400 Billion Yuan in Subsidies Fails to Spur Auto Market Growth; What’s in Store for Next Year?

![]() 12/09 2025

12/09 2025

![]() 606

606

Introduction

This isn’t a doom-and-gloom scenario—it’s rationality born from clear-eyed awareness. The downturn is filtering out the froth, allowing truly resilient players to stand firm.

“Forget It, I Won’t Buy!”

My friend Lao Zhou, who runs an engineering business in the Sichuan-Chongqing region, recently faced a dilemma. His nine-year-old Baojun 560, battered by time, was due for replacement. He planned to trade it in for a Geely Galaxy M9 priced at 216,800 yuan, fulfilling his dream of a “spacious family car.” Yet, after much deliberation, he postponed his purchase.

Lao Zhou, born in the 1980s, has seen his engineering business slump over the past two years, with projects dwindling and household income visibly shrinking. What made him hesitate further was the car trade-in policy: by the fourth quarter of this year, subsidies depended on lottery draws, leaving success to chance.

“Failing to win the lottery means losing over 10,000 yuan. Maybe better policies will emerge next year, and delayed purchases often come with discounts,” Lao Zhou mused. His concerns aren’t isolated—they mirror a broader microcosm of China’s auto market today: policy dividends have peaked, consumer confidence is shaky, and the usual year-end “sales surge” has vanished entirely.

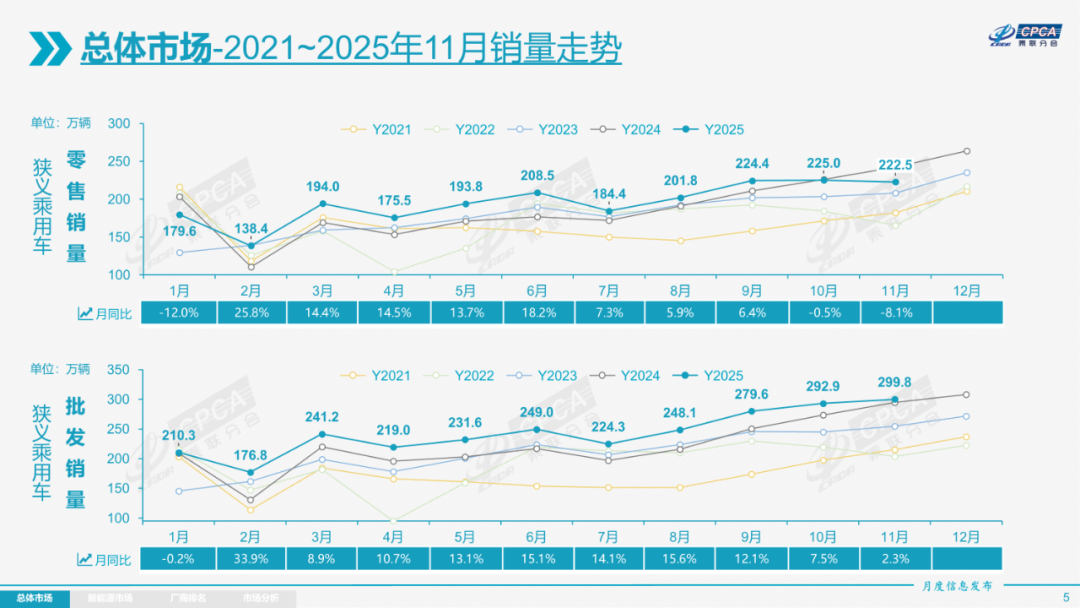

Latest data from the China Passenger Car Association (CPCA) shows an 8% year-on-year decline in domestic passenger car retail sales in November, marking the second consecutive monthly drop in the fourth quarter. This rare trend casts a pessimistic shadow over the 2026 auto market.

01 400 Billion Yuan in Subsidies Fails to Trigger a Year-End Sales Surge

“November and December are traditionally peak seasons for the auto market, with dealers swamped. This year, it’s unusually quiet,” lamented a sales manager at a joint-venture brand 4S store in Shanghai, echoing widespread sentiment in the industry.

CPCA data released on December 8 confirms this. From September to November, the domestic passenger car market exhibited a rare sideways trend, with November seeing an 8% year-on-year decline, breaking the decades-long pattern of year-end consumption growth. Retail sales for the first 11 months grew by just around 6%.

Cui Dongshu, Secretary-General of the CPCA, bluntly stated that such year-end “cooling” is unprecedented in industry history. Logically, as the phase-out of new energy vehicle (NEV) purchase tax incentives nears, consumers would rush to buy before the deadline, coupled with year-end dealer discounts. However, this expected sales boom did not materialize.

Industry feedback for the first week of December indicates continued sluggishness. Many predict a possible year-on-year decline in December. “Often, automakers shift some December sales to January of the next year. Given widespread pessimism about next year’s market, especially the first quarter, December’s figures are unlikely to look good,” an industry insider analyzed.

Behind the overall downturn, automakers face varying fortunes, particularly leading players experiencing slowed or stagnant growth. BYD, China’s top automaker, has shown signs of fatigue since September, with sales declining by -5.5%, -12%, and -5% year-on-year in the past three months—despite overseas sales surging 300% to provide strong support.

Geely and Xiaomi have also struggled. Geely’s sales growth has narrowed continuously, while Xiaomi, once swarmed by buyers, now offers immediate vehicle availability—a rare shift. If these industry leaders are faring poorly, the situation for other domestic automakers is likely direr.

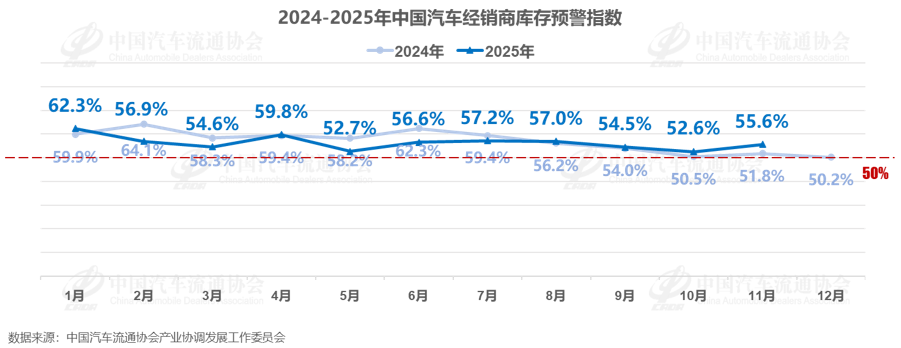

The chill is evident at the dealership level. In November, the car dealer inventory alert index soared to a yearly high of 55.6%, with nationwide inventory exceeding 3.3 million vehicles. 43.6% of dealers faced price inversions exceeding 15%, meaning they lost money on every sale—a common plight for small and medium-sized dealers. This “busy production, rosy data, cold retail” contrast underscores the auto market’s premature entry into winter.

Given these trends, the industry forecasts a rare three-month year-on-year sales decline in the fourth quarter of this year, with annual growth likely stabilizing around 5%.

Why has the year-end surge vanished? The core issue is that robust policies have drastically disrupted the auto market’s regular consumption cycle. In other words, the traditional year-end sales boom hasn’t disappeared; it was merely brought forward, exhausting demand prematurely.

Amid widespread economic sluggishness, the state has made significant efforts to boost auto consumption and stabilize the market. According to the CPCA, policies in 2025, including NEV purchase tax incentives and trade-in subsidies, released nearly 400 billion yuan in benefits. Trade-in subsidies alone are expected to exceed 180 billion yuan, while over 200 billion yuan in purchase taxes were waived for NEVs, which generated over 2 trillion yuan in sales.

Tempted by these “handouts,” not only did consumers planning to replace their cars act sooner, but many intending to buy within the next 1-2 years also accelerated their plans. Data shows that in the first 11 months of 2025, domestic auto sales neared 30 million vehicles, with over 11.2 million trade-ins accounting for more than one-third of total sales.

This means that 400 billion yuan in policy funding stimulated one-third of the market’s sales contribution, yet the net growth likely remained at just 5%. This “inefficiency” underscores the diminishing returns of auto consumption stimulus measures.

Morgan Stanley’s auto industry analyst offers a sharper critique: excluding contributions from exports and the “Two News” policy (NEVs + trade-ins), domestic electric vehicle sales have already declined by 5-6% since 2024. While the 2025 drop narrowed to 3-4%, the essence remains unchanged—policies have merely propped up current markets by prematurely exhausting replacement demand over the next 1-2 years. The 2026 replacement market will likely face a “gap.”

02 A Decline Is Inevitable; How Severe Will It Be?

Will the 2026 Auto Market Decline?

Currently, the industry holds several views. At the 2025 China Auto Dealers Association Annual Conference in early November, experts suggested that if the state continues to introduce consumption policies, the market might grow slightly by 1-3%, or at worst, remain flat. However, an insider admitted, “The optimistic outlook aims to stabilize industry confidence; the real prediction is negative growth.”

Another perspective argues that a decline is inevitable, with debate centered on its magnitude. After all, following this round of robust policy-driven consumption and tightening state and local finances, another massive subsidy rollout seems unlikely.

Recently, UBS issued a warning, projecting a 2% decline in China’s passenger car market in 2026. At the second China International Lithium Industry Conference in November, Cui Dongshu predicted 23.8 million passenger car sales in 2026, down 2.1% year-on-year.

Morgan Stanley’s forecasts are even harsher. Drawing parallels to the post-stimulus downturns after 2008-2009 or 2015-2017, they anticipate a potential 6-8% decline in China’s passenger car market in 2026.

Auto sales executives closer to the frontlines may offer more accurate insights. During last month’s Guangzhou Auto Show, most OEMs held a pessimistic view, predicting a negative growth rate near 10%, with a possible 20% plunge in the first quarter.

“The 45-day sales window from New Year’s Day to the Lunar New Year, followed by March—traditionally slow seasons—means core sales rely on the 45 days before the Lunar New Year. Without policy support and given last year’s high base, a 20% drop isn’t impossible,” an industry analyst noted. “Negative growth” has become the industry’s default “worst-case consensus,” with a 2026 auto market downturn now inevitable.

Behind this irreversible decline lies a confluence of pressures from costs, demand, production capacity, and competition.

First, the demand-side aftermath of policy-driven consumption. The 2025 trade-in boom has prematurely depleted replacement demand. By the fourth quarter, subsidies in many regions were exhausted or allocated via lotteries, leaving consumers like Lao Zhou to “wait and see.”

After the 2026 NEV purchase tax phase-out, price-sensitive buyers of sub-150,000 yuan models will react sharply. Minmetals Securities predicts that NEV sales growth will plummet from 27% in 2025 to 15% in 2026, marking an end to the high-growth era.

Next, cost pressures. In October 2025, the auto industry’s profit margin dropped to 3.9%, the lowest in five years for that period, straining automakers. From January to September, about half of domestic automakers reported losses, while multinational firms faced a “dark third quarter” across the board.

Amid profit squeezes, upstream raw materials triggered a “black swan” event. Since June 2025, lithium carbonate prices surged from 60,000 yuan/ton to 100,000 yuan/ton by November, reaching a 1.5-year high. As a core NEV material, this price hike directly raised battery costs. With limited bargaining power over suppliers, automakers had to absorb the costs, risking losses or passing them on to consumers—both choices further suppressing demand.

Additionally, China’s auto industry had a total production capacity of around 48.7 million vehicles in 2024, yet sold only 31.43 million—a 64% capacity utilization rate, far below healthy levels. This year, Geely acquired SAIC-GM’s Shenyang Beisheng plant, while Changan took over Beijing Hyundai’s Chongqing base, reflecting widespread overcapacity. With competition intensifying and new products flooding the market, 2026 will likely see a resurgence of price wars as demand falls, squeezing smaller players’ survival chances. “Merge or exit” has become the fate of many weak brands.

03 Winter Shakeout: China’s Auto Industry Breakthrough and Rebirth

Despite the overall downturn, the auto market isn’t entirely bleak. While domestic retail sales may slip, wholesale growth remains likely, revealing structural opportunities for China’s auto industry.

The export market, for instance, will be a key growth engine. Domestic auto exports are expected to near 7 million units in 2025 and continue rising in 2026.

BYD has set a 2026 overseas sales target of 1.5-1.6 million units, up roughly 70% year-on-year. Geely, Chery, and Changan are accelerating local production abroad, expanding market share through technology-for-market swaps. New-force brands are also ramping up overseas expansion, with offshore factories and localized operations becoming the norm. Despite trade protectionism challenges, China’s NEV supply chain advantages will sustain export market resilience.

Technological shifts will inject fresh vitality into the industry. Robotaxi and embodied AI are emerging as the next battlegrounds for automakers. With L3/L4 autonomous driving regulations clarifying and hardware costs declining, 2026 could see accelerated commercial pilot expansions.

Moreover, XPENG unveiled robots and ventured into low-altitude economies, while NIO launched AI glasses. Automakers are diversifying competitiveness through cross-industry integration. AI’s deep integration with the auto sector will attract high-net-worth users, escape “price wars,” and spawn new product forms and business models.

Additionally, competition logic is shifting. After the state introduced “anti-inner-roll” measures in late 2025, automakers pivoted from “price cuts” to “value enhancement”—equipping mainstream models with high-end features like lidar and fast charging, and shortening vehicle lifecycles to avoid rapid depreciation. This “value competition” enhances user experience and steers the industry from “quantity growth” to “quality transformation,” paving the way for long-term development.

Chaos precedes great order; the darkest hour comes before dawn. The 2026 winter will test survival but also offer transformation opportunities.

Enterprises reliant on policy dividends, lacking core technologies, or trapped in price wars will likely be eliminated. In contrast, those focusing on technological innovation, overseas expansion, and differentiated advantages will seize the initiative. BYD’s overseas acceleration, Geely’s tech investments, and new forces’ cross-industry explorations signal China’s auto industry is moving beyond scale expansion to high-quality development.

For consumers, short-term market fluctuations create waiting opportunities, but long-term industry shifts will deliver superior, smarter, and more cost-effective products. For China’s auto sector, this winter is a necessary rite of passage. Only through capacity rationalization, technological iteration, and global competition can China shed its “large but weak” label and emerge as a core force in the global auto market.

Editor-in-Charge: Du Yuxin Editor: Chen Xinnan

THE END