units in 2026 to 1 million units in 2030.

Regarding the ‘resurrection news,’ most car owners expressed skepticism, saying, ‘The EX5 has been discontinued for three years. Is the resumption of production just to supply ride-hailing factories?’

According to Tianyancha, the actual controller of Xiangfei Auto, Huang Jing, also controls several auto companies under the Baoneng Group. Baoneng Auto itself is deeply mired in debt, having been listed as a dishonest executed person 12 times, with a total amount involved exceeding 36.21 million yuan. Additionally, Baoneng Auto's official WeChat account also forwarded the ‘WM Motor: Supplier White Paper,’ further confirming Baoneng Group's involvement in WM Motor's resumption of production.

Industry insiders are concerned that Shenzhen Xiangfei is closely related to Shenzhen Baoneng Group, which is also facing debt pressures and operational challenges. Such a takeover could be described as ‘a drowning man trying to save another.’

Now, let's look at Neta Auto. In August this year, Hozon New Energy's administrator issued the ‘Announcement on Public Recruitment of Reorganization Investors,’ raising the registration deposit from the previous pre-recruitment threshold to 50 million yuan. The final investor is also required to pay a 100 million yuan investment deposit after signing the reorganization investment agreement. As of August 13th, it has attracted 69 interested parties.

‘Hozon New Energy's move sends two signals. First, the capital market still recognizes the residual value of ‘vehicle manufacturing qualifications + production capacity + brand’ and is willing to lock in stakes with real money. Second, the Tongxiang government hopes to quickly screen out speculative buyers through high thresholds, clearing the way for the subsequent voting and implementation of the reorganization plan,’ industry insiders believe.

On December 2nd this year, Hozon New Energy (the entity company of Neta Auto) administrator issued another announcement, publicly recruiting a management trustee.

In May 2025, Jiangsu HiPhi Auto Co., Ltd. was ‘revived’ with a registered capital of $143 million, and Canada's EV Electra became the new majority shareholder with a 69.8% stake. Lebanese businessman Jihad Mohammad proudly announced, ‘I have acquired HiPhi,’ and promised to invest $600 million to restart production lines. However, this ‘resurrection drama’ was unexpectedly shelved due to document format issues.

Unlike WM Motor, which received local government support, HiPhi has not yet reached a clear agreement with relevant Jiangsu departments, making its ‘resurrection’ path more uncertain.

A securities analyst pointed out, ‘This is like dancing in a minefield. One wrong step could lead to a complete disaster.’

According to internal sources, EV Electra has commissioned a third-party law firm to redraft the support letter, expected to be completed by mid-December. However, 20% of the creditor group insists on ‘payment before revision,’ and the game theory (game/negotiation) between the two sides continues.

It can be said that the ‘resurrection dramas’ of WM Motor, Neta, and HiPhi reflect the capital frenzy during the shuffling period of the new energy industry, but they also resemble a high-risk gamble.

Who is Driving the Resurrection of ‘Zombie Automakers’?

To start with a digression, Wang Xiaolin, once hailed as a ‘renowned entrepreneur’ in the United States, has completely tarnished his reputation in China due to suspected false capital contributions in his Saleen Auto project in Rugao, Jiangsu, becoming a pariah to be avoided at all costs.

Of course, five years ago, when Rugao first learned of this major project from the United States, the entire city was thrilled, believing they had struck gold. However, they never expected it to be an elaborate scam. By 2020, Saleen Auto had only produced one electric vehicle, the Mai Mai, which resembled a senior mobility scooter, and sold just over 30 units. This left the Rugao government with billions of yuan in investments down the drain.

What did Wang Xiaolin leave behind for Rugao? To this day, no one mentions it.

Another reason, distinct from the local government's logic of ‘protecting the industrial chain,’ is that some acquiring capitals value the ‘scarce resources’ of new energy automakers—vehicle manufacturing qualifications, production capacity, and brand residual value. These capitals are often burdened with debts themselves yet attempt to profit through ‘reviving’ automakers.

First and foremost is the coveted new energy vehicle manufacturing qualification.

Some capitals can acquire qualifications by purchasing zombie automakers and then resell them or use them for other projects. For instance, after the Baoneng Group took over WM Motor, it might attempt to utilize its qualifications to launch new models.

Neta Auto's parent company, Hozon New Energy, made ‘vehicle manufacturing qualifications’ a focal point in its December 2nd announcement publicly recruiting a management trustee. The announcement stated that to legally advance Hozon New Energy's reorganization and safeguard the debtor's asset value and ‘dual vehicle manufacturing qualifications,’ it is now publicly recruiting a management trustee.

Neta Auto obtained the new energy vehicle production qualification issued by the National Development and Reform Commission in April 2017 and received the new energy vehicle market access qualification from the Ministry of Industry and Information Technology a year later. For Neta Auto today, vehicle manufacturing qualifications are also one of its core assets. To retain its ‘dual vehicle manufacturing qualifications’ after being idle for over a year, Neta Auto must produce at least 2,000 vehicles by 2026, according to regulations.

Additionally, some capitals hope to enhance their own valuations through ‘resurrection stories.’ For example, after receiving investment from Canada's EV Electra, HiPhi Auto attempted to attract secondary market attention with the promise of ‘restarting production lines with $600 million.’

Regarding the current resurrection dramas in the automotive sector, a securities analyst pointed out, ‘Local governments and capitals must recognize that reviving zombie automakers is not ‘bailing out the market’ but ‘putting out fires.’ Without addressing fundamental issues, it will only delay industry consolidation and even trigger greater risks.’

China's new energy vehicle industry has entered the second half of the ‘knockout stage.’ Local governments need to shift their mindset from ‘protecting enterprises’ to ‘protecting industries,’ integrating resources through market-oriented means to avoid wasting fiscal funds. On the other hand, capitals must also return to rationality. Acquirers should possess industrial chain synergy capabilities rather than merely speculating on ‘qualifications’ and ‘stories.’

Overall, the ‘resurrection wave’ of new energy automakers is a product of the interplay between capital and policy, driven by both the helplessness of local governments and the greed of capital gamblers. However, market forces will ultimately prevail. Only enterprises with genuine technological, product, and industrial chain advantages can survive the knockout stage.

For zombie automakers, revival attempts may amount to little more than ‘extending their lifespan,’ while true ‘rebirth’ demands transformative changes.

Note: The images are sourced from the internet. If there is any infringement, please contact us for removal.

-END-